Maryland Sample Letter for Dormant Letter

Description

How to fill out Sample Letter For Dormant Letter?

If you wish to be thorough, acquire, or create legal document templates, utilize US Legal Forms, the premier collection of legal documents, available online.

Take advantage of the site’s straightforward and convenient search feature to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Maryland Sample Letter for Dormant Letter in just a few moments.

Every legal document template you obtain is yours permanently. You can access any form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Be proactive and download, and print the Maryland Sample Letter for Dormant Letter with US Legal Forms. There are numerous professional and state-specific forms available for your commercial or personal needs.

- If you are an existing US Legal Forms member, sign in to your account and press the Acquire button to find the Maryland Sample Letter for Dormant Letter.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your relevant region/country.

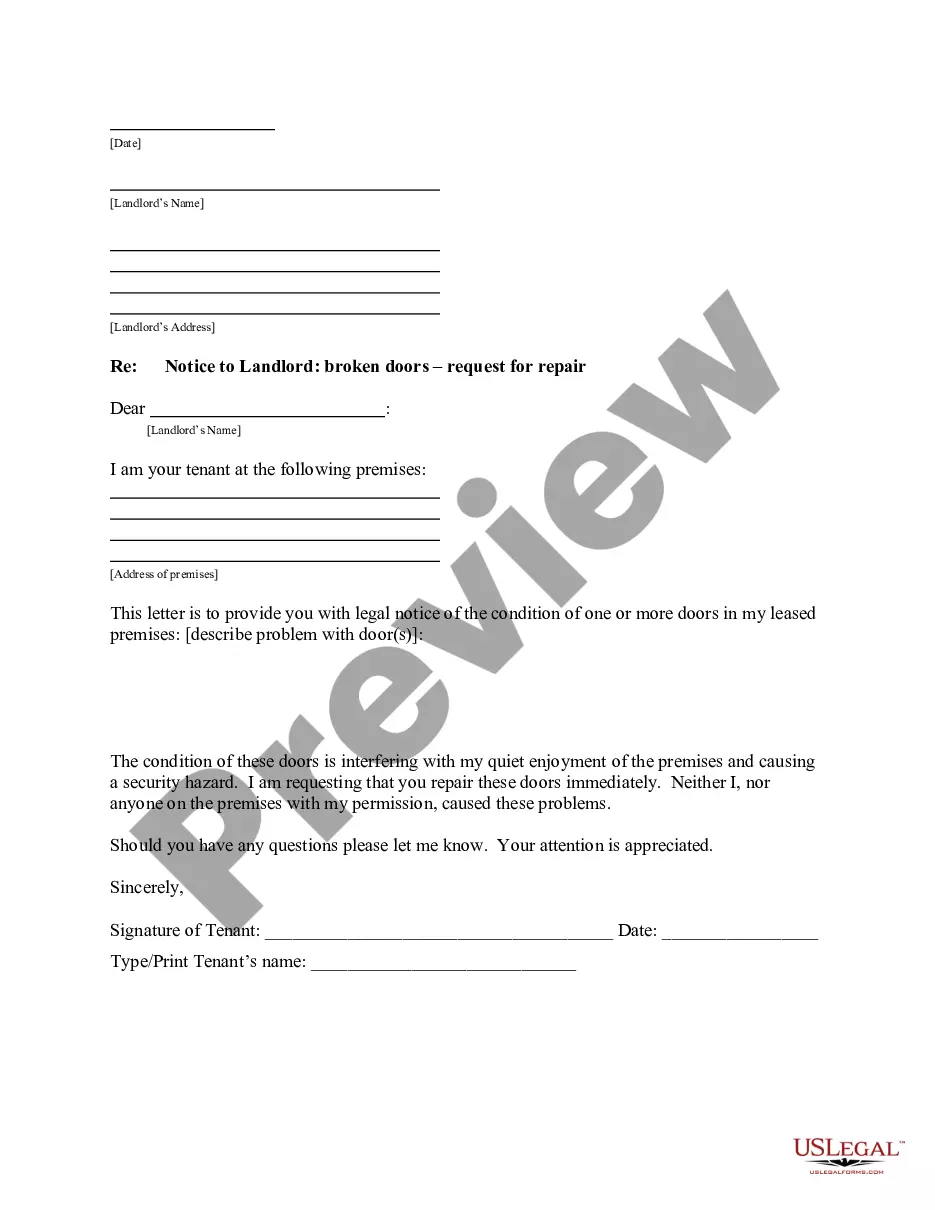

- Step 2. Utilize the Review option to inspect the content of the form. Don’t forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify and print or sign the Maryland Sample Letter for Dormant Letter.

Form popularity

FAQ

Maryland holds unclaimed property indefinitely until it is claimed by the rightful owner. The state acts as the custodian of these assets, ensuring they are safeguarded until returned. It is wise to check for any properties you may have lost track of. A Maryland Sample Letter for Dormant Letter can facilitate the claiming process and provide necessary documentation.

The dormancy period refers to the time a property remains inactive before being classified as unclaimed. In Maryland, this period is typically three years. It is essential to keep track of your assets to avoid losing them to the state. A Maryland Sample Letter for Dormant Letter is a helpful tool to assist in reclaiming dormant properties.

To close an estate in Maryland, you must file a final accounting with the Register of Wills. This includes listing all assets and their distribution to beneficiaries. After approval, the estate can be formally closed. Using resources like the Maryland Sample Letter for Dormant Letter may help if you encounter unclaimed property during this process.

Unclaimed property does not expire; however, it may become inaccessible if not claimed within a specific time frame, usually three years in Maryland. After this period, the property can be turned over to the state. Claiming the property promptly is crucial, and a Maryland Sample Letter for Dormant Letter can guide you in this process.

Property in Maryland is generally considered abandoned after a three-year dormancy period. This includes various types of assets, such as bank accounts, checks, and insurance benefits. Once classified as abandoned, the property may be turned over to the state. You can utilize a Maryland Sample Letter for Dormant Letter to take steps towards reclaiming such property.

In Maryland, the dormancy period for unclaimed property typically lasts for three years. After this period, the property may be reported as unclaimed and subject to escheatment to the state. It is essential to act within this timeframe to claim your property. Utilizing a Maryland Sample Letter for Dormant Letter can help in reclaiming your assets.

Maryland has established a threshold for unclaimed property claims, which currently stands at $25. If the property amount falls below this limit, it typically does not require reporting. However, it’s important to remain aware of any potential updates to these regulations. To align with these requirements, consider using our Maryland Sample Letter for Dormant Letter, which provides a clear format for documenting your claim.

In Maryland, businesses are encouraged to report any unclaimed property, including negative reports. Negative reporting helps maintain accuracy in the state's records. By providing details that confirm there are no unclaimed properties, entities can fulfill their legal obligations. Utilizing our Maryland Sample Letter for Dormant Letter can facilitate this process, ensuring you cover all necessary bases.

When you submit your claim for unclaimed property in Maryland, the processing time can vary. Typically, you can expect it to take several weeks to a few months. Factors such as the volume of claims and the completeness of your documentation can influence this timeline. If you use our Maryland Sample Letter for Dormant Letter, you can streamline the process and potentially avoid delays.

Requirements for a dormant account typically include a lack of transactions over a specified time frame, often one year, as well as identification and proof of ownership. Financial institutions often set their policies, so it’s essential to check specific requirements. A Maryland Sample Letter for Dormant Letter can provide clear direction in your communication with them.