Maryland Assignment of Mortgage is a legal document that allows the transfer of a mortgage loan from the original lender (assignor) to another party (assignee). This assignment effectively transfers the rights, benefits, and responsibilities of the mortgage loan to the assignee. In Maryland, there are primarily two types of Assignment of Mortgage: 1. Absolute Assignment: This type of assignment transfers the mortgage loan entirely to the assignee. The assignee becomes the new holder of the mortgage and gains all rights and obligations associated with it. The assignee assumes the responsibility of collecting payments, managing the loan, and any other related activities. 2. Collateral Assignment: Unlike an absolute assignment, a collateral assignment of mortgage transfers only a portion of the mortgage loan to the assignee. This partial assignment usually serves as collateral for a specific debt owed to the assignee. In the event of default on the debt, the assignee can foreclose on the assigned collateral portion of the mortgage. When executing the Assignment of Mortgage, it is crucial to accurately document the terms of the transfer, the assignor's and assignee's details, and the property's information. The document should also be signed and notarized to ensure its legal validity and enforceability. Keywords: Maryland Assignment of Mortgage, mortgage loan transfer, assignor, assignee, rights, benefits, responsibilities, absolute assignment, collateral assignment, transfer of mortgage loan, legal document, holder of the mortgage, collecting payments, managing the loan, collateral portion, default, foreclosure, terms, property information, signed, notarized, legal validity, enforceability.

Maryland Assignment of Mortgage

Description

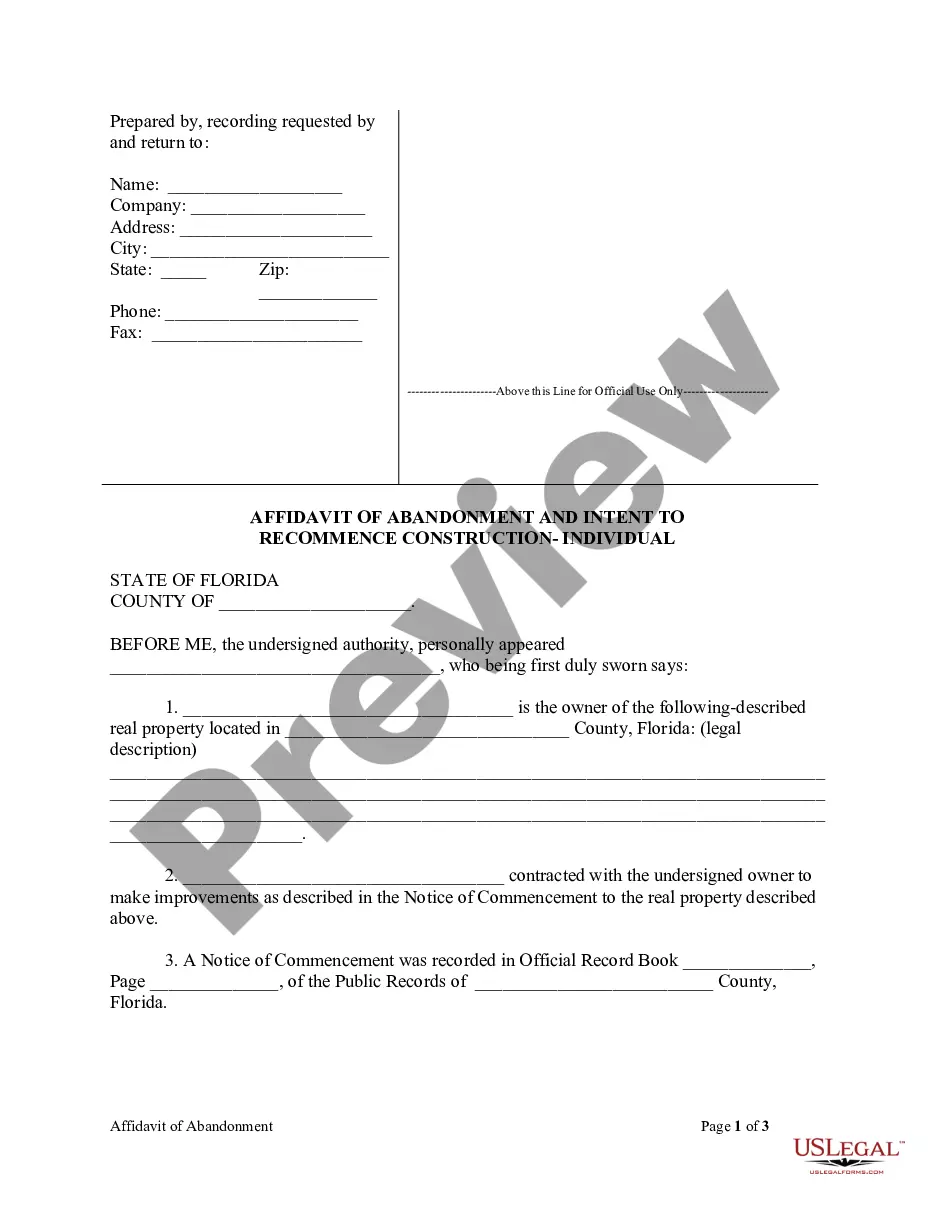

How to fill out Maryland Assignment Of Mortgage?

Are you presently in a situation in which you will need files for possibly organization or individual purposes almost every working day? There are a lot of legitimate document templates available online, but getting ones you can trust isn`t easy. US Legal Forms delivers thousands of form templates, just like the Maryland Assignment of Mortgage, which can be created to meet federal and state specifications.

When you are previously informed about US Legal Forms website and have an account, merely log in. Afterward, you are able to down load the Maryland Assignment of Mortgage design.

Should you not provide an profile and need to start using US Legal Forms, adopt these measures:

- Find the form you will need and make sure it is for the correct town/area.

- Take advantage of the Preview key to examine the shape.

- See the description to actually have selected the proper form.

- When the form isn`t what you are looking for, take advantage of the Research discipline to discover the form that meets your requirements and specifications.

- If you get the correct form, click Purchase now.

- Pick the costs program you need, complete the required details to produce your account, and buy the transaction utilizing your PayPal or bank card.

- Choose a practical document formatting and down load your backup.

Find all of the document templates you might have bought in the My Forms food list. You can obtain a extra backup of Maryland Assignment of Mortgage whenever, if needed. Just click the needed form to down load or print out the document design.

Use US Legal Forms, the most comprehensive collection of legitimate forms, in order to save time and steer clear of blunders. The assistance delivers professionally made legitimate document templates that you can use for a range of purposes. Create an account on US Legal Forms and begin generating your daily life easier.

Form popularity

FAQ

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

A recorded mortgage must be discharged by a certificate signed by the mortgagee, his personal representatives or assigns, acknowledged or proved and certified as prescribed by the chapter on ?recording transfers,? stating that the mortgage has been paid, satisfied, or discharged.

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

A release assignment or satisfaction of mortgage form is a document stating that the lender has released the homeowner from all liability regarding her mortgage.

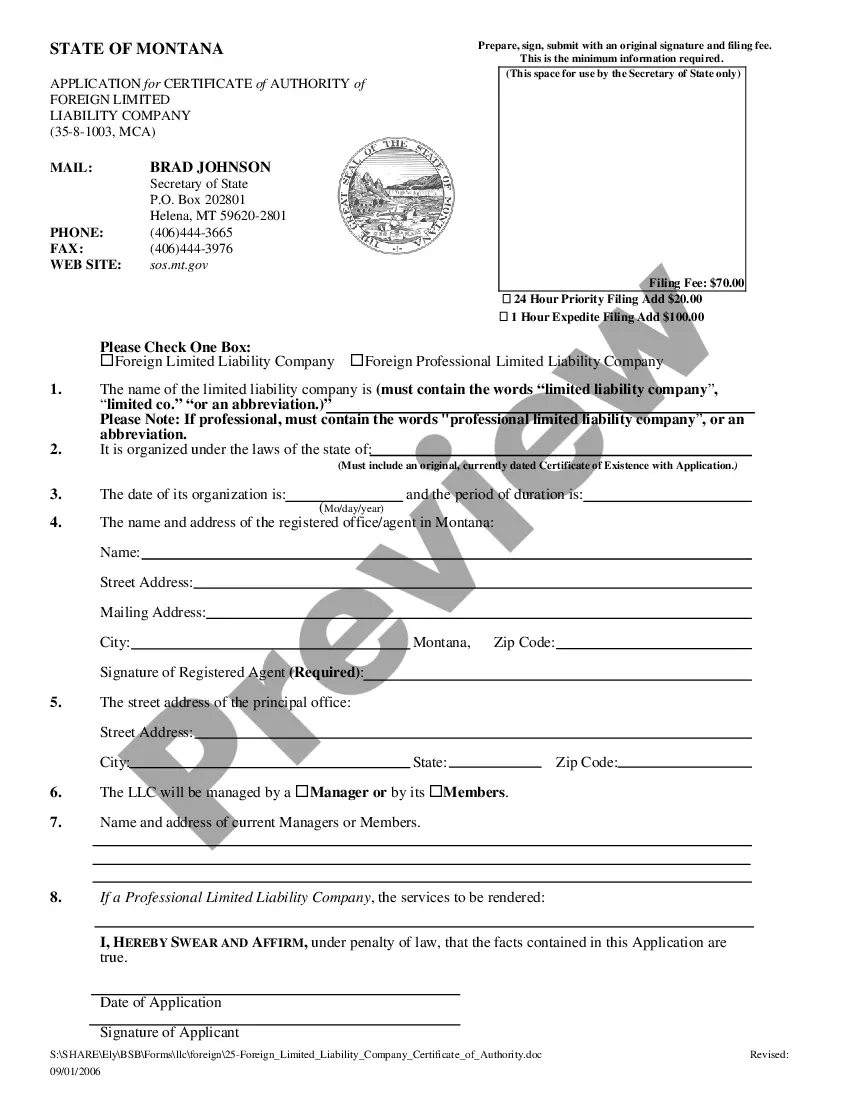

Assignment of Deed of Trust - Mortgage for Real Estate Located in Maryland. Both Deed of Trusts and Mortgages are used as security instruments to secure a debt on real property in Maryland. This form is used to assign either to another party, often used when the debt is sold to another lender.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.