Maryland Disputed Accounted Settlement

Description

How to fill out Disputed Accounted Settlement?

If you wish to comprehensive, download, or produce lawful papers themes, use US Legal Forms, the biggest variety of lawful types, which can be found on the Internet. Make use of the site`s simple and handy research to obtain the paperwork you will need. Different themes for business and individual purposes are categorized by types and says, or keywords. Use US Legal Forms to obtain the Maryland Disputed Accounted Settlement in a handful of click throughs.

When you are already a US Legal Forms customer, log in to your accounts and click on the Down load switch to find the Maryland Disputed Accounted Settlement. Also you can access types you in the past saved inside the My Forms tab of the accounts.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the form for the right city/region.

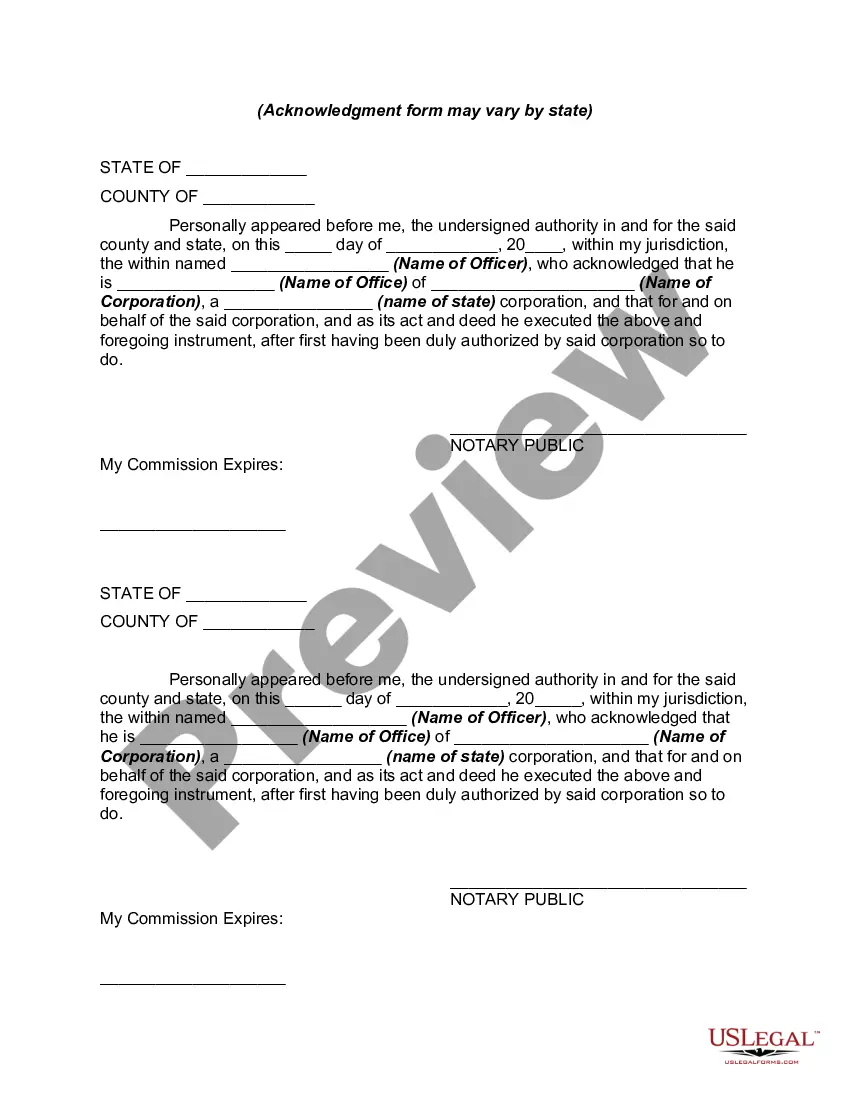

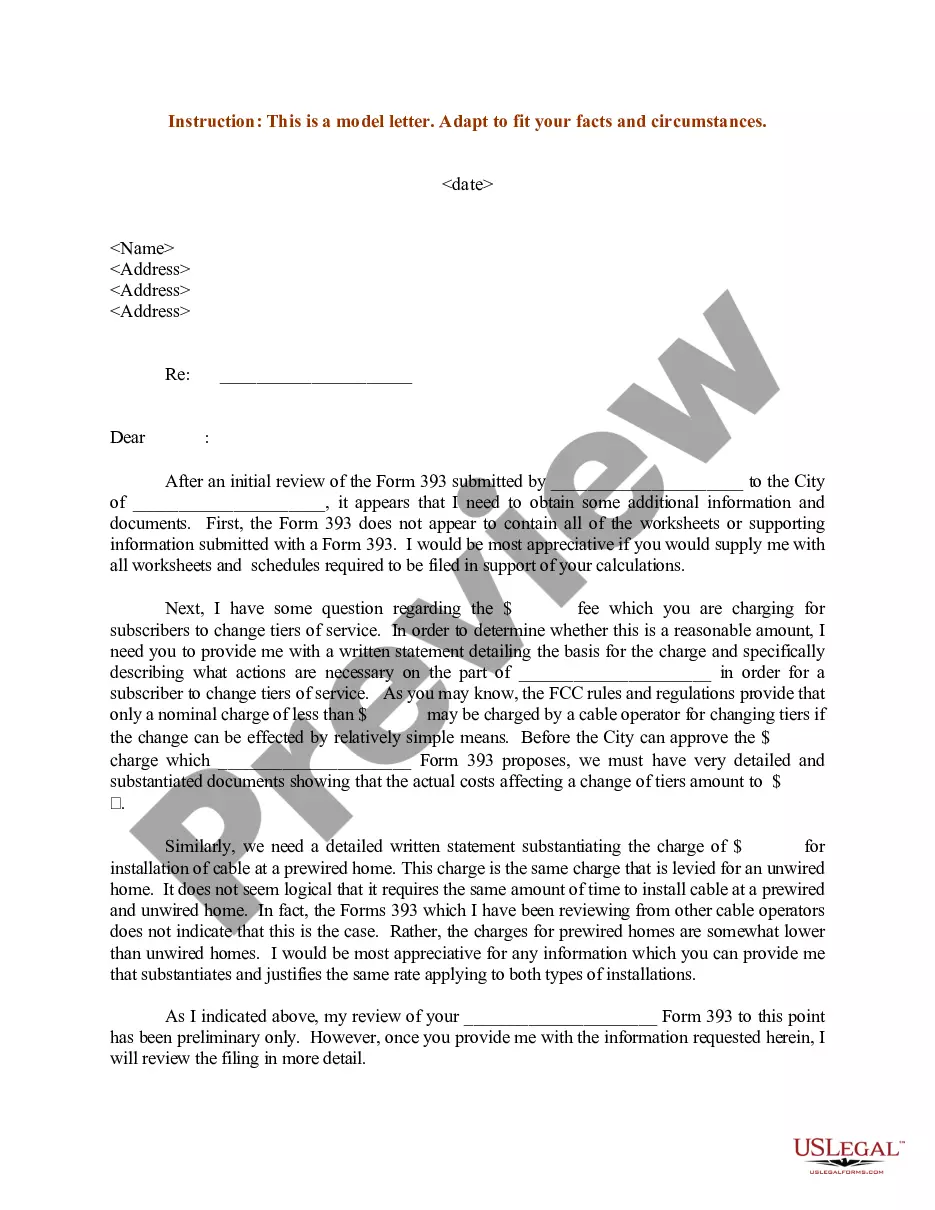

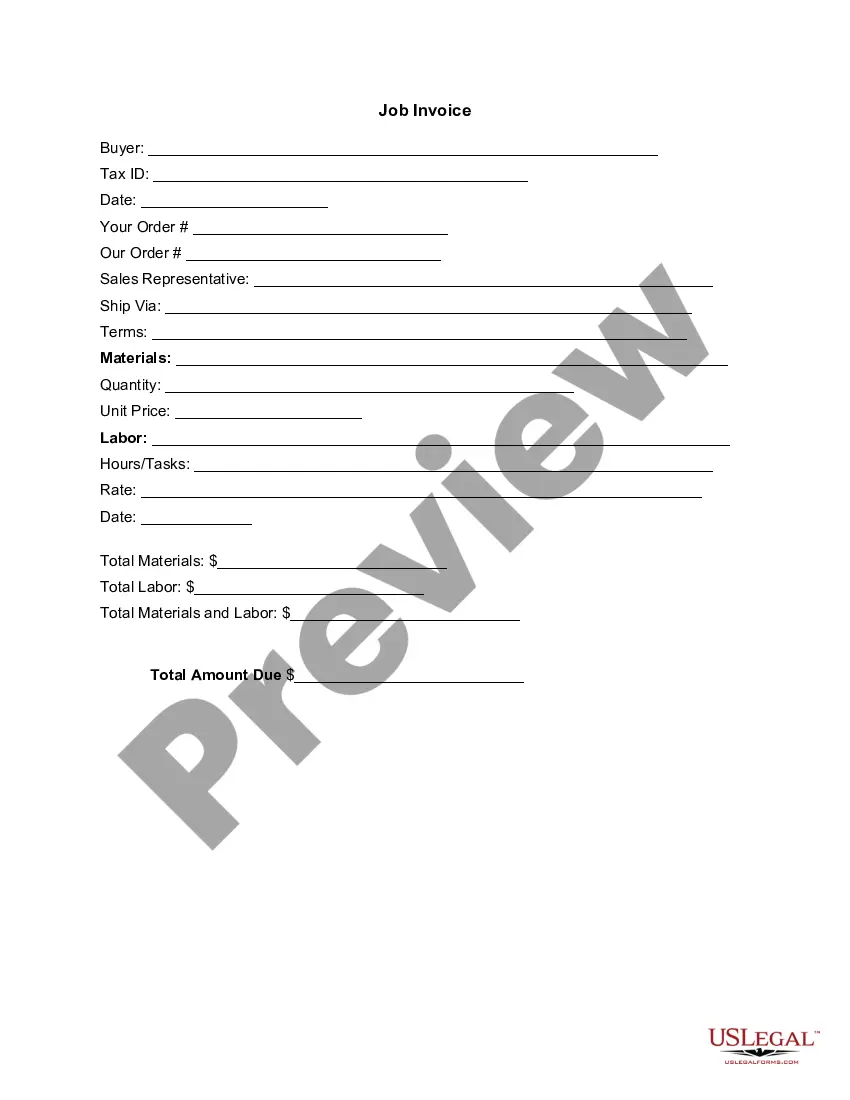

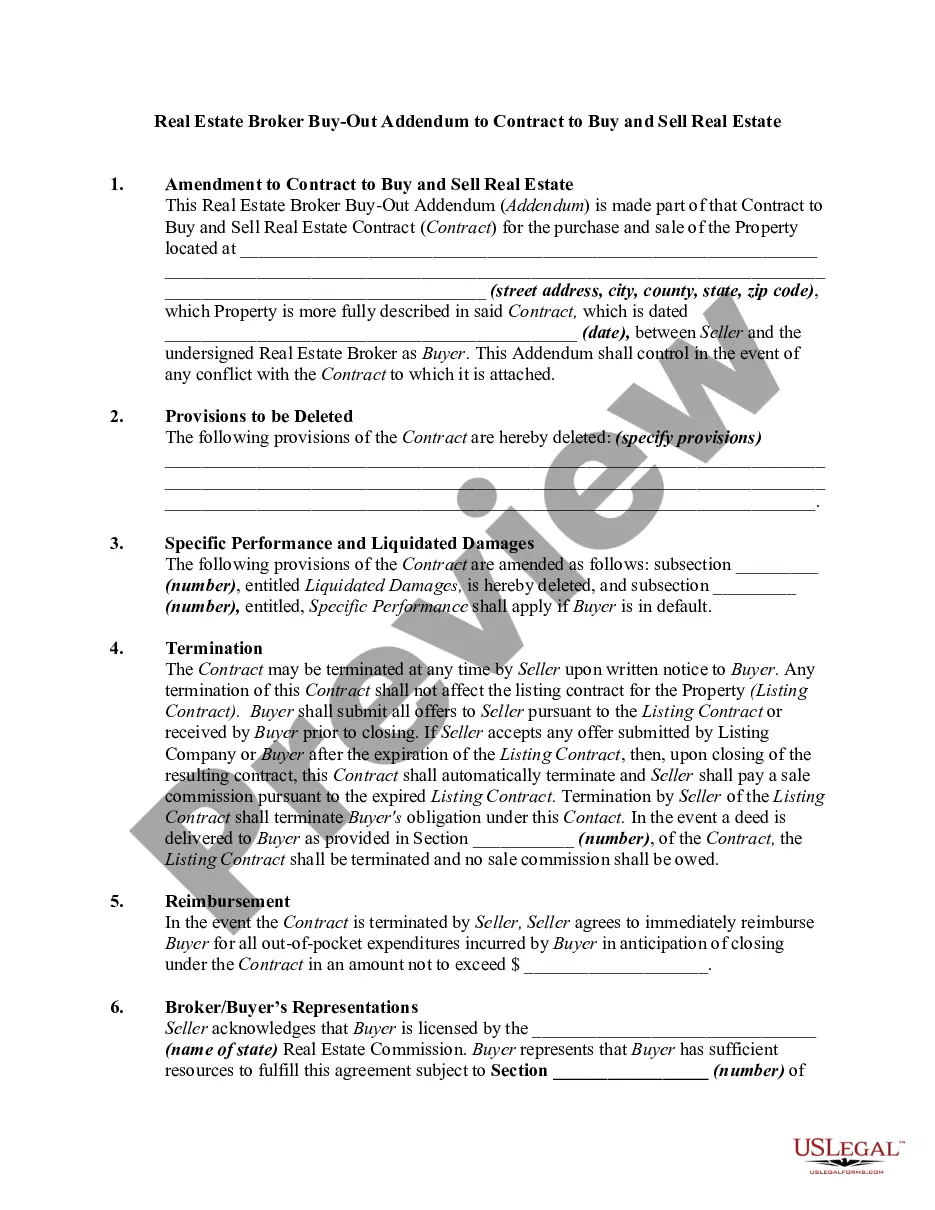

- Step 2. Use the Preview choice to look over the form`s information. Never neglect to read the outline.

- Step 3. When you are unhappy using the kind, use the Search industry towards the top of the monitor to discover other models of your lawful kind web template.

- Step 4. After you have found the form you will need, click the Acquire now switch. Select the rates plan you choose and put your credentials to register to have an accounts.

- Step 5. Procedure the financial transaction. You can use your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Find the format of your lawful kind and download it in your product.

- Step 7. Full, change and produce or signal the Maryland Disputed Accounted Settlement.

Each lawful papers web template you buy is your own property eternally. You may have acces to every single kind you saved in your acccount. Select the My Forms portion and pick a kind to produce or download once again.

Remain competitive and download, and produce the Maryland Disputed Accounted Settlement with US Legal Forms. There are many skilled and status-distinct types you can use for your business or individual requirements.

Form popularity

FAQ

For each paragraph in the complaint, state whether: the defendant admits the allegations in that paragraph; denies the allegations; lacks sufficient knowledge to admit or deny the allegations; or admits certain allegations but denies, or lacks sufficient knowledge to admit or deny, the rest.

However, the most common response to a civil lawsuit is called an ?Answer? (some other name depending on the state). An Answer is a written document in which a defendant admits or denies the allegations in the plaintiff's complaint and sets forth the reasons why the defendant should not be liable.

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland.

File a Notice of Intention to Defend: You must file this within 15 days of receiving the summons. The Notice is on the bottom half of the summons. Once you have responded, the Court will send the plaintiff a copy of this notice. File a Counterclaim, Cross-claim, or a Third-Party Complaint.

The Comptroller's office will intercept any money due to you from the State for any reason including your Maryland income tax refund. The Comptroller's office can also intercept your federal income tax refund and payments due to your as a federal vendor.

File a Notice of Intention to Defend (Md. Rule 3-307) The Notice of Intention to Defend includes space for you to explain why you disagree with all or part of the claim. ... Cut the notice at the perforated line, complete, sign, and return it to the court address on the top of the summons.

File a Notice of Intention to Defend If you choose to defend yourself, you must file the Notice of Intention to Defend, appearing on the bottom half of the summons. The Notice should be cut at the perforated line and returned to the court address listed at the top of the summons.