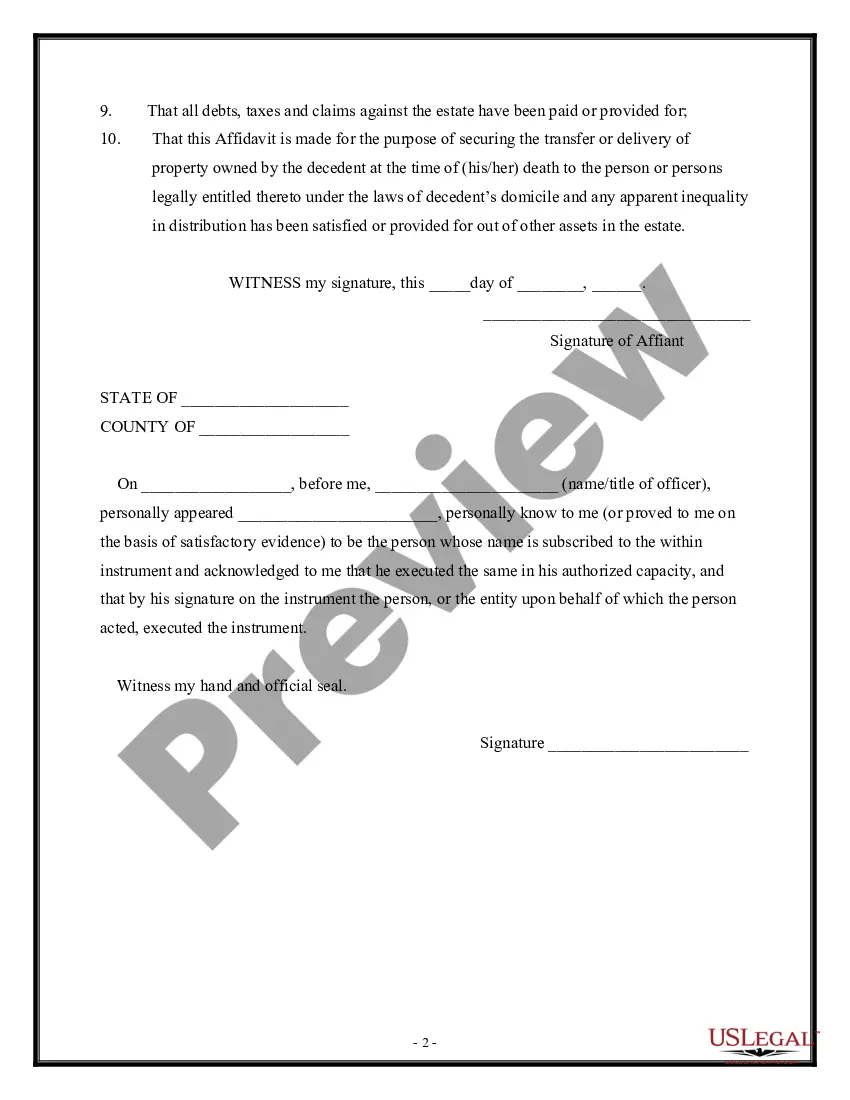

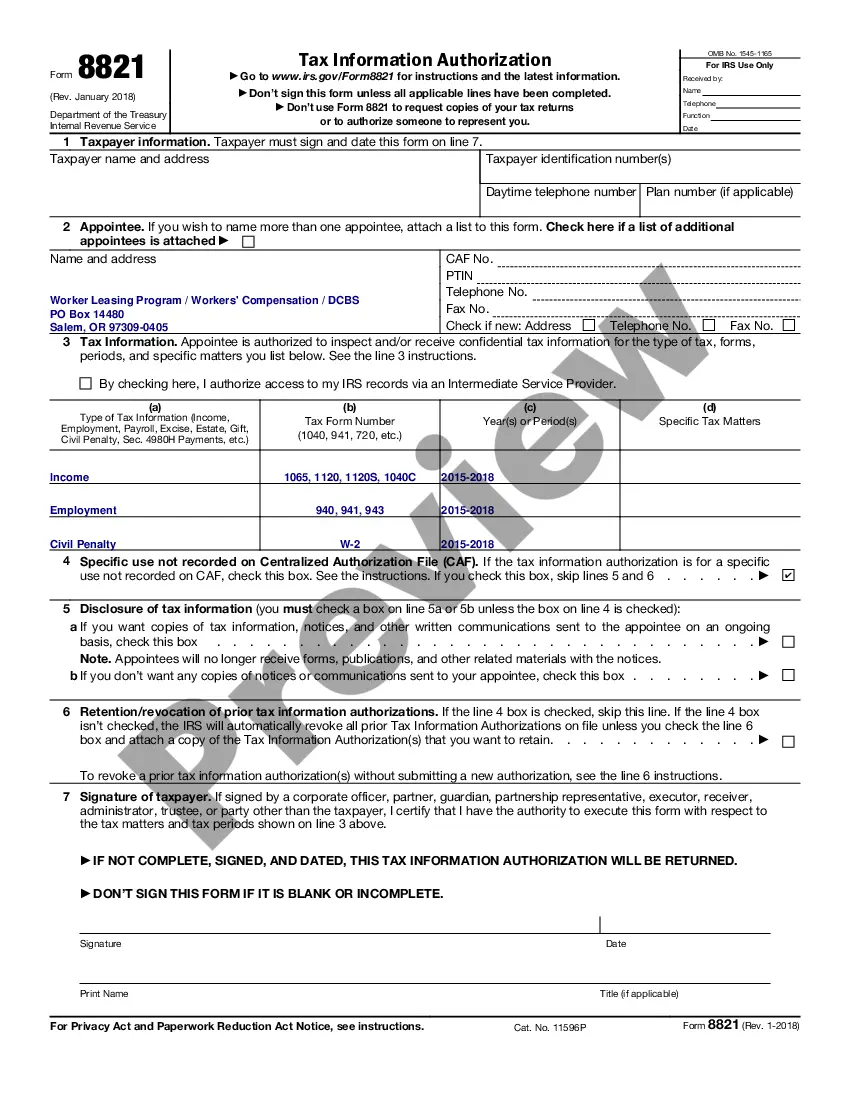

Maryland Affidavit of Domicile for Deceased is a legal document used to establish the deceased person's primary residence in the state of Maryland for various settlement purposes. It serves to provide necessary information to financial institutions, tax authorities, and other agencies involved in estate administration to determine the appropriate jurisdiction and tax implications. Keywords: Maryland, Affidavit of Domicile, deceased, legal document, primary residence, settlement purposes, financial institutions, tax authorities, estate administration, jurisdiction, tax implications. Different types of Maryland Affidavit of Domicile for Deceased include: 1. Maryland Affidavit of Domicile for Probate: This type of affidavit is typically used during the probate process to confirm the deceased person's primary residence in Maryland. It helps establish the relevant court's jurisdiction over the estate proceedings. 2. Maryland Affidavit of Domicile for Tax Purposes: This affidavit is crucial for determining the state inheritance tax, as well as federal estate tax obligations, if applicable. It provides necessary evidence to ascertain the deceased person's domicile at the time of their death. 3. Maryland Affidavit of Domicile for Financial Institutions: Financial institutions often require this affidavit to release the deceased person's assets, including bank accounts, investments, and insurance policies. It helps ensure that the assets are distributed according to the Maryland laws of intestacy or the deceased person's will. 4. Maryland Affidavit of Domicile for Real Estate Matters: This type of affidavit is utilized when the deceased person owned real estate properties in Maryland. It helps establish the primary residence for property tax, transfer of title, and other related legal and financial purposes. 5. Maryland Affidavit of Domicile for International Estate Matters: In cases where the deceased person had international connections or owned assets outside of Maryland, this affidavit may be required to provide additional proof of domicile, which can be instrumental in resolving cross-border estate issues and tax matters. Overall, a Maryland Affidavit of Domicile for Deceased is a crucial legal document used in various settlement processes and estate administration. It helps establish the deceased person's primary residence and serves as evidence for financial institutions, tax authorities, and other entities involved in distributing assets and resolving related legal matters.

Affidavit Of Domicile

Description affidavit of residency pdf

How to fill out Maryland Affidavit Of Domicile For Deceased?

US Legal Forms - among the greatest libraries of lawful kinds in the States - offers a variety of lawful file themes it is possible to down load or print. Making use of the website, you can get thousands of kinds for organization and specific reasons, categorized by types, suggests, or key phrases.You can find the newest models of kinds such as the Maryland Affidavit of Domicile for Deceased within minutes.

If you have a membership, log in and down load Maryland Affidavit of Domicile for Deceased from your US Legal Forms catalogue. The Obtain option will appear on every type you perspective. You have accessibility to all earlier acquired kinds in the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, here are straightforward directions to get you started off:

- Ensure you have selected the best type for your personal town/county. Select the Review option to review the form`s content. Read the type information to ensure that you have chosen the correct type.

- If the type doesn`t fit your requirements, utilize the Research discipline towards the top of the screen to find the one who does.

- When you are pleased with the form, confirm your decision by clicking on the Acquire now option. Then, select the pricing prepare you prefer and supply your accreditations to register on an account.

- Procedure the financial transaction. Make use of charge card or PayPal account to complete the financial transaction.

- Choose the file format and down load the form on your product.

- Make changes. Load, modify and print and signal the acquired Maryland Affidavit of Domicile for Deceased.

Each template you put into your bank account does not have an expiry date which is the one you have permanently. So, if you would like down load or print yet another duplicate, just proceed to the My Forms area and click in the type you need.

Gain access to the Maryland Affidavit of Domicile for Deceased with US Legal Forms, one of the most comprehensive catalogue of lawful file themes. Use thousands of skilled and status-certain themes that fulfill your business or specific requirements and requirements.

Form popularity

FAQ

Where a person's real property is located.

The General Rule Strong indicators of domicile include wherever a person pays taxes, votes, has a driver's license, and lives most the year.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

An Affidavit of Domicile is a legal document that you can use to verify the home address of a person who has died. As the executor or administrator of an estate, you are required to produce an Affidavit of Domicile when transferring or cashing in stocks or other investment assets of a deceased person.

'Domicile' generally refers to where you live ? your residence that you intend to keep for the foreseeable future. Your domicile has legal consequences for tax, probate, asset protection, and numerous other purposes. Domicile issues frequently arise with clients who split their time between Florida and another state.

A definition of affidavit of domicile is a term used in probate law to describe a document that names the place of residence of a decedent at the time of death. The place where a person resided at the time of death determines the jurisdiction whose probate laws will apply to the entire estate.