Maryland Invoice Template for Branch Manager

Description

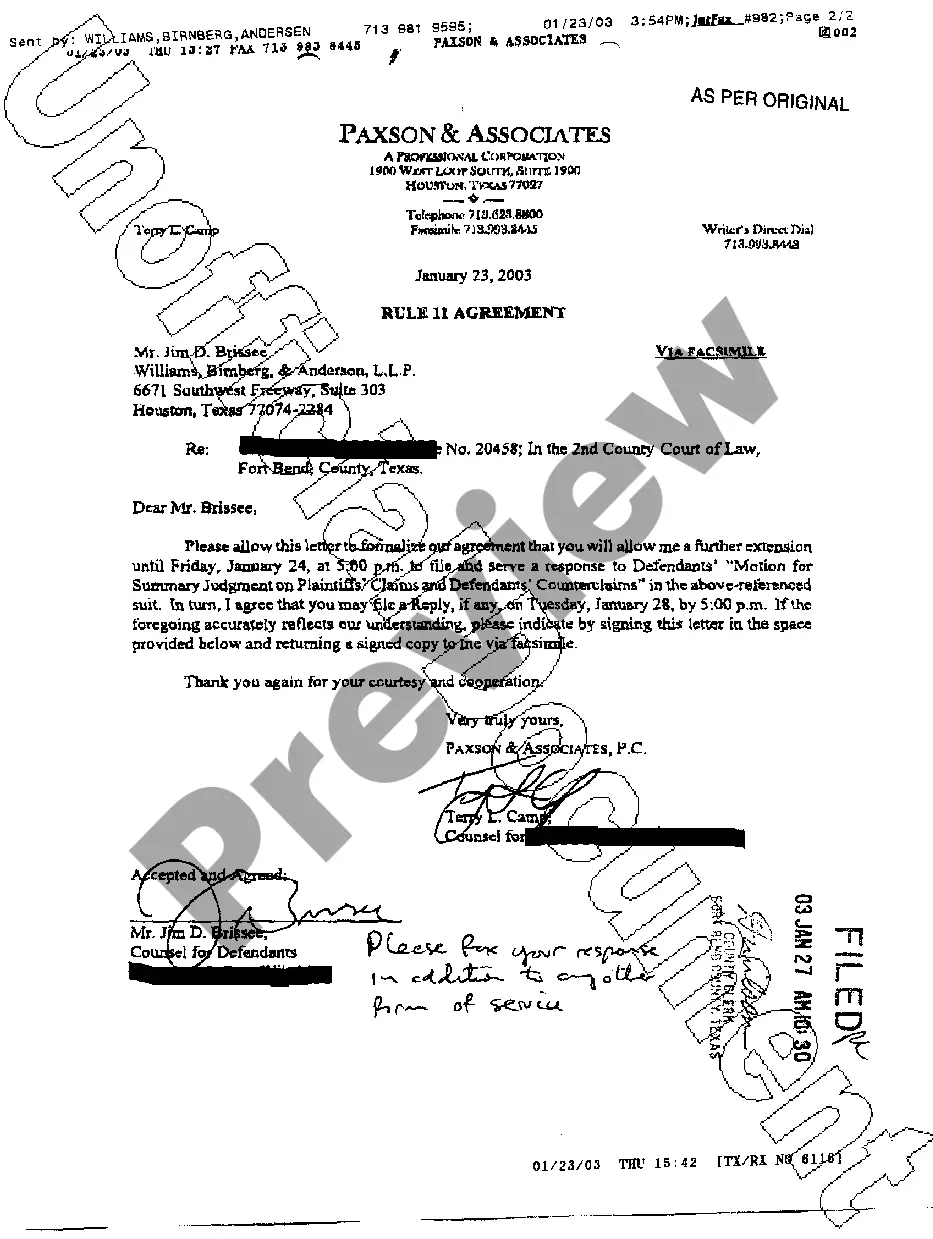

How to fill out Invoice Template For Branch Manager?

If you require extensive, download, or reproducing valid document templates, utilize US Legal Forms, the most extensive collection of valid varieties, which is accessible online.

Leverage the site's straightforward and user-friendly search to find the documents you require. Various templates for commercial and personal uses are categorized by types and states, or keywords.

Use US Legal Forms to acquire the Maryland Invoice Template for Branch Manager with just a few clicks.

Every valid document template you purchase is yours forever. You will have access to each form you acquired in your account. Choose the My documents section and select a form to print or download again.

Compete, download, and print the Maryland Invoice Template for Branch Manager with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the Maryland Invoice Template for Branch Manager.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for your correct region/country.

- Step 2. Utilize the Preview option to review the form's content. Always remember to check the description.

- Step 3. If you are not satisfied with the form, make use of the Search field at the top of the screen to find alternative versions of the valid template design.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the transaction.

- Step 6. Choose the format of your valid template and download it to your device.

- Step 7. Complete, modify, and print or sign the Maryland Invoice Template for Branch Manager.

Form popularity

FAQ

To send an invoice template, you can save the completed document as a PDF and email it directly to the recipient. Alternatively, use an online invoicing platform that allows sharing and tracking. When using the Maryland Invoice Template for Branch Manager, ensure all details are accurate for a professional presentation. Timely sending of invoices can improve payment efficiency.

Failing to file an annual report in Maryland can lead to penalties, including fines and loss of good standing for your business. This may also impact your ability to conduct business legally in the state. To avoid these consequences, always file your report on time. Utilizing the Maryland Invoice Template for Branch Manager can aid in keeping track of deadlines and important documents.

In Maryland, any business entity that owns personal property must file a personal property tax return. This includes corporations, partnerships, and individuals conducting business. Filing this return ensures compliance with state tax laws. To help with record management, consider the Maryland Invoice Template for Branch Manager.

You can mail the MD Form 1 Annual Report to the following address: Maryland State Department of Assessments and Taxation, 301 West Preston Street, Baltimore, MD 21201. Be sure to use the correct postage and include any required payment. Tracking your mail can ensure it reaches its destination without issues. For related invoicing needs, the Maryland Invoice Template for Branch Manager can be beneficial.

The due date for the Maryland annual report is April 15 each year. It is important to meet this deadline to remain in compliance with Maryland regulations. Filing on time helps maintain your business's good standing. Consider using the Maryland Invoice Template for Branch Manager for timely document management.

To file a Form 1 Annual Report in Maryland, visit the Maryland State Department of Assessments and Taxation website. You can complete the form online or download it for physical submission. Ensure all necessary information is included to avoid delays. Using the Maryland Invoice Template for Branch Manager can simplify record-keeping during this process.

Excel is an effective tool for invoicing, especially when utilizing templates like the Maryland Invoice Template for Branch Manager. It enables users to manage invoices easily, track payments, and customize formats as needed. Many businesses appreciate Excel's flexibility and the ability to update information quickly. Additionally, its compatibility with other software makes it a practical choice for many organizations.

Yes, Excel offers built-in invoice templates that are user-friendly and versatile. One could select the Maryland Invoice Template for Branch Manager to match specific business requirements. These templates include all necessary fields for billing, allowing for easy data entry and ensuring clear communication with clients. This feature can significantly enhance your invoicing process.

Creating an invoice in Excel format is straightforward. Start by opening Excel and choosing the Maryland Invoice Template for Branch Manager that meets your needs. Customize it by adding your business details, client information, and itemized charges. Once you finish editing, save it for your records or send it directly to your client.

Yes, there are numerous invoice templates available in Excel. You can easily find various designs tailored for different industries, including the Maryland Invoice Template for Branch Manager. These templates provide a simple way to create professional invoices without starting from scratch. Using these templates, you can ensure consistency and save time.