The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

Maryland Complaint for Recovery of Unpaid Wages

Description

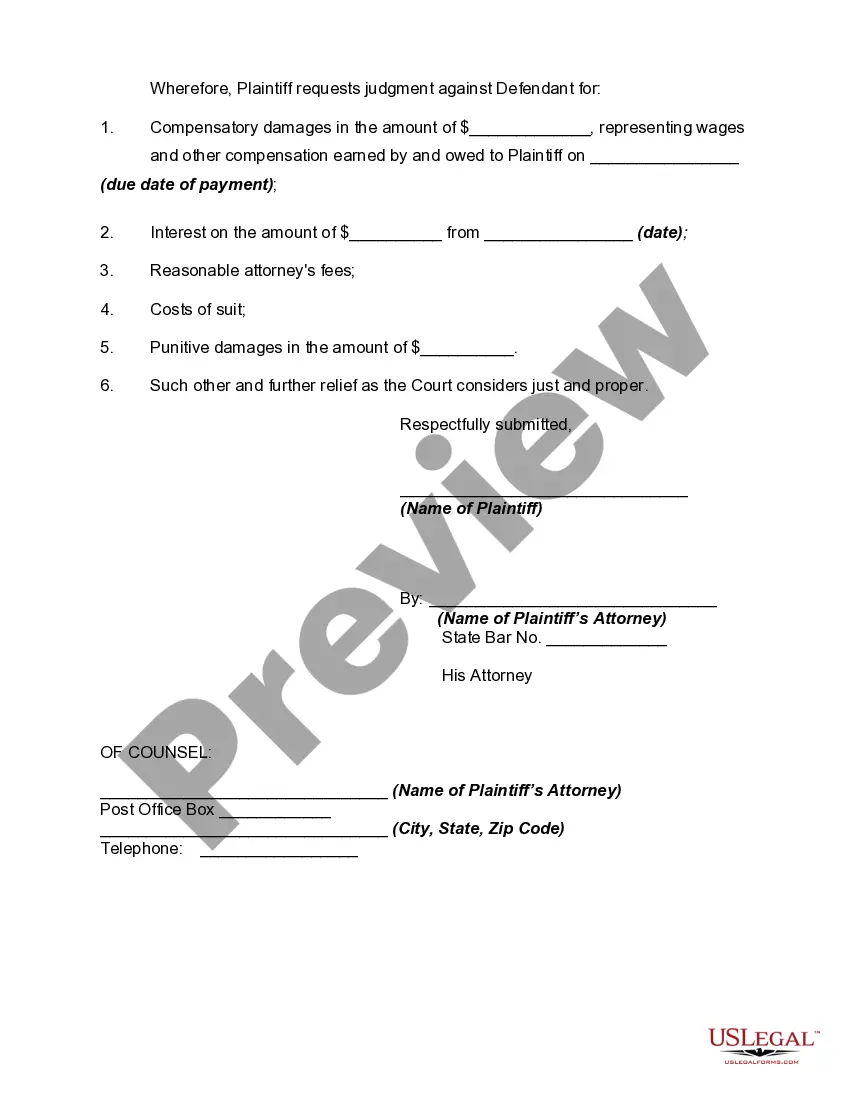

How to fill out Complaint For Recovery Of Unpaid Wages?

If you wish to complete, obtain, or print legal record themes, use US Legal Forms, the biggest selection of legal kinds, that can be found on the Internet. Make use of the site`s basic and convenient look for to get the files you need. Different themes for organization and specific purposes are sorted by groups and claims, or keywords. Use US Legal Forms to get the Maryland Complaint for Recovery of Unpaid Wages in just a handful of clicks.

In case you are currently a US Legal Forms consumer, log in in your account and click the Obtain button to get the Maryland Complaint for Recovery of Unpaid Wages. You can also entry kinds you in the past downloaded in the My Forms tab of your respective account.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the form for the appropriate metropolis/nation.

- Step 2. Utilize the Preview method to look over the form`s content. Do not forget to learn the explanation.

- Step 3. In case you are not happy with all the kind, utilize the Look for field at the top of the display to get other models of your legal kind web template.

- Step 4. Once you have found the form you need, click the Acquire now button. Opt for the costs program you prefer and include your accreditations to register for an account.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Find the format of your legal kind and obtain it on your product.

- Step 7. Comprehensive, revise and print or signal the Maryland Complaint for Recovery of Unpaid Wages.

Every legal record web template you acquire is your own property eternally. You may have acces to each kind you downloaded with your acccount. Select the My Forms section and choose a kind to print or obtain again.

Remain competitive and obtain, and print the Maryland Complaint for Recovery of Unpaid Wages with US Legal Forms. There are millions of specialist and express-certain kinds you can use to your organization or specific requires.

Form popularity

FAQ

The Fair Wage Act of 2023, effective Jan. 1, 2024, requires that all Maryland employers, regardless of size, pay minimum wage of $15.00 or more per hour to all non-exempt employees.

The Maryland Equal Pay for Equal Work law provides that an employer may not prohibit an employee from inquiring about, discussing, or disclosing the wages of an employee or another employee or requesting that the employer provide a reason for why the employee's wages are a condition of employment.

The Maryland Wage Payment and Collection Law sets forth the rights by which employees receive wages. The law states when and how often employees must be paid, general guidelines for making wage deductions, which actions are prohibited and how employees may enforce their rights.

Section 3-502 - Payment of wage (a) (1) Each employer: (i) shall set regular pay periods; and (ii) except as provided in paragraph (2) of this subsection, shall pay each employee at least once in every 2 weeks or twice in each month.

§ 3-505. Each employer shall pay an employee or the authorized representative of an employee all wages due for work that the employee performed before the termination of employment, on or before the day on which the employee would have been paid the wages if the employment had not been terminated.

An employee, or applicant, may file a written complaint with the Office of Equal Employment Opportunity (OEEO) or any Department Equal Opportunity (EEO) Designee within 30 days after the complainant (employee or applicant) knew, or reasonably should have known, of the alleged violation of the State's Fair Employment ...

Employers in Maryland must pay their employees at least every two weeks or twice every month. However, an employer may pay an administrative, executive, or professional employee on a less frequent schedule.

Typically, there is a three (3) year statute of limitations under the Maryland Wage & Hour Law (MWHL) and/or the Maryland Wage Payment & Collection Law (MWCPL) for filing a lawsuit for unpaid wages in a court.