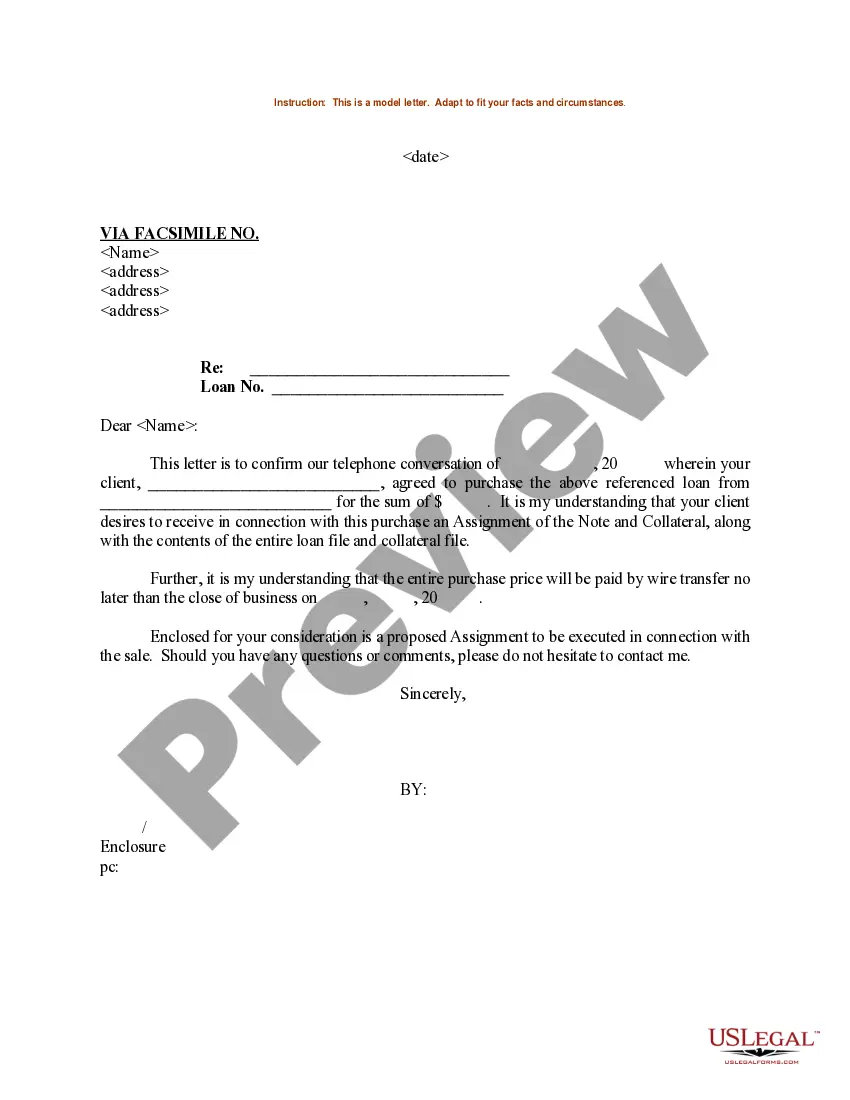

Maryland Sample Letter for Refinancing of Loan

Description

How to fill out Sample Letter For Refinancing Of Loan?

Locating the appropriate authorized document template can be rather challenging. Obviously, there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers a plethora of templates, including the Maryland Sample Letter for Refinancing of Loan, which can be useful for both business and personal needs. All the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to find the Maryland Sample Letter for Refinancing of Loan. Use your account to search for the legal forms you have previously purchased. Navigate to the My documents tab in your account and obtain another copy of the documents you need.

Select the document format and download the legal document template to your device. Complete, edit, print, and sign the received Maryland Sample Letter for Refinancing of Loan. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that meet state requirements.

- Firstly, ensure you have selected the correct form for your city/state.

- You can review the template using the Preview option and read the form description to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search feature to find the appropriate document.

- When you are confident that the form is suitable, select the Purchase now button to obtain the form.

- Choose the payment plan you prefer and provide the necessary information.

- Create your account and complete your order using your PayPal account or credit card.

Form popularity

FAQ

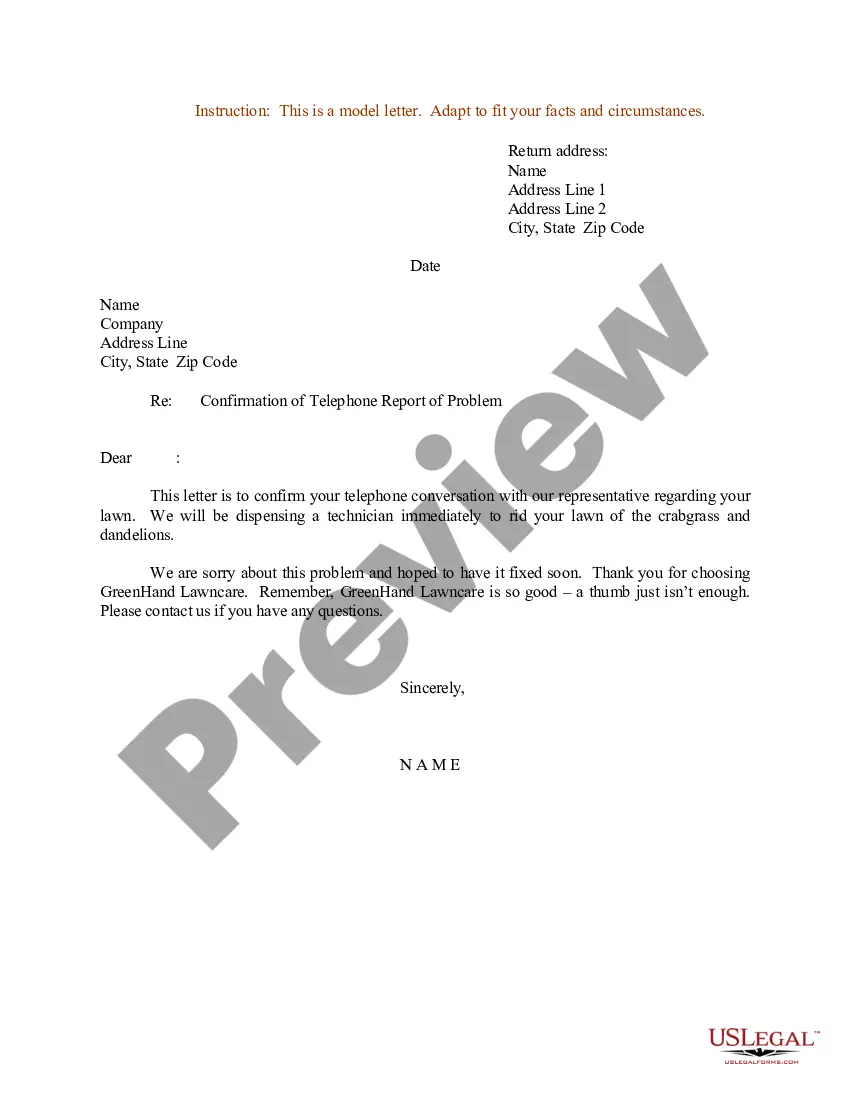

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

What to include in your letter of explanationLay out the letter as you would any other, with your full street address and phone number at the top.Date the letter with the date on which you're writing it.Put in the recipient (the lender's) name and full address.More items...?

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.20-Apr-2022

Out Refinance Letter is a formal request drafted by a mortgage borrower who is looking to use the equity they have built for their advantage and replace their old mortgage with a new one, receiving a sum of money to invest in remodeling, repay accumulated debts, or handle other financial issues.

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

Step 1: Set your refinance goals. The first step in the refinance process is to set a clear goal.Step 2: Get refinance rates from several lenders.Step 3: Compare rates and fees.Step 4: Submit your documents.Step 5: Appraisal and underwriting.Step 6: Closing day.