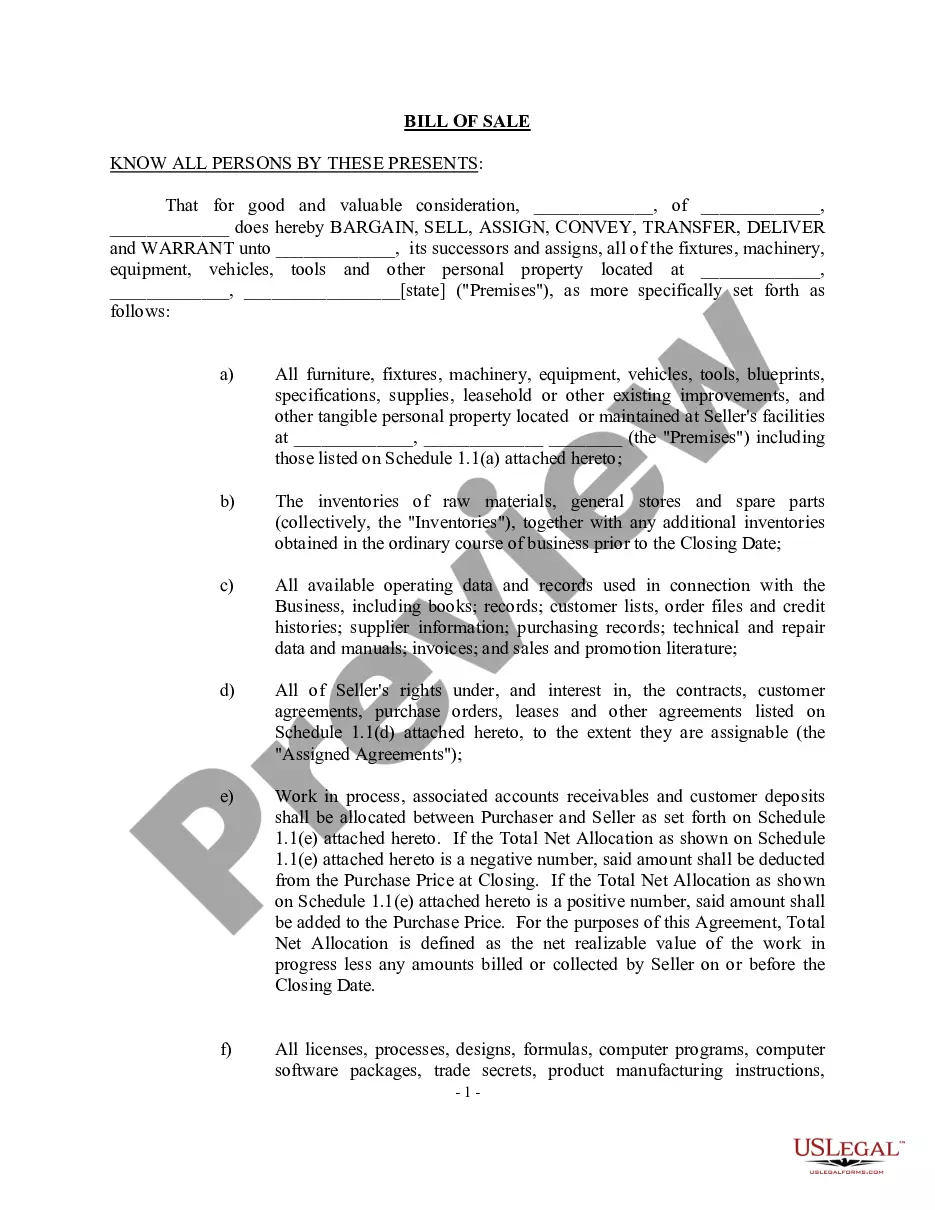

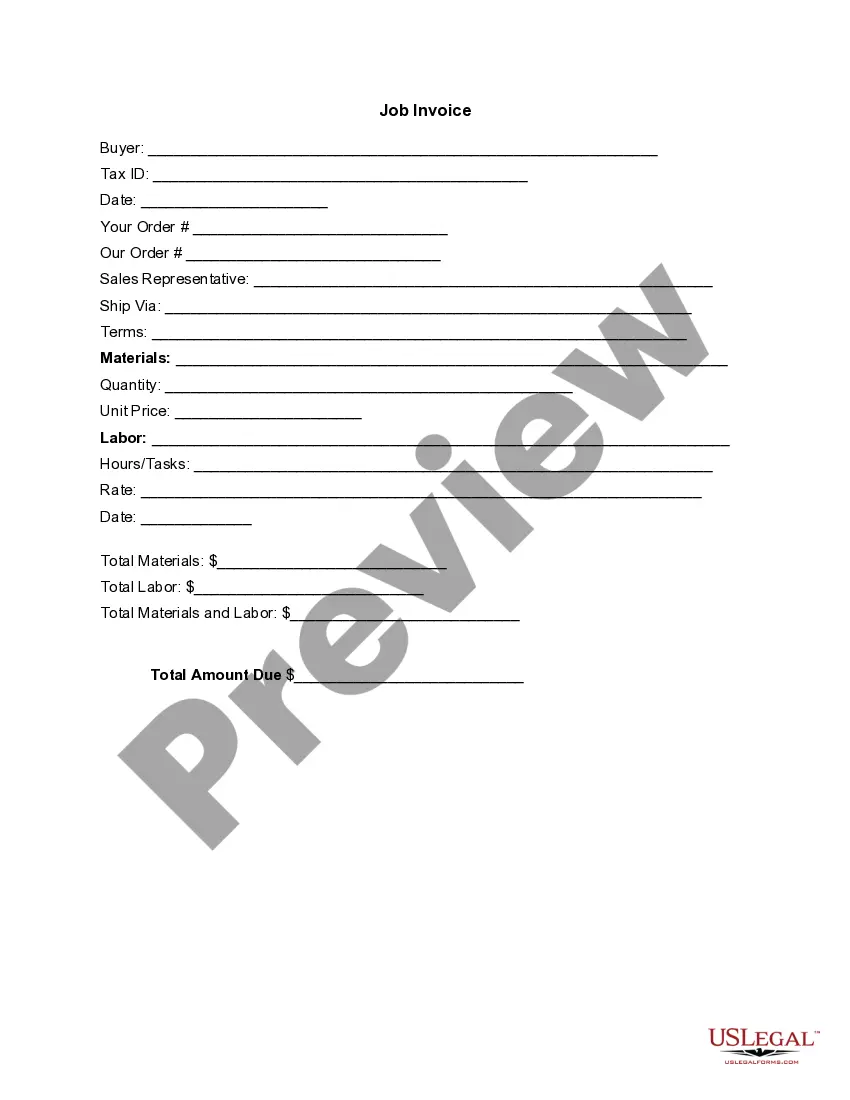

Maryland Invoice Template for Accountant is a meticulously designed tool that aids accountants in creating professional and accurate invoices for their clients in the state of Maryland. This template is specifically tailored to meet the needs and requirements of accountants operating in Maryland and ensures compliance with local tax regulations and accounting standards. It streamlines the invoicing process, minimizing errors and saving valuable time for accountants. The Maryland Invoice Template for Accountant comes with a comprehensive set of features and fields that allow accountants to include all the necessary details in their invoices. These templates are customizable, enabling users to personalize the invoice with their company logo, contact information, and branding elements, giving their invoices a professional appearance. The template includes sections that enable accountants to input client information, such as client's name, address, contact details, and other relevant information. It also features a section for the accountant's details, such as the business name, address, phone number, email address, and website. These details make it easier for clients to identify and reach out to their accountant for any queries or clarifications. In terms of invoice specifics, the Maryland Invoice Template for Accountant includes areas for invoice number, date of issuance, payment due date, and payment terms. These sections ensure clarity regarding payment deadlines and terms, making it easier for clients to understand when and how to make their payments. Additionally, the template provides ample space for accountants to list the services provided to clients along with their corresponding fees, quantity, rate, and subtotal. This allows accountants to clearly outline each service rendered and its associated cost, ensuring transparency and reducing any confusion or disputes regarding billing. Furthermore, the Maryland Invoice Template for Accountant incorporates a section for taxes and discounts. Accountants can calculate and include Maryland-specific taxes such as sales tax or withholding tax, ensuring compliance with local tax laws. Discounts, if applicable, can also be clearly mentioned in this section. Accountants can add a section for additional notes or terms and conditions to provide any relevant information or specify any billing policies and practices. This section can be used to communicate important details or special instructions to clients to ensure a smooth invoicing and payment process. Different types of Maryland Invoice Templates for Accountant may include variations based on the nature of services provided, such as hourly rate invoicing or project-based invoicing. Other templates may cater to specific industries, such as accounting services for small businesses, freelancers, or tax consulting services within Maryland. In conclusion, the Maryland Invoice Template for Accountant is an essential tool that facilitates efficient and accurate invoicing for accountants in Maryland. It ensures compliance with local tax regulations, streamlines the invoicing process, and allows accountants to maintain a professional image of their business while communicating billing information effectively to clients.

Maryland Invoice Template for Accountant

Description

How to fill out Maryland Invoice Template For Accountant?

US Legal Forms - one of many largest libraries of authorized varieties in the USA - offers a variety of authorized record layouts you are able to obtain or print out. Making use of the site, you can get a large number of varieties for enterprise and individual purposes, categorized by groups, states, or key phrases.You will discover the latest variations of varieties just like the Maryland Invoice Template for Accountant in seconds.

If you already have a registration, log in and obtain Maryland Invoice Template for Accountant from your US Legal Forms library. The Download button will appear on each and every kind you view. You have access to all in the past saved varieties inside the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, listed here are easy guidelines to help you began:

- Be sure you have picked out the best kind for the area/region. Select the Preview button to check the form`s content. See the kind information to ensure that you have selected the right kind.

- When the kind doesn`t satisfy your specifications, utilize the Research discipline on top of the screen to obtain the one which does.

- Should you be satisfied with the shape, verify your choice by visiting the Purchase now button. Then, select the pricing prepare you prefer and provide your qualifications to register for the profile.

- Process the financial transaction. Make use of your Visa or Mastercard or PayPal profile to perform the financial transaction.

- Select the file format and obtain the shape on your system.

- Make modifications. Fill out, change and print out and indication the saved Maryland Invoice Template for Accountant.

Every single template you included with your money lacks an expiry time and is also your own property for a long time. So, in order to obtain or print out an additional version, just check out the My Forms area and then click in the kind you require.

Gain access to the Maryland Invoice Template for Accountant with US Legal Forms, one of the most comprehensive library of authorized record layouts. Use a large number of specialist and condition-distinct layouts that fulfill your small business or individual demands and specifications.