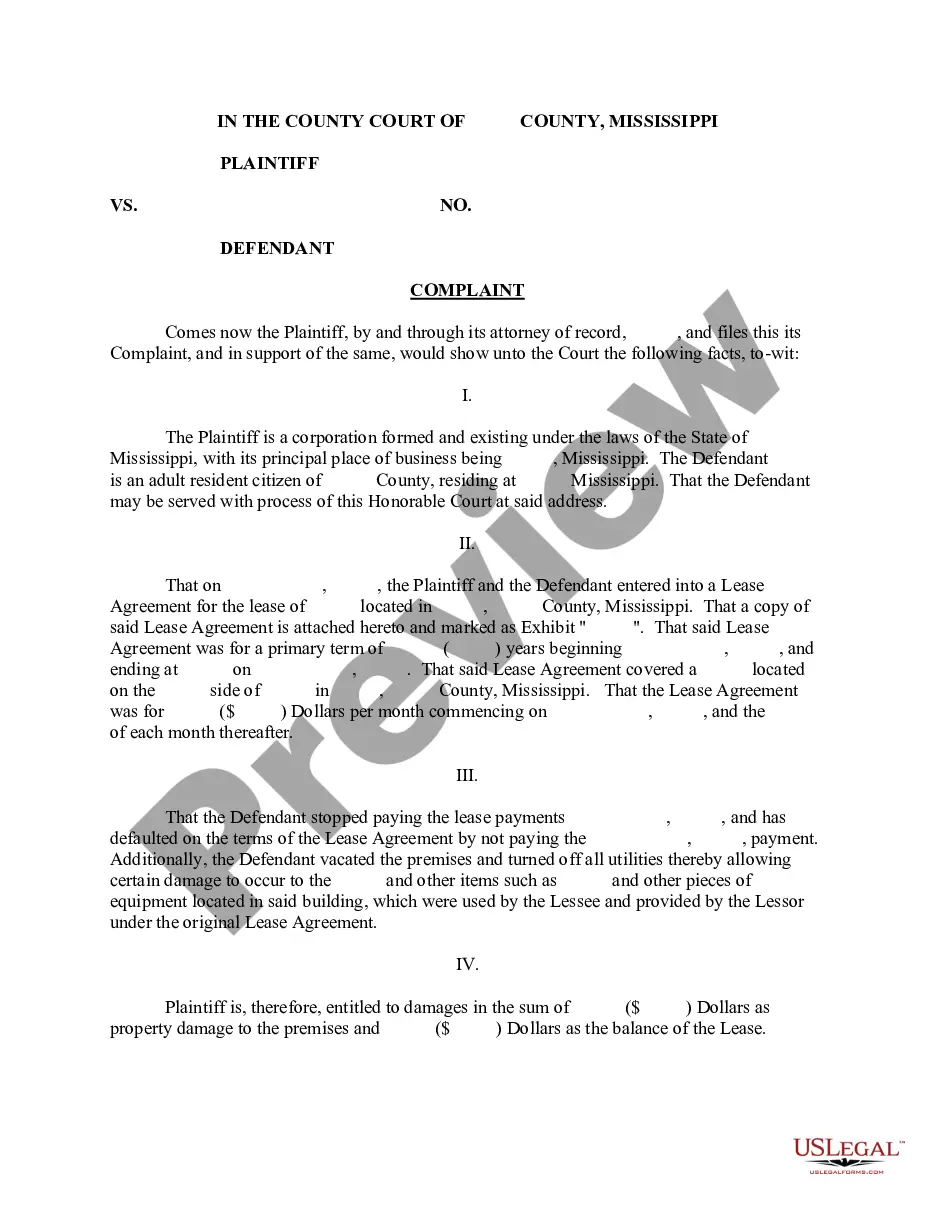

A security interest in an aircraft engine can be perfected only in the manner required by federal law. Federal law excludes by preemption the recording of title to or liens against aircraft, so that a transfer that is not recorded under the federal system is not effective. Security Interests in Engines less than 550 horsepower are not eligible for recording. A security interest in an aircraft is perfected by filing with the Aircraft Registration Branch of the Federal Aviation Administration.

Maryland Security Agreement Granting Security Interest in Aircraft Engine

Description

How to fill out Security Agreement Granting Security Interest In Aircraft Engine?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse array of legal template documents that you can download or print.

By utilizing the website, you'll encounter thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can quickly find the latest versions of documents such as the Maryland Security Agreement Granting Security Interest in Aircraft Engine.

If you already possess a monthly subscription, Log In and download the Maryland Security Agreement Granting Security Interest in Aircraft Engine from your US Legal Forms library. The Download button will appear on every document you view.

If you are satisfied with the document, confirm your selection by clicking the Get now button. Then, choose the payment plan you prefer and provide your information to register for an account.

Complete the purchase using your credit card or PayPal account. Select the format and download the document to your device. Make modifications. Fill in, edit, print, and sign the downloaded Maryland Security Agreement Granting Security Interest in Aircraft Engine.

- You can access all previously acquired documents from the My documents section of your account.

- If you're using US Legal Forms for the first time, follow these simple instructions to get started.

- Make sure you have selected the correct form for your city/county.

- Press the Review button to assess the content of the form.

- Read the form description to ensure you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

To perfect a security interest in an airplane, you typically need to file with the Federal Aviation Administration (FAA). This is because airplanes are registered assets, and the FAA maintains records of ownership and security interests. Ensuring you file the appropriate documentation protects your rights under a Maryland Security Agreement Granting Security Interest in Aircraft Engine. You may also benefit from guidance provided by platforms like uslegalforms to navigate the complexities of this process effectively.

To perfect a security interest in a fixture, you must file a financing statement with the appropriate Maryland authorities. This statement should include a description of the real estate where the fixture is located. Additionally, you should ensure that the security agreement complies with all state requirements. By doing this, you safeguard your interest in the fixture as part of your Maryland Security Agreement Granting Security Interest in Aircraft Engine.

The three primary methods for perfecting a security interest under a Maryland Security Agreement Granting Security Interest in Aircraft Engine are filing a financing statement, taking possession of the collateral, and control over the collateral. Each method has its own nuances, but filing a financing statement is the most common approach. This action provides public notice of your security interest, making it enforceable against third parties. Understanding these methods is crucial for ensuring your interests are fully protected.

A pledge agreement specifically involves transferring possession of the collateral to the lender or a third party to secure a debt. In contrast, a security agreement allows the borrower to retain possession of the collateral, while granting the lender a right to it in case of default. Both serve to protect the lender’s interests, but understanding these nuances is crucial for drafting a comprehensive Maryland Security Agreement Granting Security Interest in Aircraft Engine.

The primary purpose of a security agreement is to protect the lender's interest by clarifying the terms and conditions under which the borrower is allowed to use the aircraft engine. By establishing a legal framework, it minimizes risk for both parties involved. When you draft a Maryland Security Agreement Granting Security Interest in Aircraft Engine, you create a clear pathway for resolving disputes should they arise.

While a security agreement and a lien are closely related, they are not the same. A security agreement is a contract that creates and defines the security interest in the collateral, such as an aircraft engine. Conversely, a lien arises from the security interest and gives the lender the right to take possession of the asset if the borrower defaults on their obligations.

Yes, the Uniform Commercial Code (UCC) applies to aircraft under certain conditions. It provides a framework for regulating secured transactions involving personal property, including aircraft engines. Therefore, when creating a Maryland Security Agreement Granting Security Interest in Aircraft Engine, understanding UCC rules is essential to maintaining legal compliance.

To perfect a security interest in an aircraft, follow the proper procedures, which generally include executing a security agreement and filing a financing statement. It is important to ensure accuracy in all documentation to prevent challenges to your interest. When navigating this process, consider using US Legal Forms for templates that pertain specifically to a Maryland Security Agreement Granting Security Interest in Aircraft Engine.

A financing statement is the primary document used to perfect a security interest through filing. This statement provides details about the debtor, the secured party, and a description of the collateral involved. When you are dealing with a Maryland Security Agreement Granting Security Interest in Aircraft Engine, ensuring that your financing statement is correctly completed and filed is vital for protecting your rights.

To identify all outstanding security interests in an aircraft, you can conduct a search through the appropriate registries or databases. These records typically contain information on any filed security interests associated with the aircraft. A Maryland Security Agreement Granting Security Interest in Aircraft Engine emphasizes the importance of this due diligence to protect your investment.