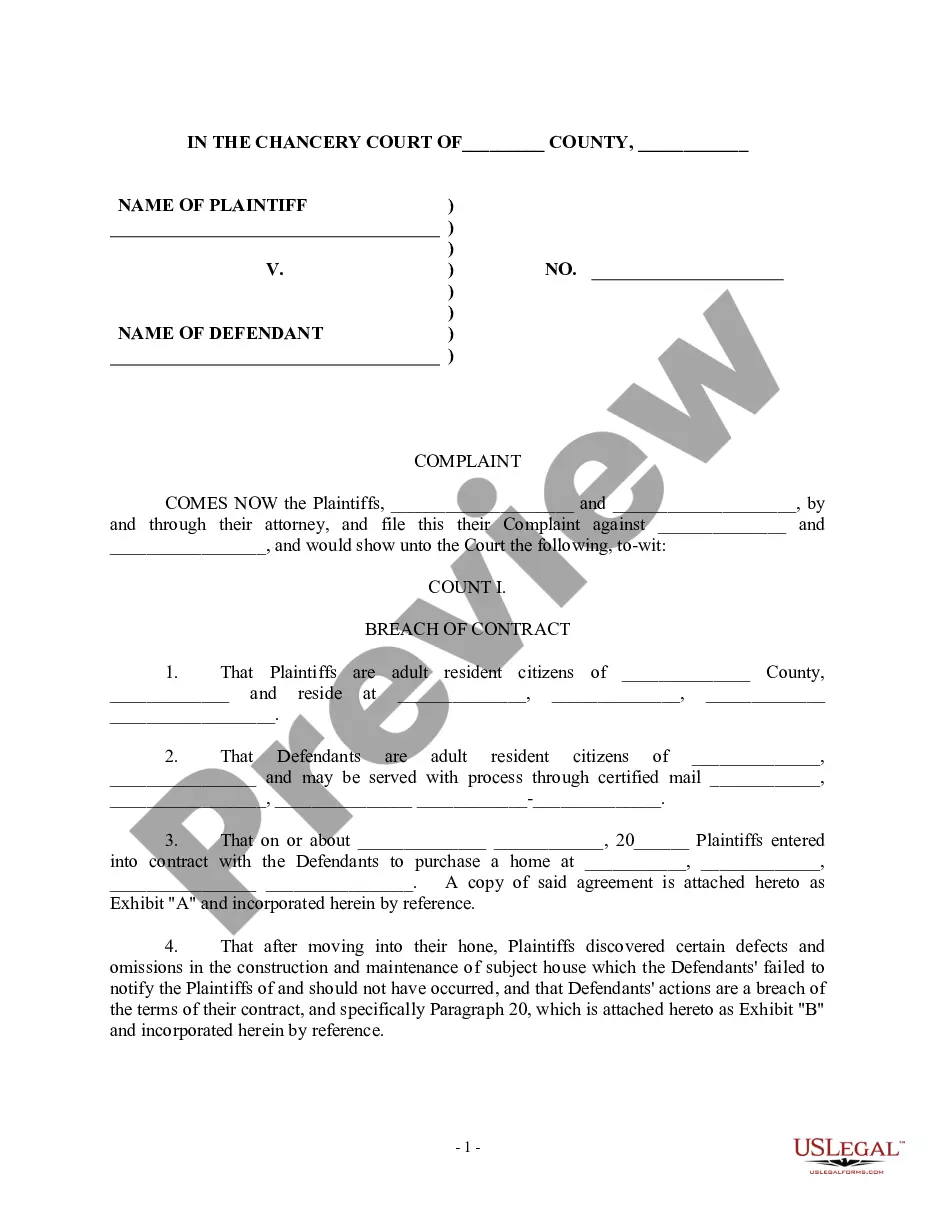

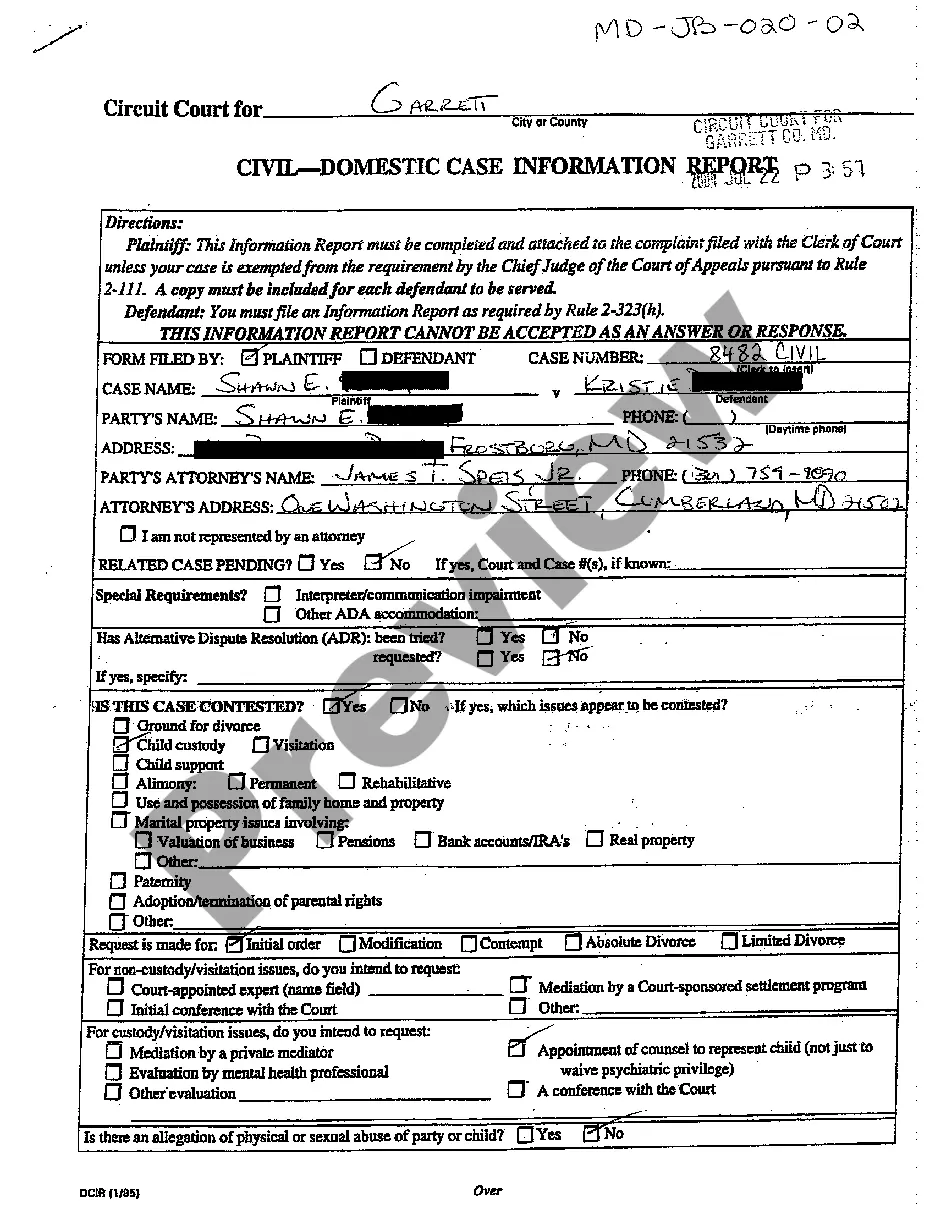

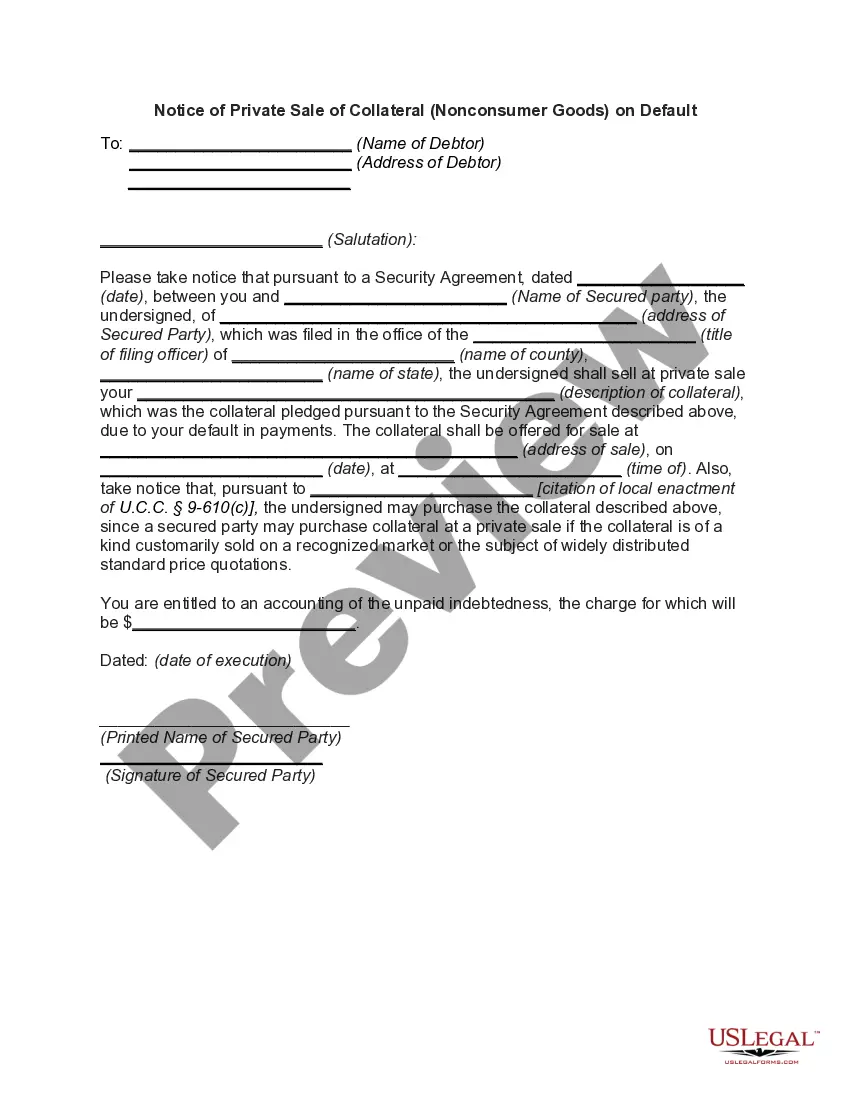

Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default is a legal document used when a borrower defaults on a loan agreement secured by non-consumer goods in Maryland. This notice informs the borrower and other interested parties about the intent to sell the collateral in order to recover the outstanding debt. The following are different types of Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default: 1. Basic Information: The notice begins by providing the basic details, including the name of the secured party (the lender), the name of the borrower, the date of the loan agreement, the description of the collateral, and the amount of the outstanding debt. 2. Default Declaration: This section outlines the specific provisions of the loan agreement that have been violated by the borrower, leading to the default. It may mention the failure to make payments on time, breach of other contractual obligations, or any other relevant default events. 3. Intent to Sell Collateral: The notice clearly states the intent to sell the collateral in a private sale and mentions the proposed date, time, and location of the sale. It also includes a statement specifying the purpose of the sale, which is to satisfy the borrower's debt obligation. 4. Right to Redeem Collateral: Maryland law grants the borrower the right to redeem the collateral before the sale takes place. This section explains the redemption process, including the deadline and the necessary steps to be taken by the borrower to exercise this right. 5. Manner of Sale and Notice Requirements: Maryland law requires the sale of non-consumer goods collateral to be conducted in a commercially reasonable manner. This section provides details on how the sale will be conducted and mentions any notice requirements that need to be fulfilled, such as advertising the sale to the public. 6. Application of Sale Proceeds: The notice explains how the proceeds from the sale will be applied. Typically, they will be used to cover the costs related to the sale, including storage, advertising, and legal expenses. Any remaining amount will then be utilized towards satisfying the outstanding debt. 7. Surplus or Deficiency: In the event that the proceeds from the sale exceed the outstanding debt, the notice will mention how the surplus will be handled. Conversely, if the proceeds are insufficient to cover the debt, the notice outlines the rights of the lender to pursue the borrower for the remaining amount. 8. Assignment of Rights: This section addresses the potential assignment of the lender's rights and obligations under the loan agreement. It states that the lender may assign the agreement, including all the rights to sell or dispose of the collateral, to a third party if deemed necessary. It is important to note that while this description provides a general overview of a Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default, it is always recommended consulting with a qualified attorney to ensure compliance with specific legal requirements and to tailor the notice as per individual circumstances.

Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

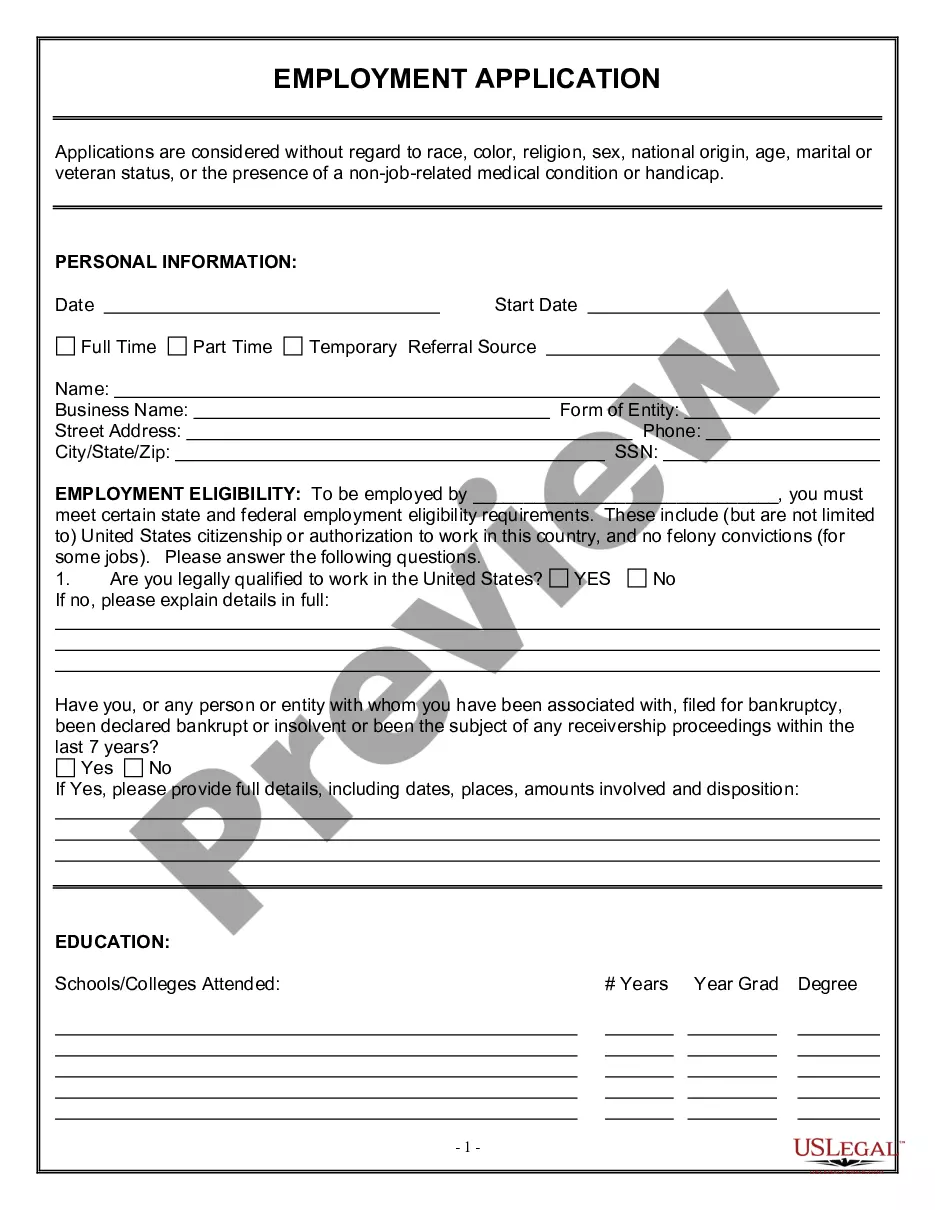

How to fill out Maryland Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

If you wish to total, down load, or printing authorized file themes, use US Legal Forms, the greatest variety of authorized varieties, that can be found on the Internet. Take advantage of the site`s easy and convenient research to obtain the files you will need. A variety of themes for company and person uses are sorted by categories and suggests, or keywords. Use US Legal Forms to obtain the Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default with a handful of mouse clicks.

In case you are currently a US Legal Forms consumer, log in in your accounts and click the Acquire key to have the Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default. Also you can gain access to varieties you earlier downloaded in the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the form for the proper metropolis/nation.

- Step 2. Utilize the Preview option to examine the form`s content. Never overlook to learn the outline.

- Step 3. In case you are unsatisfied with the type, take advantage of the Search area at the top of the screen to get other versions in the authorized type web template.

- Step 4. Upon having found the form you will need, click on the Acquire now key. Pick the pricing program you prefer and add your credentials to sign up to have an accounts.

- Step 5. Approach the deal. You can use your credit card or PayPal accounts to complete the deal.

- Step 6. Select the structure in the authorized type and down load it on your own product.

- Step 7. Full, edit and printing or sign the Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

Each authorized file web template you get is your own property permanently. You may have acces to every type you downloaded within your acccount. Click on the My Forms portion and pick a type to printing or down load once more.

Remain competitive and down load, and printing the Maryland Notice of Private Sale of Collateral (Non-consumer Goods) on Default with US Legal Forms. There are millions of skilled and condition-specific varieties you may use for your company or person requires.

Form popularity

FAQ

If two parties have a security interest in the same property, the party who filed first takes first. If the competing security interests are both unperfected, the party who was first to attach the property as collateral has priority. Other creditors of a debtor may have the first claim on secured property.

Key Takeaways. A security interest on a loan is a legal claim on collateral that the borrower provides that allows the lender to repossess the collateral and sell it if the loan goes bad.

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

When the debtor sells collateral, he or she receives proceeds, something that is exchanged for collateral. The secured party automatically has an interest in the proceeds. If 2 parties provide a loan based on the same collateral, the party with the secured interest will have priority on the collateral.

(12) "Collateral" means the property subject to a security interest or agricultural lien. The term includes: (A) proceeds to which a security interest attaches; (B) accounts, chattel paper, payment intangibles, and promissory notes that have been sold; and. (C) goods that are the subject of a consignment.

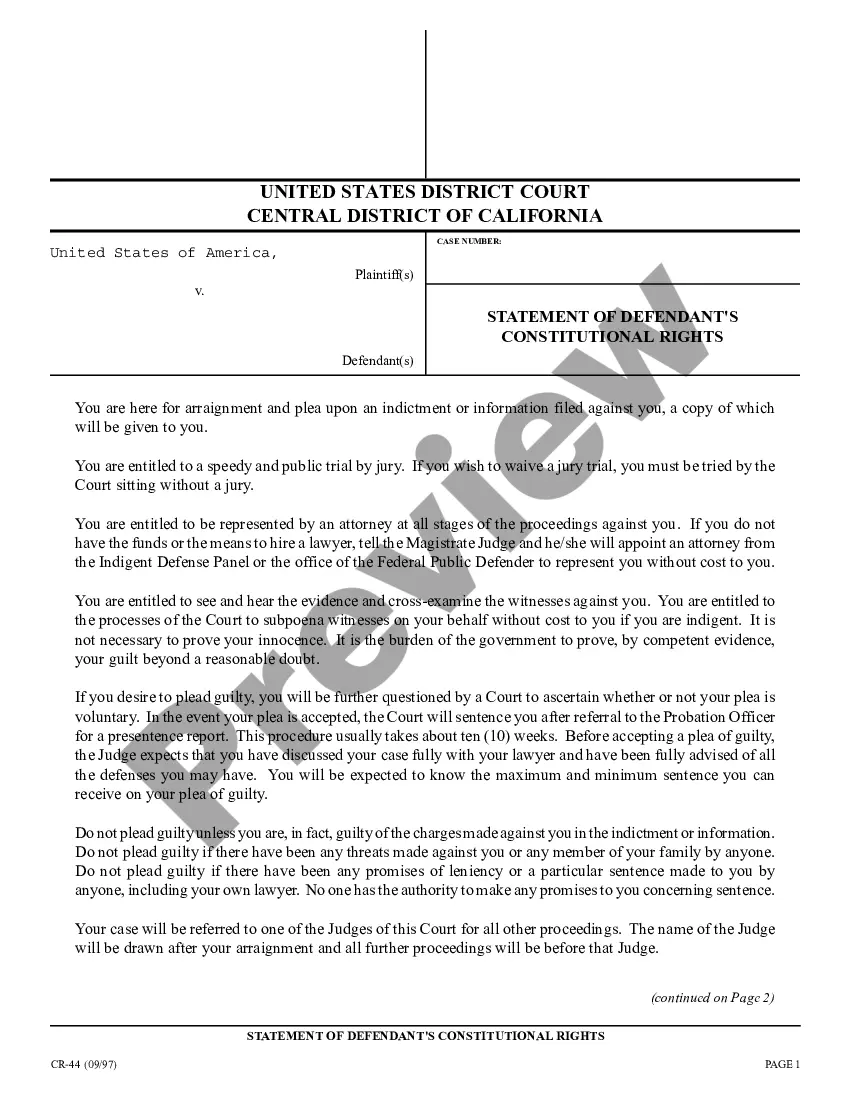

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

Under new section 9-203(e), the security interest created by the security agreement entered into by original debtor is enforceable against the new debtor without the need for any other agreement or authentication of the security agreement by the new debtor, as otherwise would be required by new section 9-203(b)(3)(A).

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

Under §9-622, a proposal to accept collateral in full satisfaction of the debt that is consented to by the debtor discharges the obligation not just the consenting debtor's liability for that obligation.