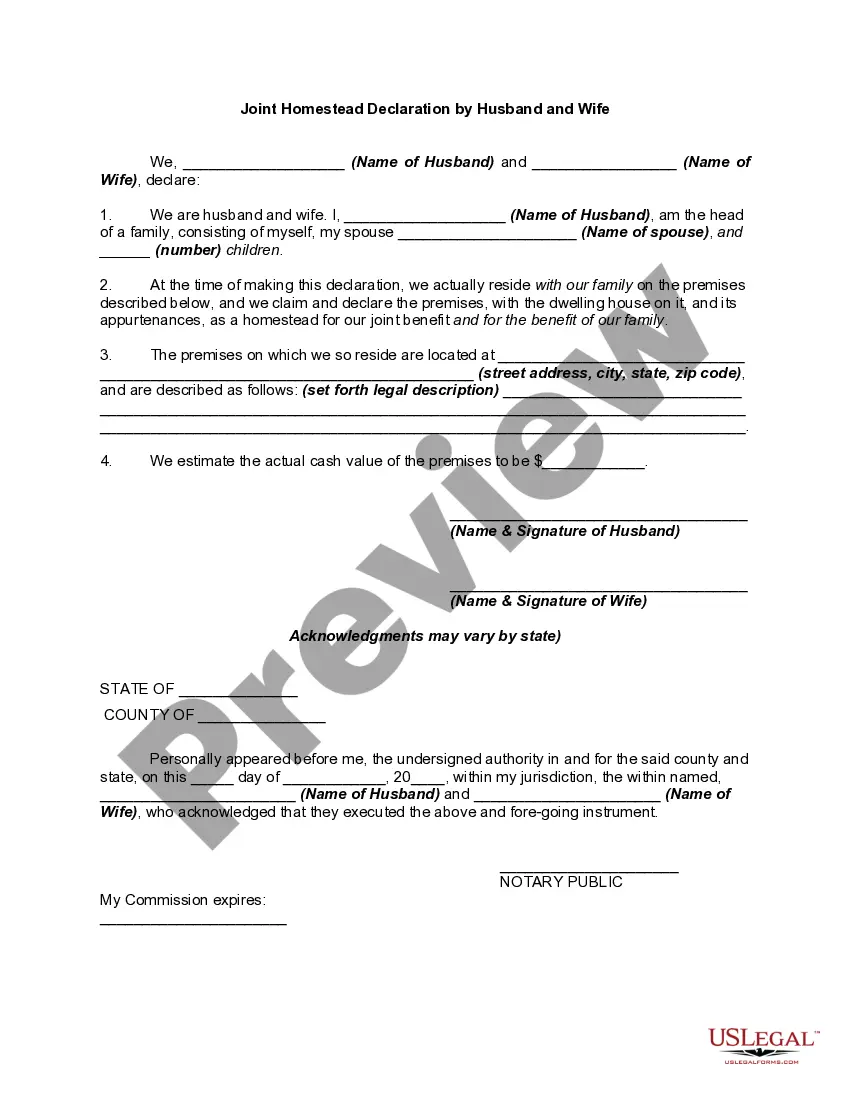

Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

Maryland Joint Homestead Declaration by Husband and Wife is a legal document that protects the primary residence of a married couple from creditors and ensures its exemption in case of financial difficulties. This declaration is governed by Maryland's Homestead Law and serves as a safeguard for homeowners, offering them additional security and peace of mind. The Maryland Joint Homestead Declaration by Husband and Wife allows married homeowners to declare their property as a homestead, which is their primary place of residence. By doing so, they establish legal protection for their home against potential claims or liens from creditors. This document is designed to shield homeowners from losing their most important asset in times of financial uncertainty. One of the significant benefits of filing a Maryland Joint Homestead Declaration is that it grants a specific exemption up to a certain value on the couple's primary residence. This exemption protects the declared value of the property from being seized by creditors to satisfy outstanding debts. The value of the exemption may vary depending on the county in which the property is located. Different types of Maryland Joint Homestead Declarations by Husband and Wife include the Declaration of Joint Homestead and Waiver and the Declaration of Joint Homestead and Non-Waiver. The Declaration of Joint Homestead and Waiver is filed when the married couple agrees to waive their homestead exemption rights, meaning they choose not to claim the protection offered by the Homestead Law. On the other hand, the Declaration of Joint Homestead and Non-Waiver is filed when the couple wishes to assert their homestead exemption rights and safeguard their property from creditors. The process of filing a Maryland Joint Homestead Declaration involves completing the required form, including relevant details about the homeowners, property address, and any co-owners. The completed form must then be notarized and submitted to the appropriate county's land records office for decoration. It is essential to ensure that all information provided is accurate and up to date to avoid any potential legal complications. In conclusion, the Maryland Joint Homestead Declaration by Husband and Wife is a vital legal document that protects the primary residence of a married couple from creditors and provides an exemption on the property's value. By filing this declaration, homeowners can secure their most valuable asset and ensure its safety during times of financial hardship. Whether it is the Declaration of Joint Homestead and Waiver or the Declaration of Joint Homestead and Non-Waiver, taking advantage of the protections offered by the Homestead Law can help ease homeowners' concerns and provide them with a sense of security.Maryland Joint Homestead Declaration by Husband and Wife is a legal document that protects the primary residence of a married couple from creditors and ensures its exemption in case of financial difficulties. This declaration is governed by Maryland's Homestead Law and serves as a safeguard for homeowners, offering them additional security and peace of mind. The Maryland Joint Homestead Declaration by Husband and Wife allows married homeowners to declare their property as a homestead, which is their primary place of residence. By doing so, they establish legal protection for their home against potential claims or liens from creditors. This document is designed to shield homeowners from losing their most important asset in times of financial uncertainty. One of the significant benefits of filing a Maryland Joint Homestead Declaration is that it grants a specific exemption up to a certain value on the couple's primary residence. This exemption protects the declared value of the property from being seized by creditors to satisfy outstanding debts. The value of the exemption may vary depending on the county in which the property is located. Different types of Maryland Joint Homestead Declarations by Husband and Wife include the Declaration of Joint Homestead and Waiver and the Declaration of Joint Homestead and Non-Waiver. The Declaration of Joint Homestead and Waiver is filed when the married couple agrees to waive their homestead exemption rights, meaning they choose not to claim the protection offered by the Homestead Law. On the other hand, the Declaration of Joint Homestead and Non-Waiver is filed when the couple wishes to assert their homestead exemption rights and safeguard their property from creditors. The process of filing a Maryland Joint Homestead Declaration involves completing the required form, including relevant details about the homeowners, property address, and any co-owners. The completed form must then be notarized and submitted to the appropriate county's land records office for decoration. It is essential to ensure that all information provided is accurate and up to date to avoid any potential legal complications. In conclusion, the Maryland Joint Homestead Declaration by Husband and Wife is a vital legal document that protects the primary residence of a married couple from creditors and provides an exemption on the property's value. By filing this declaration, homeowners can secure their most valuable asset and ensure its safety during times of financial hardship. Whether it is the Declaration of Joint Homestead and Waiver or the Declaration of Joint Homestead and Non-Waiver, taking advantage of the protections offered by the Homestead Law can help ease homeowners' concerns and provide them with a sense of security.