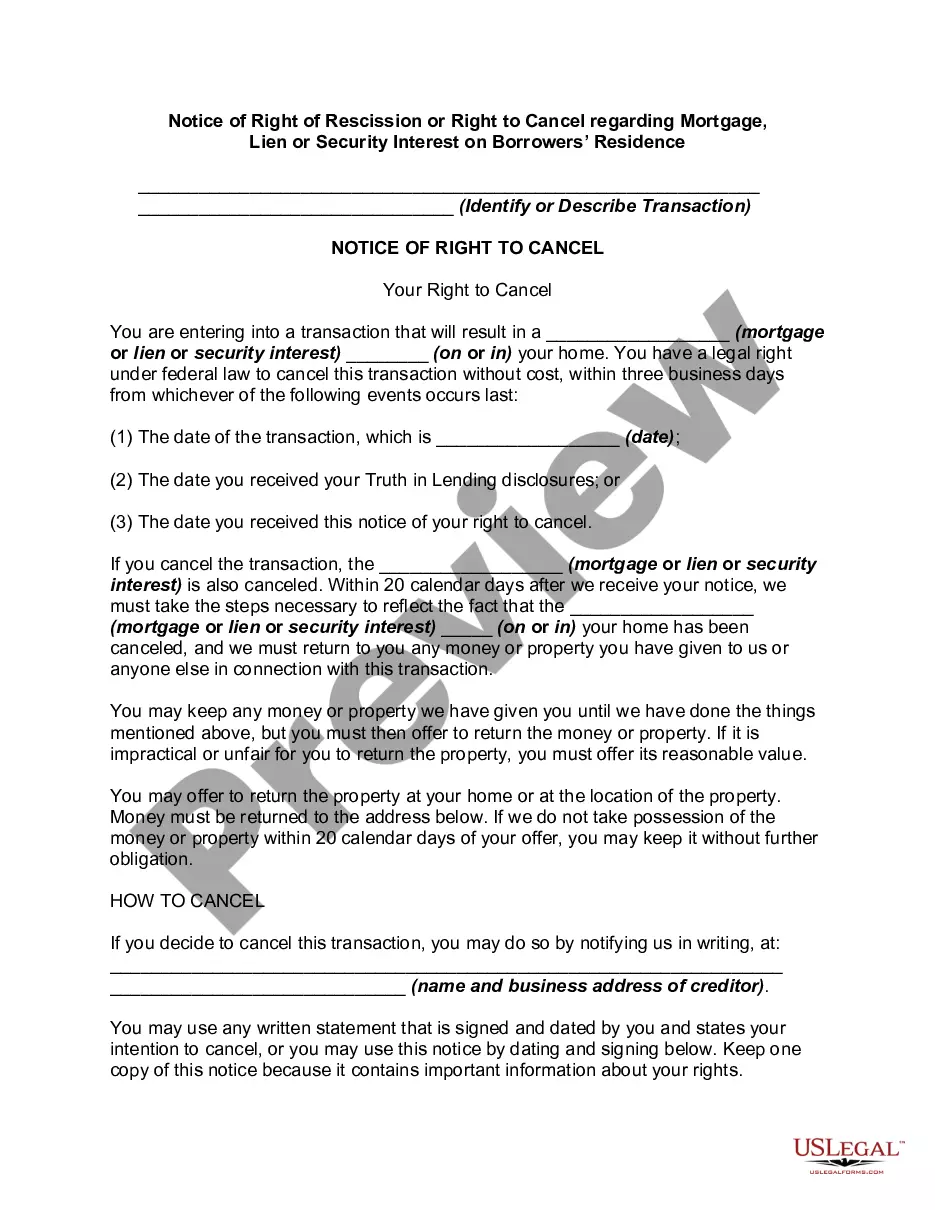

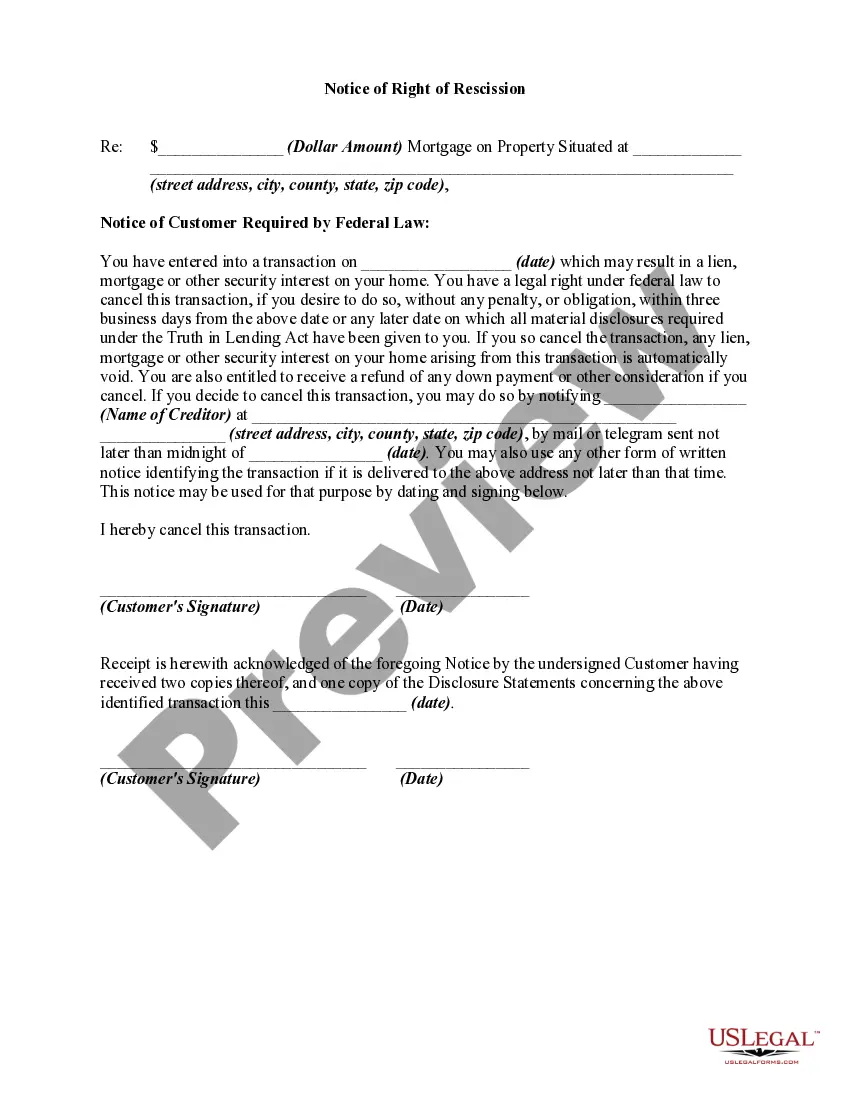

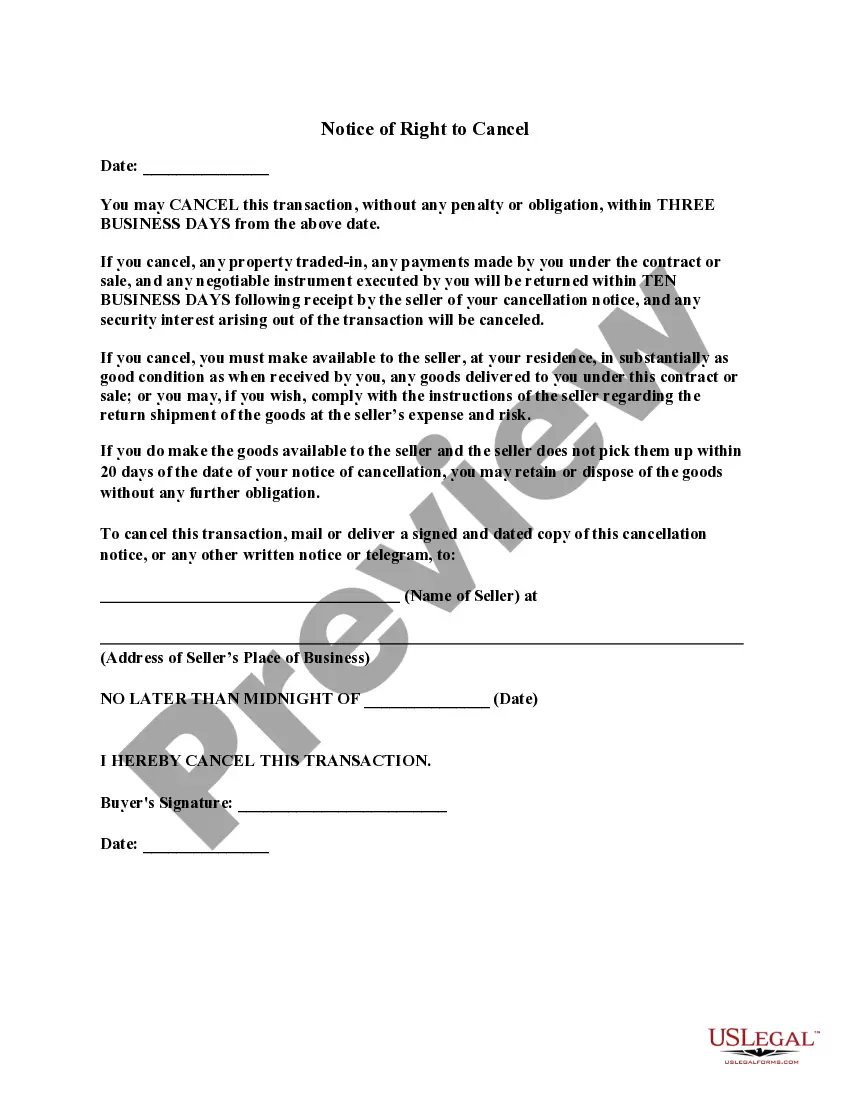

In a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership is or will be subject to the security interest has the right to rescind the transaction. Lenders are required to deliver two copies of the notice of the right to rescind and one copy of the disclosure statement to each consumer entitled to rescind. The notice must be on a separate document that identifies the rescission period on the transaction and must clearly and conspicuously:

" disclose the retention or acquisition of a security interest in the consumer's principal dwelling;

" the consumer's right to rescind the transaction; and

" how the consumer may exercise the right to rescind with a form for that purpose.