Maryland Invoice Template for Judge: A Comprehensive Description An invoice is a document sent by a provider of goods or services to a client, detailing the products or services rendered along with their corresponding costs. In legal situations, such as court proceedings or legal consultations, judges may require an invoice to be submitted for various purposes, including fee reimbursement, expense tracking, or record-keeping. Today, we will explore what a Maryland Invoice Template for Judge entails, its purpose, and potential variations. In essence, a Maryland Invoice Template for Judges is a predesigned, customizable document that assists legal professionals in creating and presenting itemized invoices to judges efficiently. It enables them to streamline their invoicing processes and maintain accurate financial records within the parameters set by Maryland judicial procedures. Key Components of a Maryland Invoice Template for Judge: 1. Header: — Identifying the invoice as a "Maryland Invoice for Judge." — Including the court name, address, and contact information. — Adding the legal professional's or law firm's details, such as name, address, and contact information. — Mentioning the date of the invoice creation and a unique invoice number for reference. 2. Client Information: — Including the name of the case or client. — Providing the client's contact details like name, address, and phone number. 3. Description of Services: — Providing a detailed breakdown of the legal services rendered. — Describing the specific tasks performed, court appearances, research, or consultations conducted. — Specifying the respective dates when the services were provided for accurate record-keeping. 4. Expenditures and Expenses: — Including any additional expenses incurred, such as court fees, travel expenses, or document preparation costs. — Ensuring that each expense is itemized and accompanied by supporting receipts, if necessary. — Summarizing the total amount for reimbursements requested. 5. Fee Calculation: — Listing the hourly rate, standard service fees, or any alternate billing arrangements, as agreed upon with the client. — Providing the duration of service or billable hours alongside the corresponding fee per service category. — Calculating the total amount due for each service category and adding it to the subtotal. 6. Taxes and Discounts: — Indicating applicable tax rates, if any, and calculating the tax amount based on the subtotal. — Mentioning any applicable discounts or adjustments made to the total amount. 7. Grand Total: — Summing up all charges, including taxes and discounts, to determine the final amount payable. — Clearly specifying the due date and preferred payment methods. — Mentioning any additional terms and conditions related to payment or penalty regarding late fees. Different Types of Maryland Invoice Templates for Judge: 1. Hourly Rate Template: — Ideal for legal professionals who charge clients based on the hours worked. — Allows for documenting and calculating billable hours for each task or service category. 2. Flat Fee Template: — Suitable for legal services with a fixed cost across a particular case or period. — Provides a straightforward breakdown of services and costs for the client's reference. 3. Retainer Template: — When clients pay an advance fee to secure legal service availability. — Outlines the retainer fee paid, tracks billable hours against the retainer balance, and provides regular updates to the client regarding fund depletion. These Maryland Invoice Templates for Judges are designed to assist legal professionals in Maryland to efficiently create professional invoices that meet the jurisdiction's specific requirements. They not only save time and effort but also aid in maintaining accurate financial records and fostering transparent communication between legal professionals and judges.

Maryland Invoice Template for Judge

Description

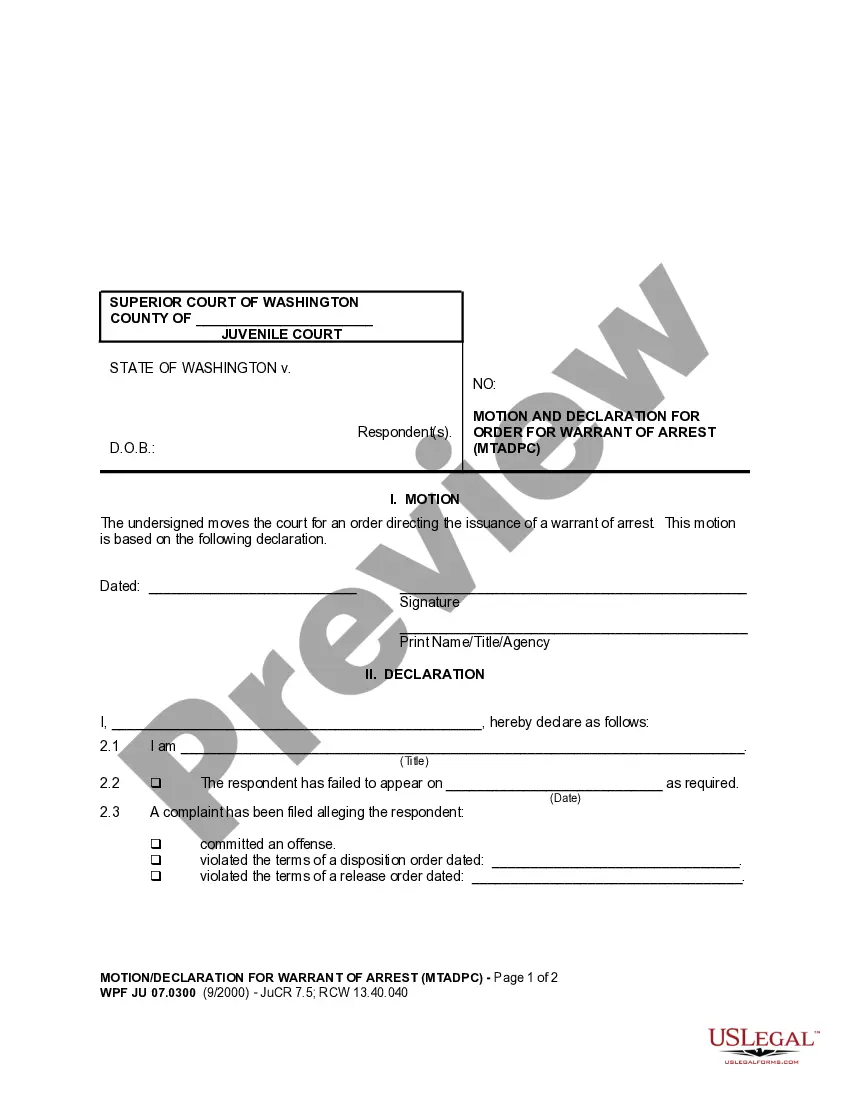

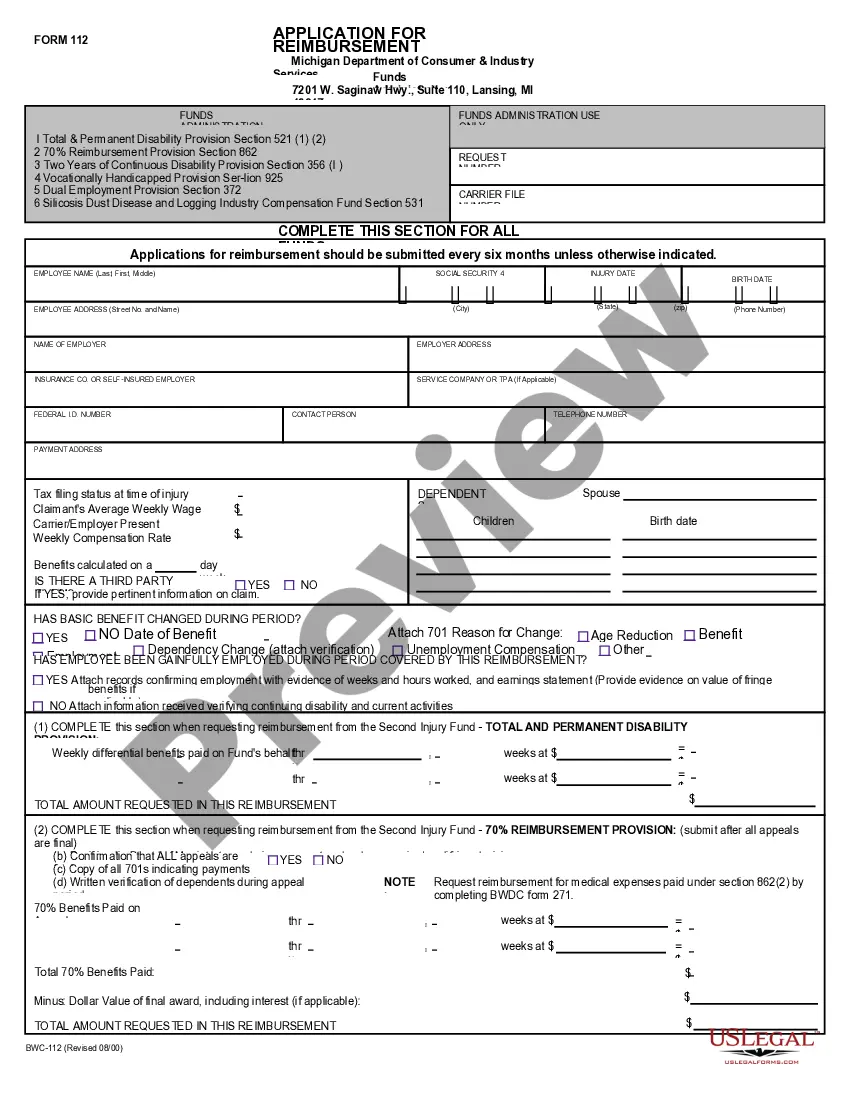

How to fill out Maryland Invoice Template For Judge?

Have you been in the position the place you need to have documents for possibly business or personal uses just about every working day? There are a variety of legitimate document layouts accessible on the Internet, but locating kinds you can depend on is not easy. US Legal Forms delivers thousands of type layouts, such as the Maryland Invoice Template for Judge, which can be written to fulfill federal and state specifications.

In case you are presently acquainted with US Legal Forms site and get a free account, just log in. Next, you may down load the Maryland Invoice Template for Judge template.

Unless you provide an profile and need to start using US Legal Forms, follow these steps:

- Get the type you will need and make sure it is for the proper area/region.

- Make use of the Review button to analyze the shape.

- Look at the information to ensure that you have chosen the right type.

- In the event the type is not what you`re looking for, take advantage of the Lookup field to discover the type that fits your needs and specifications.

- Whenever you find the proper type, simply click Buy now.

- Choose the rates strategy you desire, complete the specified information to create your account, and pay for the transaction using your PayPal or bank card.

- Pick a handy data file format and down load your copy.

Find each of the document layouts you may have purchased in the My Forms menu. You may get a further copy of Maryland Invoice Template for Judge at any time, if necessary. Just select the necessary type to down load or print the document template.

Use US Legal Forms, by far the most considerable assortment of legitimate varieties, to save time as well as steer clear of faults. The support delivers expertly produced legitimate document layouts that you can use for a selection of uses. Make a free account on US Legal Forms and begin making your way of life easier.