Judicial lien is a lien obtained by judgment, levy, sequestration or other legal or equitable process or proceeding. If a court finds that a debtor owes money to a creditor and the judgment remains unsatisfied, the creditor can ask the court to impose a lien on specific property owned and possessed by the debtor. After imposing the lien, the court issues a writ directing the local sheriff to seize the property, sell it and turn over the proceeds to the creditor.

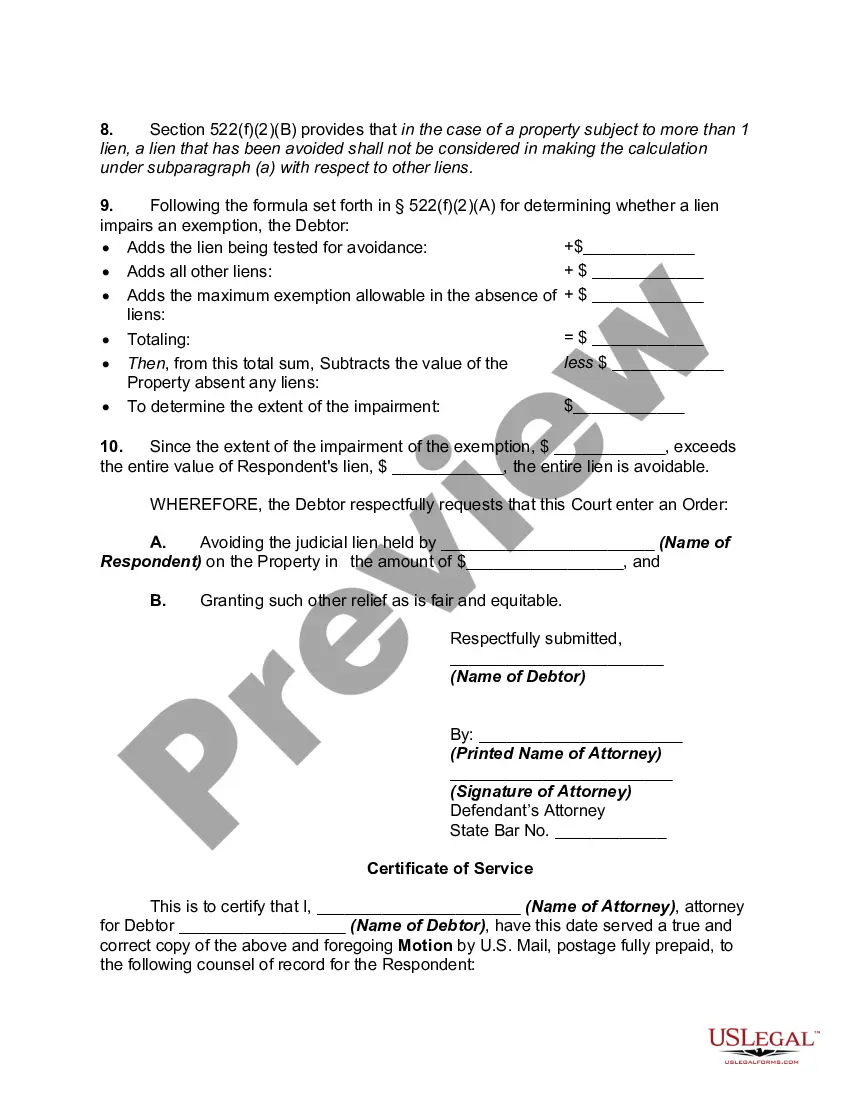

Under Bankruptcy proceedings, a creditor can obtain a judicial lien by filing a final judgment issued against a debtor through a lawsuit filed in state court. A certified copy of a final judgment may be filed in the county in which the debtor owns real property. A bankruptcy debtor can file a motion to avoid Judicial Lien. A Motion to avoid Judicial Lien can be filed by a debtor in either a chapter 7 or chapter 13 bankruptcy proceeding. In a Chapter 7 proceeding, an Order Avoiding Judicial Lien will remove the debt totally.

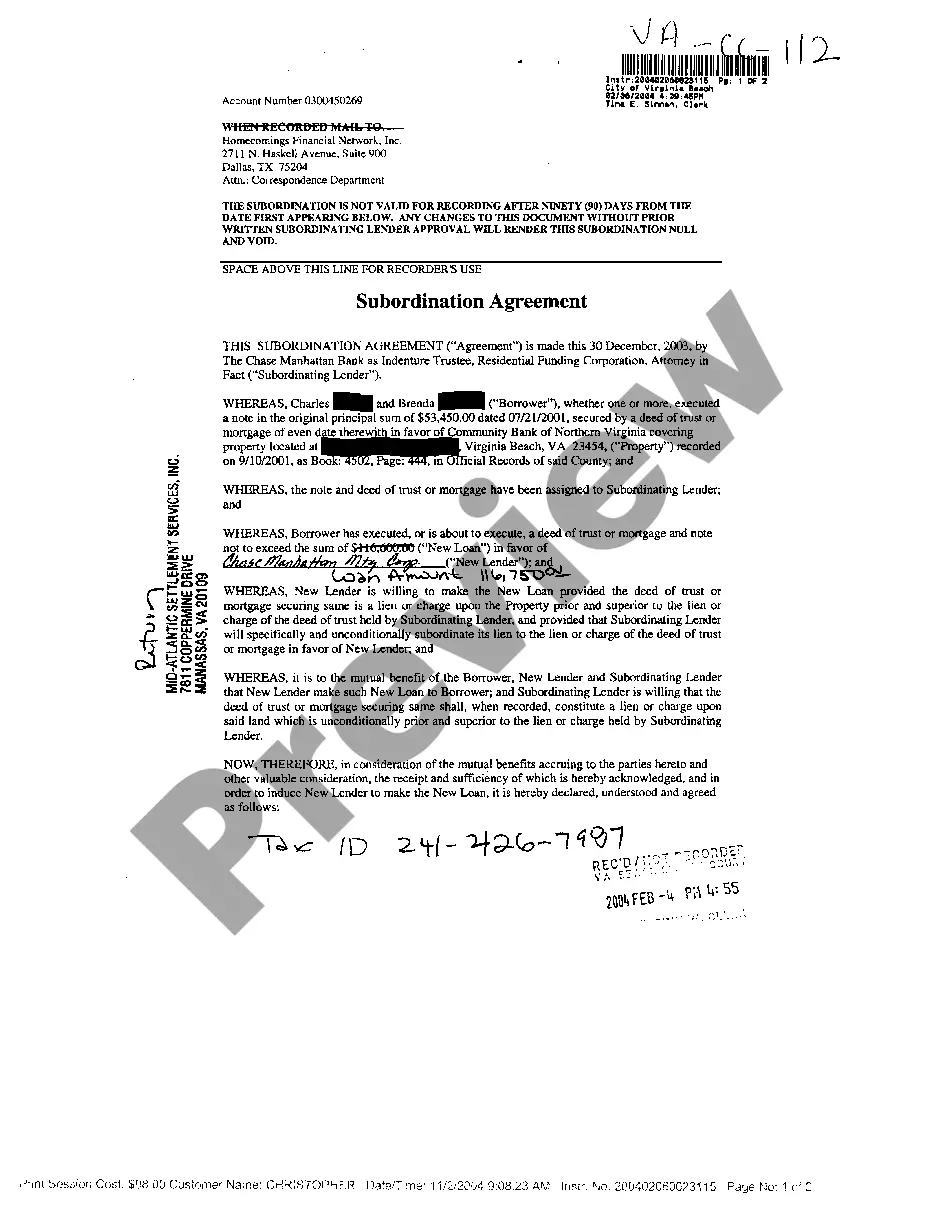

Maryland Motion to Avoid Creditor's Lien is a legal process that allows individuals or businesses to request the court to remove a creditor's lien on their property or assets. This motion is filed in bankruptcy cases under Chapter 7 or Chapter 13. A creditor's lien is a legal claim that a creditor holds against a debtor's property or assets as collateral for unpaid debts. By filing a Maryland Motion to Avoid Creditor's Lien, debtors seek relief from having their property seized or liquidated by the creditor to satisfy outstanding debts. There are several types of Maryland Motions to Avoid Creditor's Lien, each relevant to specific situations: 1. Maryland Motion to Avoid Judgment Lien: This is filed when a creditor has obtained a judgment against the debtor and subsequently placed a lien on their property. Debtors can seek to have this judgment lien removed through bankruptcy proceedings. 2. Maryland Motion to Avoid Mechanic's Lien: This type of motion is relevant when a creditor, often a contractor or supplier, has filed a mechanic's lien against the debtor's property due to disputes or unpaid bills related to construction, repairs, or improvements made on the property. 3. Maryland Motion to Avoid Tax Lien: When a debtor owes unpaid taxes to federal or state tax authorities, a tax lien can be placed on their property. Debtors can file a motion to avoid this lien if they meet certain criteria, such as having minimal equity in the property and if the lien impairs their exemption rights. 4. Maryland Motion to Avoid Non-Possessory, Non-Purchase Money Security Interests: This motion is applicable to creditors who hold a security interest in the debtor's property without possessing it physically, such as lenders or financial institutions who have provided loans or credit secured by the property. To successfully file a Maryland Motion to Avoid Creditor's Lien, debtors must gather necessary documentation, such as property appraisals, loan agreements, tax records, and proof of exemption rights, and present a compelling argument to the court supporting the removal of the lien. It is important for debtors facing liens to consult with a qualified bankruptcy attorney in Maryland to navigate the legal process effectively. Understanding the specific type of lien involved is crucial in determining the appropriate course of action and meeting the requirements of the court.

Maryland Motion to Avoid Creditor's Lien is a legal process that allows individuals or businesses to request the court to remove a creditor's lien on their property or assets. This motion is filed in bankruptcy cases under Chapter 7 or Chapter 13. A creditor's lien is a legal claim that a creditor holds against a debtor's property or assets as collateral for unpaid debts. By filing a Maryland Motion to Avoid Creditor's Lien, debtors seek relief from having their property seized or liquidated by the creditor to satisfy outstanding debts. There are several types of Maryland Motions to Avoid Creditor's Lien, each relevant to specific situations: 1. Maryland Motion to Avoid Judgment Lien: This is filed when a creditor has obtained a judgment against the debtor and subsequently placed a lien on their property. Debtors can seek to have this judgment lien removed through bankruptcy proceedings. 2. Maryland Motion to Avoid Mechanic's Lien: This type of motion is relevant when a creditor, often a contractor or supplier, has filed a mechanic's lien against the debtor's property due to disputes or unpaid bills related to construction, repairs, or improvements made on the property. 3. Maryland Motion to Avoid Tax Lien: When a debtor owes unpaid taxes to federal or state tax authorities, a tax lien can be placed on their property. Debtors can file a motion to avoid this lien if they meet certain criteria, such as having minimal equity in the property and if the lien impairs their exemption rights. 4. Maryland Motion to Avoid Non-Possessory, Non-Purchase Money Security Interests: This motion is applicable to creditors who hold a security interest in the debtor's property without possessing it physically, such as lenders or financial institutions who have provided loans or credit secured by the property. To successfully file a Maryland Motion to Avoid Creditor's Lien, debtors must gather necessary documentation, such as property appraisals, loan agreements, tax records, and proof of exemption rights, and present a compelling argument to the court supporting the removal of the lien. It is important for debtors facing liens to consult with a qualified bankruptcy attorney in Maryland to navigate the legal process effectively. Understanding the specific type of lien involved is crucial in determining the appropriate course of action and meeting the requirements of the court.