Maryland: What To Do When Starting a New Business Are you considering starting a new business in Maryland? Congratulations! Maryland offers a thriving business environment, strategic geographic location, and a supportive network of resources and opportunities. Whether you're looking to launch a tech startup, open a restaurant, or start a consulting firm, Maryland has a lot to offer. In this article, we will explore various aspects of starting a new business in Maryland and provide you with essential steps and guidance to help you succeed. 1. Conduct Thorough Market Research: Before diving into the business world, it's crucial to conduct comprehensive market research. Understand your target audience, competitors, and economic trends to gauge the viability of your business idea. This research will help you refine your concept, identify potential challenges, and create a solid business plan. 2. Develop a Well-Defined Business Plan: A carefully designed business plan is a roadmap for success. Outline your business goals, target market, financial projections, marketing strategies, and operations plan in detail. This document will serve as a crucial tool to secure funding, attract investors, and guide your business growth. 3. Choose an Appropriate Business Structure: Decide on the most suitable business structure for your venture. Maryland offers options such as sole proprietorship, partnership, limited liability company (LLC), and corporation. Each structure has its advantages and legal implications, so consult a qualified attorney or business advisor to make an informed decision. 4. Register Your Business: To establish your business legally, register it with the State of Maryland. Visit the Maryland Department of Assessments and Taxation (SEAT) website and follow the registration process. Choose a unique business name, obtain necessary permits and licenses, and fulfill any additional requirements specific to your industry. 5. Fulfill Tax Obligations: Understanding your tax obligations is crucial for every entrepreneur. Register for federal, state, and local taxes, and obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). Familiarize yourself with Maryland's tax laws, including sales tax and employer withholding. 6. Secure Sufficient Funding: Consider your financial needs and explore various funding options. Maryland offers grants, loans, and tax incentives, particularly for small businesses and innovative startups. Additionally, you may approach banks, venture capitalists, angel investors, or crowdfunding platforms to secure capital. 7. Create a Strong Online Presence: In today's digital era, establishing an online presence is essential for business success. Build a professional website, optimize it for search engines, and leverage social media platforms to engage with potential customers. Utilize Maryland's resources that support entrepreneurship and offer training in digital marketing strategies. 8. Network and Seek Support: Take advantage of Maryland's supportive business ecosystem. Join local chambers of commerce, industry associations, and business organizations to expand your network and gain valuable insights. Additionally, connect with Maryland's Business and Economic Development resources, such as the Small Business Development Center (SBC), SCORE, and Maryland Business Connection (MIX). 9. Hire Qualified Employees and Obtain Insurance: If your business requires employees, ensure you comply with Maryland's labor laws. Develop an effective recruiting process and hire qualified individuals who align with your business goals. Additionally, consider obtaining appropriate insurance coverage such as general liability, workers' compensation, and professional liability insurance to protect your business. 10. Continuously Adapt and Evolve: Starting a business is an ongoing journey. Stay informed about evolving market trends, continually assess your business performance, and adapt your strategies accordingly. Remain open to feedback, refine your products or services, and stay ahead of competitors to ensure long-term success. By following these steps and tapping into Maryland's rich entrepreneurial ecosystem, you can navigate the process of starting a new business with confidence. Whether you're in Baltimore, Annapolis, or any other city in Maryland, the state provides ample opportunities and support to help your business thrive. Start your entrepreneurial journey in Maryland today and witness your dream business come to life.

Maryland What To Do When Starting a New Business

Description

How to fill out Maryland What To Do When Starting A New Business?

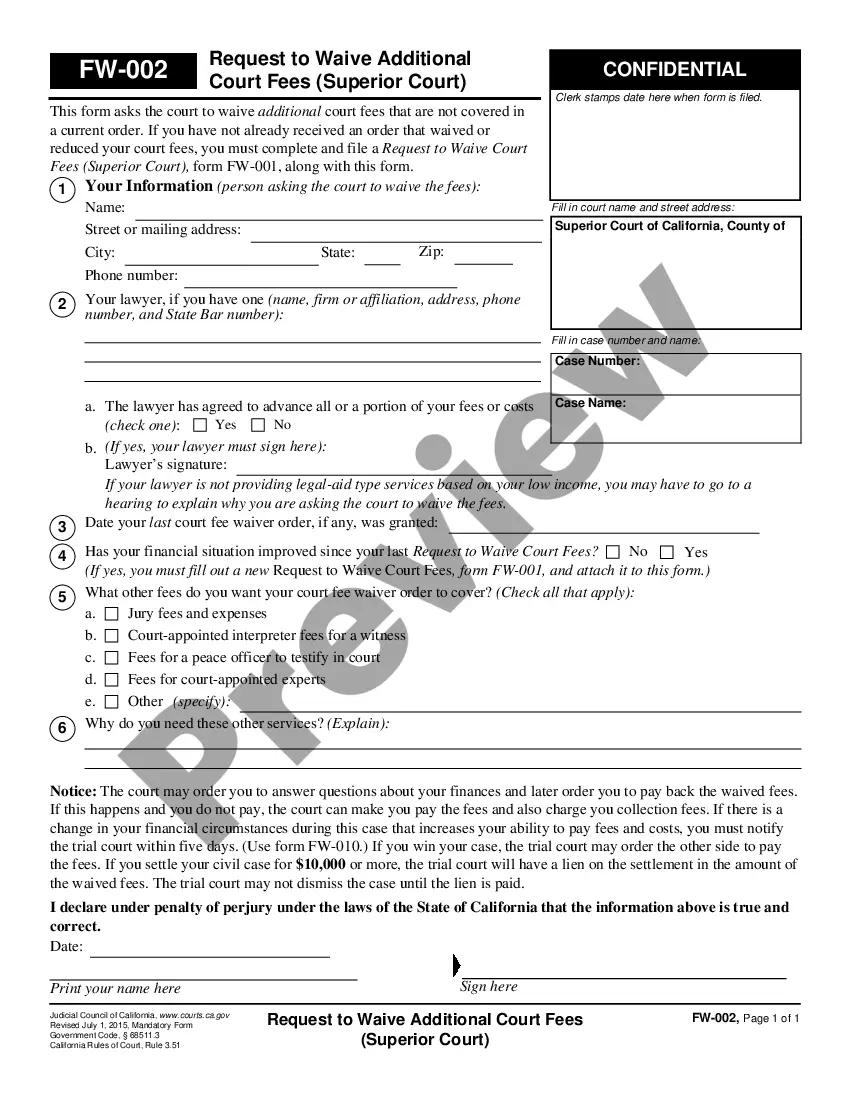

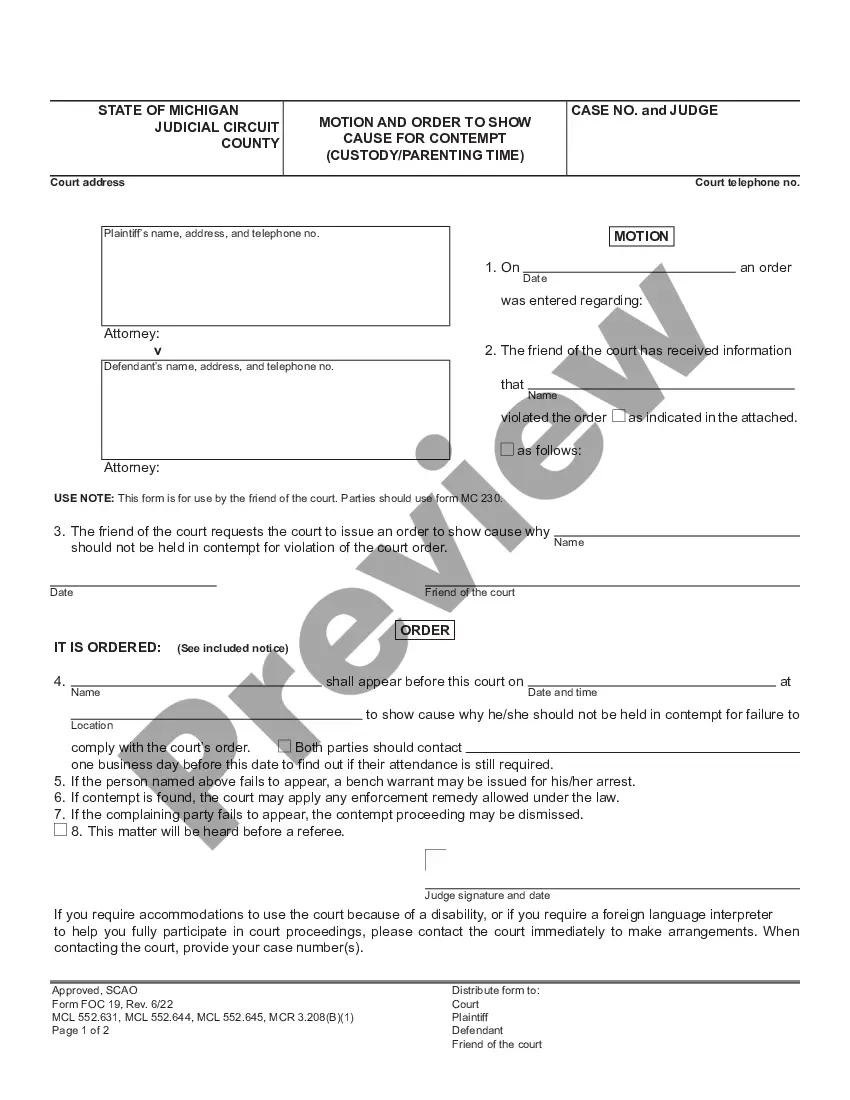

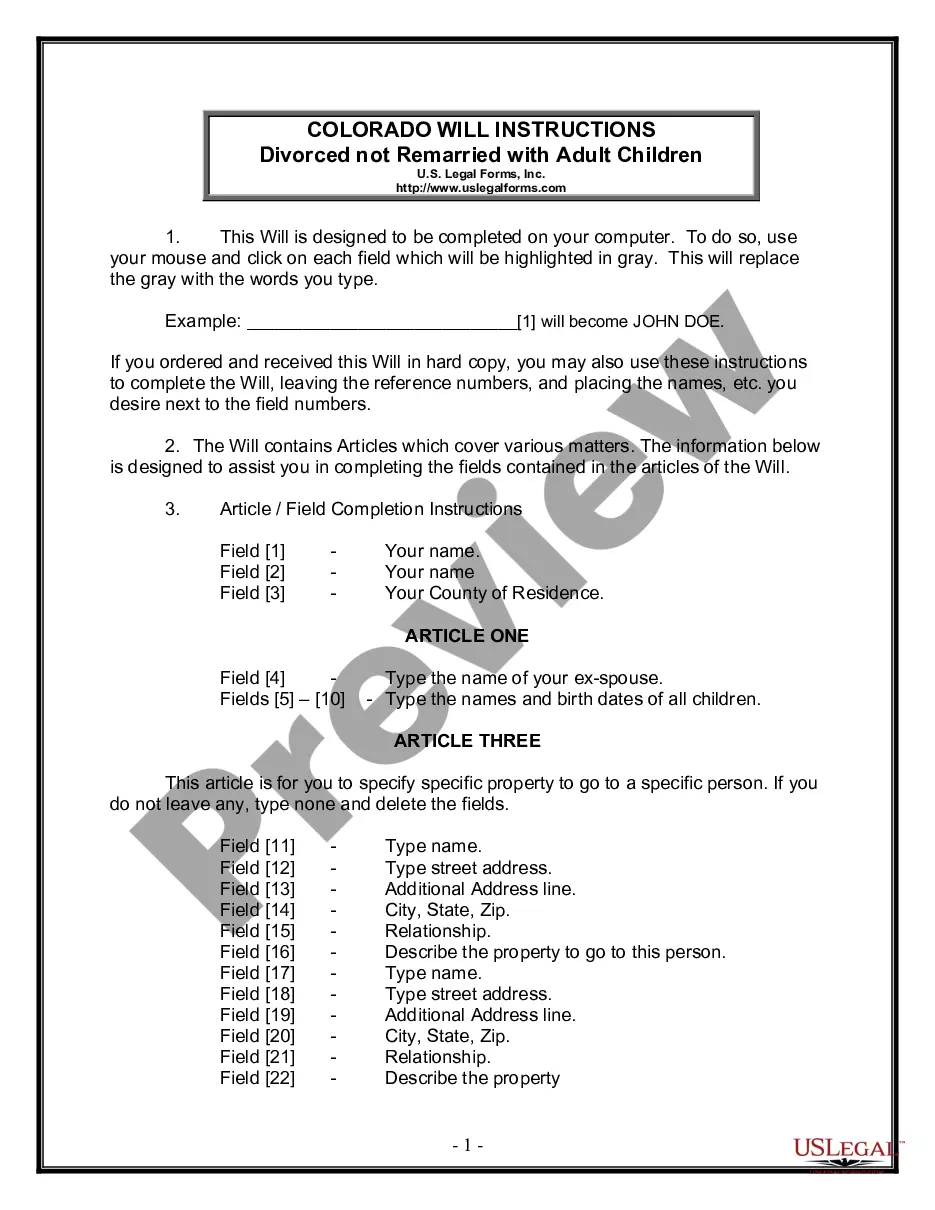

Have you been in the placement where you need to have paperwork for possibly enterprise or individual functions just about every day? There are tons of authorized document layouts accessible on the Internet, but discovering ones you can trust isn`t easy. US Legal Forms delivers a large number of kind layouts, such as the Maryland What To Do When Starting a New Business, which can be created to fulfill state and federal demands.

When you are previously acquainted with US Legal Forms internet site and possess your account, basically log in. Following that, you may down load the Maryland What To Do When Starting a New Business format.

Should you not offer an accounts and would like to start using US Legal Forms, adopt these measures:

- Get the kind you will need and make sure it is for your appropriate town/state.

- Utilize the Preview option to check the form.

- Read the information to actually have chosen the correct kind.

- In case the kind isn`t what you`re seeking, make use of the Look for industry to obtain the kind that suits you and demands.

- Once you discover the appropriate kind, click on Purchase now.

- Select the prices program you want, fill in the necessary info to create your account, and pay money for the order with your PayPal or charge card.

- Select a hassle-free data file formatting and down load your duplicate.

Discover every one of the document layouts you may have bought in the My Forms food list. You can get a more duplicate of Maryland What To Do When Starting a New Business whenever, if required. Just go through the needed kind to down load or print out the document format.

Use US Legal Forms, one of the most extensive variety of authorized varieties, to save lots of efforts and prevent errors. The support delivers expertly created authorized document layouts which you can use for a range of functions. Make your account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

A business license is required for most businesses, including retailers and wholesalers. A trader's license is required for buying and re-selling goods. And you, or the professionals you hire, may need individual occupational and professional licenses.

Forming an LLC in Maryland costs $100, but there are additional fees to consider. All Maryland LLCs must file an annual report and pay a $300 annual fee. If your LLC owns, leases or uses personal property in Maryland, you must also file a personal property tax return.

Maryland requires that all sole proprietorships, general partnerships, corporations, limited liability companies (LLCs), limited partnerships (LPs), limited liability partnerships (LLPs), or out of state companies that regularly transact business in Maryland under a name different from their legal name, must file a DBA

Small businesses are defined as firms employing fewer than 500 employees.

Maryland businesses must register using the Maryland Business Express200b portal, administered by the Department of Assessments and Taxation. The portal offers a step-by-step process to register a business online. Many businesses require permits or licenses to operate.

To start a home-based business in Maryland, you will have to fulfill certain legal requirements, including applying for a business tax account with the state and applying for a business license, if applicable, before your business officially opens.

If you want a corporation, you file Maryland Articles of Incorporation: The Maryland articles of incorporation cost $100 plus a $20 organization fee with the Maryland State Department of Assessments and Taxation.