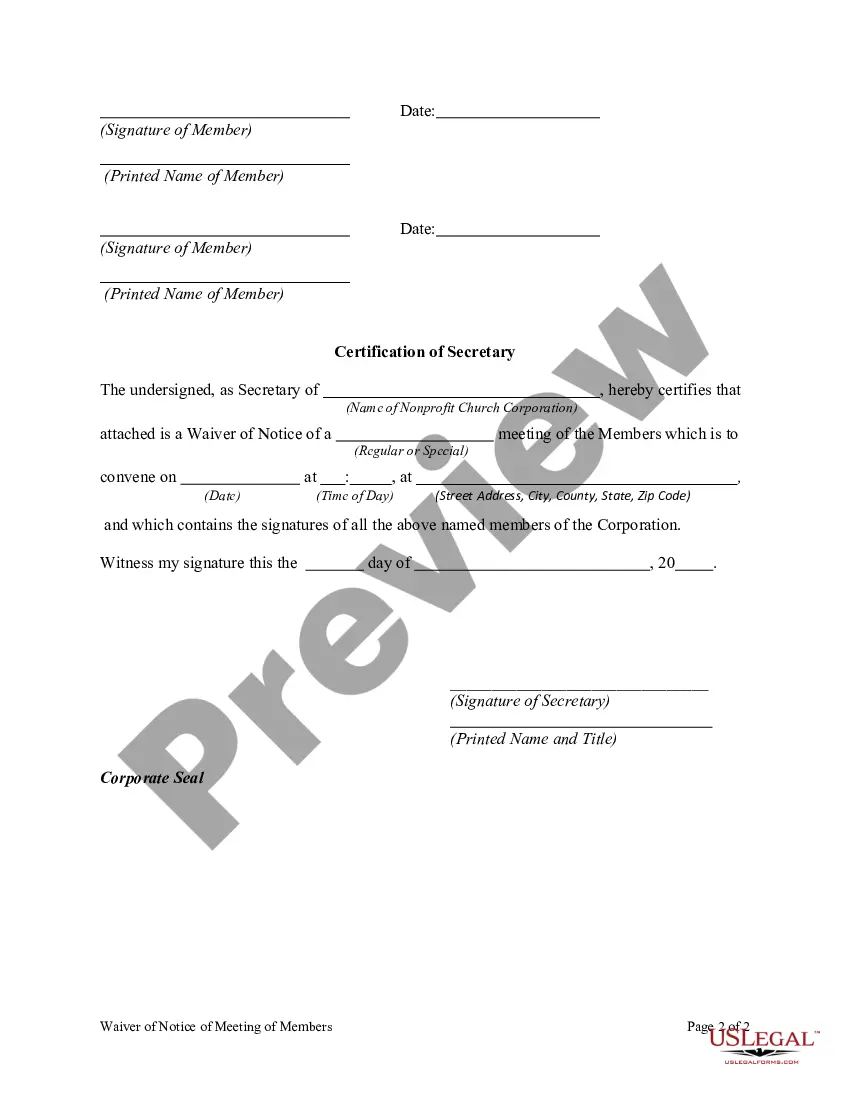

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

A Maryland Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is a legal document that allows members of a nonprofit church corporation in the state of Maryland to waive their right to receive formal notice of a meeting. In Maryland, there are several types of Waivers of Notice of Meeting that can be used by members of a Nonprofit Church Corporation: 1. General Waiver of Notice: This is the most common type of waiver used by members of a nonprofit church corporation. It allows members to waive their right to receive notice of any meeting of the corporation. By signing this waiver, members indicate that they are aware of the upcoming meetings and agree to proceed without receiving formal notice. 2. Specific Waiver of Notice: This waiver is used when members want to waive their right to receive notice for a specific meeting of the nonprofit church corporation. This may be useful when a meeting is scheduled on short notice or when members are unable to attend a meeting but still want to express their agreement with the decisions made. 3. Conditional Waiver of Notice: This type of waiver is used when members wish to waive their right to receive notice of a meeting, but only if certain conditions are met. For example, members may request to be notified if specific agenda items will be discussed during the meeting. By using these various types of waivers, members of a nonprofit church corporation can ensure that they can actively participate in the decision-making process without being hindered by the requirement of formal notice. It is important to note that Maryland law requires a certain number or percentage of members to be present in order to conduct a valid meeting, even if waivers of notice have been signed. The exact requirements vary depending on the size and structure of the nonprofit church corporation. Overall, the Maryland Waiver of Notice of Meeting of members of a Nonprofit Church Corporation provides flexibility to members, allowing them to participate in meetings without the need for formal notice, while still adhering to legal requirements.