A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Maryland Notice of Default and Election to Sell - Intent To Foreclose

Description

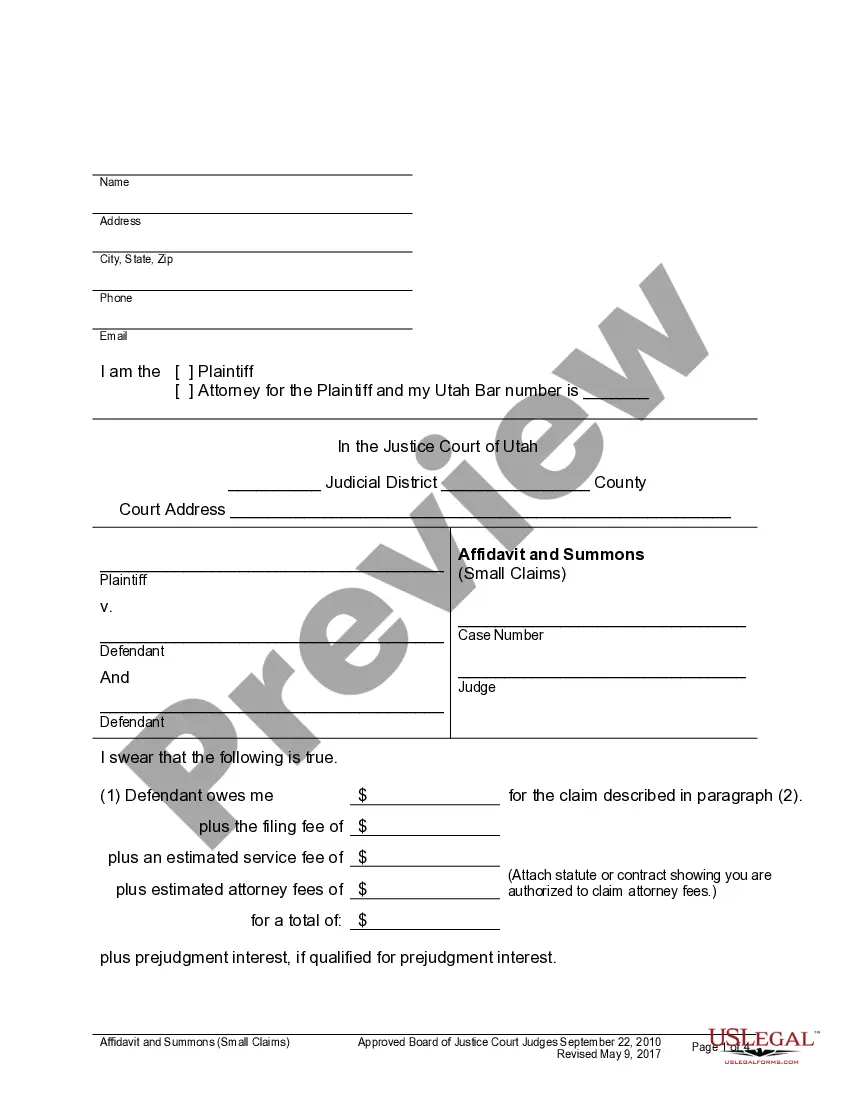

How to fill out Notice Of Default And Election To Sell - Intent To Foreclose?

Are you presently situated in a location where you require documents for both business or personal tasks on a daily basis.

There is an abundance of legal document templates available online, but locating trustworthy versions can be challenging.

US Legal Forms offers a wide array of form templates, including the Maryland Notice of Default and Election to Sell - Intent to Foreclose, which are designed to comply with state and federal regulations.

Once you find the right document, click Purchase now.

Select the payment plan you wish, enter the required information to execute your payment, and complete the transaction using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Maryland Notice of Default and Election to Sell - Intent to Foreclose template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the document.

- Read the description to ensure you have selected the correct document.

- If the document is not what you require, use the Lookup field to find the document that fits your needs.

Form popularity

FAQ

Filing a motion to stop a foreclosure sale in Maryland involves preparing legal documents and submitting them to the appropriate court. You will typically need to demonstrate why the sale should be halted, often including evidence of any defenses or negotiations. Understanding the Maryland Notice of Default and Election to Sell - Intent To Foreclose can inform your argument. The US Legal Forms platform offers essential resources to assist you in crafting and submitting the motion correctly.

Certain exceptions apply to foreclosure sales in Maryland, including cases involving military service, bankruptcy filings, or if the borrower has rectified the default before the sale. It is vital to be aware of these exceptions as they relate to the Maryland Notice of Default and Election to Sell - Intent To Foreclose. Knowing these details can aid in protecting your rights. Legal resources can provide additional guidance on how these exceptions may impact your situation.

To stop a foreclosure sale in Maryland, you may need to take legal action, such as filing a motion in court. This often involves seeking a temporary restraining order or exploring programs like mediation. Understanding your rights concerning the Maryland Notice of Default and Election to Sell - Intent To Foreclose can empower you to take necessary steps. The US Legal Forms platform can help you find the required forms and instructions to navigate this process effectively.

Yes, you can sell a house that is in foreclosure in Maryland. However, timing and communication with your lender are crucial, as the sale must generally occur before the foreclosure process is completed. It is vital to understand the ramifications of the Maryland Notice of Default and Election to Sell - Intent To Foreclose for a smooth transaction. Working with a real estate professional experienced in distressed sales can facilitate this process.

Yes, a foreclosure can often be reversed in Maryland, especially if the borrower takes timely action. Options may include negotiating with the lender, entering a repayment plan, or filing for bankruptcy. Addressing the Maryland Notice of Default and Election to Sell - Intent To Foreclose quickly can give you leverage in these discussions. Engaging with knowledgeable legal resources can enhance your chances of reversing a foreclosure.

In Maryland, there are specific exceptions that allow a foreclosure process to begin before the 120-day waiting period ends. These exceptions include cases of abandonment, property tax delinquencies, or when a borrower has filed for bankruptcy. Keep in mind that knowing these exceptions can help you navigate the Maryland Notice of Default and Election to Sell - Intent To Foreclose. It is wise to consult with a legal expert to understand how these exceptions might apply to your situation.

A letter of intent to foreclose (LIF) is a written notice listing all past due amounts owed on a mortgage and a deadline to pay those amounts. After the deadline has passed, the lender may start the foreclosure process.

Phase 1: Payment Default.Phase 2: Notice of Default.Phase 3: Notice of Trustee's Sale.Phase 4: Trustee's Sale.Phase 5: Real Estate Owned (REO)Phase 6: Eviction.Foreclosure and COVD-19 Relief.The Bottom Line.

Once you default on your mortgage loan, the lender can demand that you repay the entire outstanding balance, called "accelerating the debt." If you don't repay the full loan amount or cure the default, the lender can foreclose.

6 Ways To Stop A ForeclosureWork It Out With Your Lender.Request A Forbearance.Apply For A Loan Modification.Consult A HUD-Approved Counseling Agency.Conduct A Short Sale.Sign A Deed In Lieu Of Foreclosure.