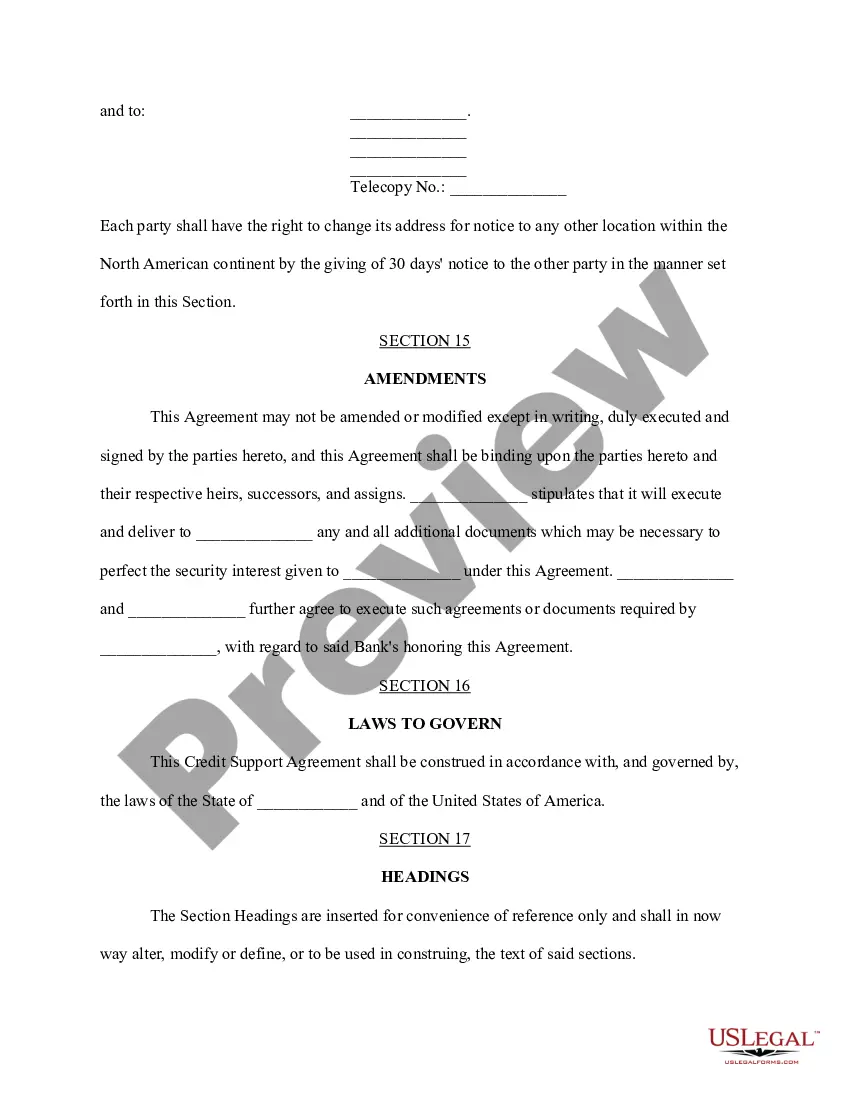

Maryland Credit support agreement

Description

How to fill out Credit Support Agreement?

Finding the right authorized document format might be a battle. Needless to say, there are a variety of web templates available on the net, but how would you get the authorized form you require? Take advantage of the US Legal Forms website. The services provides a large number of web templates, like the Maryland Credit support agreement, that you can use for business and personal demands. Every one of the kinds are checked out by specialists and meet state and federal demands.

If you are currently listed, log in in your profile and then click the Download key to obtain the Maryland Credit support agreement. Utilize your profile to appear throughout the authorized kinds you may have ordered earlier. Proceed to the My Forms tab of your respective profile and get yet another version in the document you require.

If you are a brand new customer of US Legal Forms, listed below are easy recommendations for you to follow:

- Initial, make sure you have selected the proper form for the metropolis/region. You are able to check out the form utilizing the Review key and study the form information to ensure it will be the best for you.

- In the event the form fails to meet your needs, make use of the Seach industry to find the correct form.

- When you are sure that the form would work, click on the Get now key to obtain the form.

- Choose the rates program you want and enter the essential details. Create your profile and pay for the transaction with your PayPal profile or bank card.

- Choose the data file format and acquire the authorized document format in your device.

- Comprehensive, edit and print and signal the received Maryland Credit support agreement.

US Legal Forms is definitely the largest catalogue of authorized kinds where you can find numerous document web templates. Take advantage of the company to acquire skillfully-created files that follow condition demands.

Form popularity

FAQ

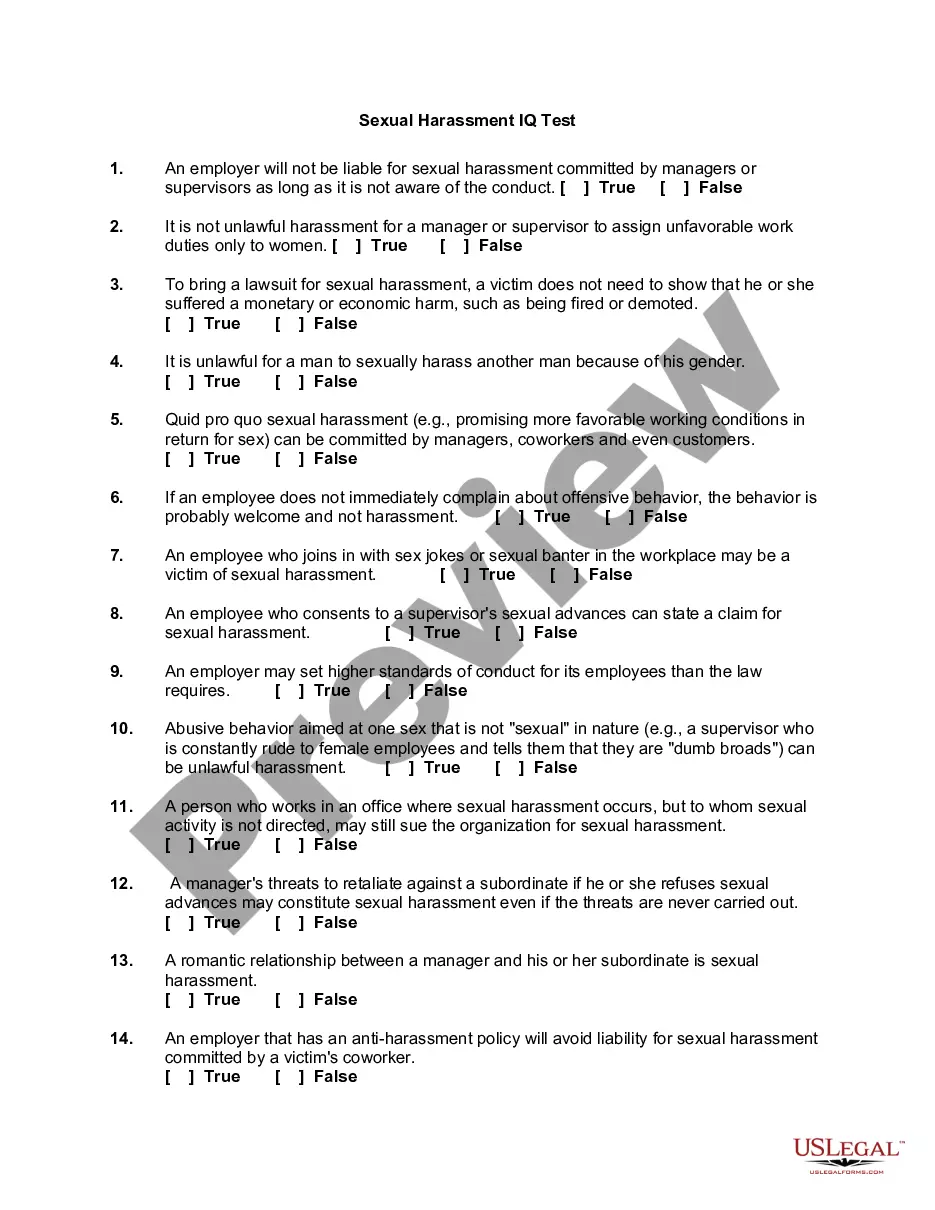

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts.

The new MD child support guidelines provide for $2,847 per month in basic child support for an aggregate monthly income of $15,000. As with the old guidelines, the Court will have discretion in setting the support level for parties and individuals with income above the maximum under the guidelines of $15,000 per month.

Imposing unfair terms or conditions on a loan (such as lower loan amount or higher interest rates) based on personal characteristics protected under the ECOA. Asking detailed personal information regarding marital status, such as whether you are widowed or divorced.

The Maryland Equal Credit Opportunity Act provides, among other things, that with respect to any aspect of a credit transaction a creditor may not discriminate against any applicant on the basis of sex, marital status, race, color, religion, national origin, or age.

You can contact the Child Support Enforcement Administration by calling their main office at (800) 332-6347. You can also use the myDHR system, to check the status of your case online. You can use your nine-digit Child Support case number when you create a login.

The statute of limitations on unpaid medical bills in Maryland is three years from the date that the debt was incurred.

Look for red flags, such as: Treated differently in person than on the phone or online. Discouraged from applying for credit. Encouraged or told to apply for a type of loan that has less favorable terms (for example, a higher interest rate)

This Act (Title VII of the Consumer Credit Protection Act) prohibits discrimination on the basis of race, color, religion, national origin, sex, marital status, age, receipt of public assistance, or good faith exercise of any rights under the Consumer Credit Protection Act.