The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. The buyer and seller (and their attorneys) must consider the law of contracts, taxation, real estate, corporations, securities, and antitrust in many situations. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted.

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

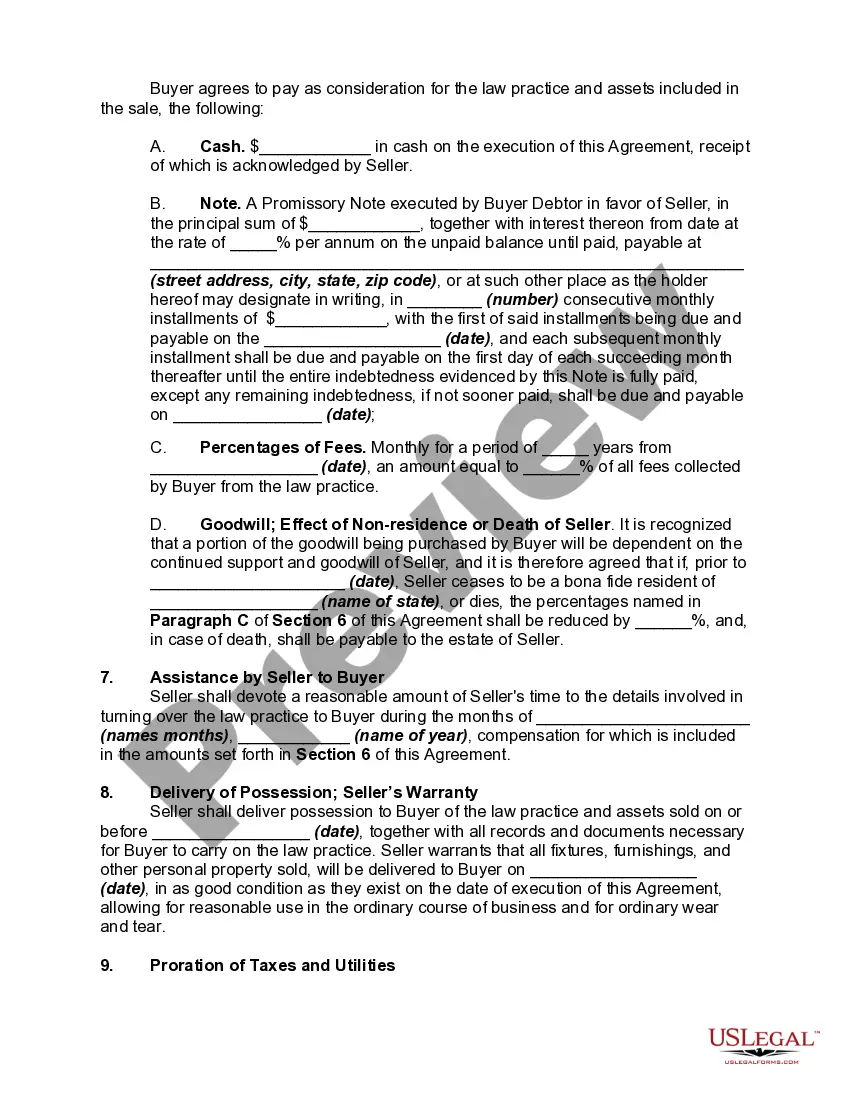

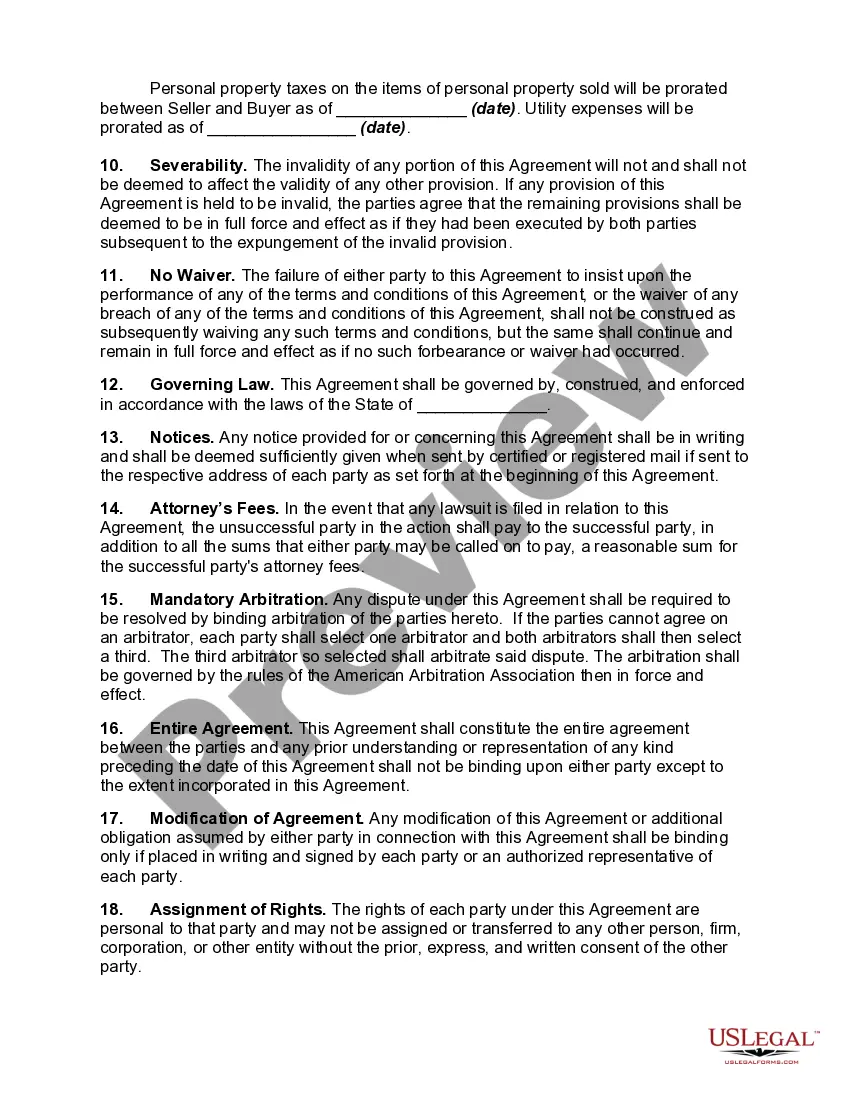

The Maryland Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a legally binding document that outlines the terms and conditions for the transfer of ownership of a sole proprietorship law practice in the state of Maryland. This agreement is designed to protect the interests of both the buyer and the seller and ensure a smooth transition of the business. A restrictive covenant is a crucial component of this agreement. It is a contractual clause that restricts the seller from competing with the buyer's newly acquired law practice within a specified geographic area and for a certain period of time. The purpose of this covenant is to safeguard the buyer's investment and prevent the seller from poaching clients or divulging confidential information to their new competitors. The Maryland Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant must comply with the state's laws and regulations governing the transfer of a law practice. It should clearly define the terms of the sale, including the purchase price, payment terms, and any contingencies that must be met for the agreement to be enforced. Different types of Maryland Agreements for Sale of Sole Proprietorship Law Practice with Restrictive Covenant typically include variations in the specific provisions and terms based on the needs and preferences of the parties involved. Some examples of these variations might include: 1. Purchase Price and Payment Terms Agreement: This type of agreement could specify different payment options, such as lump sum payment, installment payments, or a combination of both. It may also outline the financial responsibilities of the buyer and seller regarding outstanding debts, client retainers, or judgments. 2. Non-Compete Agreement: In addition to a general restrictive covenant, this type of agreement could include additional provisions specifically addressing non-solicitation of clients, non-recruitment of employees, or non-disclosure of trade secrets and proprietary information. 3. Succession Planning Agreement: In situations where a sole proprietor is planning for retirement or an eventual exit from the law practice, this type of agreement could be used to establish a timeline for the transition, including provisions for a phased handover of clients and training of the buyer. It is important to consult with a qualified attorney specializing in business law to draft or review the Maryland Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant. This will ensure the agreement complies with state laws and protects the interests of both parties involved in the transaction.The Maryland Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a legally binding document that outlines the terms and conditions for the transfer of ownership of a sole proprietorship law practice in the state of Maryland. This agreement is designed to protect the interests of both the buyer and the seller and ensure a smooth transition of the business. A restrictive covenant is a crucial component of this agreement. It is a contractual clause that restricts the seller from competing with the buyer's newly acquired law practice within a specified geographic area and for a certain period of time. The purpose of this covenant is to safeguard the buyer's investment and prevent the seller from poaching clients or divulging confidential information to their new competitors. The Maryland Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant must comply with the state's laws and regulations governing the transfer of a law practice. It should clearly define the terms of the sale, including the purchase price, payment terms, and any contingencies that must be met for the agreement to be enforced. Different types of Maryland Agreements for Sale of Sole Proprietorship Law Practice with Restrictive Covenant typically include variations in the specific provisions and terms based on the needs and preferences of the parties involved. Some examples of these variations might include: 1. Purchase Price and Payment Terms Agreement: This type of agreement could specify different payment options, such as lump sum payment, installment payments, or a combination of both. It may also outline the financial responsibilities of the buyer and seller regarding outstanding debts, client retainers, or judgments. 2. Non-Compete Agreement: In addition to a general restrictive covenant, this type of agreement could include additional provisions specifically addressing non-solicitation of clients, non-recruitment of employees, or non-disclosure of trade secrets and proprietary information. 3. Succession Planning Agreement: In situations where a sole proprietor is planning for retirement or an eventual exit from the law practice, this type of agreement could be used to establish a timeline for the transition, including provisions for a phased handover of clients and training of the buyer. It is important to consult with a qualified attorney specializing in business law to draft or review the Maryland Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant. This will ensure the agreement complies with state laws and protects the interests of both parties involved in the transaction.