Maryland Sample Letter for Assets and Liabilities of Decedent's Estate

Description

How to fill out Sample Letter For Assets And Liabilities Of Decedent's Estate?

Are you inside a placement the place you need paperwork for sometimes company or personal functions nearly every day? There are tons of legal document layouts available on the net, but discovering versions you can rely is not easy. US Legal Forms provides thousands of type layouts, just like the Maryland Sample Letter for Assets and Liabilities of Decedent's Estate, which are published to meet state and federal needs.

In case you are currently knowledgeable about US Legal Forms web site and get a merchant account, merely log in. After that, you may acquire the Maryland Sample Letter for Assets and Liabilities of Decedent's Estate design.

Unless you have an bank account and want to begin to use US Legal Forms, abide by these steps:

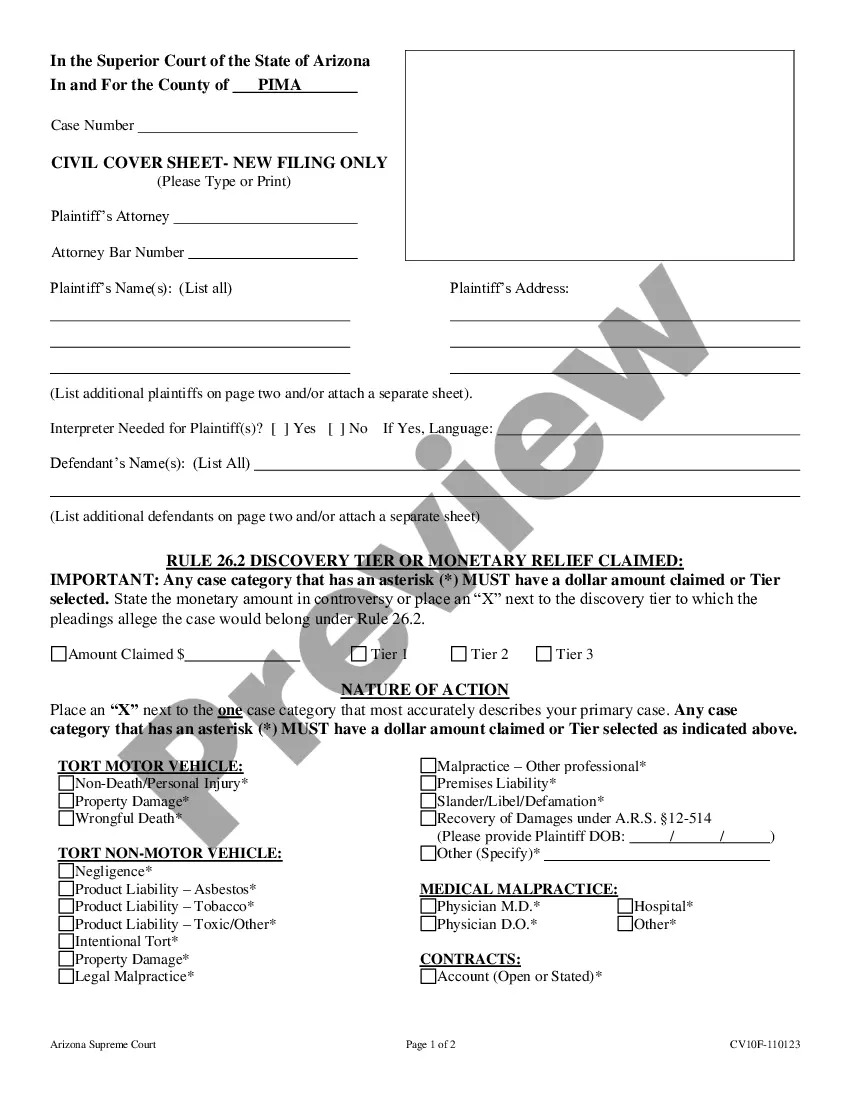

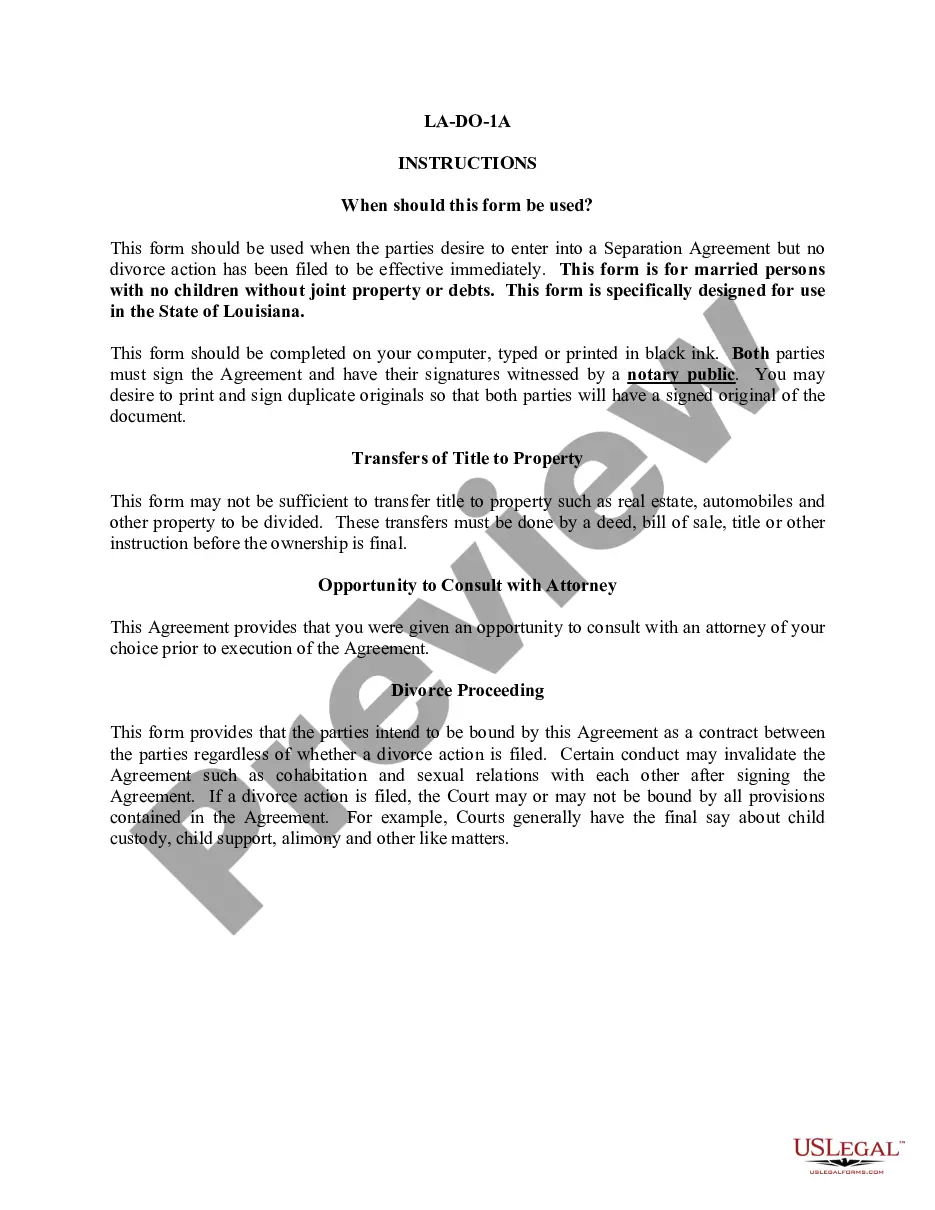

- Get the type you will need and ensure it is for that proper area/area.

- Use the Review option to analyze the shape.

- Read the information to actually have chosen the correct type.

- When the type is not what you`re searching for, make use of the Research field to find the type that suits you and needs.

- Whenever you obtain the proper type, click on Acquire now.

- Select the prices prepare you would like, submit the desired details to generate your account, and pay money for the order using your PayPal or charge card.

- Decide on a handy paper structure and acquire your copy.

Discover all the document layouts you might have purchased in the My Forms menus. You may get a more copy of Maryland Sample Letter for Assets and Liabilities of Decedent's Estate any time, if possible. Just go through the needed type to acquire or produce the document design.

Use US Legal Forms, the most substantial collection of legal forms, to save lots of some time and stay away from errors. The services provides skillfully produced legal document layouts that can be used for a range of functions. Create a merchant account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

For estates with a value of at least $50,000, there is probate fee to cover the processing costs. The probate fee is based on the value of the assets. Please see the Fees Page for more information. Unless exempted under Maryland statute, there is also an inheritance tax due on distribution of remaining assets.

In Maryland, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Non-probate property ? Property not subject to the terms of a decedent's Last Will and Testament, and which passes to a beneficiary outside of the probate process, such as property that had been transferred into trust prior to death, joint tenants by right of survivorship (or tenants by the entireties), payable on ...

First and foremost, there are a number of asset types that typically do not pass through probate. This includes life insurance policies, bank accounts, and investment or retirement accounts that require you to name a beneficiary.

Property outside of probate include assets like a family home that is owned as Joint Tenants because the surviving joint tenant becomes the owner of the property. Another example is Tenancy by the Entirety where assets are owned by a married couple. Beneficiary Designations on assets is yet another example.

(1) A claimant may make a claim against the estate, within the time allowed for presenting claims, (A) by serving it on the personal representative, (B) by filing it with the register and serving a copy on the personal representative, or (C) by filing suit.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

Ideally, you should be able to close the estate within 13 months of the decedent's death. However, depending on the size and complexity of the estate, it may take longer. In any case, it's important to keep meticulous records throughout the process to prove to the court that you've fulfilled all your fiduciary duties.