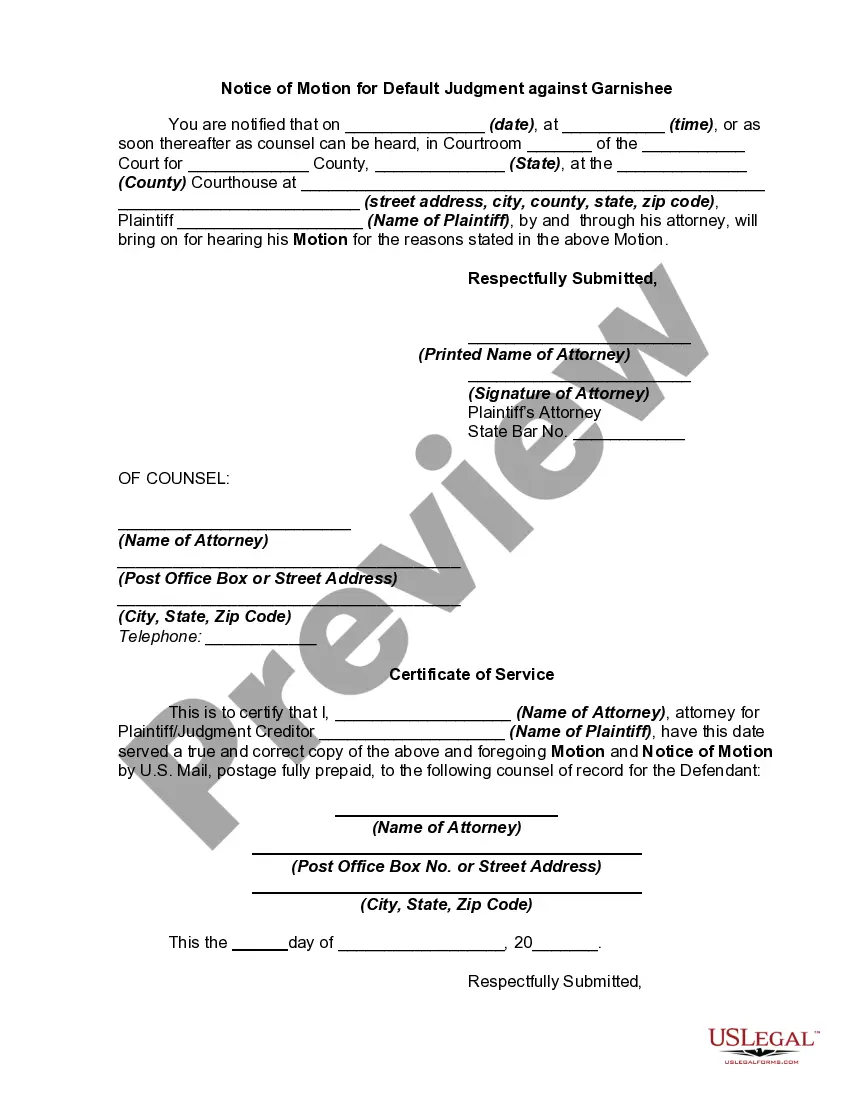

Are you presently in the position the place you require documents for either company or personal functions just about every working day? There are a lot of lawful document templates accessible on the Internet, but getting versions you can rely is not easy. US Legal Forms offers a huge number of type templates, such as the Maryland Motion for Default Judgment against Garnishee, which are published to meet federal and state needs.

In case you are currently acquainted with US Legal Forms internet site and also have a merchant account, just log in. Following that, you can download the Maryland Motion for Default Judgment against Garnishee format.

Should you not have an accounts and wish to start using US Legal Forms, adopt these measures:

- Find the type you need and ensure it is for your appropriate metropolis/state.

- Utilize the Preview key to analyze the form.

- Look at the description to actually have selected the proper type.

- In the event the type is not what you`re looking for, make use of the Lookup area to get the type that meets your needs and needs.

- Whenever you get the appropriate type, click on Buy now.

- Choose the rates prepare you desire, complete the necessary information and facts to produce your money, and pay money for an order using your PayPal or charge card.

- Decide on a convenient paper format and download your version.

Get all of the document templates you may have purchased in the My Forms food selection. You can get a extra version of Maryland Motion for Default Judgment against Garnishee anytime, if required. Just click on the needed type to download or produce the document format.

Use US Legal Forms, by far the most comprehensive assortment of lawful varieties, to conserve time as well as prevent faults. The service offers appropriately created lawful document templates which you can use for a range of functions. Produce a merchant account on US Legal Forms and commence creating your lifestyle a little easier.