Maryland Invoice Template for Pharmacist

Description

How to fill out Invoice Template For Pharmacist?

If you want to be thorough, acquire, or print authentic document templates, utilize US Legal Forms, the largest variety of legal forms, which are accessible online.

Utilize the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Maryland Invoice Template for Pharmacist in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and then click the Download button to retrieve the Maryland Invoice Template for Pharmacist.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are unsatisfied with the development, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Invoicing as a locum pharmacist involves clearly detailing the services provided and rates charged. A Maryland Invoice Template for Pharmacist can help you create a professional invoice that outlines these aspects effectively. Ensure to include your contact information, the date of service, and a breakdown of the services rendered. This clarity helps build trust with your clients.

Yes, you can create your own invoice by utilizing a Maryland Invoice Template for Pharmacist, which simplifies the process greatly. You can customize this template to fit your specific needs, including adding your logo and adjusting item descriptions. Moreover, this flexibility allows you to maintain a professional appearance while ensuring that all necessary information is included.

In Maryland, pharmacists can prescribe certain medications under a collaborative practice agreement with a physician. This allows them to manage therapies for chronic conditions such as diabetes, heart disease, and asthma. Additionally, pharmacists can provide immunizations and other patient care services. If you need a structured way to document prescriptions and services provided, consider using a Maryland Invoice Template for Pharmacist from uslegalforms, which streamlines billing and ensures compliance.

Invoicing as a locum GP requires a clear and professional approach. First, ensure you gather all relevant details, such as the services provided, dates of service, and patient information, if applicable. Then, utilize a Maryland Invoice Template for Pharmacist to create an accurate invoice that includes your contact details, the recipient's information, and a breakdown of services rendered. This template not only streamlines your invoicing process but also enhances your professionalism.

A DAW code specifies the prescriber's instructions to the payer regarding substitution of a generic equivalent or to dispense the specific prescribed medication.

Pharmacy reimbursement under Part D is based on negotiated prices, which is usually based on the AWP minus a percentage discount plus a dispensing fee. Private Third-Party Payors Private third-party payors currently base their reimbursement formula on AWP.

(or no product selection indicated) 2022 Use the DAW 0 code when dispensing a generic drug; that is, when no party (i.e., neither Prescribing Provider, nor pharmacist, nor Participant) requests the branded version of a multi-source product.

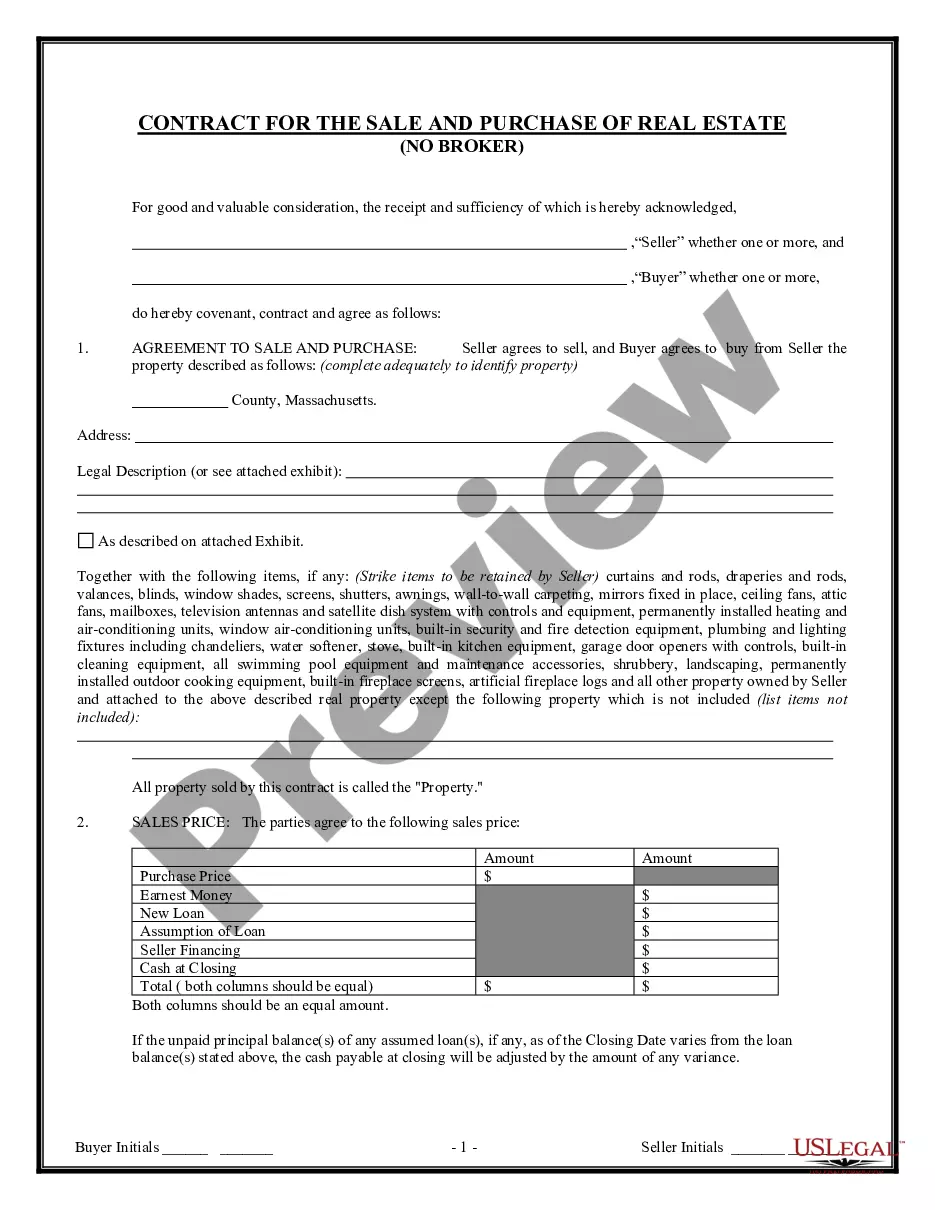

A pharmacy invoice is a billing form used by pharmacists to list prescribed and over-the-counter medications purchased by a customer, showing that payment has been made or is required by a certain date. The invoice should always include the payment made by a patient's insurance, which is detailed as co-pay.

DAW - 3 Pharmacist selected brand. Substitution allowed - pharmacist selected product dispensed. This value is used when the prescriber has indicated, in a manner specified by prevailing state laws, that generic substitution is permitted and the pharmacist determines that the brand product should be dispensed.

One of the first differences pharmacists will notice when trying to bill the medical benefit is the difference in billing formats. Billing third-party payers for prescriptions only uses prescription numbers and National Drug Codes (NDC). Medical billing uses a different set of codes.