A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

If you need to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal matters are organized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Acquire button to access the Maryland Transmutation or Postnuptial Agreement.

- You can also find forms you previously downloaded under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other types of your legal form template.

Form popularity

FAQ

In California, converting separate property into community property involves mutual agreement and proper documentation. You need to create a written agreement indicating your intent to make the change. While this process is different from Maryland, understanding the nuances of your state's laws is crucial. For help with drafting this agreement, consider using uslegalforms, which can provide tailored solutions to fit your needs.

Transmuting separate property into community property in Maryland requires a formal agreement that specifies this change. A well-crafted Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property should detail the reasons and conditions for the conversion. It is important to ensure that both spouses are in agreement and that the documentation is clear and legally binding. Utilizing uslegalforms can help you navigate this process smoothly.

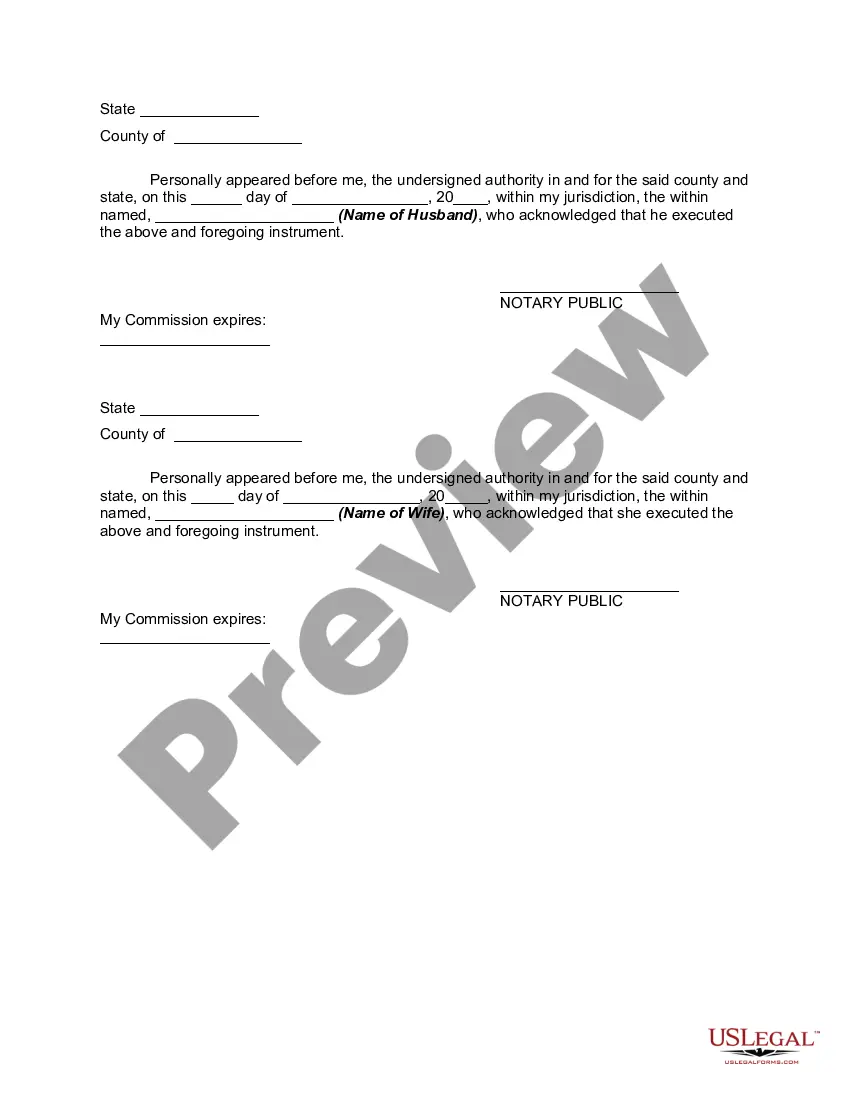

To transmute community property into separate property in Maryland, you must create a clear agreement that outlines your intentions. A Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property provides the necessary legal framework for this process. Ensure both parties agree to the transmutation, and have it written, signed, and ideally notarized. Using a platform like uslegalforms can simplify this process by offering templates and guidance.

A transmutation agreement serves the purpose of defining and changing the ownership status of property between spouses. By using a Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, couples can ensure clarity in their financial arrangements and responsibilities. This agreement can help prevent disputes by specifying what belongs to whom. Utilizing uslegalforms can simplify the creation of such an agreement to protect your interests.

The transmutation rule refers to the legal process of changing the classification of property from community to separate or vice versa. In Maryland, this can be achieved through a Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. Such an agreement helps clarify how each spouse intends to handle ownership rights and the status of property. Understanding this rule can be beneficial in protecting your individual assets.

In Maryland, marital property is divided under the principle of equitable distribution. This means that the court aims for a fair, but not necessarily equal, division of assets acquired during the marriage. First, the court will identify what constitutes marital property, including any community property involved. If you are considering a Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, this agreement can clarify ownership and streamline the division process.

A postnuptial agreement, including the Maryland Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, cannot include provisions for child custody or child support. Such agreements should also not dictate any illegal or fraudulent actions. Additionally, agreements cannot infringe upon the rights or obligations established by state law. Therefore, it is crucial to focus on marital assets and debts when drafting this type of agreement.

To convert property means to change a property's classification from one type to another, such as from community property to separate property. This process requires mutual agreement and typically involves legal documentation to ensure clarity and enforceability. For those in Maryland looking to convert community property into separate property, a Postnuptial Agreement may provide the necessary framework for such a transition.

A transmutation agreement specifically focuses on changing the ownership status of a property's title, while a postnuptial agreement encompasses broader aspects of financial arrangements and property division after marriage. Both can serve similar purposes in protecting assets, but a postnuptial agreement often includes additional elements, such as spousal support or debt division. Using a Postnuptial Agreement to Convert Community Property into Separate Property solidifies these terms and clarifies property status.

In legal terms, transmutation refers to the process of altering property ownership between spouses through mutual agreement. This can involve converting community property into separate property to reflect changes in marital agreements or financial strategies. Couples in Maryland should consider a Postnuptial Agreement to Convert Community Property into Separate Property to ensure legal clarity and protection of their assets.