Maryland Sample Letter Requesting Payoff Balance of Mortgage

Description

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

US Legal Forms - among the greatest libraries of authorized types in the United States - gives a wide array of authorized file web templates you can acquire or printing. Making use of the web site, you may get 1000s of types for organization and individual reasons, categorized by types, claims, or keywords and phrases.You can find the latest types of types much like the Maryland Sample Letter Requesting Payoff Balance of Mortgage in seconds.

If you already possess a membership, log in and acquire Maryland Sample Letter Requesting Payoff Balance of Mortgage in the US Legal Forms local library. The Obtain switch can look on each and every develop you look at. You get access to all in the past delivered electronically types inside the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, allow me to share easy directions to obtain started out:

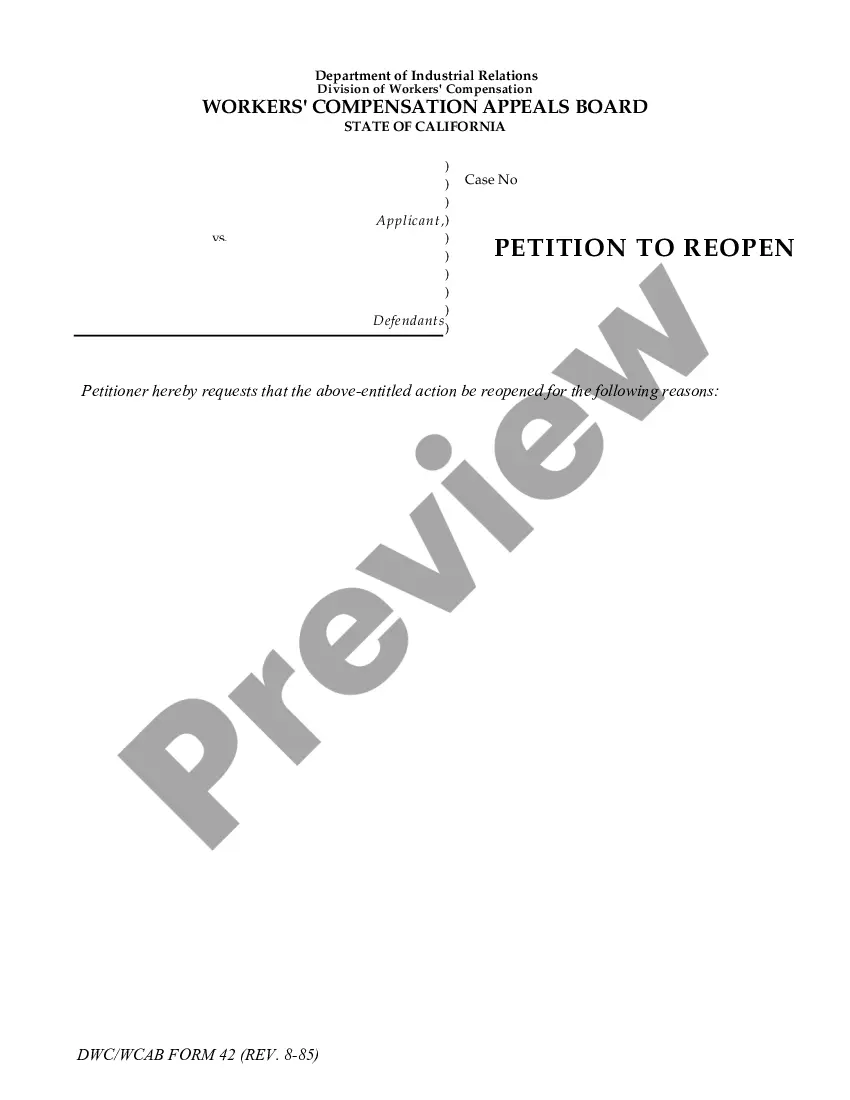

- Be sure to have selected the correct develop for your personal metropolis/area. Click on the Preview switch to check the form`s information. See the develop information to ensure that you have selected the proper develop.

- When the develop doesn`t match your requirements, take advantage of the Research field at the top of the display to obtain the one who does.

- Should you be happy with the form, affirm your option by clicking the Purchase now switch. Then, pick the pricing plan you want and supply your accreditations to register to have an profile.

- Process the transaction. Utilize your charge card or PayPal profile to complete the transaction.

- Select the file format and acquire the form on the device.

- Make modifications. Complete, revise and printing and sign the delivered electronically Maryland Sample Letter Requesting Payoff Balance of Mortgage.

Every single design you included in your money does not have an expiry particular date which is yours eternally. So, in order to acquire or printing an additional copy, just visit the My Forms segment and click on around the develop you want.

Obtain access to the Maryland Sample Letter Requesting Payoff Balance of Mortgage with US Legal Forms, by far the most extensive local library of authorized file web templates. Use 1000s of specialist and state-distinct web templates that fulfill your business or individual demands and requirements.

Form popularity

FAQ

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Lenders can also send you a payoff letter after you have finished paying off a loan. This letter serves as confirmation that your loan has been repaid in full, and your account has been closed. It's most often requested so that customers can prove to other lenders that they have no other outstanding debts.

If you want to pay off your loan balance in full, you should request a payoff statement from your loan servicer. As mentioned above, your monthly statement won't necessarily include all outstanding interest and fees if you pay off your remaining debt.

Answer. You can't just pay the amount shown on your monthly mortgage statement to pay off the loan. That amount is your outstanding loan balance, not a payoff amount. You need an official payoff statement from the servicer to ensure you pay the correct amount.

Include all relevant information in the payoff letter, including: Include the name of the loan or mortgage holder. Include the loan or mortgage number. Include the payment amount. Include the date you plan to make the payment. Include your name and address. Include your contact information.

Generally, you request it from your lender when you want to know the exact amount needed to pay off your home.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.