Maryland Release and Indemnification of Personal Representative by Heirs and Devisees

Description

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

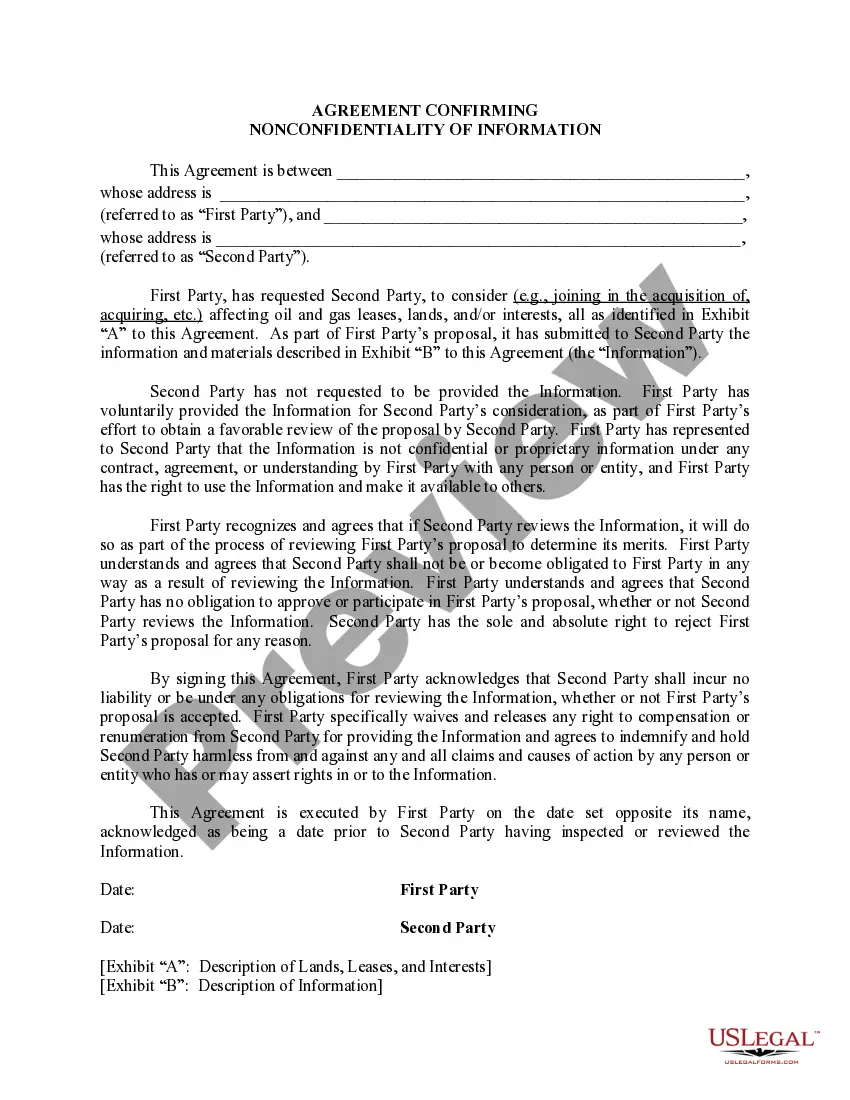

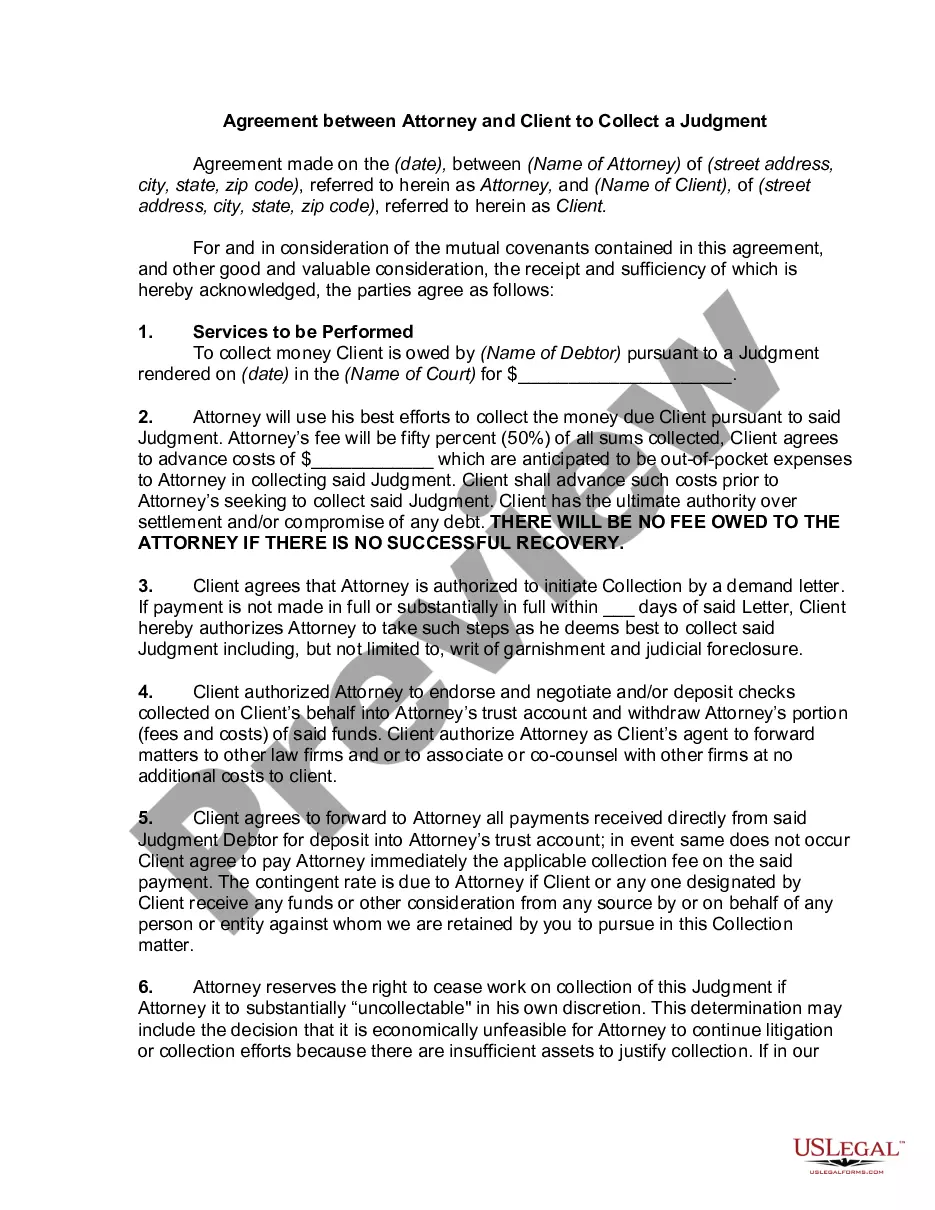

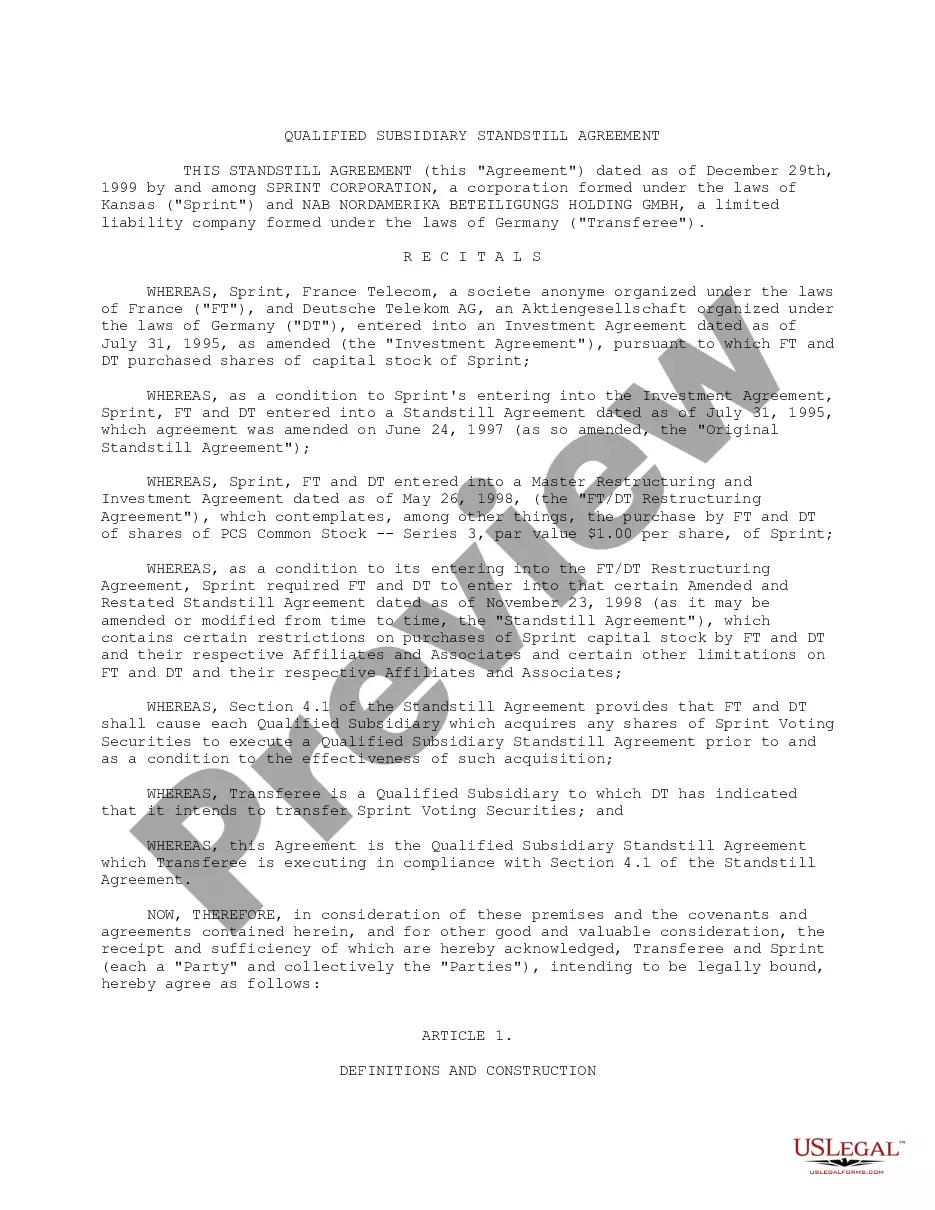

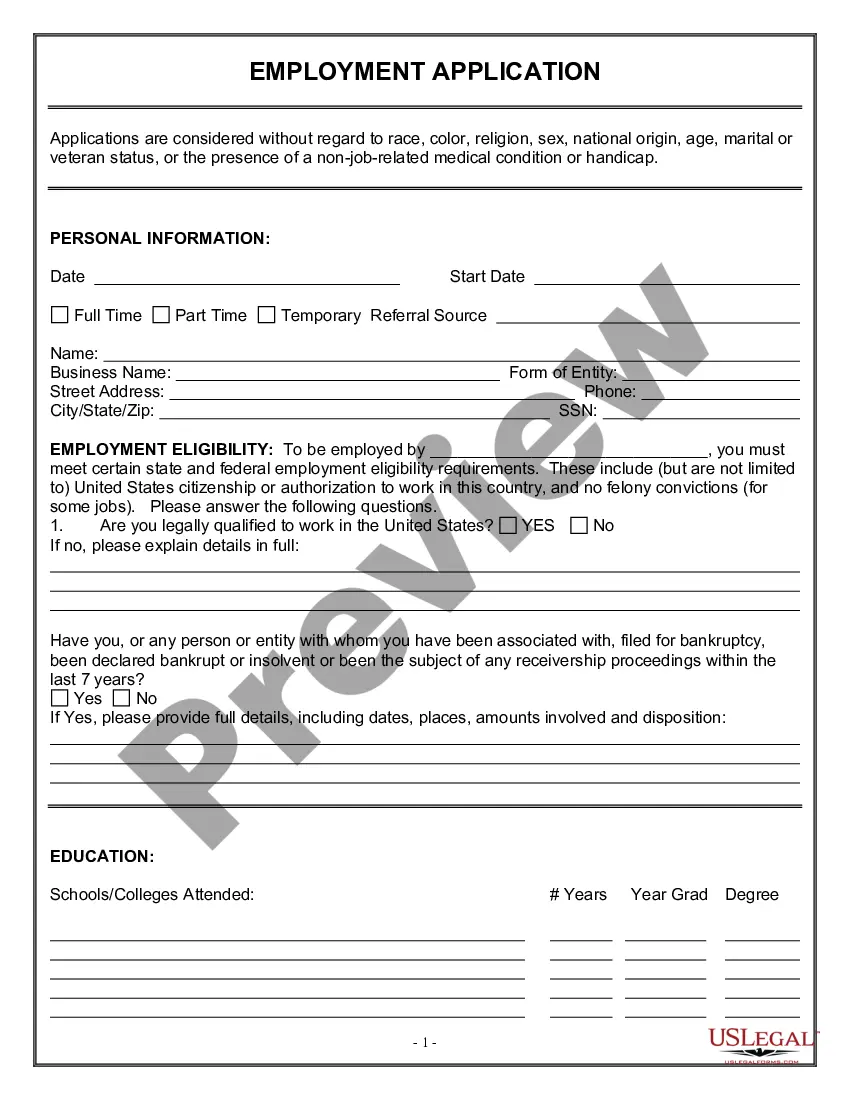

Locating the correct legal document template can be a challenge. Indeed, there are countless templates available online, but how do you identify the legal document you need? Utilize the US Legal Forms website. This service provides a wide array of templates, including the Maryland Release and Indemnification of Personal Representative by Heirs and Devisees, which can be utilized for both business and personal purposes. All these forms are examined by professionals and comply with federal and state standards.

If you are already registered, Log In to your account and hit the Download button to access the Maryland Release and Indemnification of Personal Representative by Heirs and Devisees. Use your account to review the legal forms you have acquired previously. Visit the My documents section of your account to obtain another copy of the document you need.

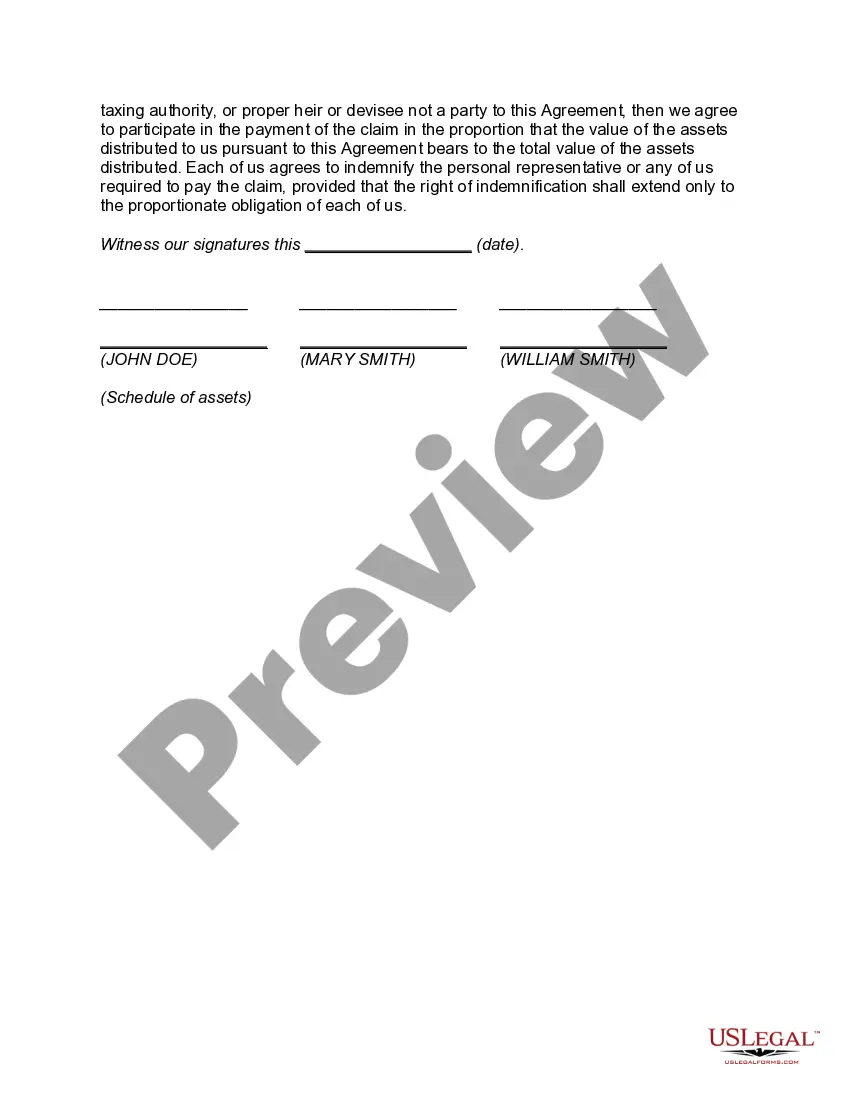

If you are a new user of US Legal Forms, here are some straightforward steps you should follow: First, make sure you have chosen the correct form for your specific area/county. You can browse the form using the Preview button and check the form description to ensure this is the right fit for you. If the form does not meet your needs, leverage the Search field to find the appropriate form. Once you are confident that the form is accurate, click the Buy now button to obtain the form. Select the payment plan you prefer and input the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, modify, and print, then sign the downloaded Maryland Release and Indemnification of Personal Representative by Heirs and Devisees.

- US Legal Forms is the premier repository of legal forms where you can find a variety of document templates.

- Employ the service to obtain properly crafted paperwork that adhere to state regulations.

Form popularity

FAQ

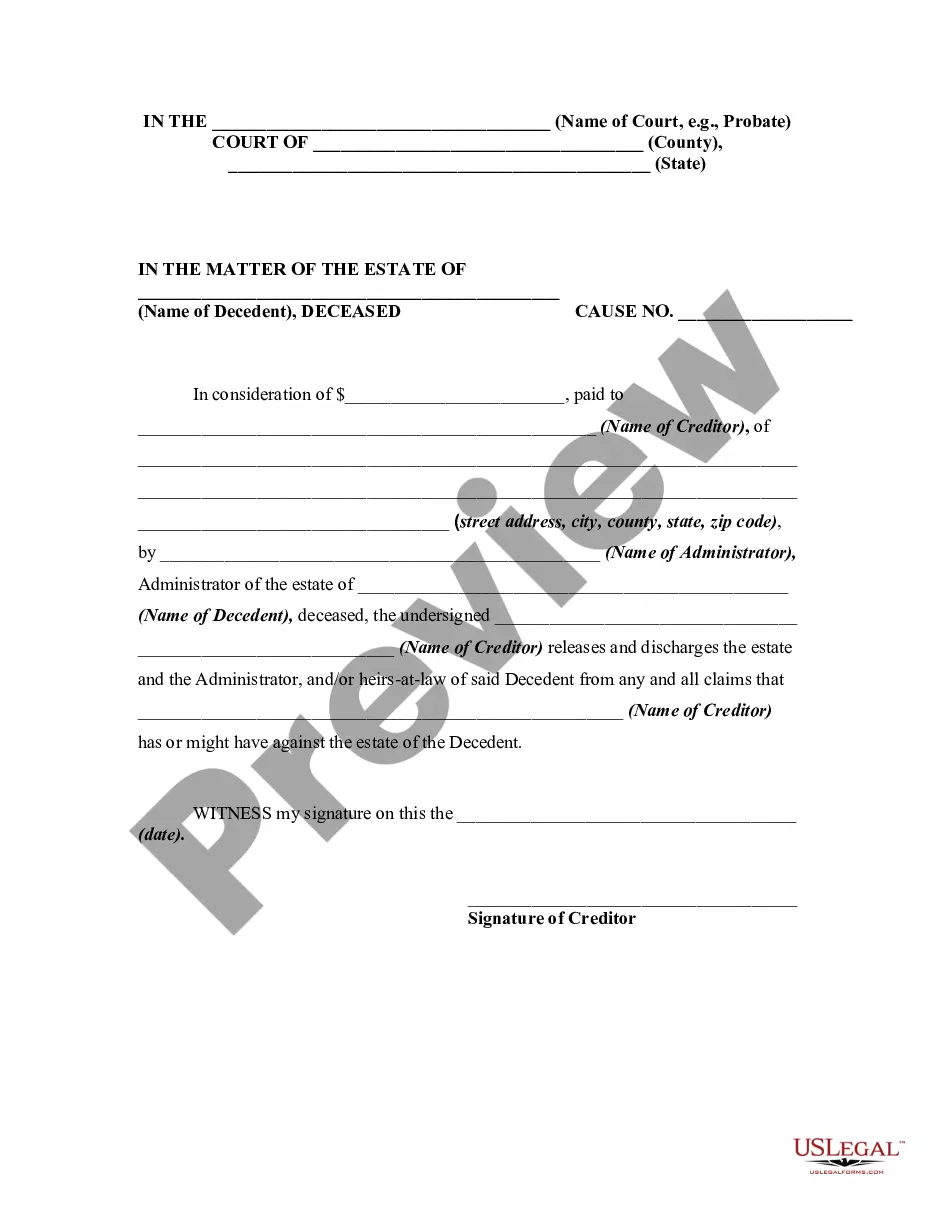

Rule 6-414 in Maryland governs the procedures surrounding the indemnification of personal representatives. It outlines the circumstances under which personal representatives may seek release from liability by heirs and devisees. Familiarizing yourself with this rule is essential for ensuring compliance and securing protection during the estate administration process, as it directly relates to the Maryland Release and Indemnification of Personal Representative by Heirs and Devisees.

Heir generally refers to a person who is entitled to receive the decedent's property under the statutes of intestate succession, the distribution process that occurs when someone passes away without a will. A devisee is any person designated to receive real or personal property in a decedent's will.

Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.

How Long Does Probate in Maryland Take? Probate in Maryland can take a year or longer. Creditors have six months from the date of death to submit a claim. Once the assets have been distributed, probate must remain open for at least six months to allow for a creditor to come forward.

Can an Executor Remove a Beneficiary? As noted in the previous section, an executor cannot change the will. This means that the beneficiaries who are in the will are there to stay; they cannot be removed, no matter how difficult or belligerent they may be with the executor.

An heir-at-law is anyone who's entitled to inherit from someone who dies without leaving a last will and testament or other estate plans. This status can be an important factor not only in settling an estate but in determining who might be entitled to challenge or contest a will when the deceased does leave one.

Definition of devisee : one to whom a devise of property is made.

An heir is a person who is legally entitled to collect an inheritance when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants, or other close relatives of the decedent.

DETERMINING WHO IS AN HEIR Generally, the heirs of the decedent are their surviving spouse and children, including all of decedent's biological children and adopted children.

Generally, unless the estate includes real property which needs to be sold, requires the filing of a U.S. Estate Tax Return, or is tied up in litigation, a regular estate proceeding may be closed after the period for filing creditor claims expires (six months from the date of death).