Maryland Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

Are you presently in a situation where you require documents for possible business or particular purposes nearly every working day.

There are numerous authentic document templates available online, but locating ones you can trust is challenging.

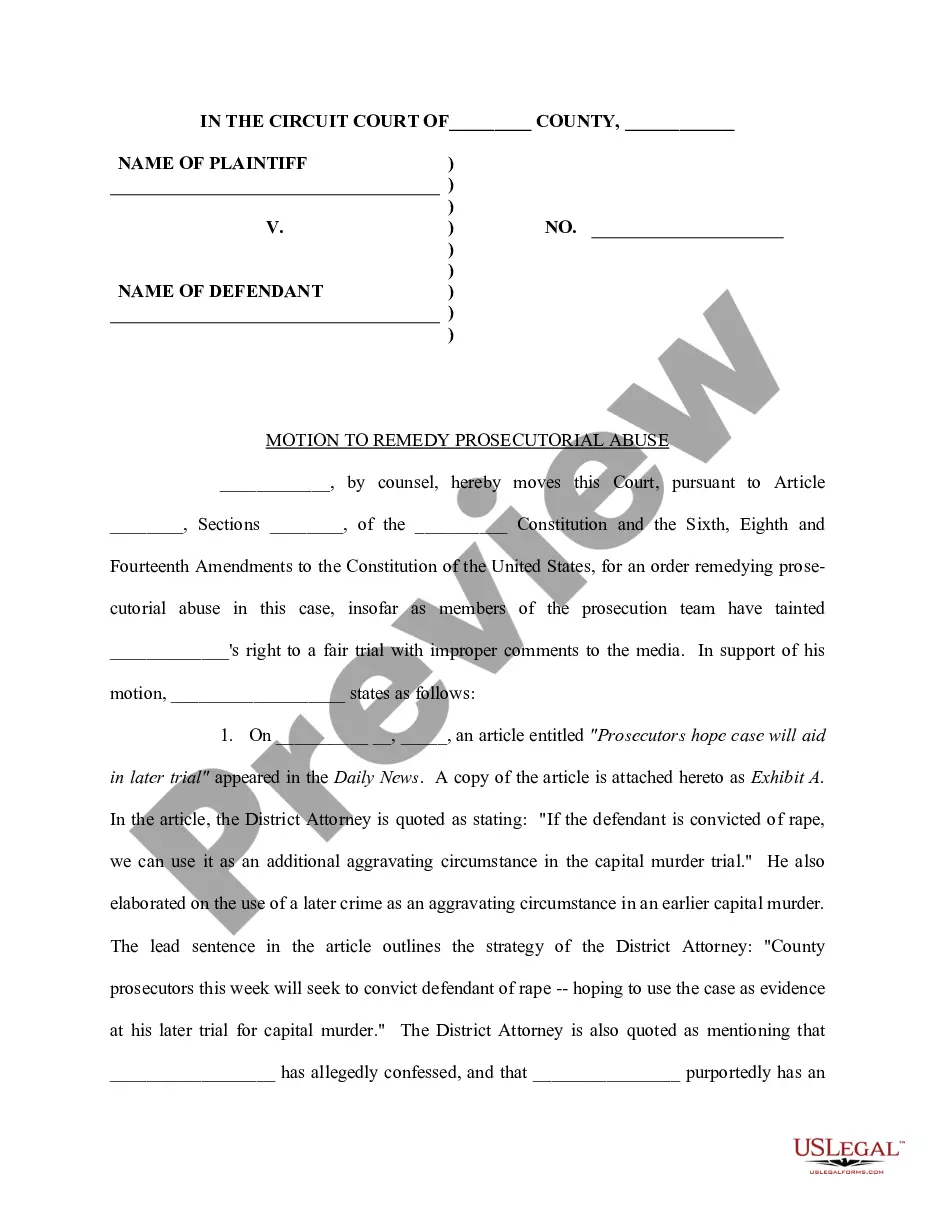

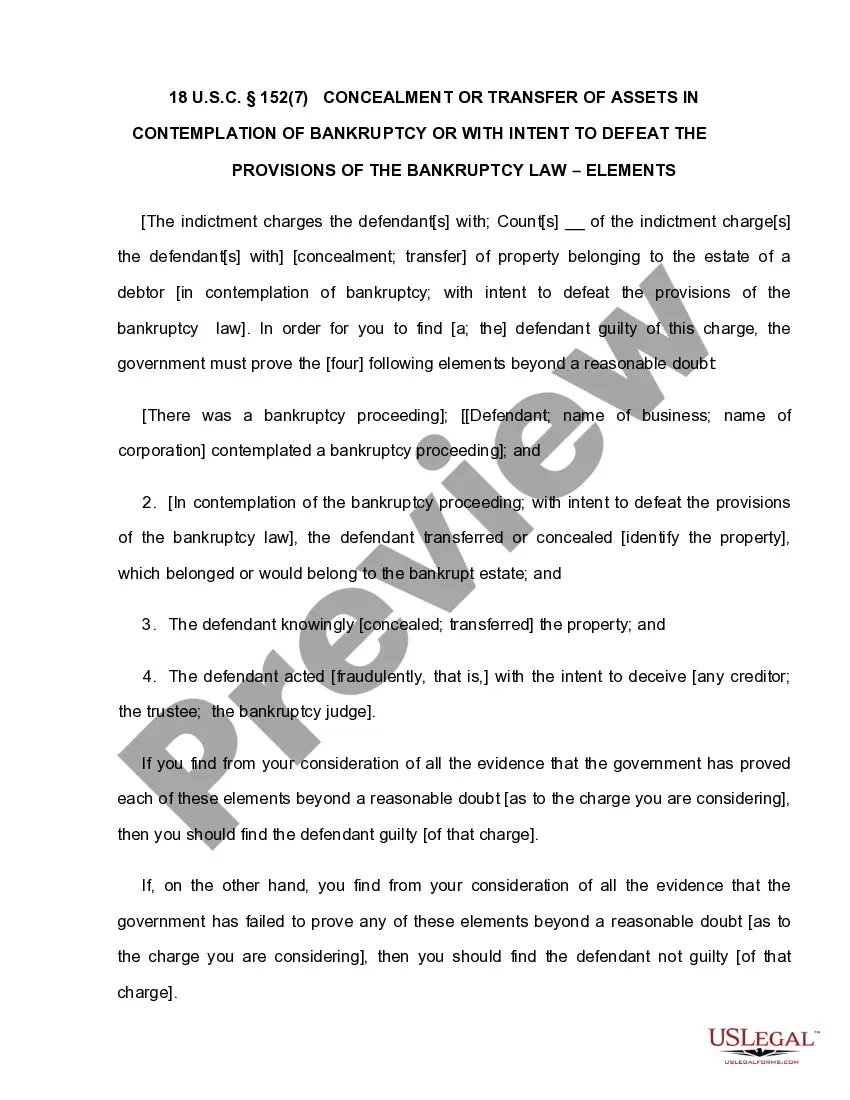

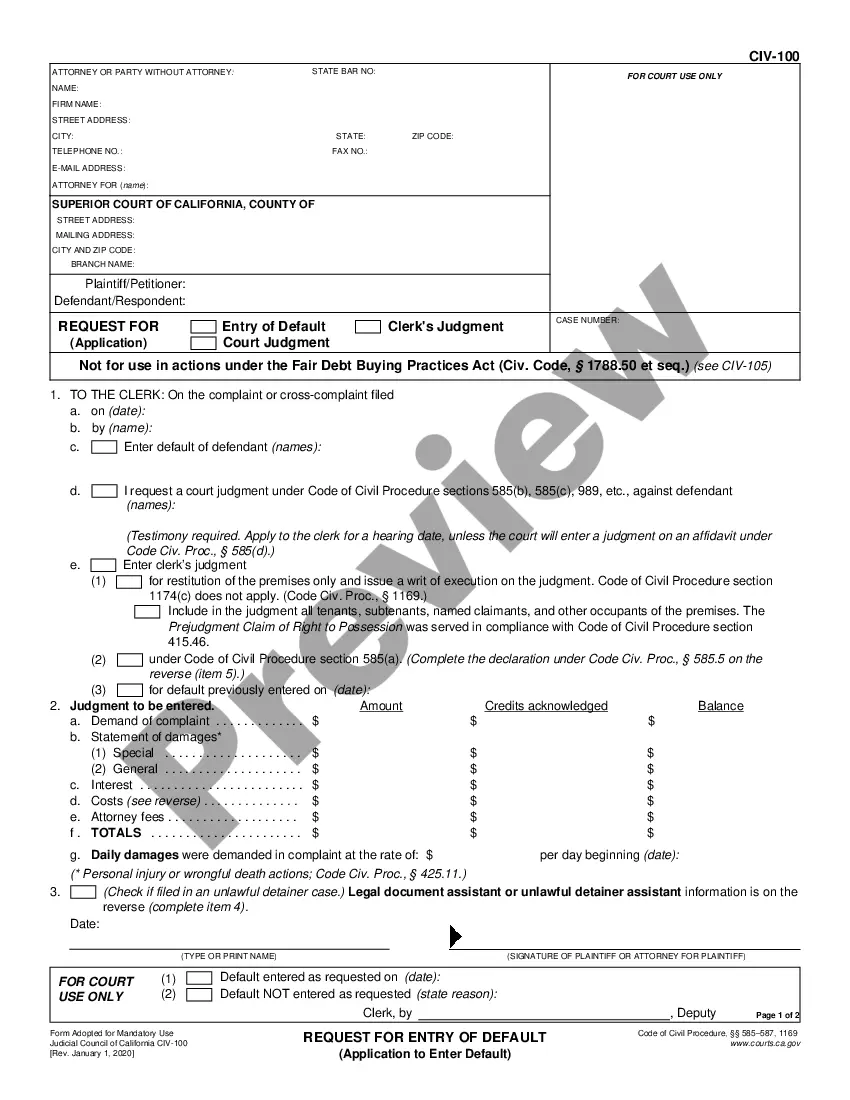

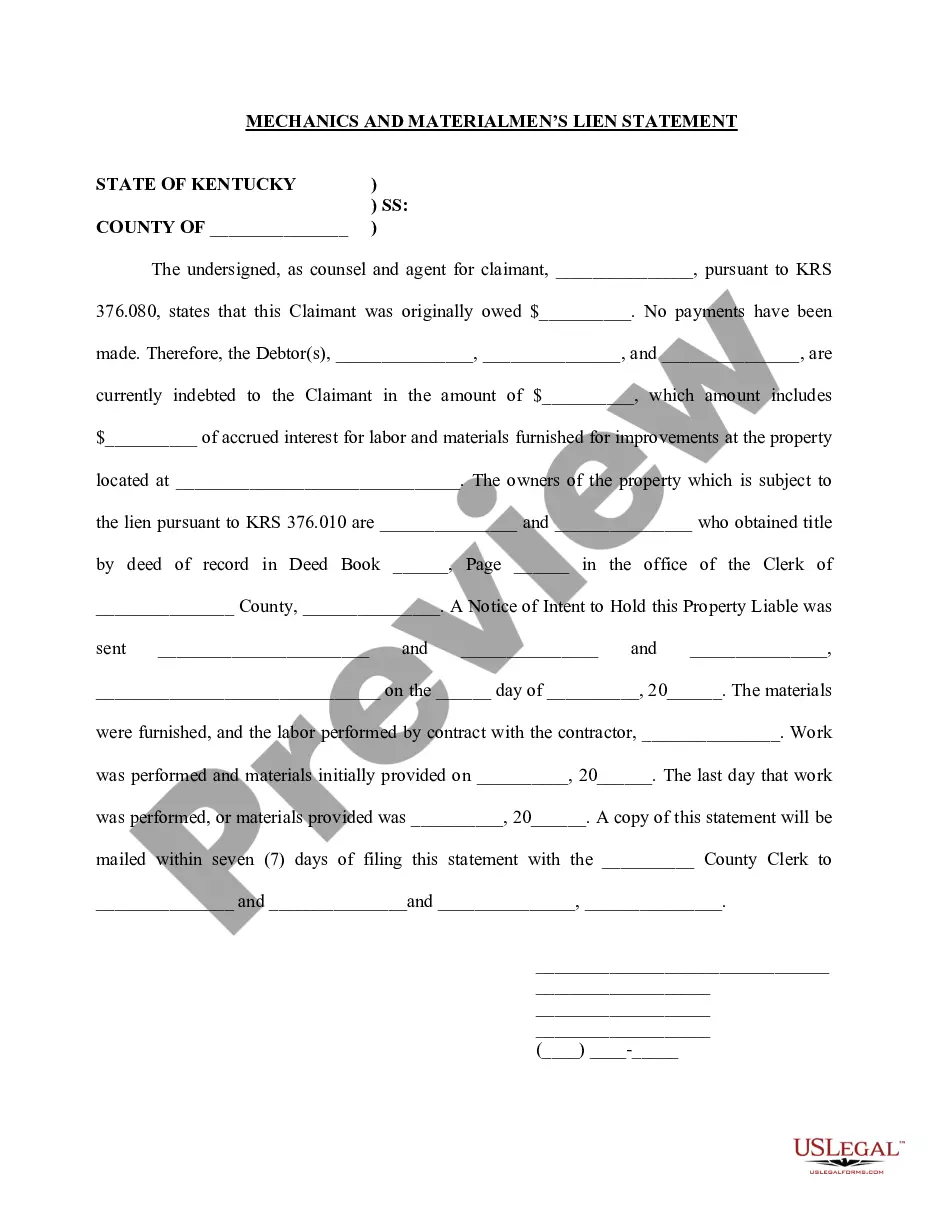

US Legal Forms offers a vast array of form templates, such as the Maryland Purchase Agreement by a Corporation of Assets of a Partnership, which are designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

You can find all of the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Maryland Purchase Agreement by a Corporation of Assets of a Partnership at any time, if needed. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Purchase Agreement by a Corporation of Assets of a Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

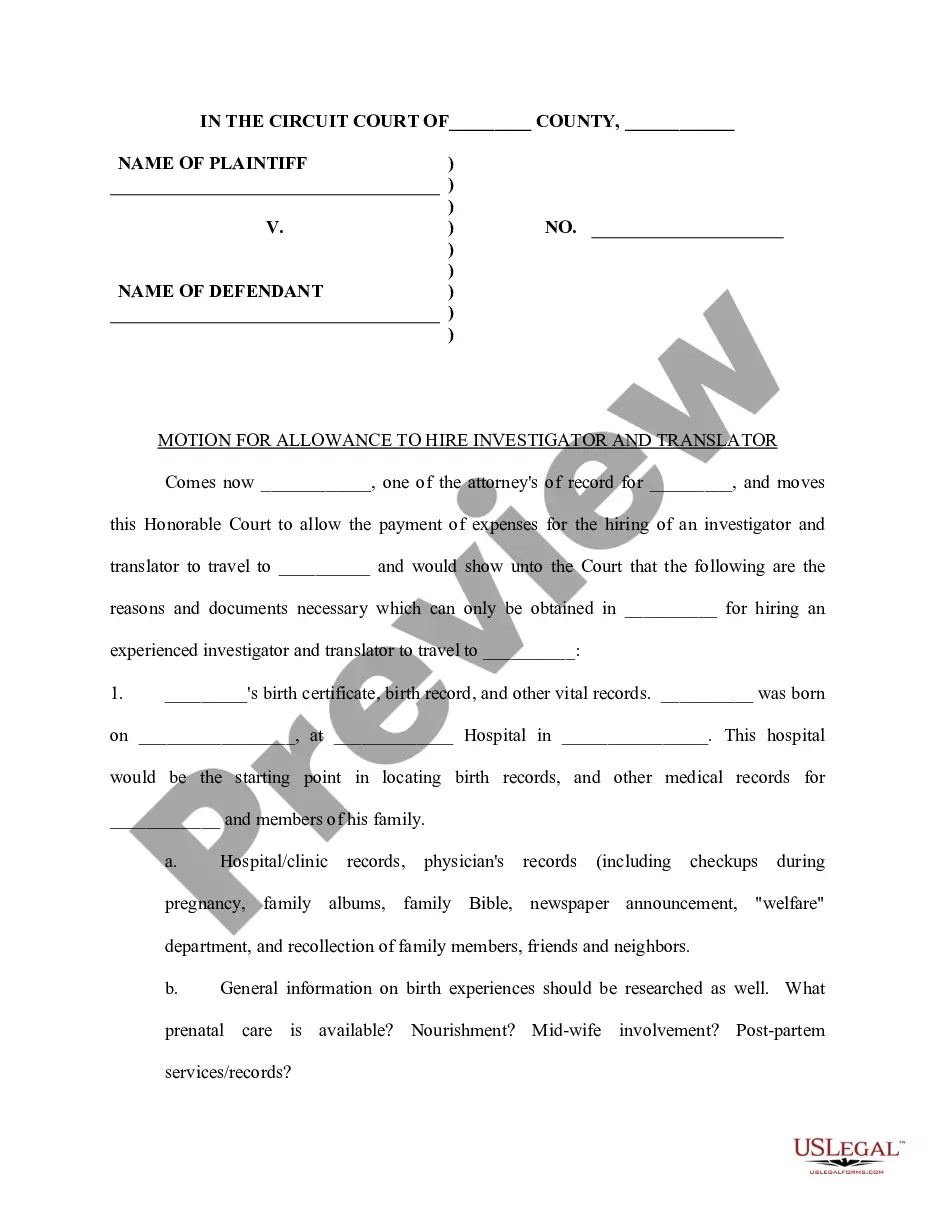

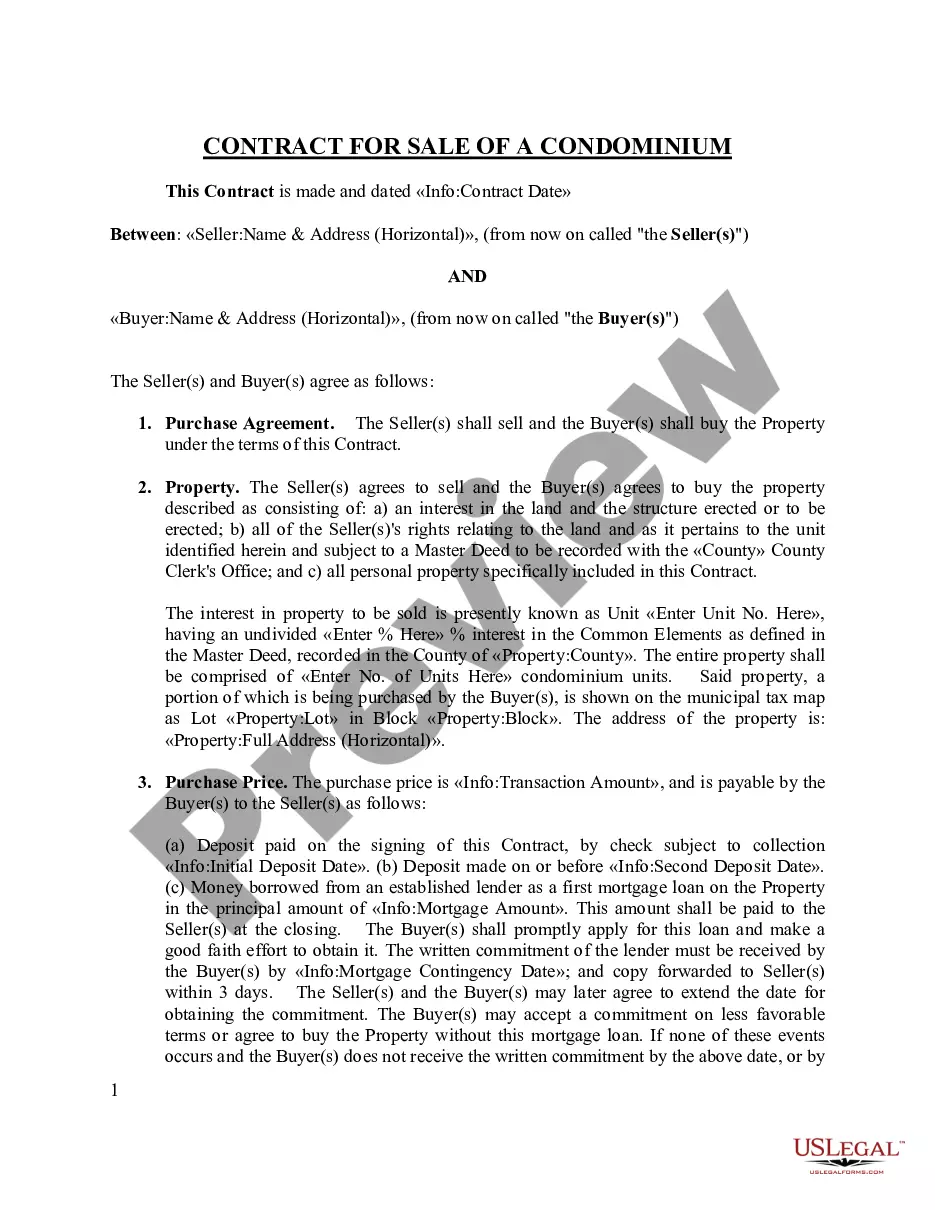

- Use the Preview button to review the form.

- Read the description to confirm you have chosen the right form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, provide the necessary information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

What Is an Equity Contribution Agreement? An equity contribution agreement occurs between two parties that are agreeing to pool together cash, capital, and other assets into a company to conduct business. The capital is provided in exchange for a portion of the equity in the company venture.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

This agreement sets out the terms and conditions by which a management equityholder rolls over exiting equity in the target portfolio company and receives equity in a newly-formed holding company in a tax beneficial exchange.

By Practical Law Real Estate. Maintained 2022 USA (National/Federal) A form agreement favoring the investor member for the contribution of vacant land intended for development to a newly-formed joint venture (JV) between two parties, a developer and an investor.

A contribution agreement, also known as a deed of contribution, is a legal document that provides for the transfer of an asset from one party to another party. It will express the conditions required including liability, indemnities and more.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.