Maryland Sample Letter for Closure of Estate - Request for Petition Signature

Description

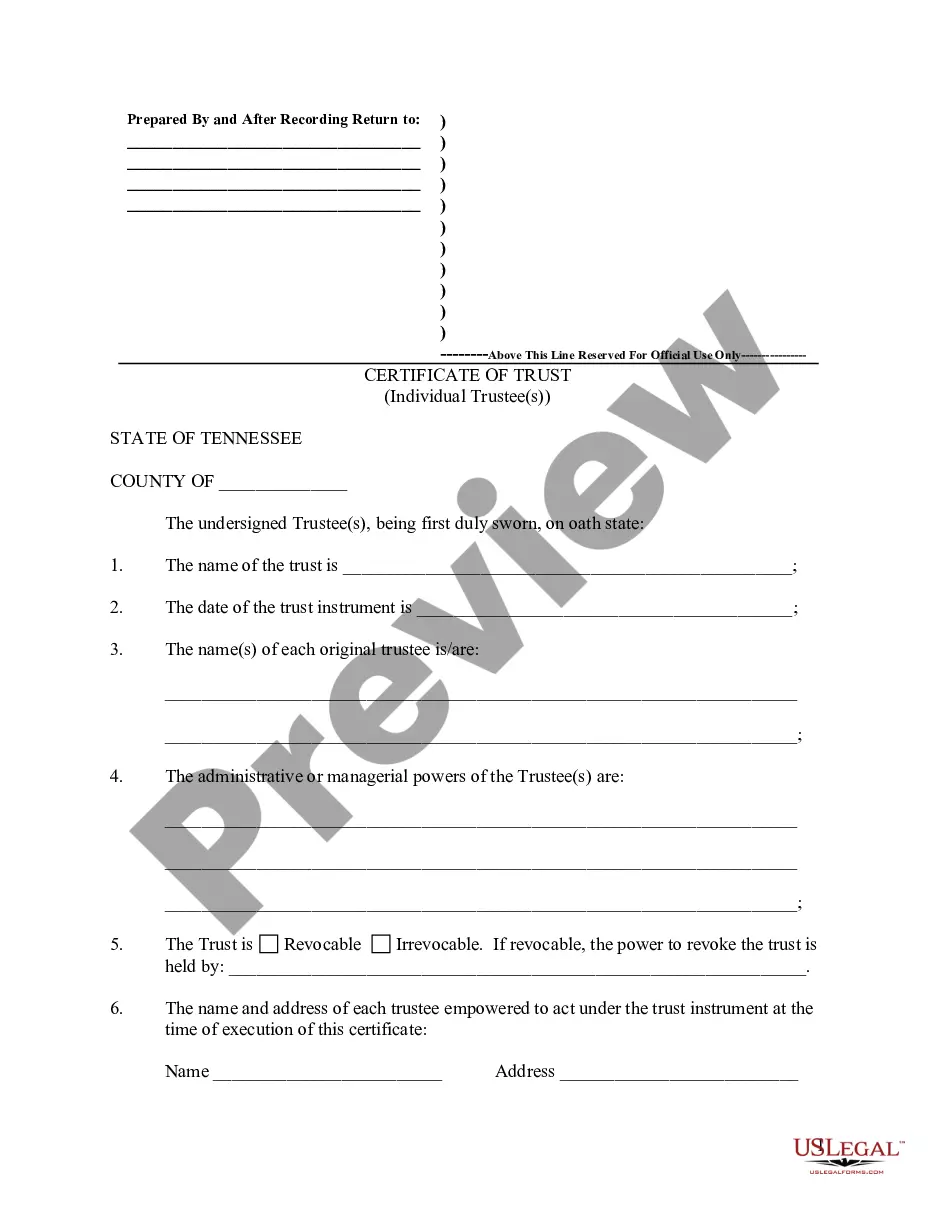

How to fill out Sample Letter For Closure Of Estate - Request For Petition Signature?

If you want to complete, acquire, or produce lawful record templates, use US Legal Forms, the largest assortment of lawful types, which can be found on the Internet. Use the site`s simple and easy handy lookup to find the documents you need. Various templates for company and person uses are sorted by groups and suggests, or keywords. Use US Legal Forms to find the Maryland Sample Letter for Closure of Estate - Request for Petition Signature with a number of click throughs.

If you are already a US Legal Forms customer, log in to your profile and then click the Download switch to find the Maryland Sample Letter for Closure of Estate - Request for Petition Signature. You can also entry types you formerly acquired in the My Forms tab of the profile.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the appropriate area/land.

- Step 2. Use the Preview choice to look through the form`s content. Don`t forget about to learn the description.

- Step 3. If you are not happy using the develop, utilize the Search area near the top of the display to locate other models of your lawful develop template.

- Step 4. After you have identified the form you need, go through the Acquire now switch. Pick the prices plan you like and add your accreditations to register for the profile.

- Step 5. Procedure the deal. You should use your charge card or PayPal profile to accomplish the deal.

- Step 6. Pick the file format of your lawful develop and acquire it on your system.

- Step 7. Comprehensive, modify and produce or signal the Maryland Sample Letter for Closure of Estate - Request for Petition Signature.

Every single lawful record template you get is the one you have forever. You might have acces to each and every develop you acquired inside your acccount. Go through the My Forms area and choose a develop to produce or acquire once more.

Remain competitive and acquire, and produce the Maryland Sample Letter for Closure of Estate - Request for Petition Signature with US Legal Forms. There are many specialist and condition-distinct types you can utilize for the company or person requires.

Form popularity

FAQ

Pursuant to Maryland Rule 6-452(a), ?[t]he removal of a personal representative may be initiated by the court or the register, or on a petition of an interested person.? Before a personal representative may be removed, a full hearing must be conducted by the Orphans' Court to determine whether removal is deserved.

A ?Living? or Revocable Trust A revocable living trust is a common method many people use to avoid probate in Maryland and in other states. The ?living? part means that it needs to be established while you are alive and that you have control over your assets during your life.

Maryland Probate Fees Value Of Probate Estate Is At Least:But Less Than:The Fee Is:$0$200$2$200$5,0001% of the estate$5000$10,000$50$10,000$20,000$10010 more rows

What are Letters of Administration in Maryland? Obtaining Letters of Administration grants the personal representative the authority to handle the deceased person's assets, pay off their debts, address any tax liability, and distribute their remaining assets to the rightful heirs.

Generally, unless the estate includes real property which needs to be sold, requires the filing of a U.S. Estate Tax Return, or is tied up in litigation, a regular estate proceeding may be closed after the period for filing creditor claims expires (six months from the date of death).

This is done by filing a ?Petition for Declaration of Completion of Administration? along with any supporting documentation. The court will review your petition and, if everything ticks, will issue an Order Closing Estate. With this order, you can distribute any remaining assets to the rightful heirs and beneficiaries.

During the estate administration process, the personal representative, or executor, has many management duties, including, but not limited to, notifying known and unknown creditors that the decedent has passed away, ascertaining the assets, having the assets appraised, managing the estate assets in a prudent way, and ...

Generally, the Intestacy statutes provide for property to be distributed to a decedent's closest living relatives, i.e., to a surviving spouse and children, if there are any; to children in equal shares if there is no surviving spouse; to parents if there are no spouse and children; and so on to more distant relatives.