Title: Maryland Business Deductions Checklist: Key Considerations for Maximizing Tax Savings Description: The Maryland Business Deductions Checklist is a comprehensive document designed to assist business owners in identifying and claiming various tax deductions available to them in the state of Maryland. By adhering to this checklist, businesses can effectively reduce their tax liability and optimize their financial position. Keywords: Maryland, business deductions' checklist, tax savings, Maryland business tax deductions, tax liability reduction, financial optimization. Types of Maryland Business Deductions Checklists: 1. Small Business Deductions Checklist: This variant of the Maryland Business Deductions Checklist is tailored specifically for small businesses. It provides a simplified overview of commonly available deductions relevant to this category, such as home office expenses, equipment depreciation, and travel expenses. 2. Maryland Startup Deductions Checklist: Startups face unique challenges, especially in their early stages. The Maryland Startup Deductions Checklist focuses on deductions specific to newly established businesses, including research and development expenses, cost of incorporation, and other expenses incurred during setup. 3. Industry-Specific Deductions Checklist: Different industries have specific expenses eligible for deductions. For instance, the construction industry may have deductions available for materials, equipment rentals, or subcontractor costs. The Industry-Specific Deductions Checklist caters to businesses in various sectors, outlining deductions that are relevant to their specific field. 4. Employee Benefits Deductions Checklist: This checklist centers around deductions pertaining to employee benefits provided by businesses. It covers expenses related to health insurance premiums, retirement plans, education assistance, and other similar employee benefit programs. 5. Green Business Deductions Checklist: Maryland promotes environmental sustainability, offering tax incentives to businesses focused on eco-friendly practices. The Green Business Deductions Checklist details deductions available to businesses engaging in green initiatives, such as solar panel installations, energy-efficient equipment, and waste reduction measures. 6. Charitable Contributions Deductions Checklist: Maryland businesses frequently support local charities and nonprofits. The Charitable Contributions Deductions Checklist assists businesses in claiming deductions for monetary or in-kind donations made to approved charitable organizations, helping businesses fulfill their philanthropic goals while reducing their taxable income. By utilizing the appropriate Maryland Business Deductions Checklist based on their unique circumstances, businesses can navigate the complex tax landscape more efficiently, seize eligible deductions, and optimize their tax savings. Remember to consult with a qualified tax professional to ensure accurate interpretation and application of the checklist. Keywords: Maryland Business Deductions Checklist, small business deductions, startup deductions, industry-specific deductions, employee benefits deductions, green business deductions, charitable contributions deductions.

Maryland Business Deductions Checklist

Description

How to fill out Maryland Business Deductions Checklist?

It is possible to devote hrs on the web trying to find the legal papers template which fits the state and federal needs you want. US Legal Forms provides a huge number of legal forms that are analyzed by professionals. You can actually download or print out the Maryland Business Deductions Checklist from our services.

If you already have a US Legal Forms profile, you may log in and click the Acquire key. Next, you may total, edit, print out, or indication the Maryland Business Deductions Checklist. Every legal papers template you purchase is your own property forever. To acquire yet another duplicate of any purchased form, visit the My Forms tab and click the related key.

If you are using the US Legal Forms web site the very first time, stick to the simple instructions beneath:

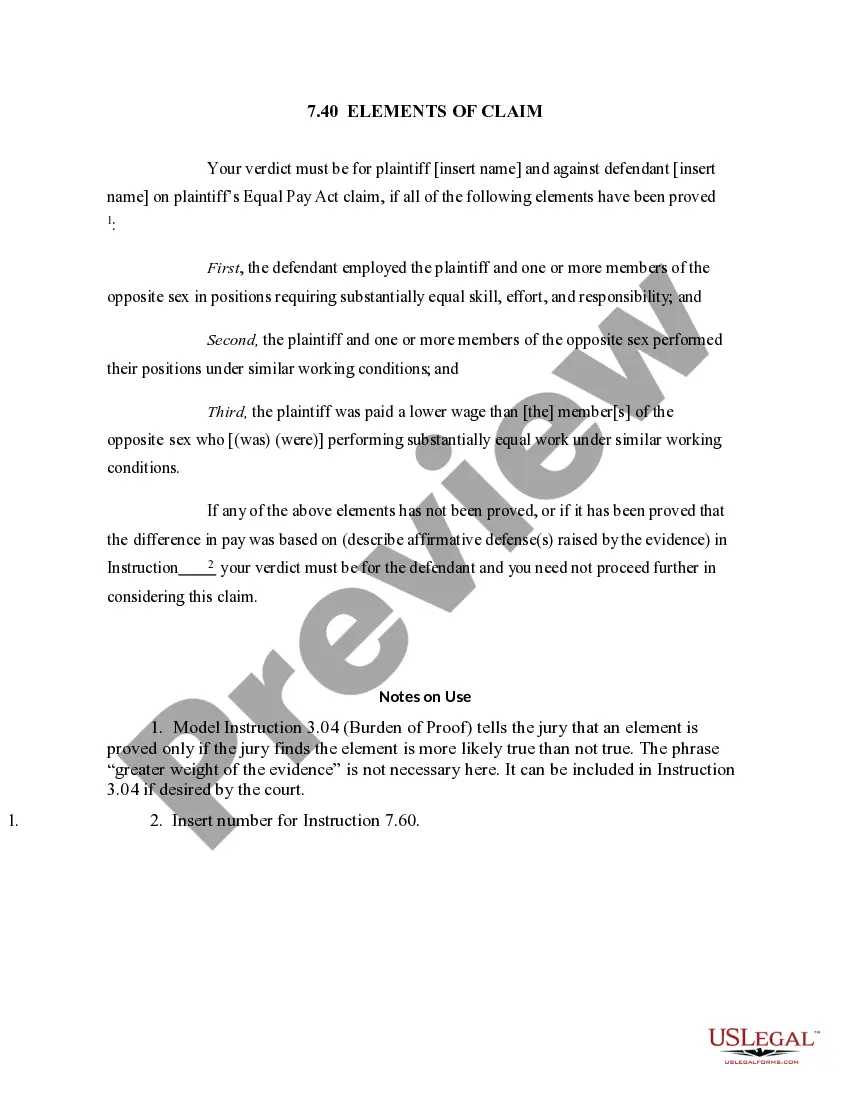

- Initial, make certain you have chosen the proper papers template to the county/town of your liking. Browse the form information to ensure you have selected the appropriate form. If available, make use of the Review key to check through the papers template as well.

- If you wish to get yet another variation of the form, make use of the Lookup industry to find the template that meets your needs and needs.

- Once you have discovered the template you want, click Purchase now to carry on.

- Select the pricing prepare you want, key in your references, and register for your account on US Legal Forms.

- Full the financial transaction. You may use your credit card or PayPal profile to pay for the legal form.

- Select the formatting of the papers and download it to your product.

- Make alterations to your papers if required. It is possible to total, edit and indication and print out Maryland Business Deductions Checklist.

Acquire and print out a huge number of papers layouts while using US Legal Forms site, that offers the most important assortment of legal forms. Use skilled and status-certain layouts to take on your company or personal requires.