28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

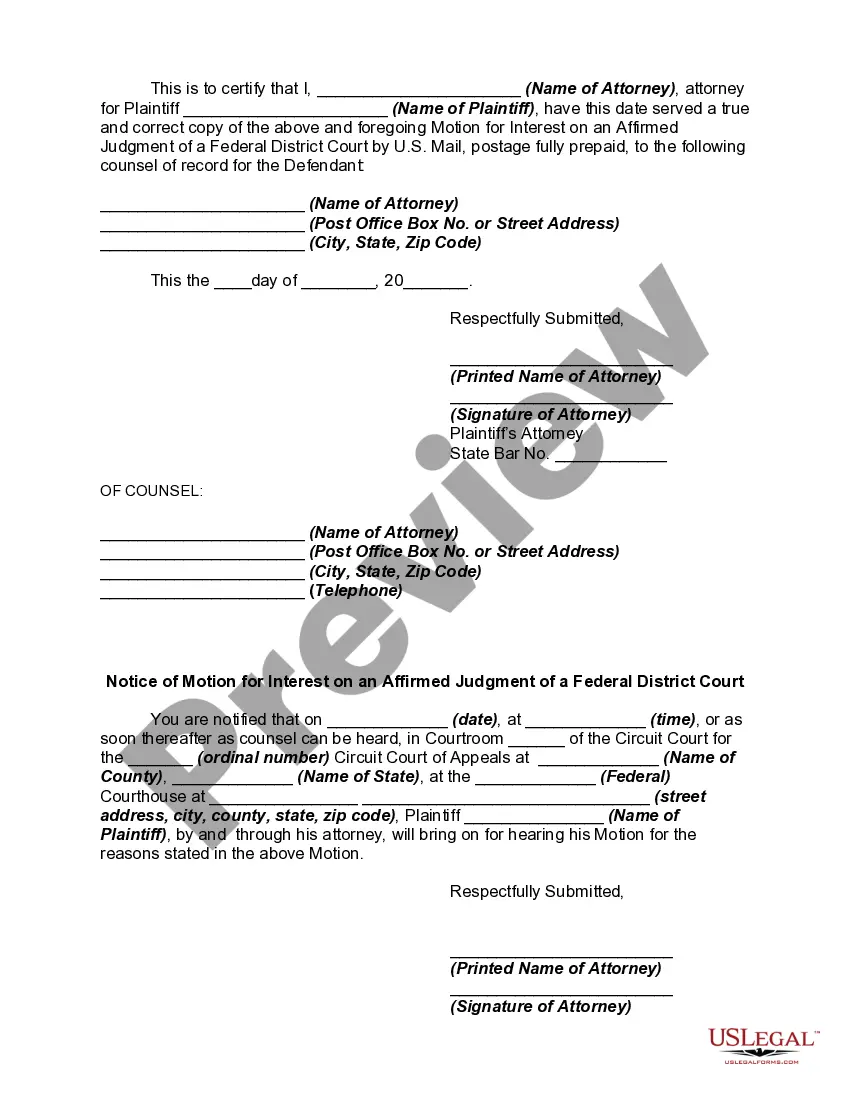

Maryland Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

US Legal Forms - among the largest libraries of lawful types in the USA - gives a wide array of lawful file templates you can acquire or produce. While using web site, you can find a large number of types for business and person uses, sorted by groups, states, or key phrases.You can find the most recent versions of types such as the Maryland Motion for Interest on an Affirmed Judgment of a Federal District Court in seconds.

If you currently have a subscription, log in and acquire Maryland Motion for Interest on an Affirmed Judgment of a Federal District Court from your US Legal Forms collection. The Obtain switch will appear on every single form you view. You gain access to all formerly saved types inside the My Forms tab of the bank account.

If you want to use US Legal Forms the very first time, listed here are basic instructions to get you started:

- Be sure to have selected the right form for your city/region. Click the Review switch to analyze the form`s information. Browse the form explanation to ensure that you have selected the appropriate form.

- In the event the form does not suit your needs, utilize the Research area towards the top of the monitor to find the one that does.

- If you are happy with the form, affirm your option by simply clicking the Acquire now switch. Then, select the pricing plan you like and give your qualifications to sign up to have an bank account.

- Approach the purchase. Make use of bank card or PayPal bank account to accomplish the purchase.

- Choose the file format and acquire the form in your device.

- Make alterations. Fill out, change and produce and indicator the saved Maryland Motion for Interest on an Affirmed Judgment of a Federal District Court.

Each and every template you included in your account does not have an expiry time and is your own property for a long time. So, if you want to acquire or produce another version, just check out the My Forms area and click about the form you need.

Get access to the Maryland Motion for Interest on an Affirmed Judgment of a Federal District Court with US Legal Forms, by far the most comprehensive collection of lawful file templates. Use a large number of professional and express-particular templates that meet your small business or person demands and needs.

Form popularity

FAQ

(a) For Lack of Jurisdiction. An action against any defendant who has not been served or over whom the court has not otherwise acquired jurisdiction is subject to dismissal as to that defendant at the expiration of one year from the last issuance of original process directed to that defendant.

A creditor who obtains a judgment against you is the "judgment creditor." You are the "judgment debtor" in the case. A judgment lasts for 12 years and the plaintiff can renew the judgment for another 12 years.

Md. Section 11-107 - Interest on judgments generally; interest on money judgment for rent; interest on money judgment for delinquent property taxes (a) Except as provided in § 11-106 of this subtitle, the legal rate of interest on a judgment shall be at the rate of 10 percent per annum on the amount of judgment.

Calculating interest owed You input the judgment amount, date, and payment history, and the program does all the calculations for you. The calculator has the interest rate set at 10%.

Subject to subsection (a)(2) of this Rule, any party may file a motion for new trial within ten days after entry of judgment. A party whose judgment has been amended on a motion to amend the judgment may file a motion for new trial within ten days after entry of the amended judgment.

Each state has its own interest rate laws, that help consumers by placing a limit on the amount of interest a creditor can charge. The legal maximum in Maryland is 6%, but can be 8% under a written contract.

Interest begins on the date the judgment is entered. CCP § 685.020(a). When the judgment is payable in installments (e.g., child support awards), interest accrues from the date each installment becomes due. Post-judgment interest is not compounded unless the judgment is renewed.

A party may move for judgment on any or all of the issues in any action at the close of the evidence offered by an opposing party, and in a jury trial at the close of all the evidence. The moving party shall state with particularity all reasons why the motion should be granted.