Maryland General Form of Amendment to Partnership Agreement

Description

How to fill out General Form Of Amendment To Partnership Agreement?

If you need extensive, obtain, or printing legal document templates, utilize US Legal Forms, the premier selection of legal templates that can be accessed online.

Employ the website's simple and user-friendly search to find the documents you require.

A range of templates for business and personal use are categorized by type and state, or keywords.

Step 4. Once you have located the form you desire, click the Purchase now button. Choose the payment plan you wish and enter your details to register for the account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to get the Maryland General Form of Amendment to Partnership Agreement in just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and select the Download button to retrieve the Maryland General Form of Amendment to Partnership Agreement.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

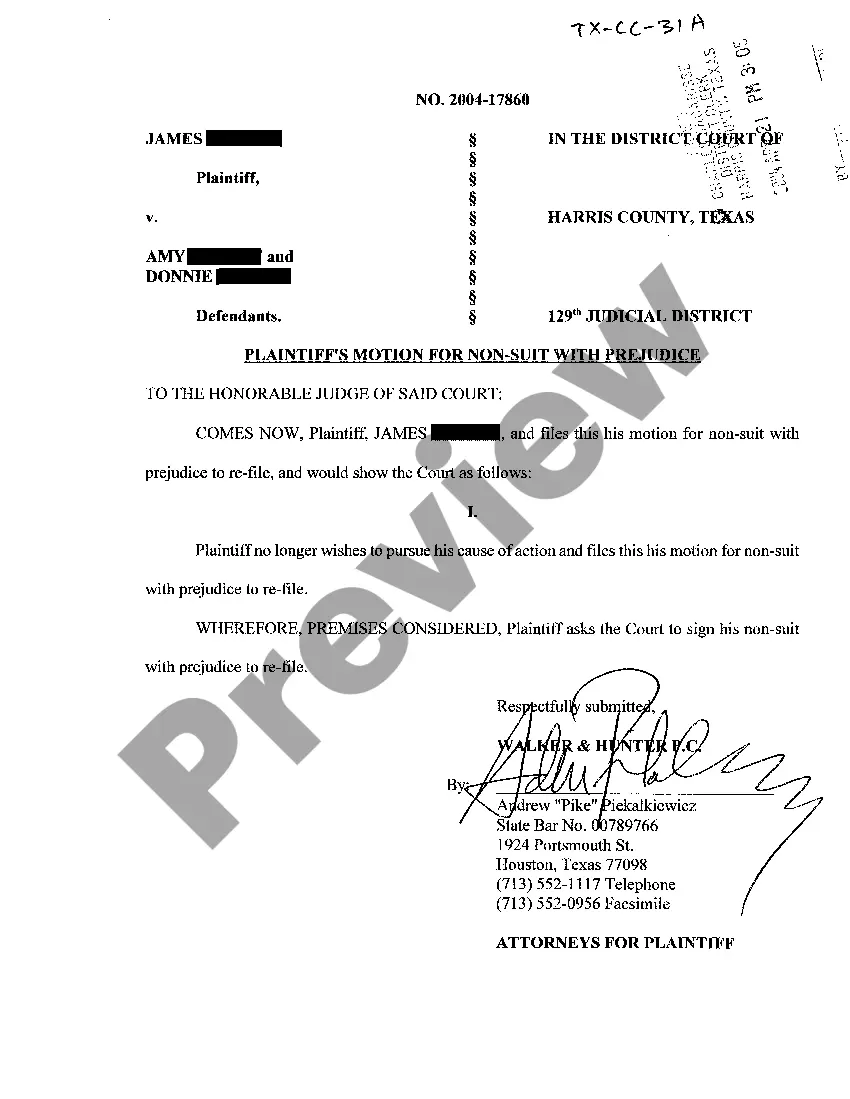

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document format.

Form popularity

FAQ

To reinstate your LLC in Maryland, you must first ensure that your business complies with state requirements. Begin by submitting the necessary application and paying any outstanding fees. If your LLC has undergone amendments, you might need to utilize the Maryland General Form of Amendment to Partnership Agreement to update your records accurately. Ensuring all documentation is complete accelerates the reinstatement process and keeps your business in good standing.

While it's not legally required to hire a lawyer to form a partnership in Maryland, consulting one can provide valuable insights and ensure your partnership agreement is comprehensive. A knowledgeable attorney can help you navigate the legal requirements, including the use of the Maryland General Form of Amendment to Partnership Agreement for future changes. Investing in legal guidance can help prevent misunderstandings and disputes down the line.

To form a partnership in Maryland, you need at least two individuals who agree to operate a business together. It's essential to create a formal partnership agreement that specifies each partner's responsibilities, contributions, and profit shares. You may also consider filing the Maryland General Form of Amendment to Partnership Agreement as your partnership evolves and partnerships need to be updated.

Forming a partnership in Maryland starts with choosing a suitable business name and drafting a partnership agreement. This agreement outlines the roles, responsibilities, and profit distribution among partners. Using the Maryland General Form of Amendment to Partnership Agreement can facilitate any changes in the future, ensuring that your partnership remains compliant and cohesive as it grows.

Yes, Maryland does allow domestic partnerships, offering couples certain legal rights similar to marriage. To establish a domestic partnership in Maryland, you must meet specific criteria and file a Declaration of Domestic Partnership with your local government. This partnership can also require amendments to existing agreements, such as the Maryland General Form of Amendment to Partnership Agreement, if you're involved in a business.

To change ownership of an LLC in Maryland, you will need to file the Maryland General Form of Amendment to Partnership Agreement. This form updates your LLC's operating agreement and officially reflects the new ownership structure. It's important to ensure that all members consent to this change to avoid future disputes. Additionally, keep a copy of the updated agreement for your records.

To change the terms of a partnership agreement, you must draft an amendment that specifies the new terms. Using the Maryland General Form of Amendment to Partnership Agreement simplifies this process, providing a structured framework. Ensure all partners agree to the new terms and sign the amended document for legal validation. This formalizes the changes and helps maintain a positive working relationship among partners.

The amendment form for Maryland is essentially the Maryland General Form of Amendment to Partnership Agreement. It is designed to facilitate the proper documentation of any changes to your partnership agreement. When completing this form, ensure that all partners review it to avoid disputes and ensure clarity. This proactive approach keeps your partnership agreement current and legally sound.

An Amendment form is used to officially record changes made to an existing partnership agreement. The Maryland General Form of Amendment to Partnership Agreement serves this purpose by allowing partners to outline and document any modifications. This form ensures changes are legally recognized, helping to prevent misunderstandings among partners. It is vital for keeping your partnership compliant with Maryland laws.

To file an Amendment form in Maryland, you should complete the Maryland General Form of Amendment to Partnership Agreement with the necessary changes. Ensure all partners have agreed to the amendments before you submit the form. Submit the completed document to the Maryland State Department of Assessments and Taxation, along with any applicable fees. Timely filing is important for maintaining your partnership’s legal status.