Maryland Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank

Description

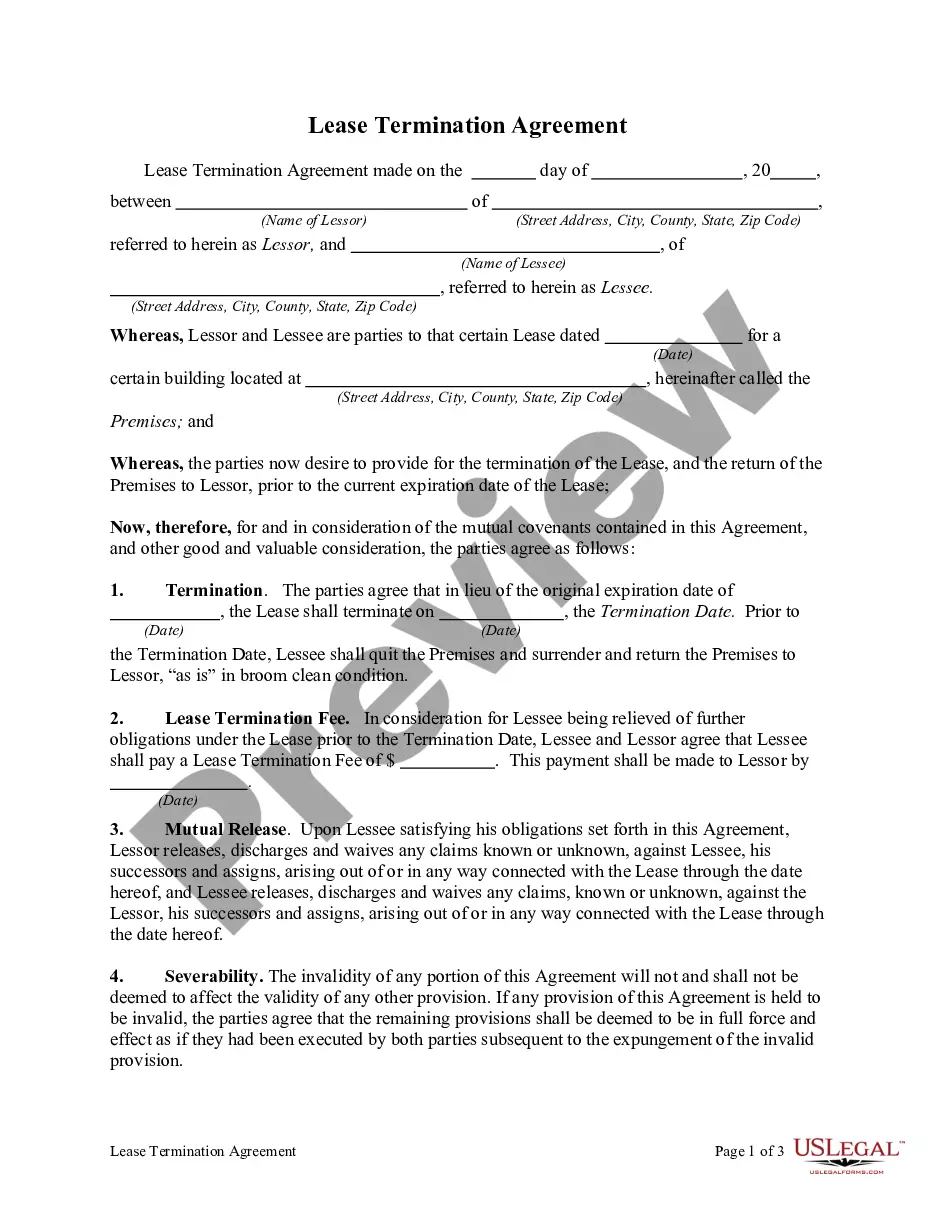

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

You are able to invest several hours on the web searching for the authorized file format that meets the state and federal needs you need. US Legal Forms provides 1000s of authorized kinds that are reviewed by experts. You can actually down load or print the Maryland Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank from our service.

If you have a US Legal Forms bank account, you can log in and click on the Down load option. Following that, you can complete, edit, print, or indicator the Maryland Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank. Each authorized file format you acquire is the one you have eternally. To acquire one more backup of the obtained type, check out the My Forms tab and click on the related option.

Should you use the US Legal Forms internet site the first time, adhere to the easy directions beneath:

- Initially, make sure that you have selected the proper file format for that state/area of your liking. See the type information to make sure you have selected the proper type. If accessible, take advantage of the Preview option to appear through the file format also.

- If you want to discover one more version of the type, take advantage of the Look for discipline to obtain the format that meets your needs and needs.

- Once you have found the format you need, click Purchase now to continue.

- Find the costs plan you need, type your credentials, and register for an account on US Legal Forms.

- Complete the financial transaction. You may use your bank card or PayPal bank account to fund the authorized type.

- Find the file format of the file and down load it to the gadget.

- Make adjustments to the file if required. You are able to complete, edit and indicator and print Maryland Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank.

Down load and print 1000s of file themes utilizing the US Legal Forms web site, which offers the most important assortment of authorized kinds. Use expert and state-specific themes to take on your company or individual demands.

Form popularity

FAQ

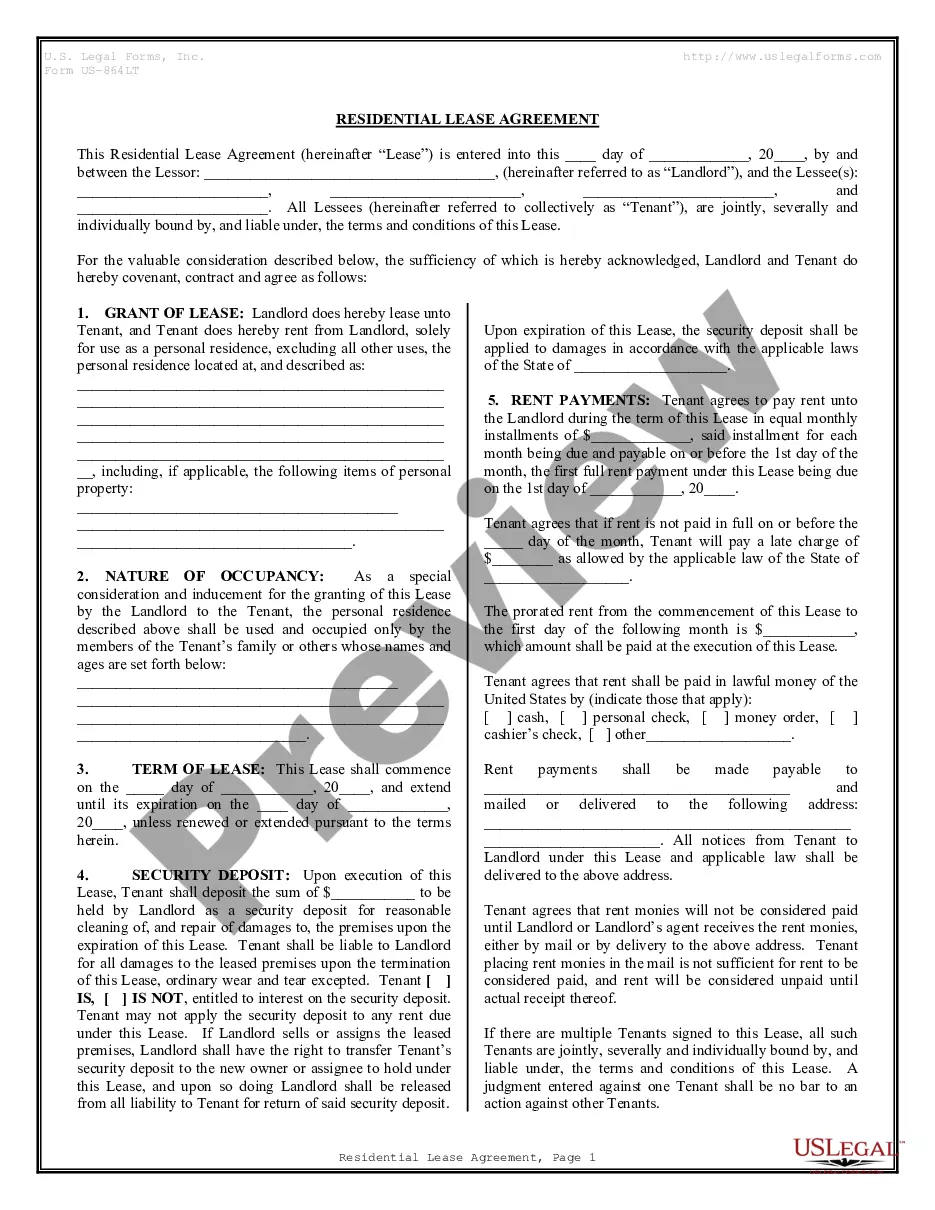

A business loan agreement is a legally binding document that outlines the details of a loan between a lender and borrower. Loan agreements typically include information like the loan amount, repayment term and due dates, interest rates and other costs.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

The Borrower agrees and authorises the Bank to debit their account without notice, towards principal, Interest and/or other charges, expenses etc., due to the Bank under this Agreement to the extent of balance available in the said account and the said debit made as per the authority specifically given hereby and ...

A loan gives you a lump sum of money that you repay over a period of time. A line of credit lets you borrow money up to a limit, pay it back, and borrow again.

Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lenderat a later date. It allows you to buy now with the promise of paying later. By understanding how each type of credit works, you will learn to manage credit successfully.

LOAN AGREEMENT AND PROMISSORY NOTE.

A lending agreement (loan agreement) is a formal contract between a lender and a borrower. Lending agreements spell out all the details of the loan, such as the principal amount, interest rate, amortization period, term, fees, payment terms and any covenants.