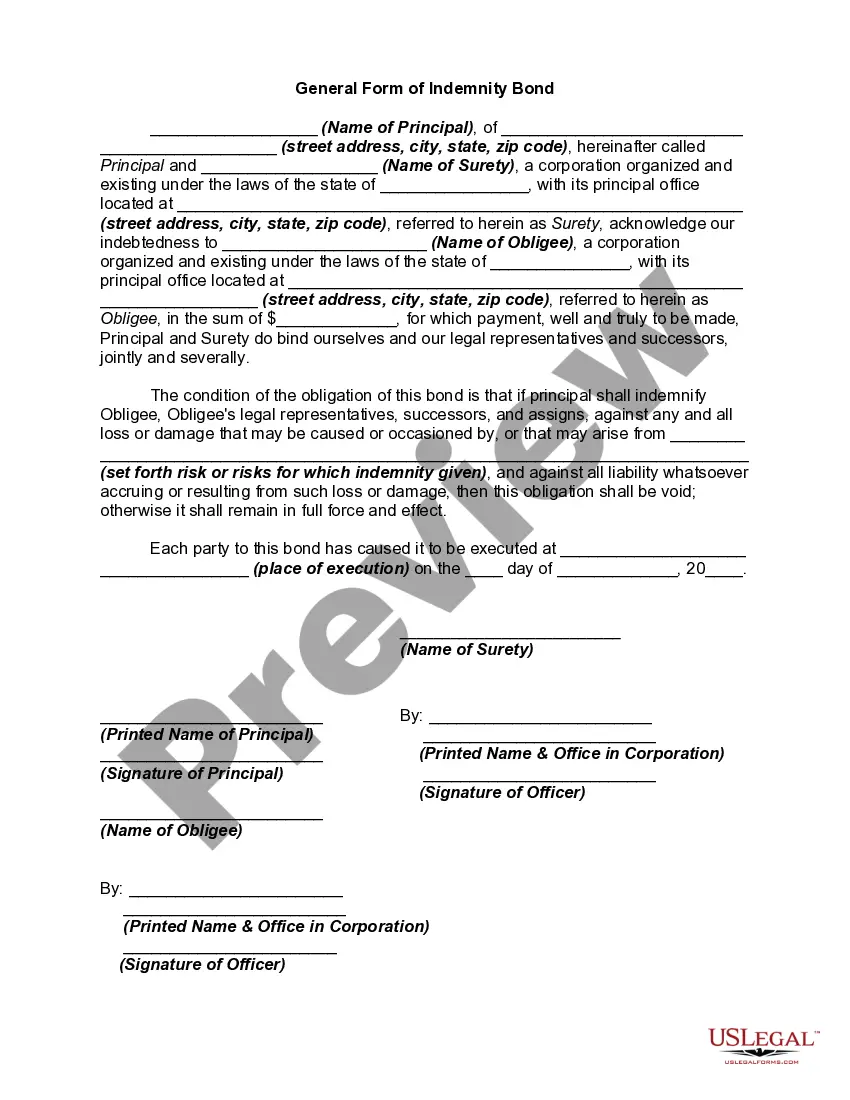

An indemnity bond provides coverage for the loss of an Obligee in the event that the Principal fails to perform according to standards agreed upon between the Obligee and the Principal. A surety is a person obligated by a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the surety's performance will first try to collect or obtain performance from the debtor before trying to collect from the surety. A surety is often found, for example, when someone is required to post a bond to secure a promise.

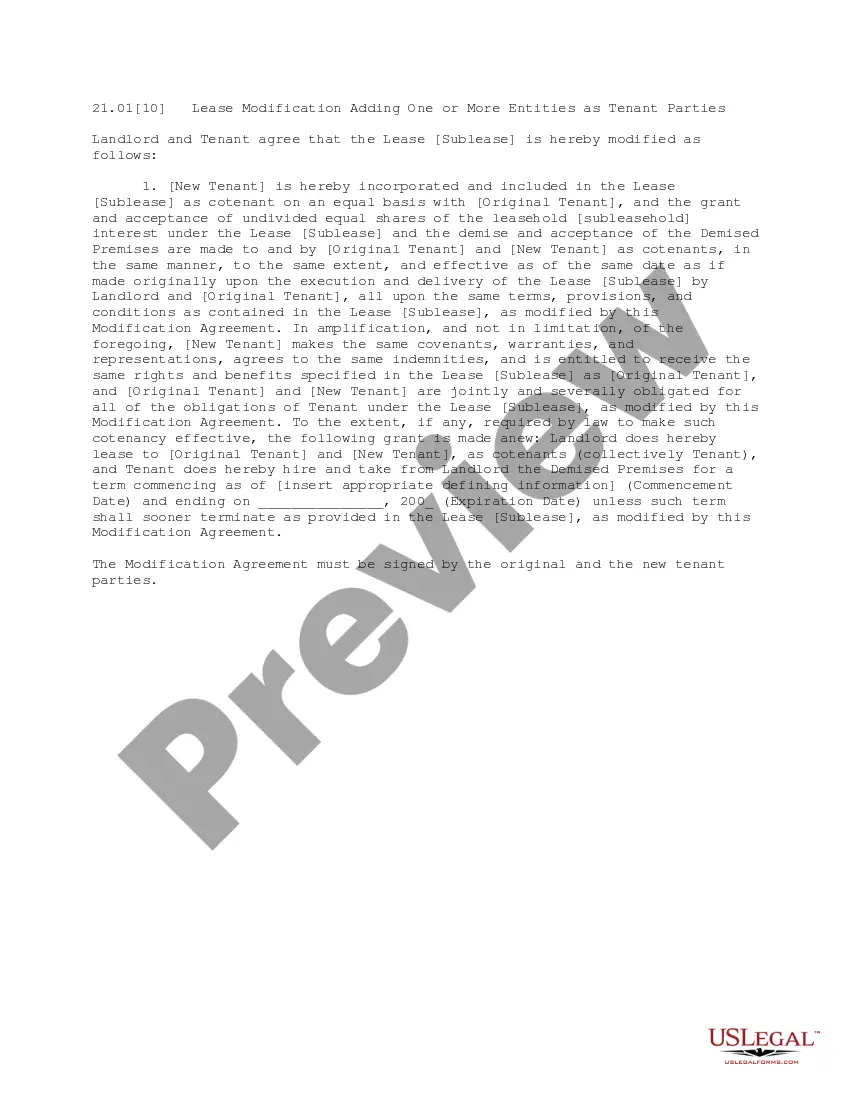

Maryland General Form of Indemnity Bond

Description

How to fill out General Form Of Indemnity Bond?

US Legal Forms - one of several biggest libraries of legitimate forms in the United States - offers a variety of legitimate file web templates you can down load or print out. While using web site, you can find a large number of forms for organization and specific uses, sorted by classes, claims, or search phrases.You will find the latest models of forms much like the Maryland General Form of Indemnity Bond in seconds.

If you currently have a monthly subscription, log in and down load Maryland General Form of Indemnity Bond from the US Legal Forms catalogue. The Download key will appear on every single type you view. You gain access to all previously delivered electronically forms from the My Forms tab of your respective bank account.

If you would like use US Legal Forms for the first time, listed here are basic directions to help you started out:

- Be sure to have picked the proper type to your town/county. Click the Preview key to check the form`s content. Browse the type information to actually have chosen the appropriate type.

- In the event the type does not satisfy your needs, take advantage of the Lookup industry at the top of the display screen to obtain the one that does.

- In case you are pleased with the shape, verify your selection by clicking the Acquire now key. Then, select the prices strategy you favor and offer your references to register for the bank account.

- Procedure the financial transaction. Make use of your charge card or PayPal bank account to accomplish the financial transaction.

- Select the format and down load the shape on your own product.

- Make alterations. Fill up, modify and print out and indicator the delivered electronically Maryland General Form of Indemnity Bond.

Every template you included in your money lacks an expiry time and is also yours for a long time. So, in order to down load or print out yet another backup, just go to the My Forms segment and click on about the type you require.

Gain access to the Maryland General Form of Indemnity Bond with US Legal Forms, by far the most considerable catalogue of legitimate file web templates. Use a large number of professional and status-particular web templates that fulfill your small business or specific requires and needs.

Form popularity

FAQ

Indemnity bonds demand stamp duty payments in line with the Indian Stamp Act 1899 and the stamp duty rules of the relevant states and union territories. The charges are three percent of the security's value, up to a maximum of one hundred rupees. Indemnity bond: Know importance, characteristics, benefits and sample housing.com ? news ? indemnity-bond housing.com ? news ? indemnity-bond

Surety Bond Requirements in MD Various regulatory authorities in Maryland require surety bonds in order for certain professionals, contract workers, and companies to do business in the state.

A Surety Bond Indemnity Agreement is an agreement between the principal and the surety bond company stating the company will be indemnified if it pays out a loss on the Principal's behalf due to a surety bond claim. What is a Surety Bond Indemnity Agreement? alphasurety.com ? surety-bond-info ? what-is-a-su... alphasurety.com ? surety-bond-info ? what-is-a-su...

An indemnity bond assures the holder of the bond, that they will be duly compensated in case of a possible loss. This bond is an agreement that protects the lender from loss if the borrower defaults on a legally binding loan. What is an indemnity bond? - Surety Bond Professionals suretybondprofessionals.com ? what-is-an-in... suretybondprofessionals.com ? what-is-an-in...

You can purchase indemnity bonds through several insurance companies, however, they are often difficult to obtain. Contact your insurance broker for help. Be aware that even after you present an indemnity bond, a bank may require you to wait 30?90 days before it will issue a replacement check.

A general agreement of indemnity, or GIA, is a contract between the surety company and the contractor and the other indemnitors. The GIA obligates the named indemnitors to protect the surety company from any loss or expense that the surety sustains as a result of having issued bonds on behalf of the bond principal.

Indemnity is the backbone of many surety bonds. In short, indemnity compels a party to compensate another party. Regarding a surety bond, this means that the obligee has the legal right to collect from the surety if the principal of the bond fails to uphold their end of the bond.

A letter of indemnity (LOI) is a legal agreement that renders one or both parties to a contract harmless by some third party in the event of a delinquency or breach by the contracted parties. In other words, the party or parties are indemnified against a possible loss by some third party, such as an insurance company. What Is a Letter of Indemnity (LOI)? Definition and Example - Investopedia investopedia.com ? terms ? letterofindemnity investopedia.com ? terms ? letterofindemnity