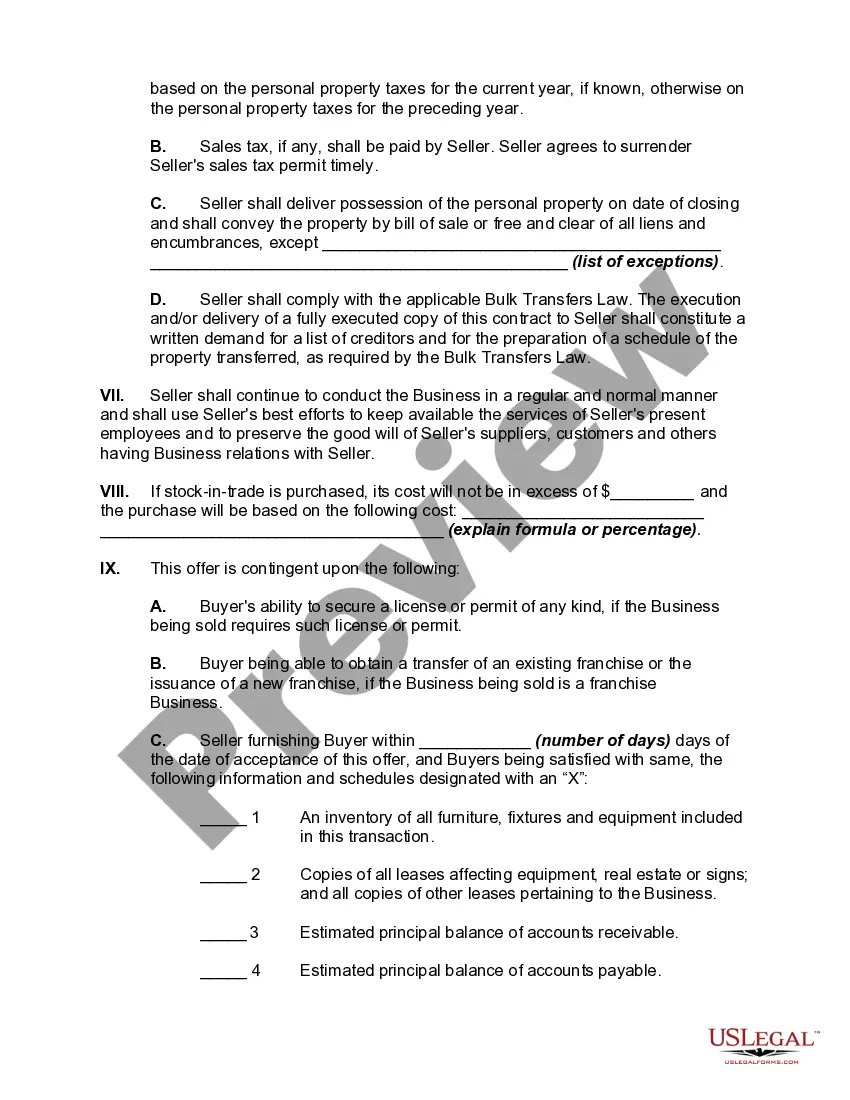

The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

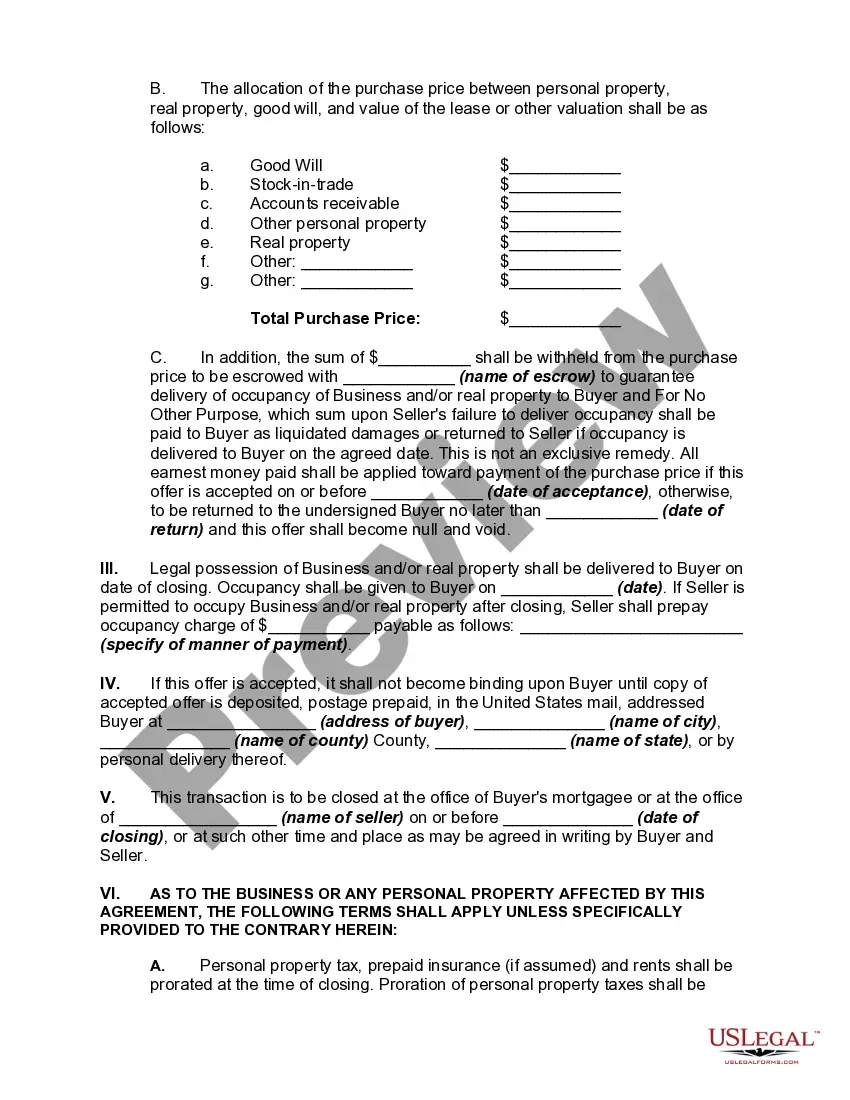

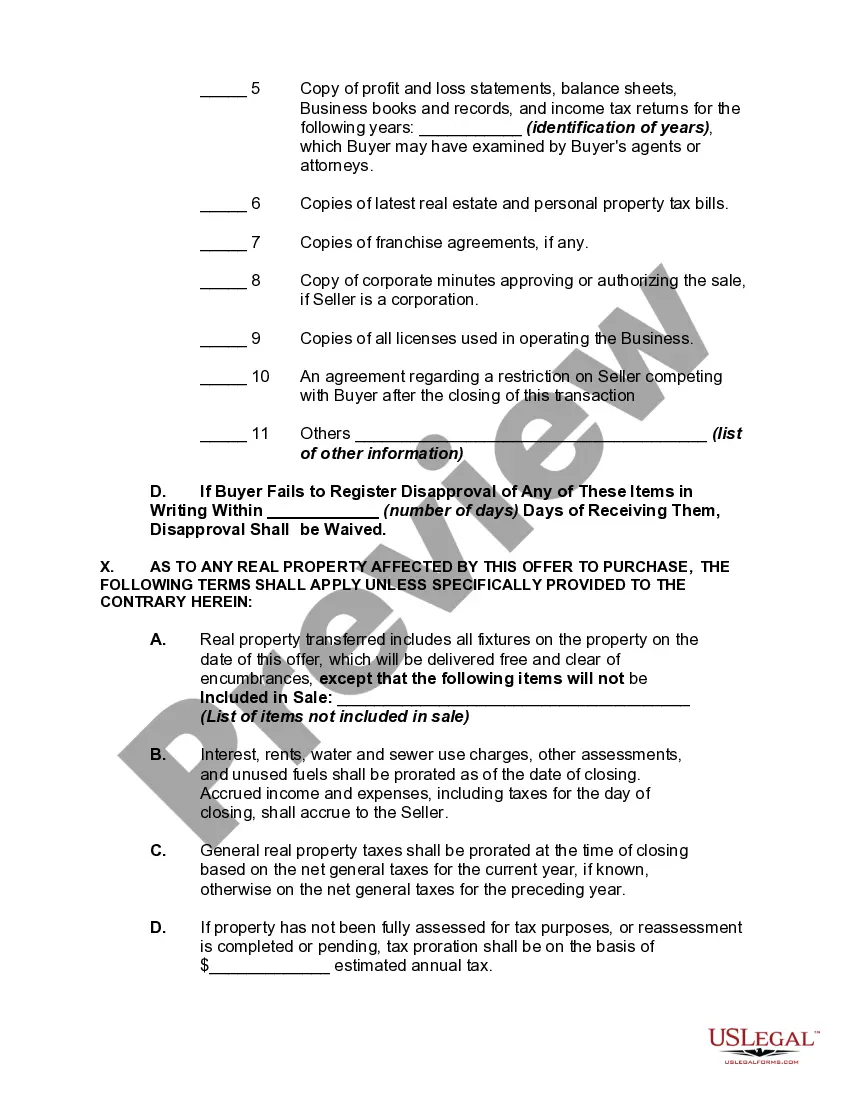

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

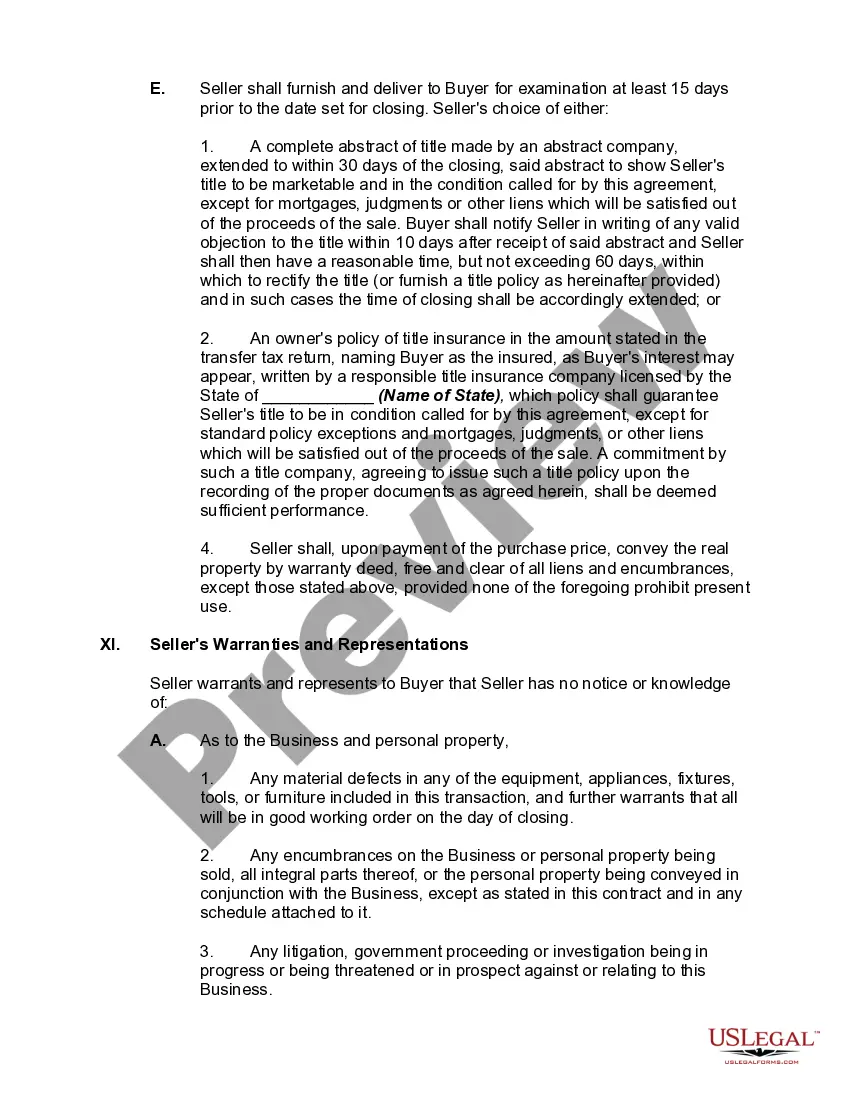

Maryland Offer to Purchase Business, Including Good Will: A Comprehensive Guide Introduction: The state of Maryland offers a unique mechanism known as the Offer to Purchase Business, Including Good Will, which allows individuals or entities to acquire an existing business, including its intangible assets like reputation, customer base, and brand value. In this detailed description, we will explore the key features, legal considerations, and various types of Maryland Offer to Purchase Business, Including Good Will. Key Features of Maryland Offer to Purchase Business, Including Good Will: 1. Binding Contract: The Maryland Offer to Purchase Business, Including Good Will, is a legally binding contract that outlines the terms and conditions for the sale and transfer of a business, encompassing both tangible and intangible assets. 2. Asset Valuation: This document enables the buyer and seller to agree on the valuation of the assets being transferred, including tangible assets like infrastructure, inventory, equipment, etc., as well as intangible assets like customer goodwill, trademarks, copyrights, and intellectual property. 3. Payment Terms: The Offer to Purchase Business, Including Good Will, specifies the payment terms and methods, such as lump-sum payment, installment plans, or assumption of existing business debts, ensuring that both parties are clear about the financial arrangements. 4. Due Diligence: The buyer has the right to conduct a thorough due diligence process to evaluate the business's financial health, legal compliance, contracts, liabilities, and any potential risks or contingencies associated with the acquisition. 5. Non-Compete Clause: Maryland Offer to Purchase Business, Including Good Will, often includes a non-compete clause that restricts the seller from starting a similar business in the same geographic area for a specified period. This protects the buyer's interests and ensures the business's continuity without direct competition. Types of Maryland Offer to Purchase Business, Including Good Will: 1. Asset Purchase Agreement: This type of offer focuses on acquiring the business's assets, such as equipment, inventory, and intangible assets like goodwill, trademarks, customer lists, and intellectual property rights. The buyer may choose to purchase specific assets while excluding others. 2. Stock Purchase Agreement: In this type of offer, the buyer purchases the existing owner's stock or shares, acquiring the business and all its assets and liabilities. This approach may involve more complex legal considerations, including potential tax implications. 3. Merger or Acquisition Agreement: In certain cases, businesses may choose to merge with or acquire another business to achieve strategic growth or diversify their operations. Maryland Offer to Purchase Business, Including Good Will, can be tailored to accommodate such mergers or acquisitions, considering the interests of all parties involved. Legal Considerations: When preparing a Maryland Offer to Purchase Business, Including Good Will, it is advisable to seek legal counsel to ensure compliance with state laws and regulations. Key legal factors to consider include: 1. Statutory Requirements: Understanding Maryland's specific legal requirements for such transactions, including necessary disclosures, notices, and registration processes. 2. Tax Implications: Assessing the potential tax consequences such as sales tax, property tax, and transfer tax that may apply to the purchase of business assets or shares. 3. Employment Contracts: Reviewing employee contracts, benefits, and labor laws to determine the extent of employee transfers or obligations. 4. Licenses and Permits: Considering any required licenses, permits, or certifications necessary to operate the acquired business legally. Conclusion: Maryland Offer to Purchase Business, Including Good Will, provides a structured framework for buying and selling existing businesses in the state. Whether opting for an asset purchase, stock purchase, or merger, this comprehensive legal document ensures clarity, protects interests, and facilitates a smooth transition. By considering the various types and legal aspects, buyers and sellers can navigate the transaction process successfully, unlocking new opportunities and achieving business growth.Maryland Offer to Purchase Business, Including Good Will: A Comprehensive Guide Introduction: The state of Maryland offers a unique mechanism known as the Offer to Purchase Business, Including Good Will, which allows individuals or entities to acquire an existing business, including its intangible assets like reputation, customer base, and brand value. In this detailed description, we will explore the key features, legal considerations, and various types of Maryland Offer to Purchase Business, Including Good Will. Key Features of Maryland Offer to Purchase Business, Including Good Will: 1. Binding Contract: The Maryland Offer to Purchase Business, Including Good Will, is a legally binding contract that outlines the terms and conditions for the sale and transfer of a business, encompassing both tangible and intangible assets. 2. Asset Valuation: This document enables the buyer and seller to agree on the valuation of the assets being transferred, including tangible assets like infrastructure, inventory, equipment, etc., as well as intangible assets like customer goodwill, trademarks, copyrights, and intellectual property. 3. Payment Terms: The Offer to Purchase Business, Including Good Will, specifies the payment terms and methods, such as lump-sum payment, installment plans, or assumption of existing business debts, ensuring that both parties are clear about the financial arrangements. 4. Due Diligence: The buyer has the right to conduct a thorough due diligence process to evaluate the business's financial health, legal compliance, contracts, liabilities, and any potential risks or contingencies associated with the acquisition. 5. Non-Compete Clause: Maryland Offer to Purchase Business, Including Good Will, often includes a non-compete clause that restricts the seller from starting a similar business in the same geographic area for a specified period. This protects the buyer's interests and ensures the business's continuity without direct competition. Types of Maryland Offer to Purchase Business, Including Good Will: 1. Asset Purchase Agreement: This type of offer focuses on acquiring the business's assets, such as equipment, inventory, and intangible assets like goodwill, trademarks, customer lists, and intellectual property rights. The buyer may choose to purchase specific assets while excluding others. 2. Stock Purchase Agreement: In this type of offer, the buyer purchases the existing owner's stock or shares, acquiring the business and all its assets and liabilities. This approach may involve more complex legal considerations, including potential tax implications. 3. Merger or Acquisition Agreement: In certain cases, businesses may choose to merge with or acquire another business to achieve strategic growth or diversify their operations. Maryland Offer to Purchase Business, Including Good Will, can be tailored to accommodate such mergers or acquisitions, considering the interests of all parties involved. Legal Considerations: When preparing a Maryland Offer to Purchase Business, Including Good Will, it is advisable to seek legal counsel to ensure compliance with state laws and regulations. Key legal factors to consider include: 1. Statutory Requirements: Understanding Maryland's specific legal requirements for such transactions, including necessary disclosures, notices, and registration processes. 2. Tax Implications: Assessing the potential tax consequences such as sales tax, property tax, and transfer tax that may apply to the purchase of business assets or shares. 3. Employment Contracts: Reviewing employee contracts, benefits, and labor laws to determine the extent of employee transfers or obligations. 4. Licenses and Permits: Considering any required licenses, permits, or certifications necessary to operate the acquired business legally. Conclusion: Maryland Offer to Purchase Business, Including Good Will, provides a structured framework for buying and selling existing businesses in the state. Whether opting for an asset purchase, stock purchase, or merger, this comprehensive legal document ensures clarity, protects interests, and facilitates a smooth transition. By considering the various types and legal aspects, buyers and sellers can navigate the transaction process successfully, unlocking new opportunities and achieving business growth.