In most states a certificate or memorandum of a trust agreement which conveys or entrusts an interest in real property may be recorded with the land records clerk of the appropriate county in lieu of the entire trust agreement. The certificate must be executed by the trustee and it must contain the following: (a) the name of the trust; (b) the street and mailing address of the office, and the name and street and mailing address of the trustee; (c) the name and street and mailing address of the trustor or grantor; (d) a legally sufficient description of all interests in real property owned by or conveyed to the trust; (e) the anticipated date of termination of the trust; and (f) the general powers granted to the trustee.

Maryland Certificate or Memorandum of Trust Agreement

Description

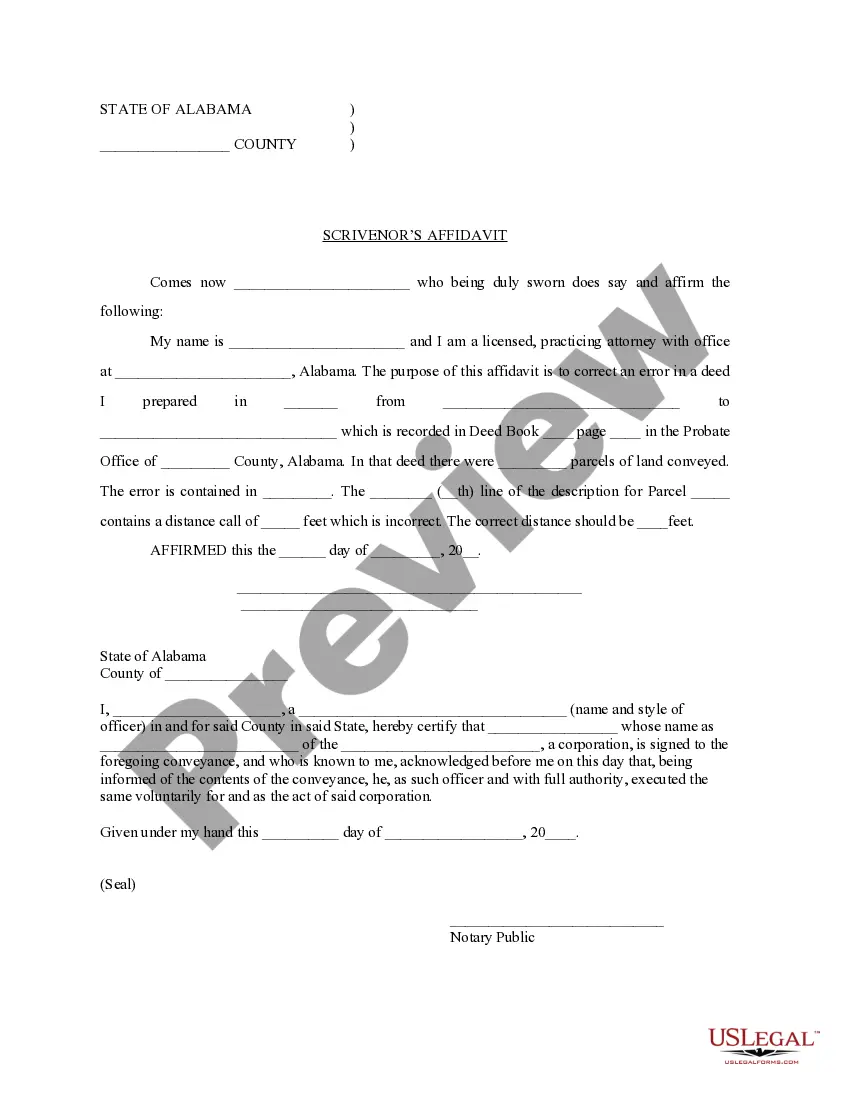

How to fill out Certificate Or Memorandum Of Trust Agreement?

It is possible to commit hours online looking for the authorized papers format that meets the state and federal demands you want. US Legal Forms provides 1000s of authorized forms which can be analyzed by experts. It is simple to download or printing the Maryland Certificate or Memorandum of Trust Agreement from my support.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Obtain option. Next, you are able to comprehensive, modify, printing, or sign the Maryland Certificate or Memorandum of Trust Agreement. Each authorized papers format you buy is your own property eternally. To get yet another backup of any bought type, go to the My Forms tab and then click the related option.

If you use the US Legal Forms internet site initially, follow the basic guidelines beneath:

- Initially, ensure that you have chosen the best papers format for your county/area of your choosing. Read the type explanation to make sure you have picked out the correct type. If available, utilize the Preview option to check with the papers format as well.

- In order to get yet another edition in the type, utilize the Lookup industry to find the format that meets your needs and demands.

- When you have identified the format you desire, simply click Purchase now to proceed.

- Choose the costs plan you desire, type your references, and register for a free account on US Legal Forms.

- Total the transaction. You can use your credit card or PayPal bank account to fund the authorized type.

- Choose the formatting in the papers and download it to the product.

- Make changes to the papers if necessary. It is possible to comprehensive, modify and sign and printing Maryland Certificate or Memorandum of Trust Agreement.

Obtain and printing 1000s of papers themes utilizing the US Legal Forms Internet site, that offers the largest assortment of authorized forms. Use skilled and state-specific themes to deal with your organization or person requires.

Form popularity

FAQ

A certificate of trust ? also called a ?trust certificate? or ?memorandum of trust? ? is a legal document that's often used to prove (or ?certify?) a trust exists and to provide information about its important terms.

A certification of trust is a document certifying that a trust was established, exists, and is under the management of a certain trustee. Certifications of trust prove the trustee's legal authority to act as such. Certifications of trust also serve as an abbreviated version of the trust.

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act. It's shorter than the actual Trust document, and it can offer pertinent information without making every aspect of the Trust public.

A trust instrument is not required to be notarized in Maryland. However, it is common practice to notarize the settlor's signature and the witnesses' signatures of the trust agreement to express that the settlor: ? Intentionally created the trust. ? Had the mental capacity to create the trust.

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.

The trust is not filed with a court as a will is. While Maryland requires that a schedule of the trust assets be filed with the Register of Wills which becomes public record, the trust document itself is never public nor are the beneficiaries or terms of the trust.

The certification of trust is codified under 14.5--910 of the Estates and Trusts Article of the Maryland Code. The document is an abbreviation of a trust instrument, verifying the trust's existence and the trustee's authority to enter into the impending transaction.