Maryland Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

Have you ever been in a situation where you find yourself needing documentation for possibly administrative purposes or certain tasks almost every day.

There are numerous legal document templates available online, but finding reliable versions is not straightforward.

US Legal Forms provides a vast array of template forms, such as the Maryland Telecommuting Worksheet, which are designed to meet state and federal regulations.

Once you locate the appropriate form, click Get now.

Choose your payment plan, enter the required information for payment, and finalize your order using PayPal, Visa, or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Maryland Telecommuting Worksheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Look for the form you require and ensure it corresponds to the correct city/state.

- Utilize the Review feature to examine the form.

- Check the details to ensure you have selected the accurate form.

- If the form is not what you are after, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Teleworking and remote work are similar, as both involve employees completing tasks outside the traditional office. However, teleworking often implies a structured arrangement facilitated by the employer. Organizations can benefit from using the Maryland Telecommuting Worksheet to establish clear guidelines for these work arrangements, enhancing productivity for all parties involved.

Remote work (also known as work from home WFH or telecommuting) is a type of flexible working arrangement that allows an employee to work from remote location outside of corporate offices.

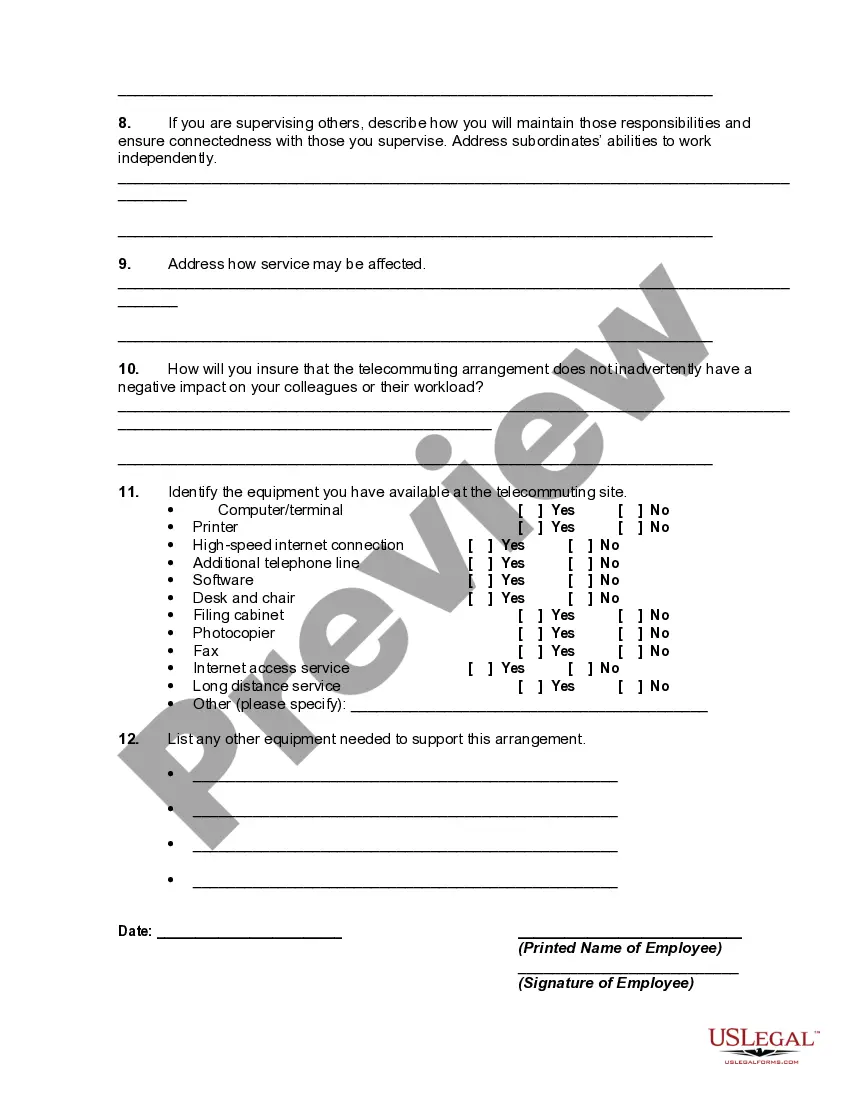

For instance, remote workers may need:Computer/laptop.Internet connection.Mobile device and service.Apps or software (particularly for timekeeping and scheduling).Printers (if documents cannot be utilized virtually for the position).Supplies (pens, paper, scanner).Transportation (to visit clients, etc.)

If you're among the employed Americans who were allowed to work remotely during the pandemic last year, count your blessings. But if you worked from a state other than the one where your employer is based, you may have to pay up for that privilege come tax time.

Nonresidents who work in Maryland or derive income from a Maryland source are subject to the appropriate Maryland income tax rate for their income level, as well as a special nonresident tax rate. The special nonresident tax rate has increased from 1.25% to 1.75% in 2016.

Regardless of where your employer is based your personal income taxes will always need to be filed in the state where you reside. The state that you actually live in, where you have a permanent home, is known as your resident state or domicile.

Yes, the same situation would be applicable to 2020. MD would not tax the income earned working for the MD company but remotely in NH. You would allocate two months to MD for the two months you physically worked in MD as a non-resident. MD did not change it's business nexus rules due to COVID 19.

Positions that can be regularly performed remotely are those that: o Don't require a traditional office or clinical space to interact with internal and external customers. o Have access to required systems and software associated with the position responsibilities. o Have remote access to files. o Have supervisors who

Telework: Working from home, a satellite office, or shared space rather than commuting to a nearby office. Remote Work: Working from home, a satellite office, or shared space regardless if an office exists in close proximity to you.

If you want to know if a job can be done remotely, use technology as a guide in determining if that job can be done virtually. A run through FlexJobs' list of 100 Top Companies with Remote Jobs can give you a sense of the broad landscape for jobs that can be done from home.