Maryland Summary of Account for Inventory of Business

Description

How to fill out Summary Of Account For Inventory Of Business?

Are you currently within a position that you need to have files for either company or specific reasons nearly every day time? There are plenty of authorized document layouts available on the Internet, but getting ones you can rely on isn`t easy. US Legal Forms gives 1000s of type layouts, just like the Maryland Summary of Account for Inventory of Business, which can be written to satisfy federal and state needs.

In case you are presently knowledgeable about US Legal Forms internet site and also have a free account, basically log in. Following that, it is possible to download the Maryland Summary of Account for Inventory of Business template.

Should you not provide an profile and want to begin to use US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for your correct metropolis/state.

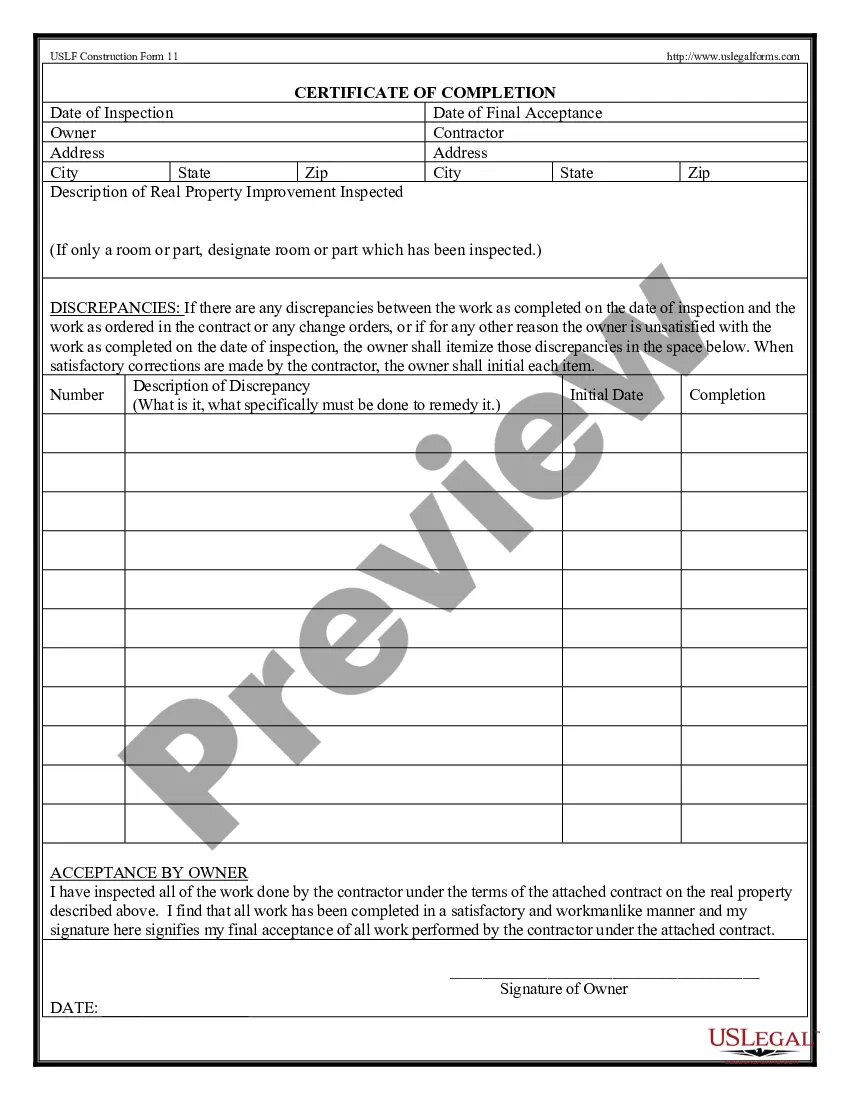

- Utilize the Preview key to review the shape.

- Read the information to ensure that you have chosen the right type.

- In case the type isn`t what you`re seeking, take advantage of the Research area to discover the type that meets your requirements and needs.

- Whenever you obtain the correct type, simply click Get now.

- Choose the rates program you would like, submit the specified information to create your bank account, and pay money for the order making use of your PayPal or bank card.

- Choose a hassle-free document structure and download your backup.

Locate all of the document layouts you have bought in the My Forms menu. You can get a more backup of Maryland Summary of Account for Inventory of Business anytime, if needed. Just select the required type to download or print the document template.

Use US Legal Forms, one of the most considerable variety of authorized types, in order to save some time and steer clear of blunders. The service gives appropriately created authorized document layouts which you can use for an array of reasons. Make a free account on US Legal Forms and commence generating your lifestyle a little easier.

Form popularity

FAQ

Agricultural products and commodities are exempt from all property taxes. Manufacturing or commercial business inventory is exempt from state property taxes. Livestock is exempt from all property taxes. By law, only Wicomico County is allowed to tax inventory at the county level.

Maryland has no state business personal property tax, however, some local jurisdictions may require it, and they may include inventories.

Yes. Inventory tax is a ?taxpayer active? tax. That the taxpayer (business owner) must calculate it. Business owners can count and value unsold inventory based on one of the three accepted valuation methods: cost, retail, or lower of cost or retail.

The Maryland Form 511 An Electing PTE Income Tax Return must be filed electronically if the pass-through entity has generated a business tax credit from Form 500CR or a Heritage Structure Rehabilitation Tax Credit from Form 502S to pass on to its members. taxhelp@marylandtaxes.gov.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.

Tax-exempt goods Examples include most non-prepared food items, prescription and over-the-counter medicines, and medical supplies. We recommend businesses review the laws and rules put forth by the Comptroller of Maryland to stay up to date on which goods are taxable and which are exempt, and under what conditions.

Entities Required to File Every other PTE that is subject to Maryland income tax law must file Form 510. Any PTE that has credits in Maryland and a PTE that is a member of a PTE that is required to file in Maryland must file Form 511 if it is an Electing PTE, or Form 510 if it not an Electing PTE.

Goods - All goods are subject to sales and use tax. This includes food, clothing, jewelry, vehicles, furniture, and art. However, there are exceptions, including: Agricultural Products ? Items sold/bought are not taxed if they are bought by a farmer and are being used for an agricultural purpose.