Maryland Free Linking Agreement

Description

How to fill out Free Linking Agreement?

Have you experienced the scenario where you require documents for both business or specific reasons every time.

There are numerous legal document templates accessible online, but finding options you can trust is not simple.

US Legal Forms offers a vast array of form templates, including the Maryland Free Linking Agreement, which can be tailored to satisfy state and federal regulations.

Once you've found the correct form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maryland Free Linking Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct area/county.

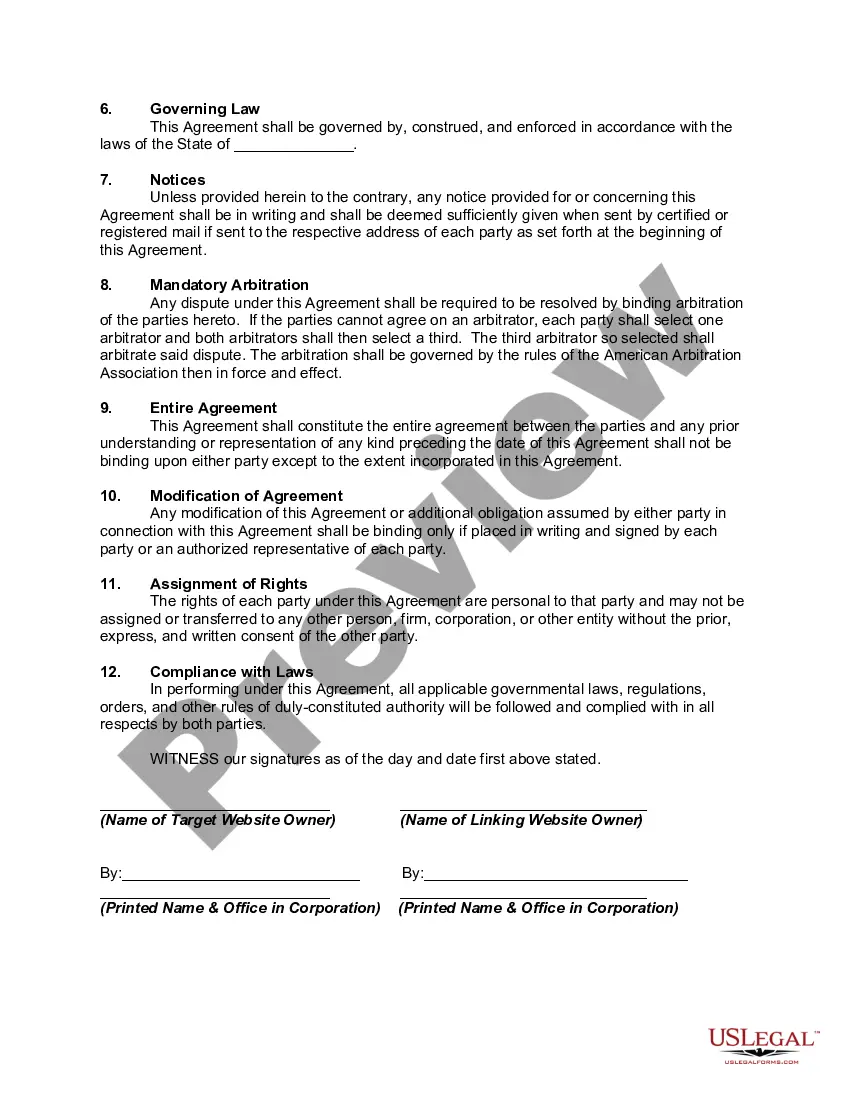

- Use the Preview button to review the document.

- Check the summary to confirm that you have selected the right form.

- If the form does not meet your requirements, make use of the Search field to find the form that aligns with your needs.

Form popularity

FAQ

Forming a partnership in Maryland involves a clear agreement between the partners, detailing the terms of the partnership. While you don’t need to register your partnership with the state, it’s beneficial to create a written agreement to protect everyone involved. Using resources like USLegalForms can guide you through drafting the perfect partnership agreement for your specific needs and considerations.

Form 502 and form 502B filed together are the individual income tax return forms for Maryland residents claiming any dependants. We last updated the Maryland Dependents Information in January 2022, so this is the latest version of Form 502B, fully updated for tax year 2021.

Tax Amendments Due To Changed Unemployment Taxation. The following information applies to 2020 Returns filed in 2021 only. The Unemployment Compensation Exclusion (UCE) and your 2020 Tax Return. If you e-Filed on or after March 16, 2021, you don't have to do anything; you do NOT have to file a tax amendment.

The RELIEF Act will repeal all state and local income taxes on unemployment benefits for tax years 2020 and 2021, helping people get more refunds during tax filing season. Marylanders will save more than $400 million over the next two years as a result.

Revised Maryland individual tax forms are ready. Taxpayers eligible to subtract unemployment benefits must use Maryland Form 502LU Comptroller Peter Franchot has announced that all individual Tax Year 2020 tax forms have been updated and are ready for use by taxpayers and tax preparers, effective immediately.

Form 511 is used by an Electing PTE to file an income tax return for a specific tax year or period and to remit Electing PTE tax paid on all members' distributive or pro rata shares of income. You must elect to remit tax on all members' shares of income in order to use this form.

You can file both your Maryland and federal tax returns online using approved software on your personal computer.

The State of Maryland has a form that includes both the federal and state withholdings on the same form. Your current certificate remains in effect until you change it. The absence of a completed form results in being taxed at the highest rate and undeliverable paychecks.

The Form PV is a payment voucher you will send with your check. or money order for any balance due in the Total Amount Due line of your Forms 502 and 505, Estimated Tax Payments and Extension Payments.

This form may be used by both resident and nonresident individuals. If you received unemployment compensation, or if you received a Coronavirus Relief Payment, use this form to subtract those amounts from your federal adjusted gross income to determine your Maryland adjusted gross income.