Maryland Estate Planning Data Sheet

Description

How to fill out Estate Planning Data Sheet?

If you wish to complete, acquire, or print legal document layouts, use US Legal Forms, the most important collection of legal varieties, which can be found on-line. Use the site`s simple and easy hassle-free lookup to discover the files you need. A variety of layouts for business and personal functions are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the Maryland Estate Planning Data Sheet with a few mouse clicks.

If you are already a US Legal Forms client, log in for your accounts and click on the Down load option to get the Maryland Estate Planning Data Sheet. Also you can gain access to varieties you previously saved in the My Forms tab of your own accounts.

If you use US Legal Forms the very first time, follow the instructions beneath:

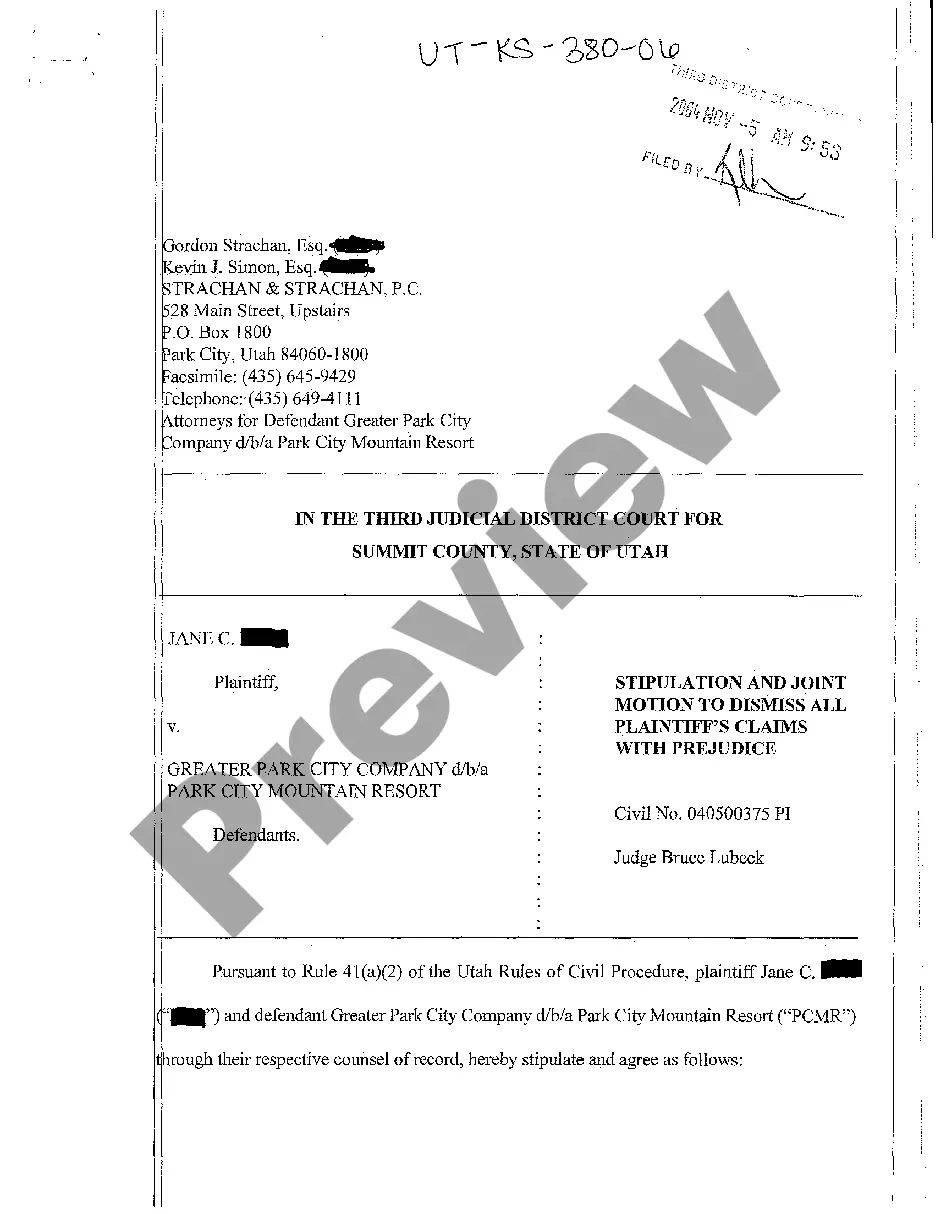

- Step 1. Be sure you have chosen the shape to the appropriate area/nation.

- Step 2. Take advantage of the Preview solution to check out the form`s content. Do not neglect to read the explanation.

- Step 3. If you are unsatisfied with all the kind, make use of the Look for field at the top of the display to locate other versions of your legal kind design.

- Step 4. After you have discovered the shape you need, click the Acquire now option. Opt for the pricing plan you prefer and put your accreditations to sign up for the accounts.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal accounts to accomplish the deal.

- Step 6. Choose the format of your legal kind and acquire it on the system.

- Step 7. Comprehensive, edit and print or signal the Maryland Estate Planning Data Sheet.

Every single legal document design you buy is the one you have permanently. You might have acces to every kind you saved in your acccount. Go through the My Forms section and choose a kind to print or acquire once again.

Compete and acquire, and print the Maryland Estate Planning Data Sheet with US Legal Forms. There are thousands of professional and condition-specific varieties you may use for the business or personal requires.

Form popularity

FAQ

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

However, revocable living trusts can be expensive, don't have direct tax benefits, and don't protect against creditors. Carefully weigh these pros and cons against your situation before deciding to set up a revocable living trust. A financial advisor can help you create an estate plan for your family's needs and goals.

Estate Plan Drafting In the case of a will or trust, they define how your estate will be managed and distributed after your death. In Maryland, the cost for comprehensive estate plan drafting can range from $900 to $4,250 or more, depending on the complexity of your estate and the attorney's experience.

Hear this out loud Pauseing to Maryland law, executor fees are calculated based on a sliding scale. This scale ranges from 9% of the first $20,000 of the gross estate, down to 0.5% of the excess over $5,000,000. This means the larger the estate, the lower the percentage the executor will receive.

Hear this out loud PauseIn Maryland, the average cost for a will typically ranges from $200 to $600, depending on the attorney's fees and the complexity of the will. The average cost for a trust in Maryland can range from $1,000 to $3,000 or more, depending on the type of trust, attorney's fees, and the complexity of the trust's provisions.

Hear this out loud Pause4.1. 2.1 The personal representative is entitled to ?reasonable compensation for services.? Statutory commissions for personal representatives are expressed as a maximum: not to exceed $1,800 plus 3.6% of the excess over $20,000 unless a larger amount is provided by the will. Sec. 7-601, Estates and Trusts Article.

Hear this out loud PauseIn Maryland, the cost for comprehensive estate plan drafting can range from $900 to $4,250 or more, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in Maryland can range from roughly $250 to $850. A Maryland trust typically costs anywhere between $900 and $2,950.

The Estate Planning Must-Haves. Wills and Trusts. Durable Power of Attorney. Beneficiary Designations. Letter of Intent. Healthcare Power of Attorney. Guardianship Designations. Estate Planning FAQs.