Maryland Joint Trust with Income Payable to Trustees During Joint Lives is a legal arrangement in Maryland that allows individuals, known as trustees, to create a joint trust with the purpose of protecting and managing their assets during their lifetimes. This type of trust provides several benefits, including income generation, asset preservation, and estate planning. In a Maryland Joint Trust with Income Payable to Trustees During Joint Lives, the trustees transfer their assets to the trust, which is managed by a designated trustee. The trustees retain the right to receive income from the trust during their joint lives, ensuring financial stability and security. This income can be generated from various sources, such as rental properties, dividends, interest, and other investments. One of the prominent advantages of this trust is the preservation of assets. By placing assets in the trust, trustees are shielded from potential creditors, lawsuits, and other unforeseen financial challenges. The trustees can enjoy the income generated by their assets while safeguarding them for future generations. Additionally, a Maryland Joint Trust with Income Payable to Trustees During Joint Lives offers comprehensive estate planning benefits. Upon the death of one trust or, the trust assets are distributed as per the trust document. This can include passing assets to the surviving trust or, funding the trust for the benefit of children or other beneficiaries, or even making charitable contributions. There are different variations or terms that can be included in a Maryland Joint Trust with Income Payable to Trustees During Joint Lives depending on the specific needs and circumstances of the trustees. Some of these variations include: 1. Specific income distribution: Trustees may specify a fixed amount or percentage of income to be distributed to them during their joint lives. This ensures a steady financial stream to meet their ongoing expenses and lifestyle. 2. Beneficiary designation: Trustees can name specific individuals or organizations as beneficiaries who would receive the trust assets upon their deaths. This allows for control and direction over asset distribution and allows trustees to support their loved ones or philanthropic causes. 3. Investment management provisions: Trustees can provide instructions regarding the management and investment of trust assets. This ensures that the trustee follows a specific investment strategy or focuses on certain investment vehicles, aligning with the trustees' financial goals and risk tolerance. 4. Trust termination provisions: Trustees can indicate the conditions under which the trust can be terminated, such as the death of both trustees or a specific event occurring. This allows for flexibility and control over the lifespan of the trust. Overall, a Maryland Joint Trust with Income Payable to Trustees During Joint Lives offers trustees in Maryland a comprehensive and flexible estate planning tool with income benefits during their joint lives. It provides asset protection, income generation, and various customization options to meet individual needs and preferences.

Maryland Joint Trust with Income Payable to Trustors During Joint Lives

Description

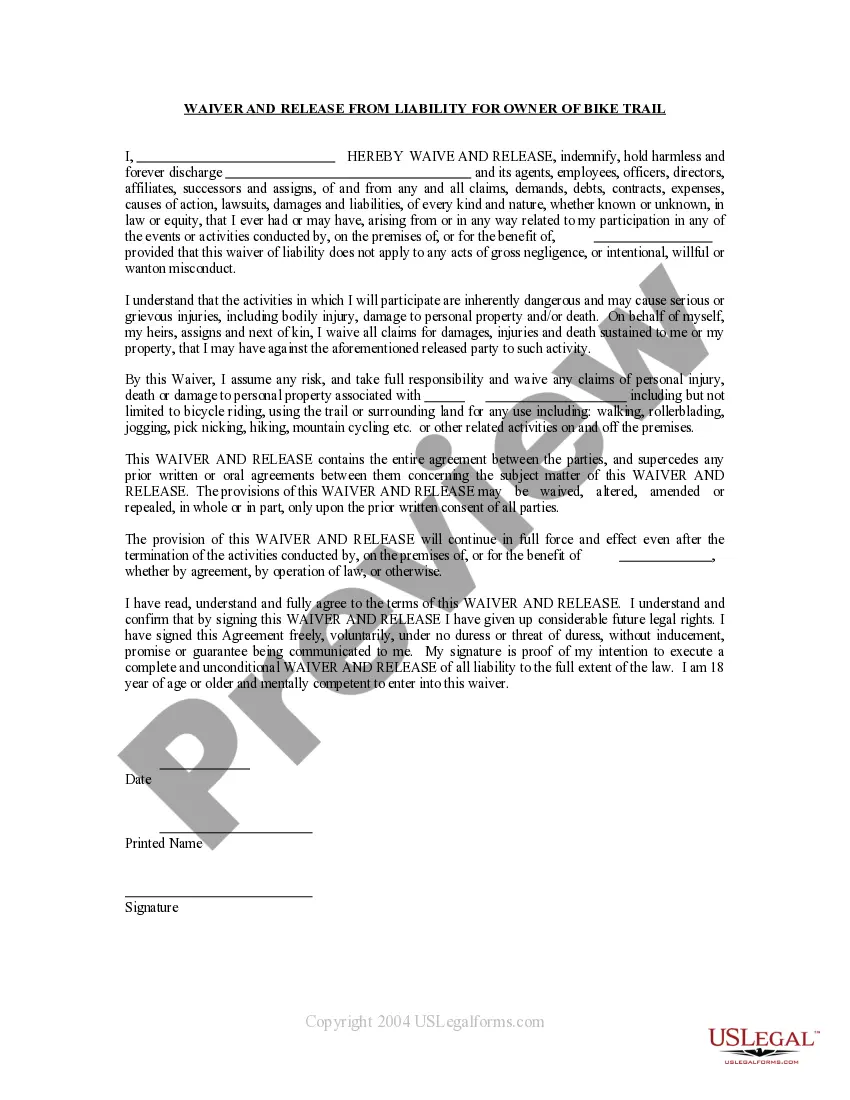

How to fill out Maryland Joint Trust With Income Payable To Trustors During Joint Lives?

US Legal Forms - one of several biggest libraries of legitimate forms in America - offers a wide range of legitimate record themes it is possible to download or print. While using web site, you will get 1000s of forms for company and person reasons, sorted by types, states, or key phrases.You can find the most up-to-date types of forms such as the Maryland Joint Trust with Income Payable to Trustors During Joint Lives in seconds.

If you already have a membership, log in and download Maryland Joint Trust with Income Payable to Trustors During Joint Lives from your US Legal Forms catalogue. The Down load switch will appear on each develop you see. You have accessibility to all formerly acquired forms within the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, here are easy guidelines to get you started off:

- Ensure you have picked the correct develop for your personal area/county. Click the Review switch to review the form`s content. Browse the develop outline to ensure that you have chosen the appropriate develop.

- If the develop does not suit your specifications, take advantage of the Research discipline on top of the display screen to get the one that does.

- When you are pleased with the form, validate your option by clicking on the Acquire now switch. Then, opt for the pricing program you like and provide your credentials to register on an account.

- Procedure the transaction. Make use of your Visa or Mastercard or PayPal account to perform the transaction.

- Find the format and download the form on the gadget.

- Make alterations. Fill out, edit and print and indicator the acquired Maryland Joint Trust with Income Payable to Trustors During Joint Lives.

Each design you put into your account lacks an expiry day which is your own for a long time. So, if you want to download or print another version, just proceed to the My Forms area and then click around the develop you want.

Get access to the Maryland Joint Trust with Income Payable to Trustors During Joint Lives with US Legal Forms, by far the most comprehensive catalogue of legitimate record themes. Use 1000s of skilled and condition-specific themes that meet your organization or person requirements and specifications.