Maryland Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Installment Promissory Note With Bank Deposit As Collateral?

If you require to sum up, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site's straightforward and user-friendly search to find the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Maryland Installment Promissory Note with Bank Deposit as Collateral in just a few clicks.

Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the Maryland Installment Promissory Note with Bank Deposit as Collateral.

- If you are currently a US Legal Forms customer, sign in to your account and click the Acquire button to obtain the Maryland Installment Promissory Note with Bank Deposit as Collateral.

- You can also access forms you previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the relevant city/region.

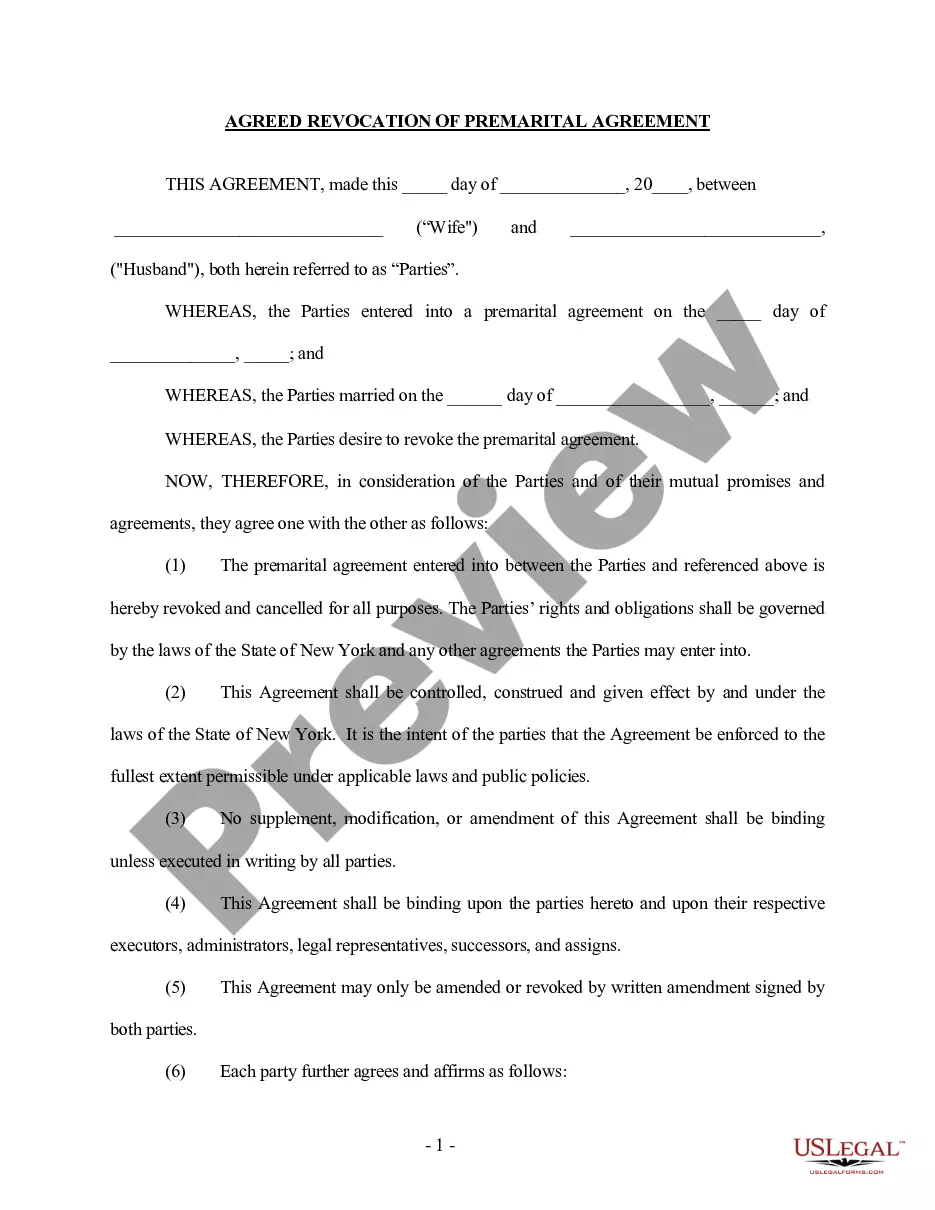

- Step 2. Utilize the Review option to examine the form’s content. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other versions of your legal form.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

A collateralized note is a promissory note that is backed by collateral, providing security for the lender. This type of note reduces risk, as it gives the lender a claim to the collateral if the borrower defaults. The Maryland Installment Promissory Note with Bank Deposit as Collateral exemplifies how tying an asset to a note can create a stronger financial agreement.

A collateral assignment of a note is a legal agreement where a borrower assigns their rights in the note to a lender as security for their obligations. This arrangement can be particularly effective when utilizing the Maryland Installment Promissory Note with Bank Deposit as Collateral. It allows the lender greater assurance that they will receive payment while keeping the borrower in control of the asset until default occurs.

Securitizing a promissory note involves converting it into a security that can be sold to investors. You may bundle multiple Maryland Installment Promissory Notes with Bank Deposit as Collateral to maximize value. By doing this, you enhance liquidity while providing investors the opportunity to earn from interest payments.

In Maryland, a promissory note does not necessarily have to be notarized to be valid; however, notarization can provide extra protection. A Maryland Installment Promissory Note with Bank Deposit as Collateral is more robust when signed in front of a notary, especially in legal disputes. Notarization helps verify the identities of the parties involved and confirms their agreement to the terms. Therefore, while optional, notarizing your promissory note can be a wise move.

A Maryland Installment Promissory Note with Bank Deposit as Collateral can hold up in court, provided it meets certain legal requirements. The note must clearly outline the obligations of both parties and include necessary signatures. If disputes arise, having a well-documented agreement enhances its enforceability. Therefore, it is crucial to draft your promissory note with care to ensure it serves its purpose effectively.

For a promissory note to be valid, it must include key elements such as the principal amount, interest rate, payment schedule, and signatures from all parties involved. In Maryland, a Maryland Installment Promissory Note with Bank Deposit as Collateral must also comply with state laws to ensure enforceability. Always consult an expert or platform like UsLegalForms to ensure your note meets these requirements.

Reporting a promissory note on your taxes involves declaring any interest earned as income. If you have issued a Maryland Installment Promissory Note with Bank Deposit as Collateral, keep accurate records of the payments received and any interest accrued. You must report this information on your tax return, following the IRS guidelines to ensure compliance. Consider consulting a tax professional for personalized advice.

Yes, a promissory note can serve as a form of payment in various transactions. By using a Maryland Installment Promissory Note with Bank Deposit as Collateral, you establish a formal agreement that outlines the terms of the repayment. This ensures that both parties understand their obligations and provides security for the lender. Make sure you are aware of the details to effectively utilize this financial instrument.