Maryland Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust refers to a legal process that allows for the termination of a Granter Retained Annuity Trust (GREAT) in Maryland, where the assets are then transferred to an Existing Life Insurance Trust (ELITE). This strategy is often used for estate planning purposes and can provide several benefits for individuals and their beneficiaries. The Maryland Termination of Granter Retained Annuity Trust allows the granter, the person who created the GREAT, to terminate the trust and redirect the assets to an Existing Life Insurance Trust. This process is undertaken when the granter wants to leverage the benefits of life insurance within the estate plan or change the distribution of assets to their intended beneficiaries. By terminating the GREAT in favor of an Existing Life Insurance Trust, the granter can provide for the potential payment of estate taxes using the proceeds of the life insurance policy. This can be particularly advantageous for individuals whose estates may face significant tax liabilities upon their passing. The life insurance proceeds can help cover these expenses, ensuring that beneficiaries receive a larger portion of the estate. Additionally, this strategy allows the granter to maintain control over the management of the trust assets while providing for their loved ones. The Existing Life Insurance Trust can be structured to provide specific instructions on how the insurance proceeds should be used and allocated among beneficiaries, ensuring that the granter's wishes are carried out. It's important to note that there may be different types of Maryland Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust. These variations can include different terms and conditions, such as the length of the GREAT term, the annuity payments, and the specifications for the Existing Life Insurance Trust. It is essential to work closely with legal and financial professionals to determine the most suitable structure and tailoring the trust to meet individual needs and goals. In summary, the Maryland Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust is a legal process that allows the termination of a GREAT and the transfer of assets to an Existing Life Insurance Trust. This strategy can help individuals effectively manage their estate tax liabilities while ensuring their loved ones are adequately provided for. By working with knowledgeable professionals, individuals can create a comprehensive plan that aligns with their specific circumstances and goals.

Maryland Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

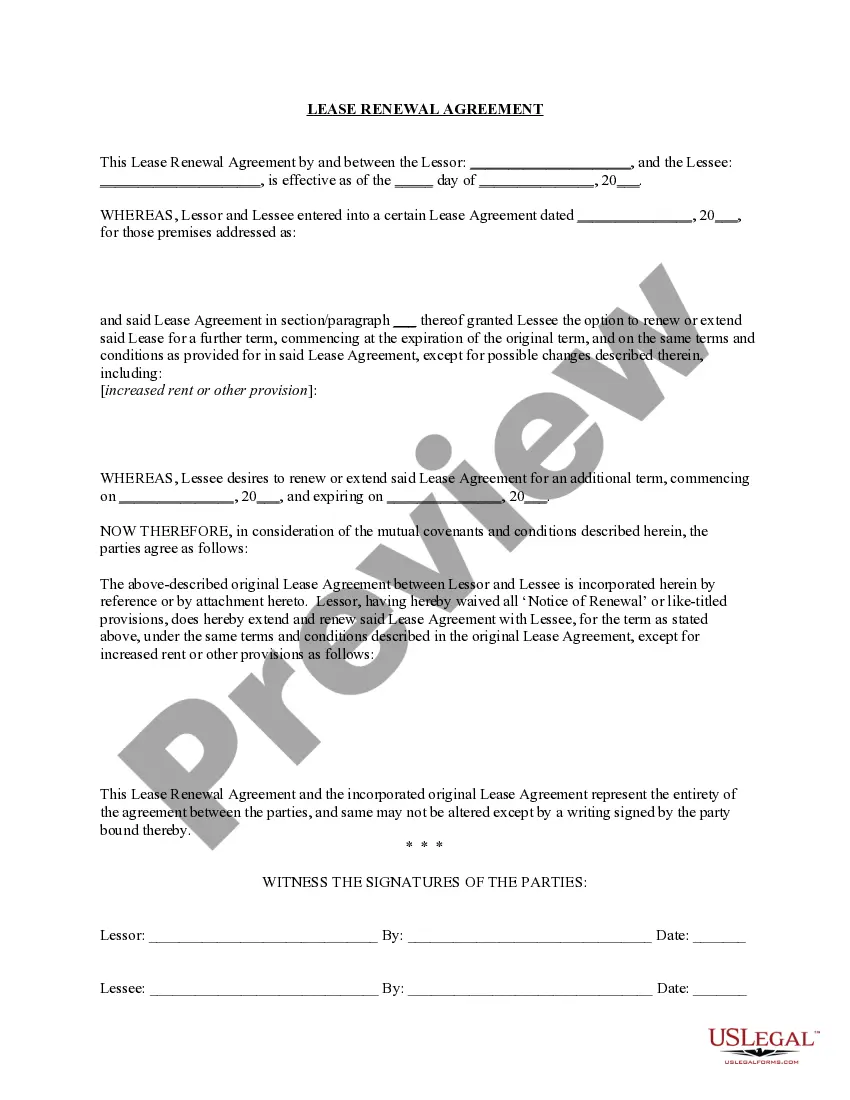

How to fill out Maryland Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

If you wish to full, obtain, or print out authorized papers themes, use US Legal Forms, the greatest variety of authorized varieties, which can be found on the web. Make use of the site`s basic and convenient lookup to find the papers you will need. Various themes for business and person functions are categorized by classes and says, or key phrases. Use US Legal Forms to find the Maryland Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust in just a couple of clicks.

When you are currently a US Legal Forms customer, log in to your accounts and click the Acquire button to obtain the Maryland Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust. You can also access varieties you previously saved within the My Forms tab of your accounts.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your appropriate town/land.

- Step 2. Take advantage of the Preview choice to look through the form`s content material. Never overlook to see the information.

- Step 3. When you are unsatisfied with all the develop, utilize the Research field on top of the screen to get other variations of your authorized develop design.

- Step 4. Once you have identified the shape you will need, go through the Buy now button. Select the costs strategy you choose and put your credentials to sign up for the accounts.

- Step 5. Process the purchase. You should use your charge card or PayPal accounts to complete the purchase.

- Step 6. Select the file format of your authorized develop and obtain it in your system.

- Step 7. Complete, revise and print out or signal the Maryland Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

Each and every authorized papers design you buy is the one you have for a long time. You have acces to each and every develop you saved in your acccount. Click on the My Forms area and select a develop to print out or obtain yet again.

Remain competitive and obtain, and print out the Maryland Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust with US Legal Forms. There are thousands of professional and state-specific varieties you can use for the business or person requires.