Maryland Receiving Order

Description

How to fill out Receiving Order?

Are you presently in a role where you periodically need documents for particular businesses or specific tasks almost all the time.

There are numerous official document templates available online, but locating versions you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Maryland Receiving Order, designed to meet both federal and state requirements.

Once you locate the correct form, click on Purchase now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Receiving Order template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

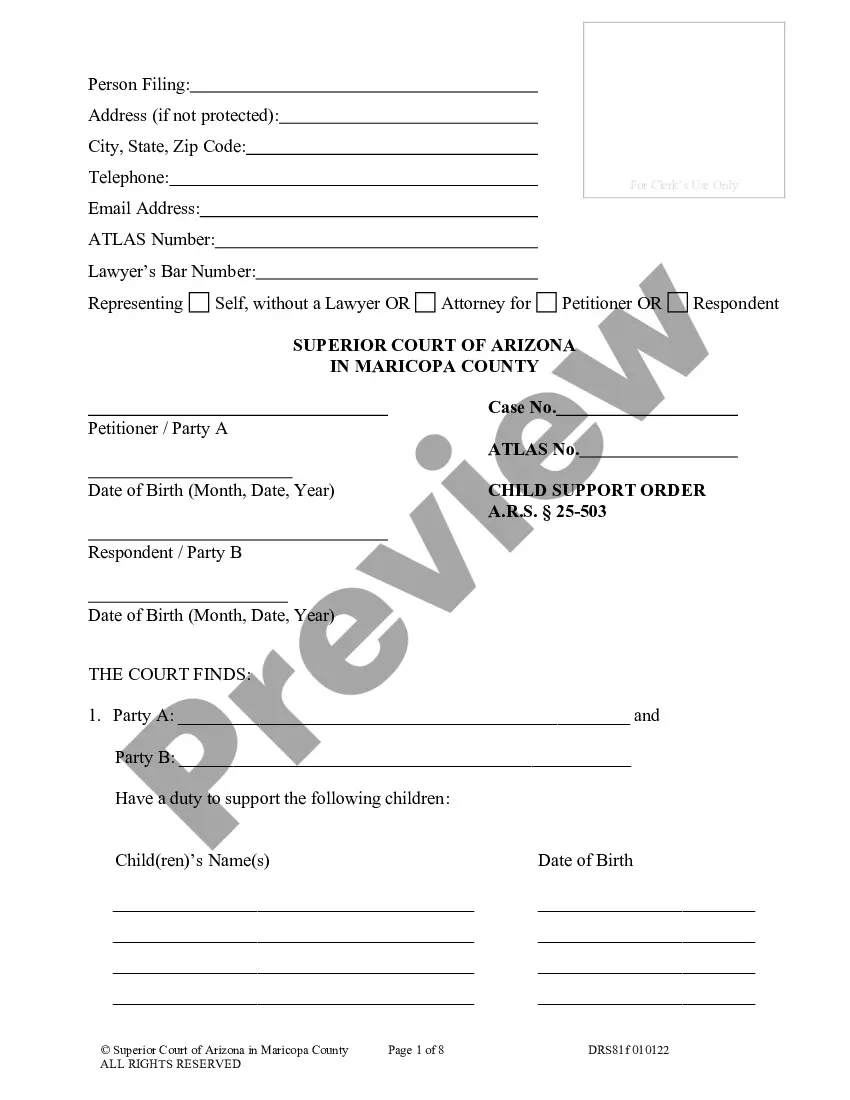

- Click the Preview button to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search field to find a form that meets your needs and criteria.

Form popularity

FAQ

Filing a peace order in Maryland involves visiting your local district court and completing the necessary forms. You will need to describe the specific incidents that led you to seek protection. Once filed, a hearing will be scheduled where you can present your case. For assistance, consider using platforms like USLegalForms, which can help guide you through the process.

Yes, you need to provide evidence when seeking a peace order in Maryland. This proof should demonstrate that harassment or abuse has occurred and support your request for legal protection. The court will carefully review your evidence before issuing a Maryland Receiving Order. Strong documentation greatly enhances your chances of obtaining the order swiftly.

To obtain a restraining order in Maryland, you need to present clear evidence of threats, harassment, or harm. This proof can include photographs, text messages, or witnesses who can attest to the behavior. The court evaluates this evidence to decide if a Maryland Receiving Order is appropriate for your situation. Being thorough with your documentation is key to a successful application.

After a Maryland Receiving Order issues an order of default, the court typically schedules a hearing. During this hearing, the judge will consider evidence and arguments presented by the parties involved. If you are the plaintiff, you may receive a favorable judgment if the defendant does not respond. This process helps ensure fair treatment under Maryland law.

In MD, to get your title after paying off your car, you must have the lien release from your lender. Submit this along with a title application at your local MVA branch. Be prepared to provide identification and any other documents requested by the MVA staff. Turn to uslegalforms for guidance and templates to ensure you complete your request correctly.

To secure a Maryland safety inspection certificate, take your vehicle to an authorized inspection station. The station will inspect your vehicle to ensure it meets state safety standards. If your vehicle passes, you will receive the certificate. Using uslegalforms can help you understand the requirements and find a nearby inspection center.

To obtain the title to your car after paying it off, first ensure your lender sends you a lien release document. Once you have that, you’ll need to apply for a new title through the Maryland MVA. Make sure to include the lien release and any other required documentation in your submission. Uslegalforms provides helpful resources to assist with this process, ensuring you get your title without hassle.

Yes, you can obtain a copy of your car title online in Maryland. Visit the Maryland MVA's website and use their online services to find the title request forms. This convenient method reduces wait times and helps you efficiently manage your vehicle records. Remember, having a valid Maryland Receiving Order may simplify your online request.

When someone avoids being served a restraining order, it can delay the court proceedings. The individual may continue their behavior without consequences until they are officially notified. Utilizing legal services to navigate the complexities of a Maryland Receiving Order can help ensure that the order is served properly. This proactive approach can provide you with the necessary protections.

If a protective order is not served in Maryland, it may be dismissed or considered ineffective. The affected party must be informed of the order to enforce the protections it provides. This underscores the importance of ensuring delivery of the Maryland Receiving Order. Failure to serve can complicate your legal situation, so it's advisable to seek help from legal professionals.