Maryland Renunciation of Legacy in Favor of Other Family Members is a legal process through which an individual willingly gives up their right to inherit assets or property from an estate in favor of other family members. This renunciation can occur for various reasons, such as personal preference, financial considerations, or to comply with certain laws or regulations. In Maryland, there are different types of Renunciation of Legacy that individuals can consider based on their specific circumstances: 1. Renunciation of Legacy with Full Consent: This type of renunciation occurs when an individual willingly and voluntarily gives up their right to inherit assets or property from an estate in favor of other family members. This can be done through a specific legal document known as a Renunciation of Legacy form. 2. Renunciation of Legacy to Satisfy Debts: In some cases, an individual may choose to renounce their legacy to satisfy outstanding debts or obligations. This type of renunciation allows the renounced's share of the inheritance to be used for settling financial liabilities before being passed on to other family members. 3. Renunciation of Legacy for Estate Planning Purposes: Some individuals may renounce their legacy to facilitate estate planning. By renouncing their inheritance, they may be able to minimize tax implications or ensure that assets are distributed according to their desired plan, such as passing them on to a charitable organization. 4. Renunciation of Legacy to Comply with Medicaid Eligibility Rules: In situations where an individual is seeking Medicaid benefits, they may need to renounce their inheritance to meet the eligibility requirements. Medicaid has strict asset limitations, and by renouncing their legacy, individuals can ensure they remain within the allowed thresholds. Renunciation of Legacy in Maryland is a legal process that requires proper documentation and adherence to state laws. It is advisable for individuals considering renunciation to consult with an experienced attorney who specializes in estate planning and probate matters to ensure compliance with all legal requirements. Keywords: Maryland, renunciation of legacy, family members, estate, assets, property, legal process, renunciation types, full consent, debts, estate planning, Medicaid eligibility, documentation, state laws, attorney, estate planning, probate.

Maryland Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Maryland Renunciation Of Legacy In Favor Of Other Family Members?

If you want to total, download, or produce legal file themes, use US Legal Forms, the most important selection of legal types, which can be found on-line. Make use of the site`s simple and easy hassle-free lookup to find the documents you need. Different themes for company and specific purposes are sorted by types and says, or key phrases. Use US Legal Forms to find the Maryland Renunciation of Legacy in Favor of Other Family Members within a few mouse clicks.

Should you be previously a US Legal Forms buyer, log in in your bank account and then click the Download option to get the Maryland Renunciation of Legacy in Favor of Other Family Members. You can even access types you earlier saved in the My Forms tab of your respective bank account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form to the appropriate area/nation.

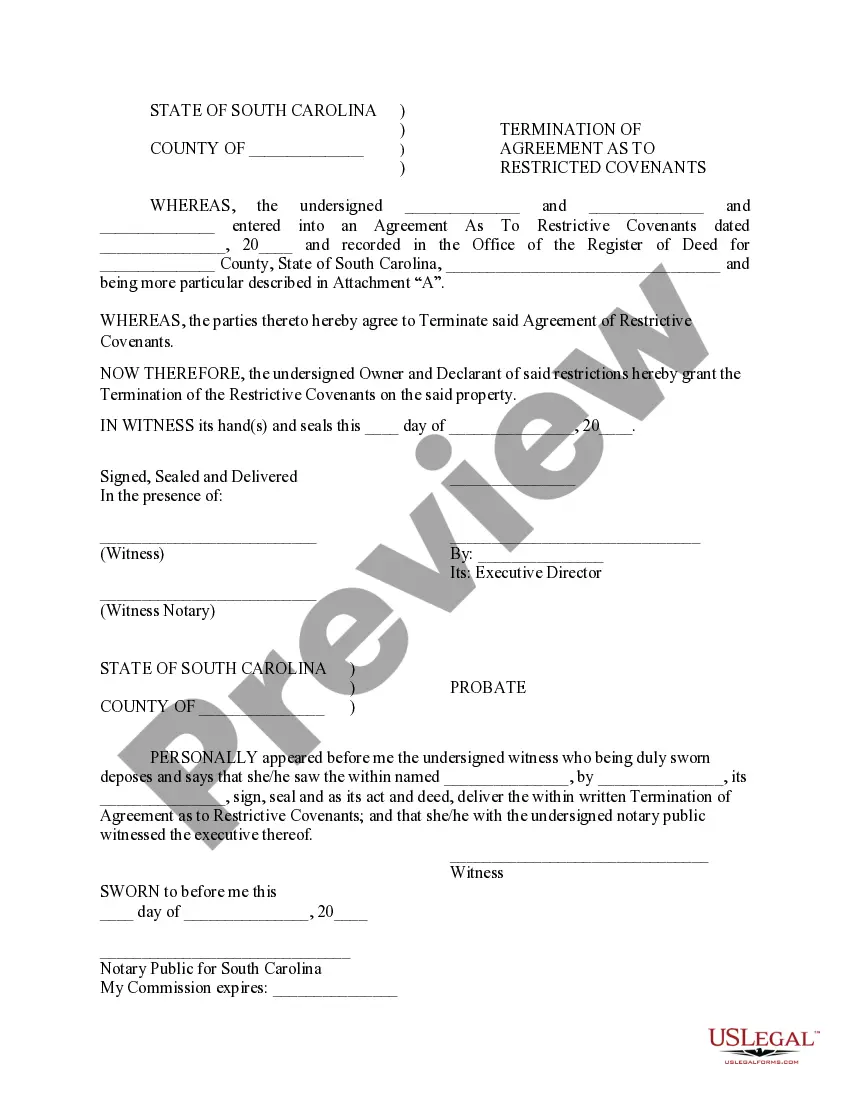

- Step 2. Utilize the Review solution to examine the form`s articles. Don`t neglect to see the explanation.

- Step 3. Should you be not happy with the kind, utilize the Research area towards the top of the monitor to locate other variations from the legal kind web template.

- Step 4. After you have identified the form you need, select the Acquire now option. Choose the pricing prepare you choose and include your qualifications to sign up for the bank account.

- Step 5. Method the financial transaction. You should use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Find the file format from the legal kind and download it in your system.

- Step 7. Complete, revise and produce or indication the Maryland Renunciation of Legacy in Favor of Other Family Members.

Each and every legal file web template you buy is your own for a long time. You might have acces to every single kind you saved in your acccount. Click on the My Forms portion and select a kind to produce or download again.

Compete and download, and produce the Maryland Renunciation of Legacy in Favor of Other Family Members with US Legal Forms. There are millions of specialist and status-particular types you can utilize for your personal company or specific requires.

Form popularity

FAQ

In the absence of a prenup or postnup, surviving spouses are guaranteed one-half of the community property, regardless of what their deceased spouse's will or trust says.

Maryland has a survivorship period. In order to inherit under Maryland's intestate succession law, the heir in question must survive the decedent by at least 30 days. In addition, relatives conceived before you die but born after your death are eligible to inherit as if they had been born while you were alive.

Generally, the Intestacy statutes provide for property to be distributed to a decedent's closest living relatives, i.e., to a surviving spouse and children, if there are any; to children in equal shares if there is no surviving spouse; to parents if there are no spouse and children; and so on to more distant relatives.

A disclaimer of a legacy, intestate share, survivorship interest, or other interest in or a power over a decedent's property shall be in writing or other record and shall (1) describe the interest or power disclaimed, (2) declare the disclaimer, (3) be signed by the person making the disclaimer, and (4) be acknowledged ...

Surviving Spouse: If the deceased person has a surviving spouse but no children or parents, the spouse will inherit the entire estate. However, if the deceased person has a surviving spouse and children, the spouse will share the estate with the children.

Maryland law protects spouses from being disinherited by the other. The rule of law called the elective share gives the surviving spouse the right to receive a fixed amount of the deceased spouse's estate.

Spouses do not automatically inherit all of the property and assets unless there are no other relatives. In most cases, spouses receive half or less of community property and assets.

Rule 6-125 - Service (a) Method of Service. (1)Generally. Except where these rules specifically require that service shall be made by first-class mail, return service requested, service may be made by (A) personal delivery, (B) certified mail, or (C) first-class mail.