Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner: A Comprehensive Guide In Maryland, an Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner is a legal document that allows business partners to establish a plan for the transfer of property ownership upon the death or incapacitation of one partner. This agreement ensures a smooth transition of assets, protects the interests of the surviving partner, and avoids any potential disputes or conflicts in the future. Types of Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner: 1. Partnership Agreement: This agreement defines the roles, responsibilities, and ownership interests of each partner, including a provision for the transfer of property upon death or incapacity. It ensures a clear understanding of how the property will be distributed and maintained by the surviving partner. 2. Buy-Sell Agreement: This type of agreement outlines the procedure for the sale or transfer of ownership interests between partners, including the provision for the transfer of property upon death or incapacitation. It also establishes a valuation method and funding mechanism for the purchase of the deceased partner's share by the surviving partner. 3. Will or Last Testament: A will is a legal document that allows individuals to designate how their property and assets should be distributed after their death. In the context of a business partnership, a partner can include provisions for transferring their share of the business property to the surviving partner. Key elements to include in a Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner: 1. Identification of the business: Clearly state the name, address, and description of the business being addressed in the agreement. 2. Parties' information: Provide the names, addresses, and contact details of all business partners involved. 3. Property description: Provide a detailed description of the property to be transferred, including assets, shares, real estate, and any other relevant businesses or assets. 4. Transfer conditions: Outline the circumstances under which the transfer of property would take place, such as death, incapacitation, or withdrawal from the partnership. 5. Terms and conditions: Define the terms and conditions that will govern the transfer process, including the value or purchase price of the property, payment terms, and any restrictions or limitations on the transfer. 6. Valuation process: Specify the method that will be used to determine the value of the property, such as appraisal, book value, or a mutually agreed-upon valuation formula. 7. Funding mechanism: Establish a mechanism for funding the transfer, which may include life insurance policies, installment payments, or other financial arrangements. 8. Dispute resolution: Include provisions for resolving potential disputes or disagreements that may arise during the transfer process, such as mediation or arbitration. 9. Governing law and jurisdiction: Clearly state that the agreement is governed by Maryland law and identify the appropriate jurisdiction for any legal proceedings related to the agreement. By having a Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner in place, business partners can ensure a seamless transfer of property, protect their interests, and provide clarity for the surviving partner during a challenging time. It is advisable to consult with an experienced attorney to draft a comprehensive agreement tailored to the specific needs of the business and its partners.

Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

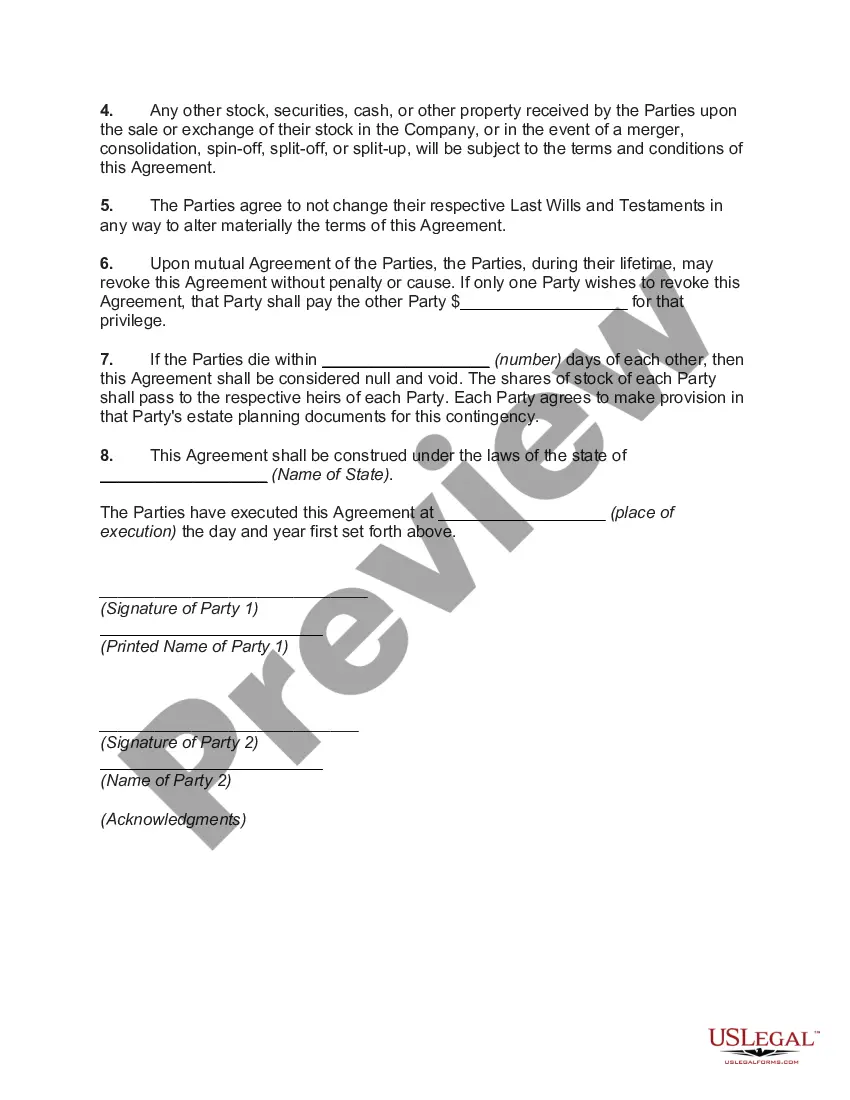

How to fill out Maryland Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

You are able to devote time online searching for the lawful document template which fits the federal and state requirements you need. US Legal Forms provides a large number of lawful forms that are evaluated by experts. You can actually obtain or print out the Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner from the support.

If you already have a US Legal Forms account, you may log in and click the Down load key. Afterward, you may full, modify, print out, or indication the Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner. Each and every lawful document template you get is yours permanently. To obtain one more duplicate of any purchased form, check out the My Forms tab and click the related key.

If you work with the US Legal Forms web site the very first time, adhere to the straightforward recommendations below:

- First, make certain you have chosen the best document template for your area/town of your choosing. See the form description to ensure you have chosen the proper form. If offered, use the Review key to look throughout the document template too.

- If you want to locate one more variation of the form, use the Look for field to get the template that suits you and requirements.

- After you have found the template you need, just click Buy now to carry on.

- Find the pricing prepare you need, type in your references, and register for your account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal account to purchase the lawful form.

- Find the file format of the document and obtain it to the product.

- Make adjustments to the document if possible. You are able to full, modify and indication and print out Maryland Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner.

Down load and print out a large number of document web templates using the US Legal Forms Internet site, which provides the biggest variety of lawful forms. Use professional and state-specific web templates to tackle your small business or specific requires.