Maryland Assignment of Interest in Trust

Description

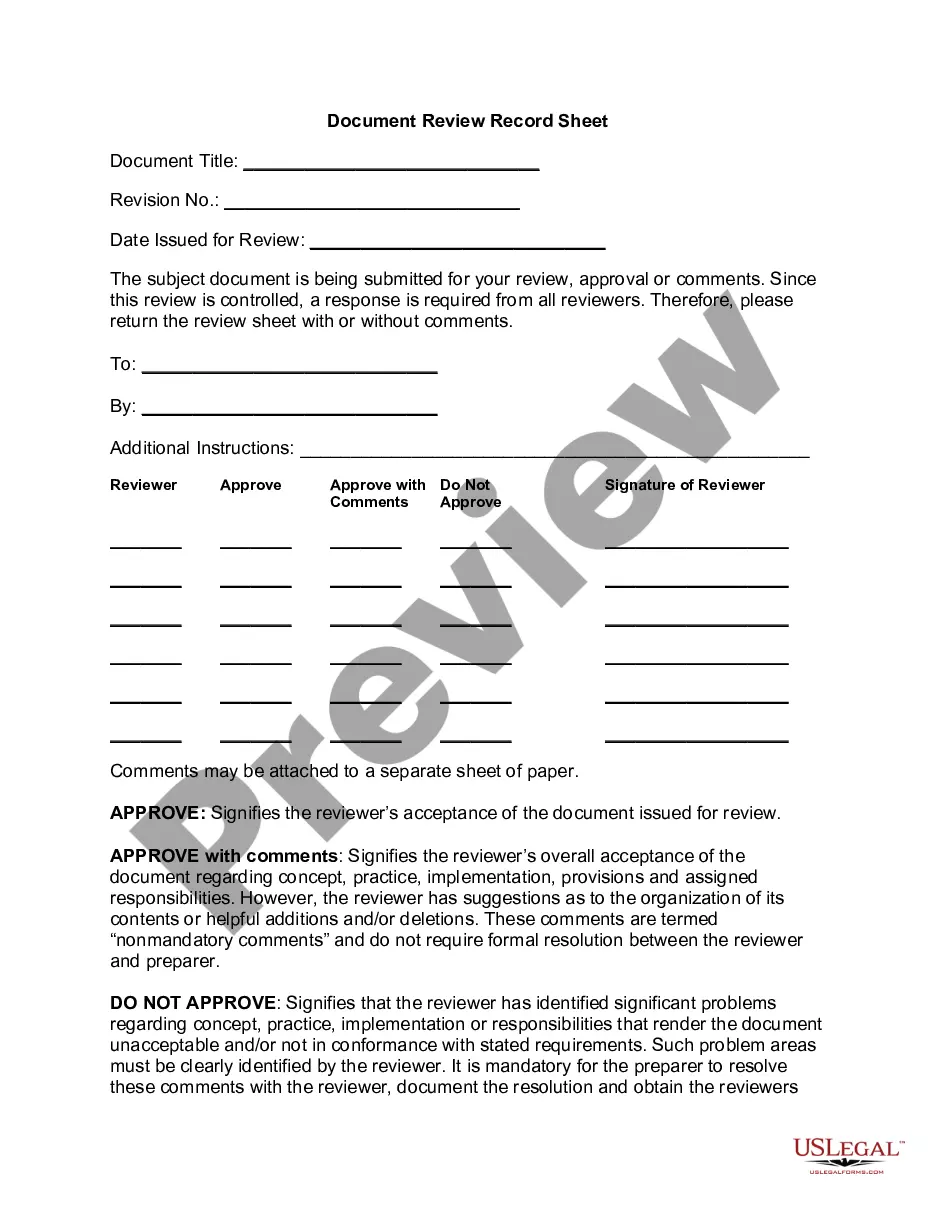

How to fill out Assignment Of Interest In Trust?

US Legal Forms - one of the premier collections of legal documents in the United States - offers a variety of legal template files that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal use, sorted by categories, states, or keywords.

You can find the latest versions of documents such as the Maryland Assignment of Interest in Trust in just a few minutes.

Check the form outline to ensure you have chosen the correct document.

If the form does not meet your needs, utilize the Search field at the top of the screen to find a more suitable one.

- If you have a monthly subscription, Log In to download the Maryland Assignment of Interest in Trust from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- To use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the appropriate form for your city/region.

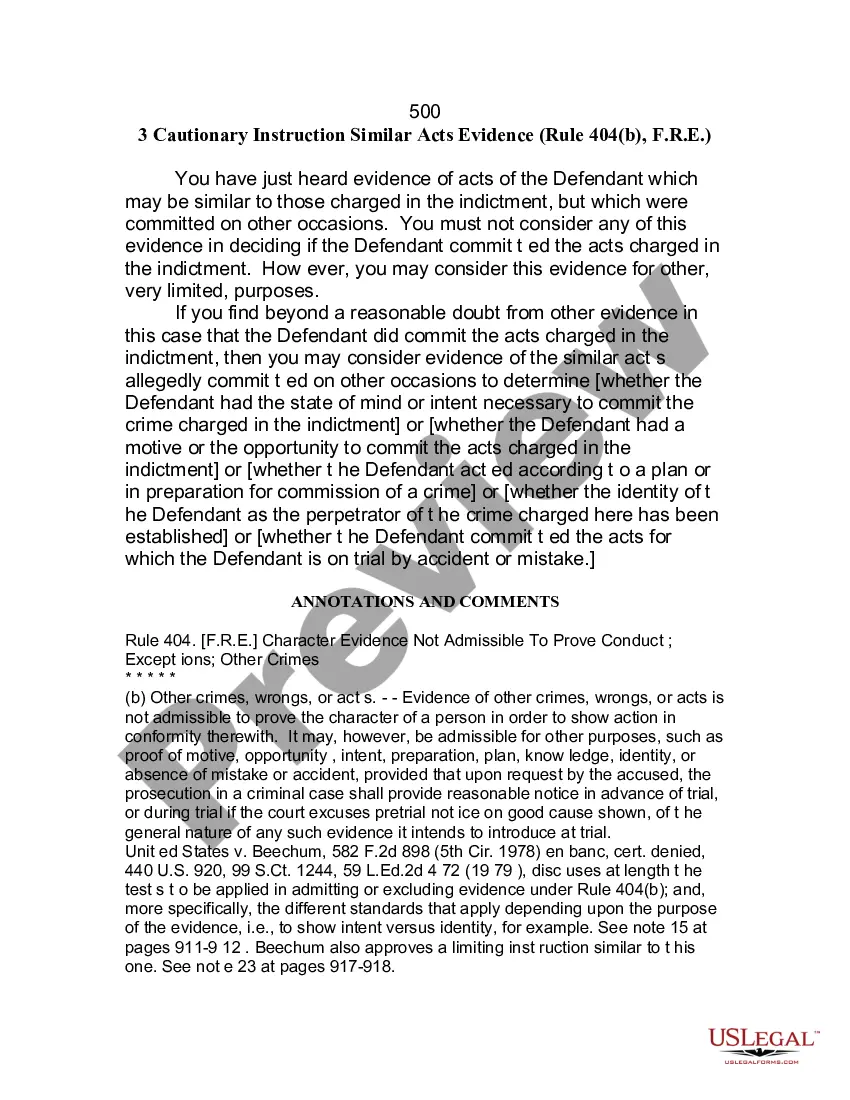

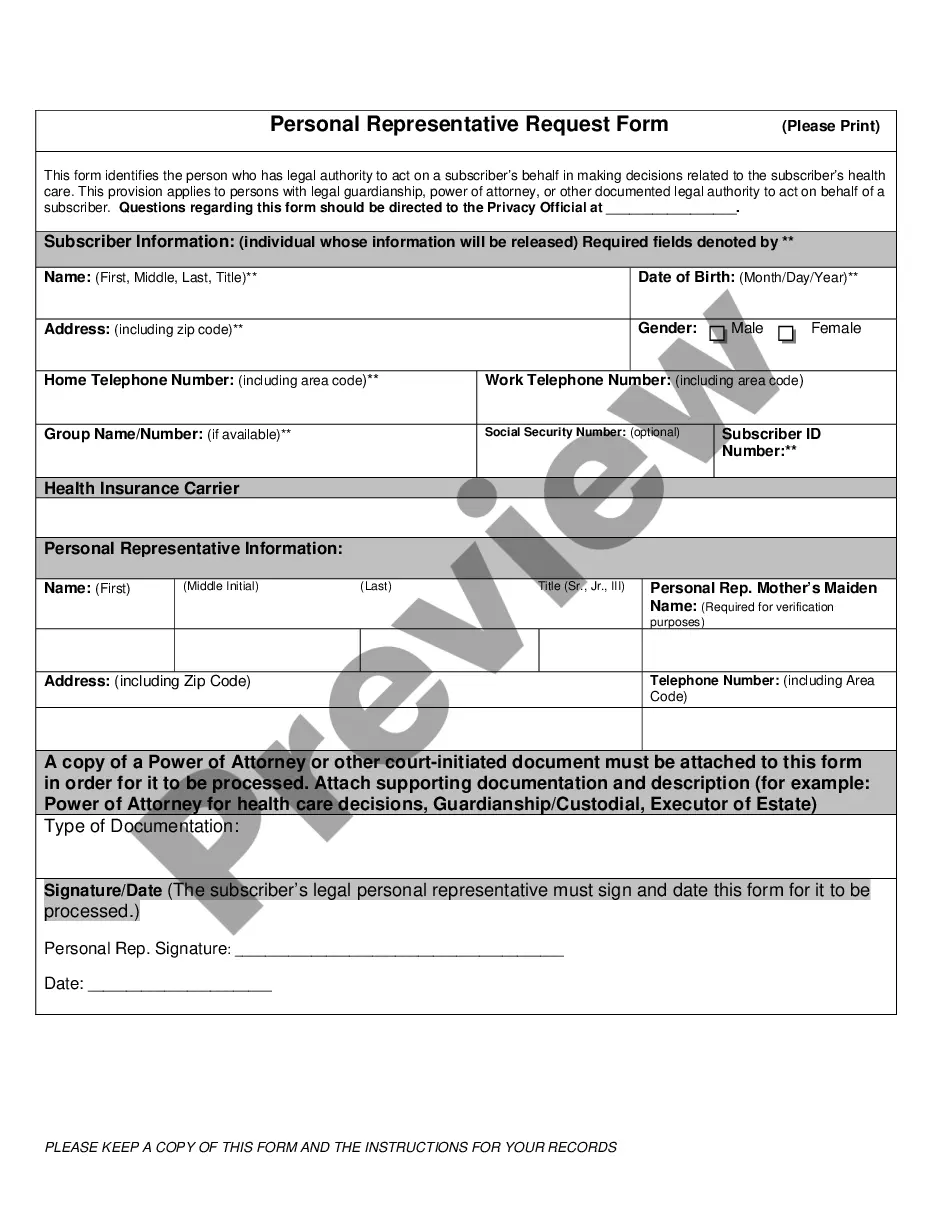

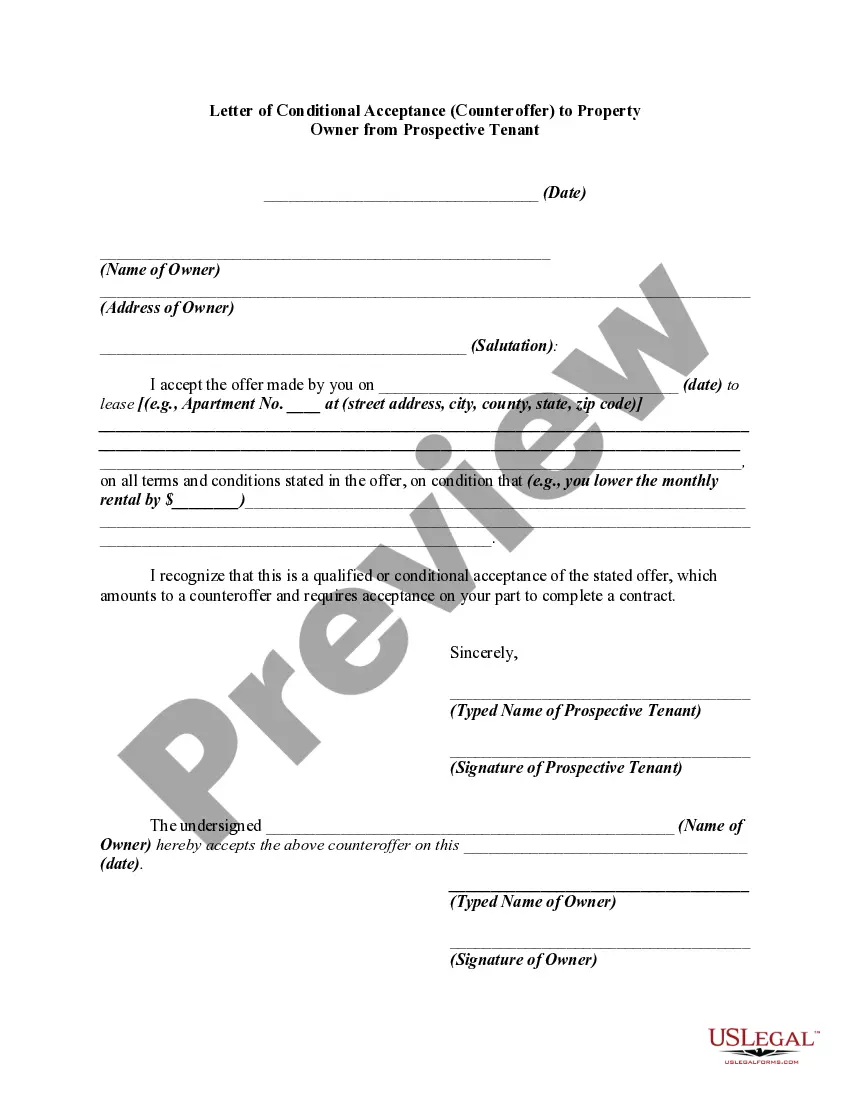

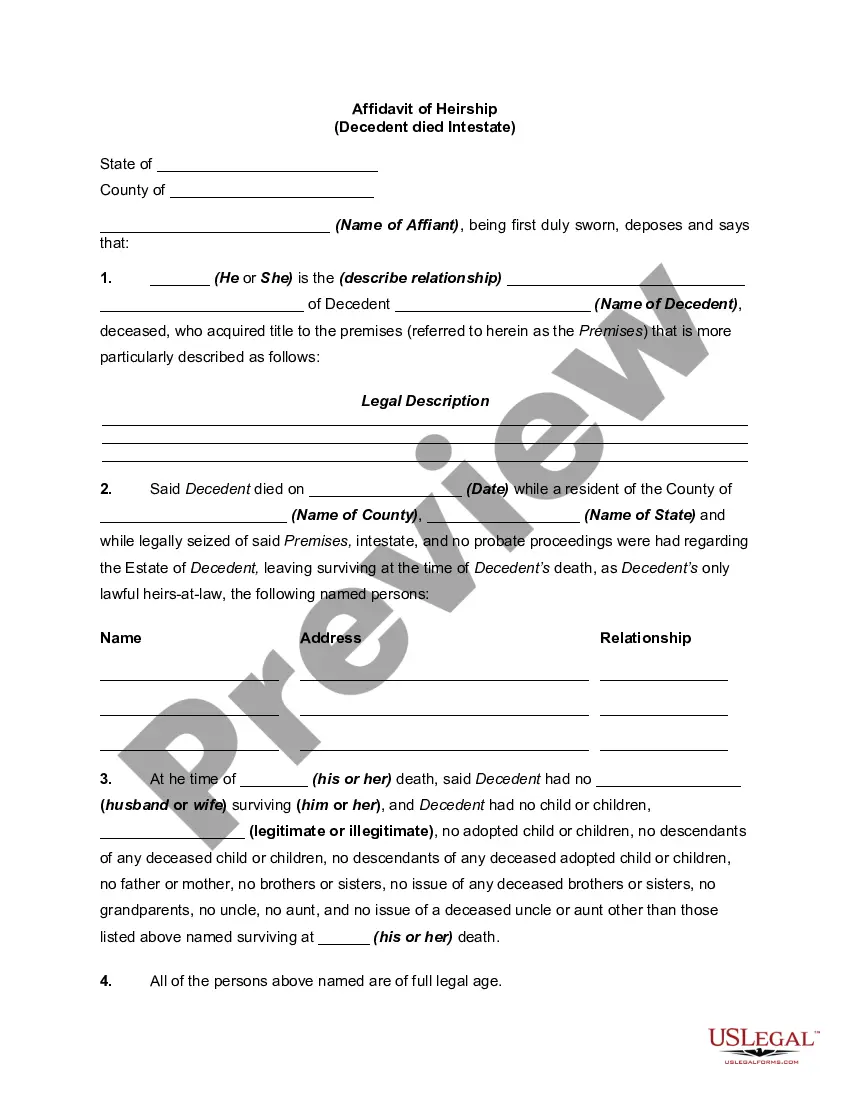

- Use the Review option to examine the form's content.

Form popularity

FAQ

A: Yes. Md. Code Ann., Corporations and Associations Article §12-902 requires such trusts to register with the Department of Assessments and Taxation before doing any business in Maryland.

A conflict of interest for a trustee occurs when the trustee's personal interests potentially conflict with their responsibilities to the trust beneficiaries.

To make a living trust in Maryland, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

To make a living trust in Maryland, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

A trust instrument is not required to be notarized in Maryland. However, it is common practice to notarize the settlor's signature and the witnesses' signatures of the trust agreement to express that the settlor: 220e Intentionally created the trust.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Assignments, however, almost never apply to a beneficiary's interests in a trust. Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

The amount you'll spend to create a living trust in Maryland depends on the method you use to create it. If you do it yourself with the help of an online program, you'll probably spend a few hundred dollars or so. If you hire an attorney, the total cost will probably be more than $1,000.