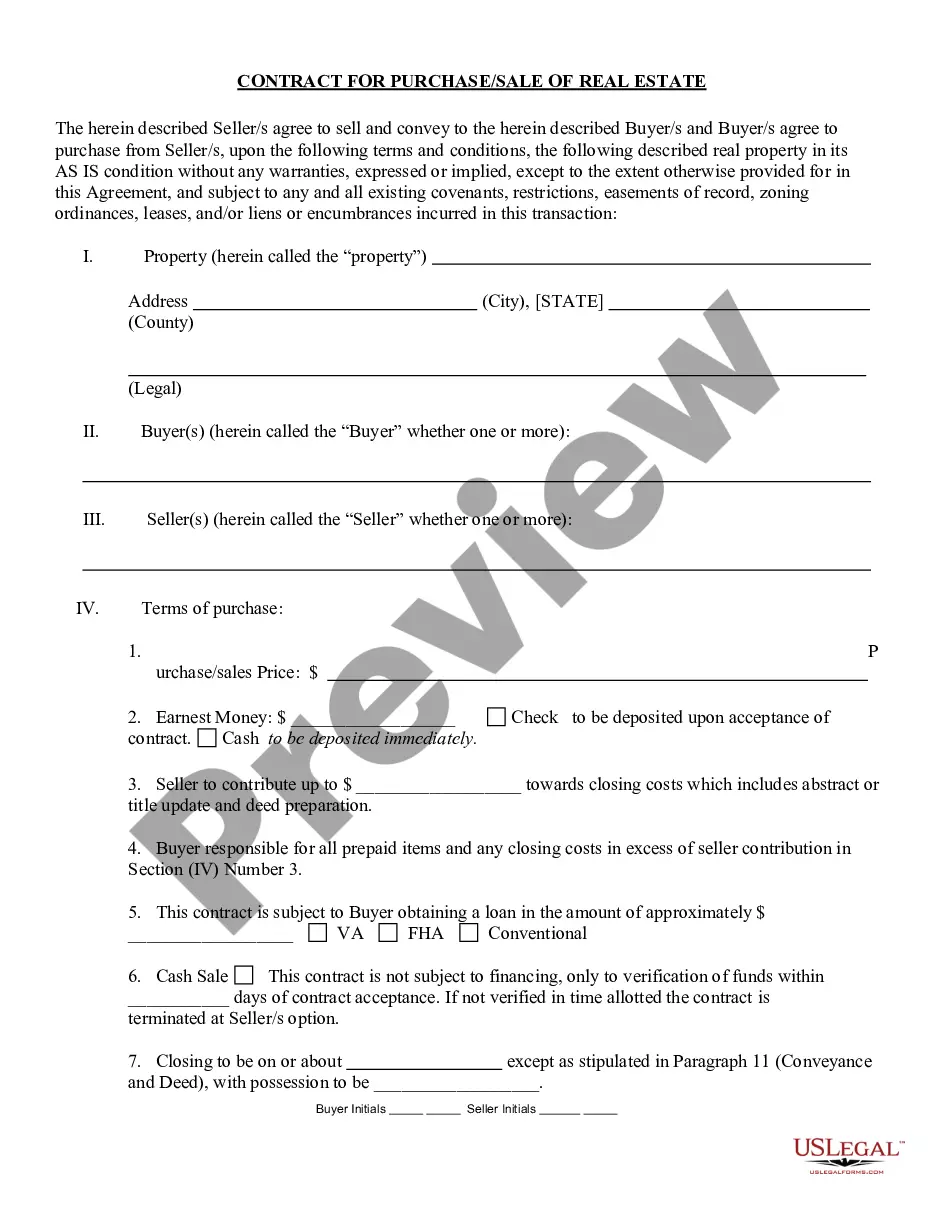

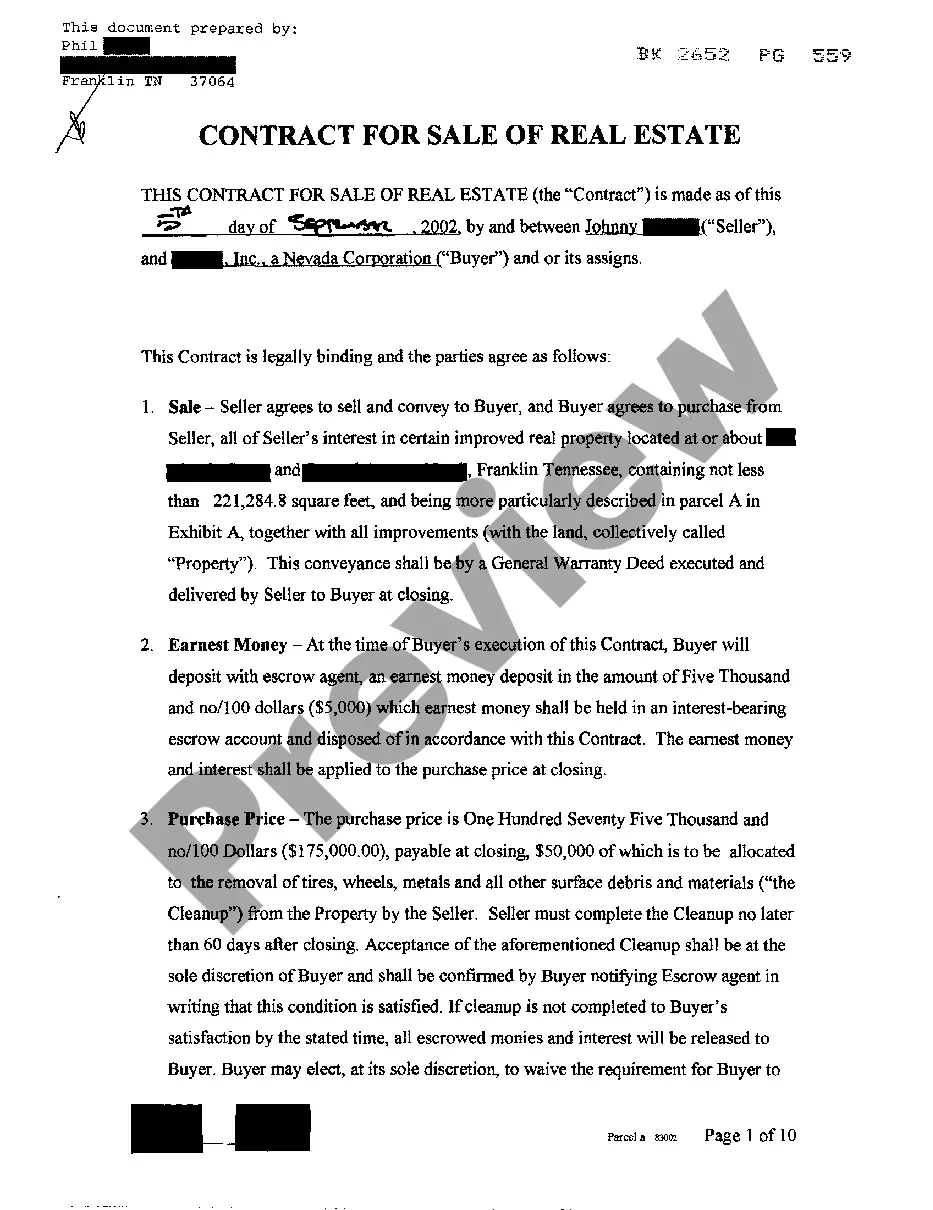

Maryland Contract for the Sale and Purchase of Commercial or Industrial Property

Description

How to fill out Contract For The Sale And Purchase Of Commercial Or Industrial Property?

You might spend numerous hours online looking for the legal document template that meets the state and federal criteria you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the Maryland Contract for the Sale and Purchase of Commercial or Industrial Property from the service.

If you want to find another version of your form, utilize the Search field to locate the template that fits your needs and specifications.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Maryland Contract for the Sale and Purchase of Commercial or Industrial Property.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm that you have chosen the appropriate form.

- If available, use the Preview button to browse through the document template as well.

Form popularity

FAQ

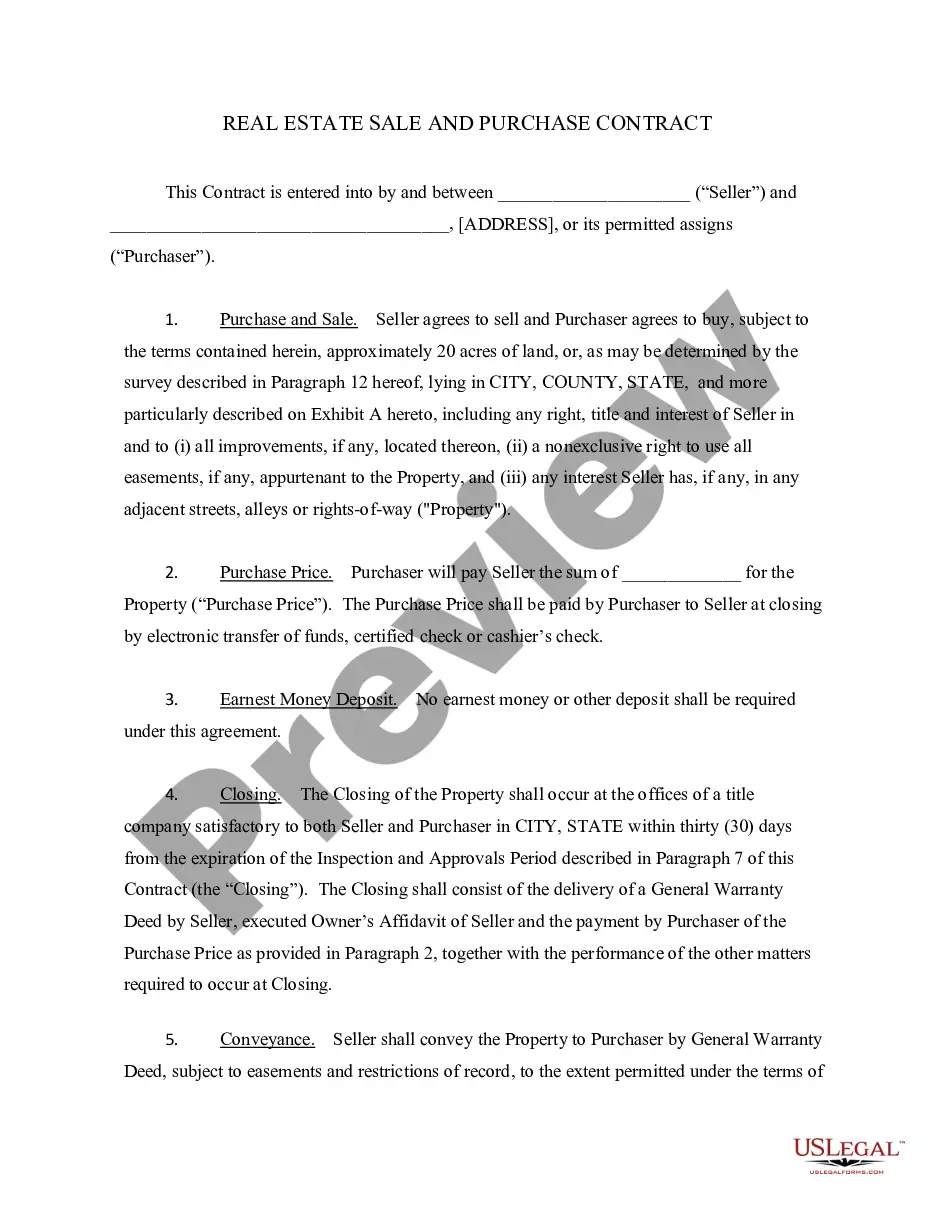

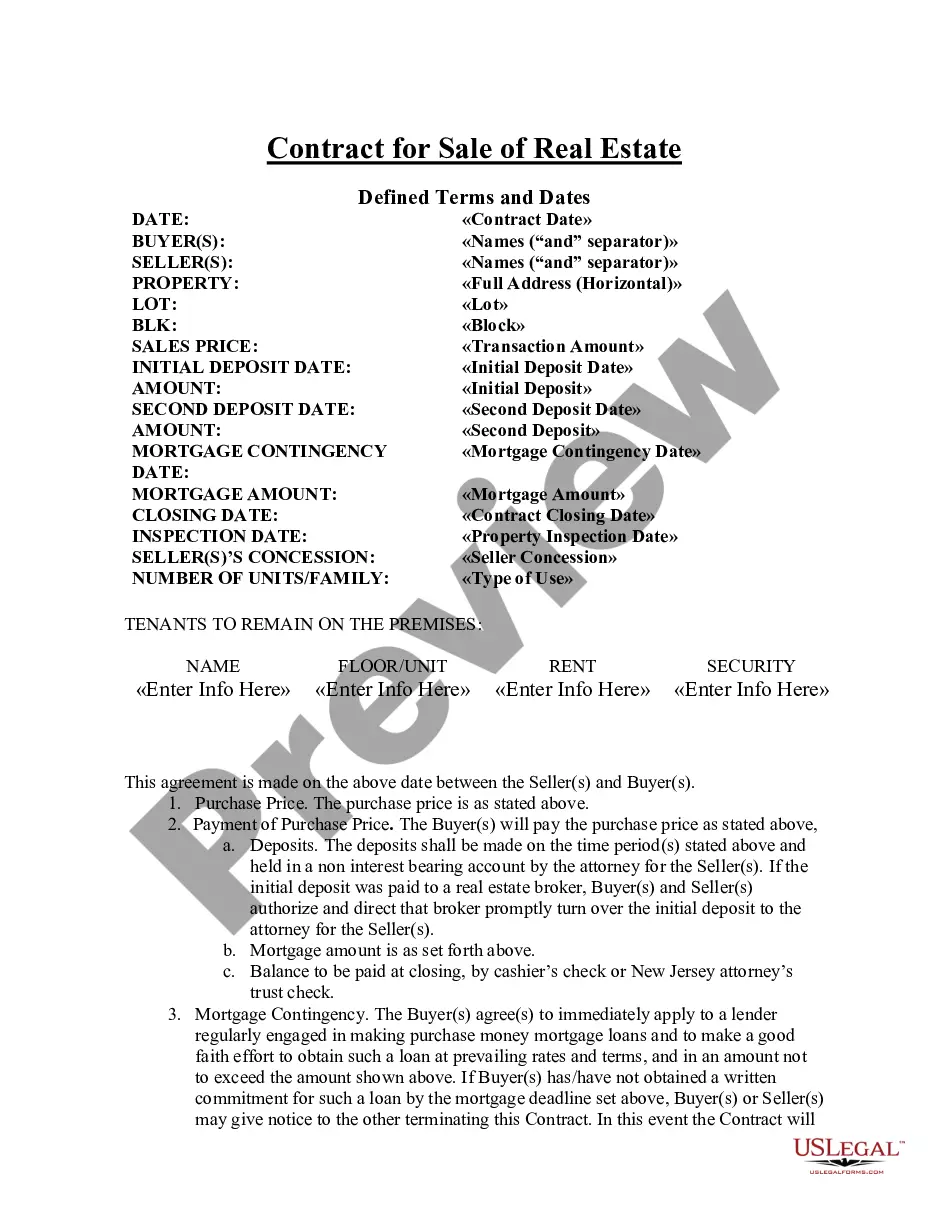

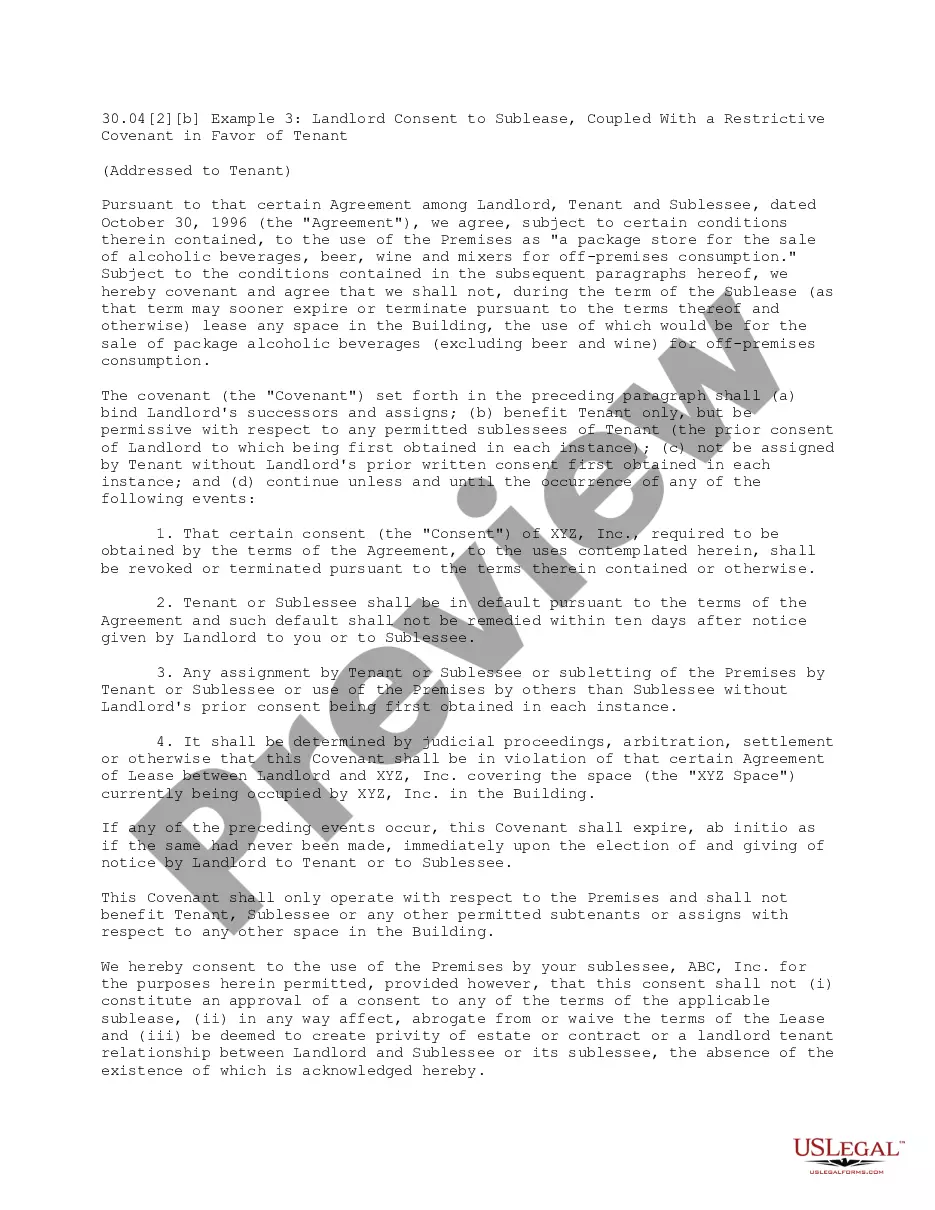

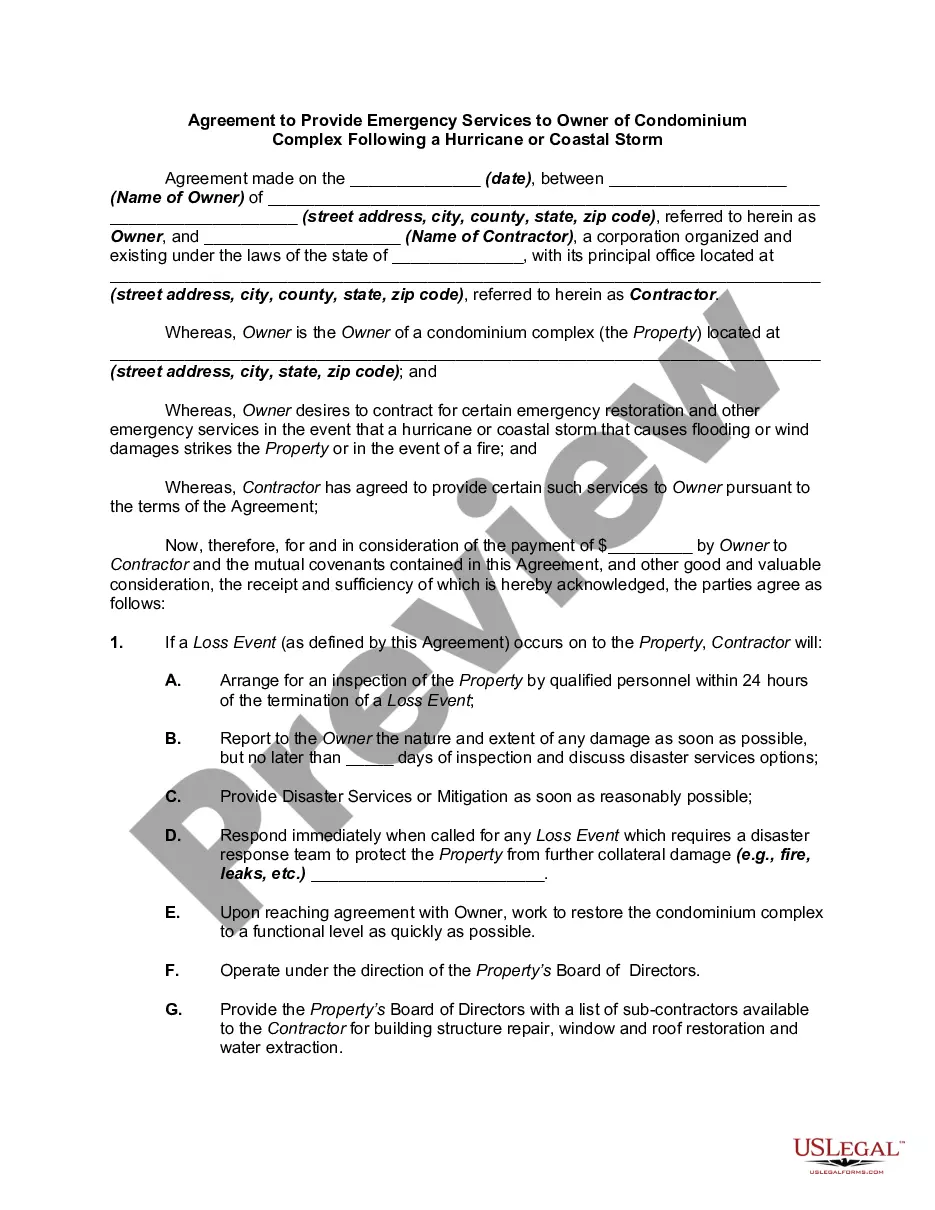

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts.

The Five Elements of a ContractOffer.Acceptance.Consideration.Capacity.Lawful Purpose.

The basics: What is an option contract in real estate? In the simplest terms, a real-estate option contract is a uniquely designed agreement that's strictly between the seller and the buyer. In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame.

Real Estate Terms GlossaryBorrower.Broker.Buyer's agent/listing agent.Buyer's market/seller's market.Co-borrower.Commission.Eminent domain.Exclusive listing.More items...?

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

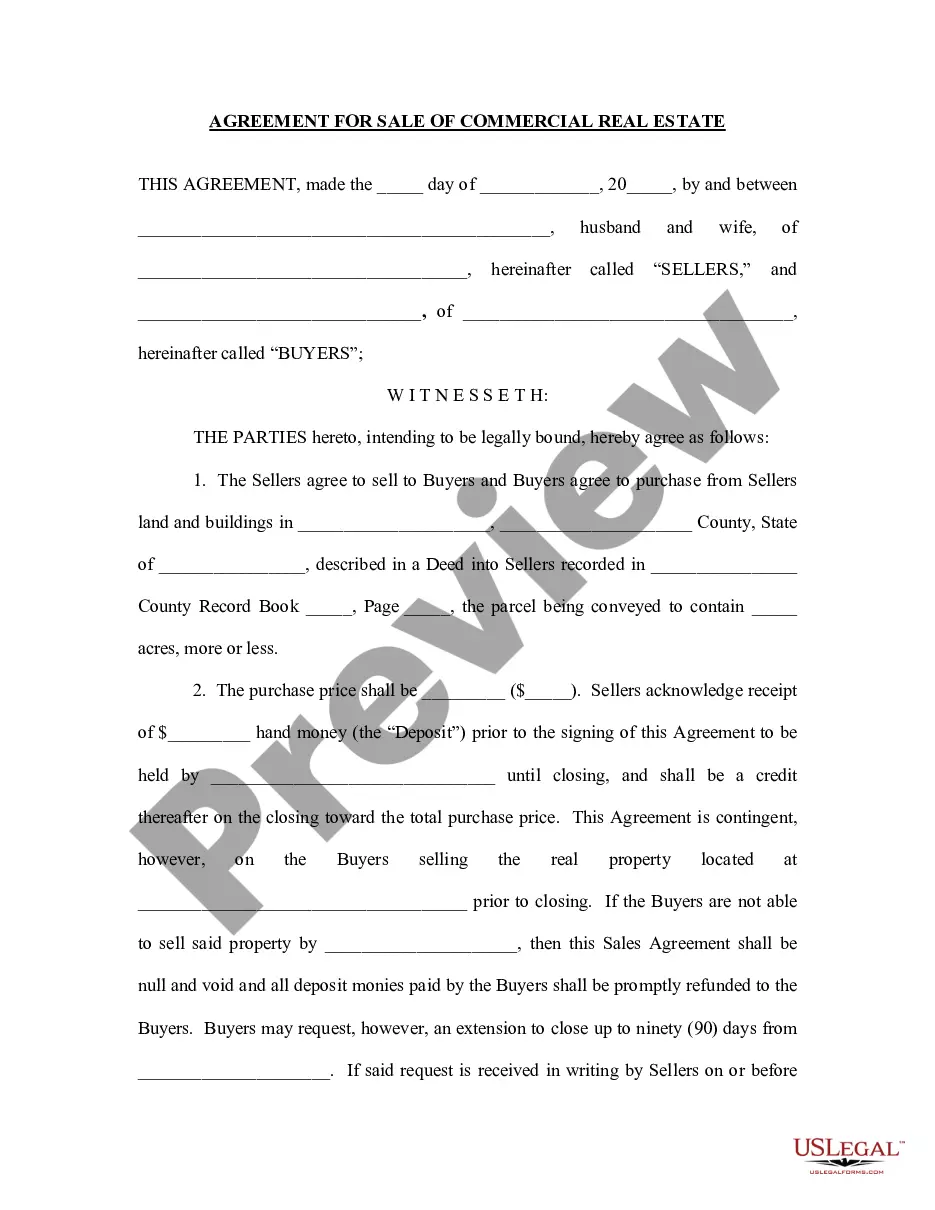

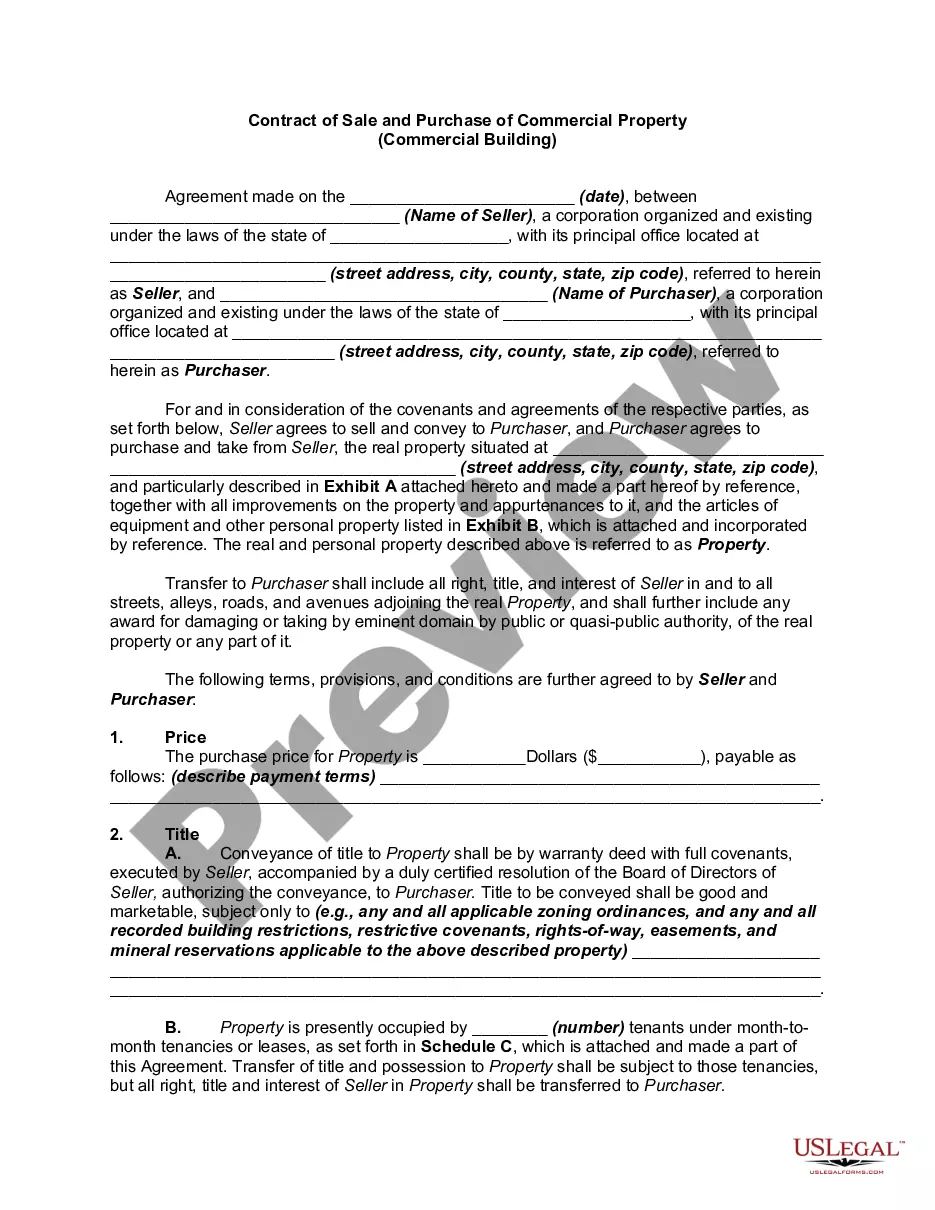

A contract of sale lists all the relevant information pertaining to the sale of a property, including such things as names and address of the buyer and seller, conditions of the sale and inclusions. Once signed, is a legally binding agreement between the purchaser and the seller.

Buyer contingencies addenda. Buyer contingencies are the most common addenda, according to Justin Ostow, a top real estate agent in Tampa, Florida, who completes 10% more sales than the average agent. Contingencies dictate certain conditions which must be met for the contract to go through.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.