A Maryland Simple Promissory Note for Personal Loan is a legal document that outlines the terms and conditions of a loan agreement between two parties, where one party acts as the lender and the other as the borrower. This agreement is designed to protect the rights and interests of both parties involved in the loan transaction. A simple promissory note in Maryland serves as a written agreement that clearly defines the loan amount, the interest rate, repayment terms, and any additional provisions specific to the agreement. It is a legally binding contract that ensures the borrower promises to repay the loan amount within a specified time frame, along with any accrued interest. Keywords: Maryland, simple promissory note, personal loan, legal document, loan agreement, terms and conditions, lender, borrower, loan transaction, rights and interests, loan amount, interest rate, repayment terms, additional provisions, written agreement, legally binding contract, repay the loan, specified time frame, accrued interest. Different types of Maryland Simple Promissory Notes for Personal Loans can be categorized based on their specific features and purposes, such as: 1. Secured Promissory Note: This type of note includes collateral, such as a property or asset, which the lender can claim in case the borrower defaults on the loan. 2. Unsecured Promissory Note: In contrast to a secured note, an unsecured promissory note does not involve any collateral. The borrower's creditworthiness and personal guarantee act as the primary basis of trust for the lender. 3. Installment Promissory Note: This type of note outlines the repayment terms with equal monthly installments, including principal and interest, over a specified period. 4. Lump Sum Promissory Note: This note requires the borrower to repay the entire loan amount, along with interest, in a single payment at a predetermined date. 5. Demand Promissory Note: A demand note allows the lender to call for repayment of the loan at any time, upon giving a notice to the borrower. 6. Interest-Only Promissory Note: This type of note specifies that the borrower is obligated to make interest payments only, for a certain period, with the principal amount due at the end of the loan term. 7. Balloon Promissory Note: In a balloon note, the borrower makes smaller monthly payments throughout the loan term, but a large lump sum payment is due at the end, which represents the remaining principal amount. It is crucial to consult with a legal professional or financial advisor to ensure that the promissory note complies with Maryland state laws and suits the specific needs of all parties involved in the personal loan transaction.

Maryland Simple Promissory Note for Personal Loan

Description

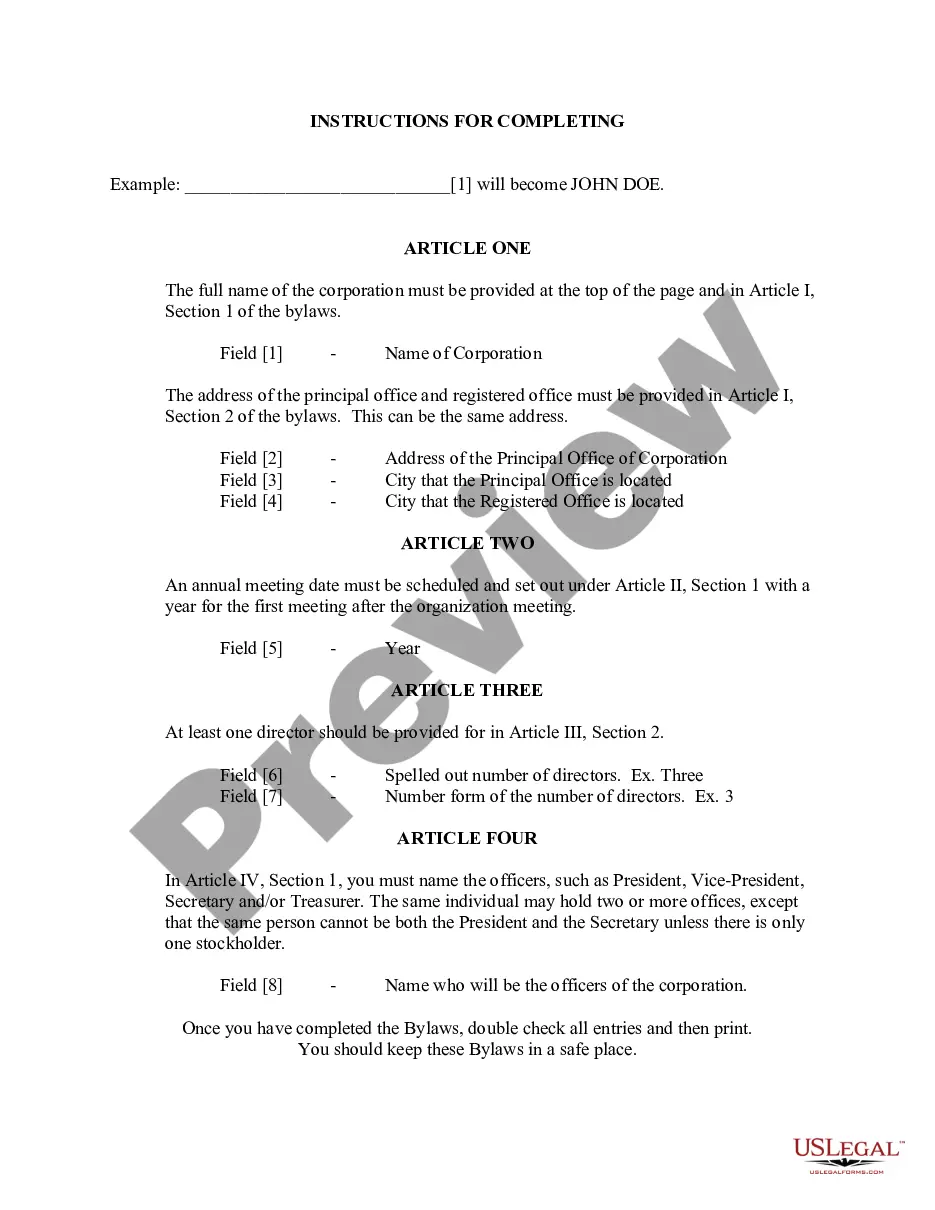

How to fill out Maryland Simple Promissory Note For Personal Loan?

Finding the right authorized document web template can be a struggle. Naturally, there are plenty of layouts available on the Internet, but how can you find the authorized form you will need? Take advantage of the US Legal Forms internet site. The support delivers thousands of layouts, for example the Maryland Simple Promissory Note for Personal Loan, which can be used for company and private needs. Each of the kinds are checked by experts and fulfill state and federal needs.

Should you be previously signed up, log in to the bank account and click the Obtain switch to obtain the Maryland Simple Promissory Note for Personal Loan. Make use of bank account to appear through the authorized kinds you might have acquired previously. Check out the My Forms tab of your respective bank account and have one more duplicate of your document you will need.

Should you be a fresh end user of US Legal Forms, allow me to share simple recommendations that you should comply with:

- First, make sure you have selected the right form to your city/area. You can check out the shape using the Review switch and look at the shape description to ensure this is the right one for you.

- When the form will not fulfill your expectations, use the Seach discipline to discover the proper form.

- Once you are certain the shape would work, go through the Acquire now switch to obtain the form.

- Select the prices plan you need and enter the required information. Make your bank account and pay for the transaction with your PayPal bank account or bank card.

- Choose the data file file format and acquire the authorized document web template to the system.

- Total, change and printing and indicator the attained Maryland Simple Promissory Note for Personal Loan.

US Legal Forms may be the greatest local library of authorized kinds for which you will find different document layouts. Take advantage of the company to acquire professionally-produced paperwork that comply with status needs.

Form popularity

FAQ

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

Any two parties who wish to enter into a loan agreement can draft a promissory note, which states the intention of the lender to loan the borrower a specific amount of money, as well as the terms and conditions for repayment of that loan, to which both parties have agreed.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

There is no legal requirement for most promissory notes to be witnessed or notarized in Maryland (a promissory note that involves a mortgage, however, must be witnessed and notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

More info

This page is meant for personal, small business, and business loan agreements. I have created a free promissory note template that can easily be modified to suit your needs. To get this free template in the form as you need, you simply download the text files, and use your word program to put everything on your computer. I have also included a sample letter, which can be used to send your note to the original debtors to whom the loan was obtained. Please note that I am not affiliated with any company, whether for free or any other charges.