A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

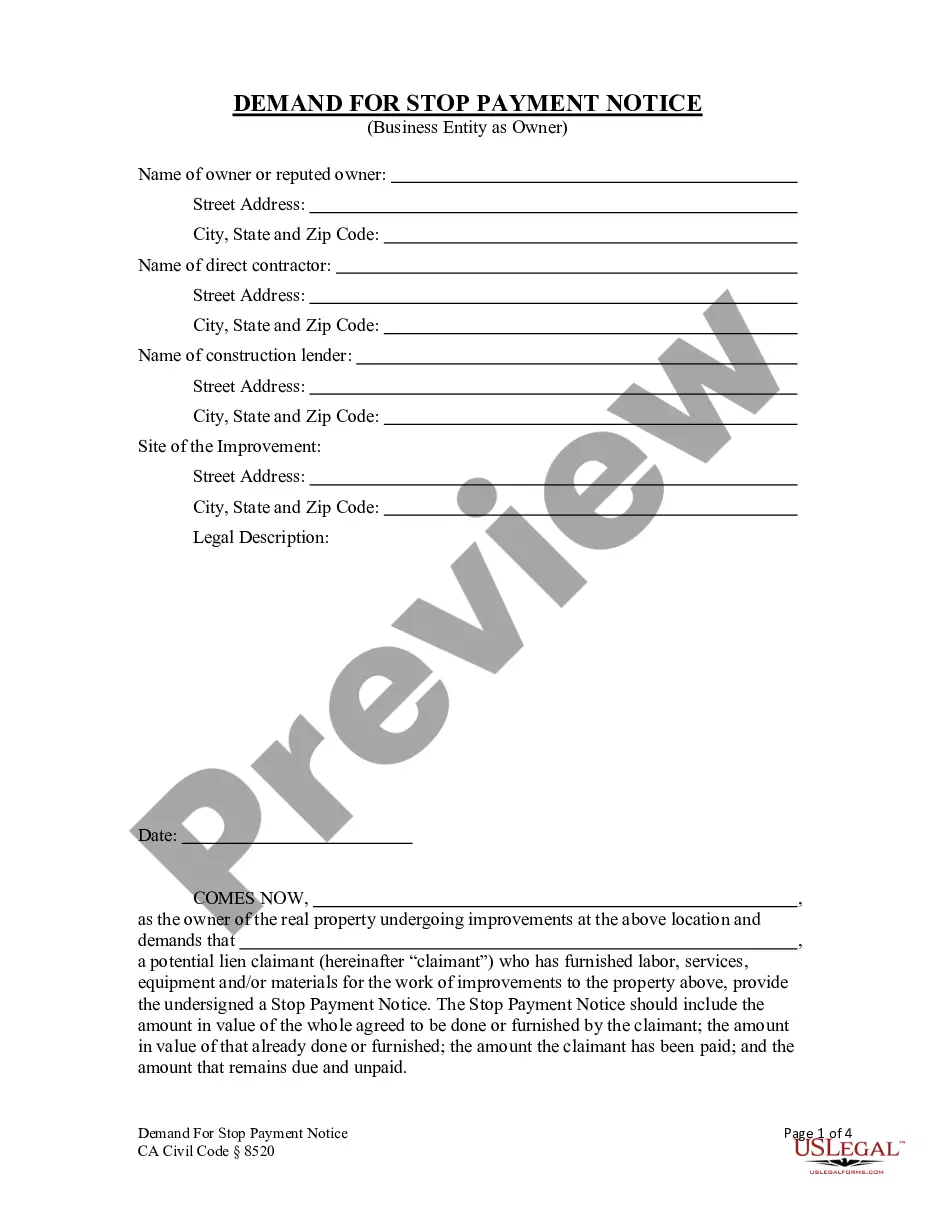

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Maryland Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren is a legally binding document that allows individuals in Maryland to establish a trust for the benefit of their loved ones. This trust is irrevocable, meaning that once it is created, it cannot be modified or revoked without the consent of all beneficiaries. By creating such a trust, the granter can ensure that their spouse, children, and grandchildren are provided for financially and their assets are protected. The trust agreement includes specific instructions on how the assets within the trust should be managed, distributed, and used for the beneficiaries' well-being. There are different types of Maryland Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren that individuals can consider: 1. Maryland Irrevocable Life Insurance Trust (IIT): This type of trust is commonly used to own life insurance policies. By establishing an IIT, the life insurance proceeds can be excluded from the granter's taxable estate, providing a tax-efficient way to pass on assets to their family. 2. Maryland Charitable Lead Trust: With this trust, the granter designates a charitable organization as the beneficiary for a specified term. After the term ends, the remaining assets are distributed to the granter's spouse, children, or grandchildren. This type of trust allows the granter to support a cause they care about while still providing for their loved ones. 3. Maryland Qualified Personnel Residence Trust (PRT): PRT is a trust specifically designed for the transfer of a primary residence or vacation home to the next generation. By transferring the property into the trust, the granter retains the right to live in the residence for a specified period. After that term, the property passes to the beneficiaries, offering potential estate tax savings. 4. Maryland Granter Retained Annuity Trust (GREAT): A GREAT allows the granter to transfer assets into the trust and receive annuity payments for a set number of years. At the end of the term, any remaining assets pass to the beneficiaries, typically the granter's spouse, children, or grandchildren. Grants are often utilized to minimize estate tax liability while still providing income to the granter during their lifetime. To create a Maryland Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren, it is important to seek the assistance of an attorney experienced in estate planning and Maryland trust laws. This ensures that the trust is properly drafted and tailored to meet the granter's specific goals and objectives.