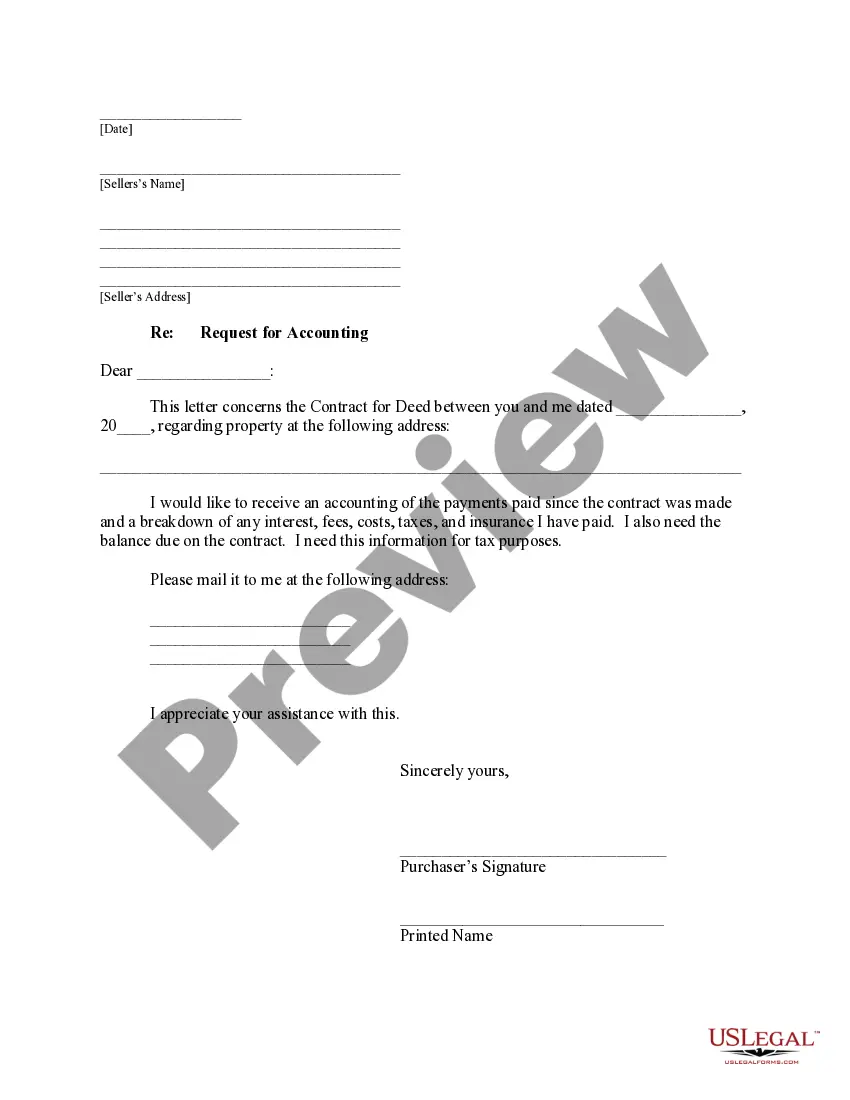

Title: Maryland Sample Letter for Denial of Cash Advances — Comprehensive Guide and Variations Introduction: When it comes to managing financial transactions, occasionally, businesses or individuals may find it necessary to deny cash advances for various reasons. In the state of Maryland, it is essential to follow a proper protocol and provide a well-documented explanation to ensure transparency and avoid potential legal complications. This article will provide a detailed description of what a Maryland Sample Letter for Denial of Cash Advances should include, elaborating on its key components, variations, and their potential applications. Maryland Sample Letter for Denial of Cash Advances — Key Components: 1. Salutation: Begin the letter by addressing the recipient in a courteous and respectful manner. Use their full name, followed by a relevant title (if applicable). 2. Date: Clearly state the exact date the letter is being written for record-keeping purposes. 3. Subject: Use an appropriate subject line, such as "Denial of Cash Advance Request" or "Cash Advance Request Declined." 4. Explanation: Concisely and clearly explain the reasons for denying the cash advance request. Provide factual details to justify the decision while maintaining a professional tone. 5. Supporting Documentation: If applicable, mention any supporting documents that influenced the denial decision, such as credit reports, financial statements, or company policies. Specify that the recipient may request these documents upon their request. 6. Alternative Suggestions: Offer alternative solutions or steps the recipient can take to address their financial needs, such as suggesting an alternative financing option, seeking alternative funding sources, or advising them to revisit the request after fulfilling specific criteria or resolving financial issues. 7. Contact Information: Provide accurate contact information, including a designated person or department to address any related questions or concerns. 8. Closing: Express appreciation for their understanding and apologize, if appropriate, for any inconvenience caused. Sign off with a professional closure, such as "Sincerely," followed by the sender's name and designation. Types of Maryland Sample Letter for Denial of Cash Advances: 1. Business Cash Advance Denial Letter: Used by businesses denying cash advances to employees, contractors, or clients based on specific criteria or financial policies. 2. Personal Cash Advance Denial Letter: Utilized when individuals decline cash advance requests from friends, family members, or acquaintances due to personal reasons, financial concerns, or an inability to provide such assistance. 3. Financial Institution Cash Advance Denial Letter: Employed by financial institutions, such as banks or credit unions, to notify customers about the denial of their cash advance applications due to creditworthiness, insufficient collateral, or other financial factors. 4. Government Agency Cash Advance Denial Letter: Used by government agencies to reject cash advance requests for grants, emergency funds, or financial aid based on eligibility requirements or budgetary constraints. Conclusion: Writing a Maryland Sample Letter for Denial of Cash Advances is a crucial step towards maintaining transparency and adherence to regulations. By incorporating the key components and understanding the different variations, businesses, individuals, financial institutions, and government agencies can effectively communicate their decision while providing an explanation and offering alternative solutions.

Maryland Sample Letter for Denial of Cash Advances

Description

How to fill out Maryland Sample Letter For Denial Of Cash Advances?

It is possible to commit time on the Internet attempting to find the authorized document web template that meets the state and federal requirements you will need. US Legal Forms provides thousands of authorized kinds that happen to be analyzed by professionals. You can easily download or print out the Maryland Sample Letter for Denial of Cash Advances from my support.

If you already possess a US Legal Forms bank account, you can log in and click on the Acquire option. Following that, you can total, revise, print out, or indicator the Maryland Sample Letter for Denial of Cash Advances. Each and every authorized document web template you get is the one you have forever. To have yet another backup for any acquired type, check out the My Forms tab and click on the related option.

If you work with the US Legal Forms website the first time, stick to the basic guidelines under:

- Initial, be sure that you have chosen the best document web template for your area/town of your choosing. Read the type information to ensure you have picked the correct type. If available, use the Review option to look with the document web template at the same time.

- If you want to locate yet another version of your type, use the Look for field to discover the web template that suits you and requirements.

- Once you have discovered the web template you need, simply click Buy now to continue.

- Pick the prices strategy you need, type your references, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal bank account to pay for the authorized type.

- Pick the file format of your document and download it in your system.

- Make alterations in your document if necessary. It is possible to total, revise and indicator and print out Maryland Sample Letter for Denial of Cash Advances.

Acquire and print out thousands of document layouts utilizing the US Legal Forms web site, that offers the largest selection of authorized kinds. Use skilled and status-particular layouts to deal with your organization or personal demands.