The Maryland Partnership Agreement for Investment Club is a legal agreement that outlines the terms and conditions for establishing and operating an investment club in the state of Maryland. This partnership agreement is specifically designed to facilitate the pooling of funds from individual members for the purpose of investing in financial securities and various assets. The agreement covers various important aspects, including the club's objectives, organizational structure, membership rules, financial contributions, decision-making processes, profit sharing, taxation, and dissolution procedures. It ensures a clear understanding and consensus among club members, thus providing a solid framework for successful collaboration and minimizing potential conflicts. Maryland Partnership Agreements for Investment Clubs can differ based on several factors, including the club's investment strategy, objectives, and membership requirements. Different types of Maryland Partnership Agreements for Investment Clubs include: 1. General Partnership Agreement: This type of agreement is suitable for investment clubs with a simple organizational structure and where all members have equal decision-making authority and liability. 2. Limited Partnership Agreement: In this type of agreement, there are two categories of partners — general partners and limited partners. General partners are responsible for managing the club and have unlimited liability, while limited partners have limited liability but no control over the club's operations. 3. Limited Liability Partnership Agreement: This agreement provides limited liability protection to all partners, meaning they are not personally responsible for the club's debts or actions beyond their invested capital. It is a suitable option for investment clubs looking for liability protection. 4. Limited Liability Company (LLC) Operating Agreement: An LLC operating agreement is another option for investment clubs. It combines some aspects of a partnership agreement with the benefits of limited liability protection. This type of agreement offers flexibility in terms of management structure and profit distribution. In conclusion, the Maryland Partnership Agreement for Investment Club is a crucial legal document that outlines the rules and responsibilities for operating an investment club in Maryland. It provides a clear framework for organizing activities, decision-making, and profit sharing among members. Different types of partnership agreements cater to varying needs and preferences of investment clubs, ensuring flexibility and protection for their members.

Maryland Partnership Agreement for Investment Club

Description

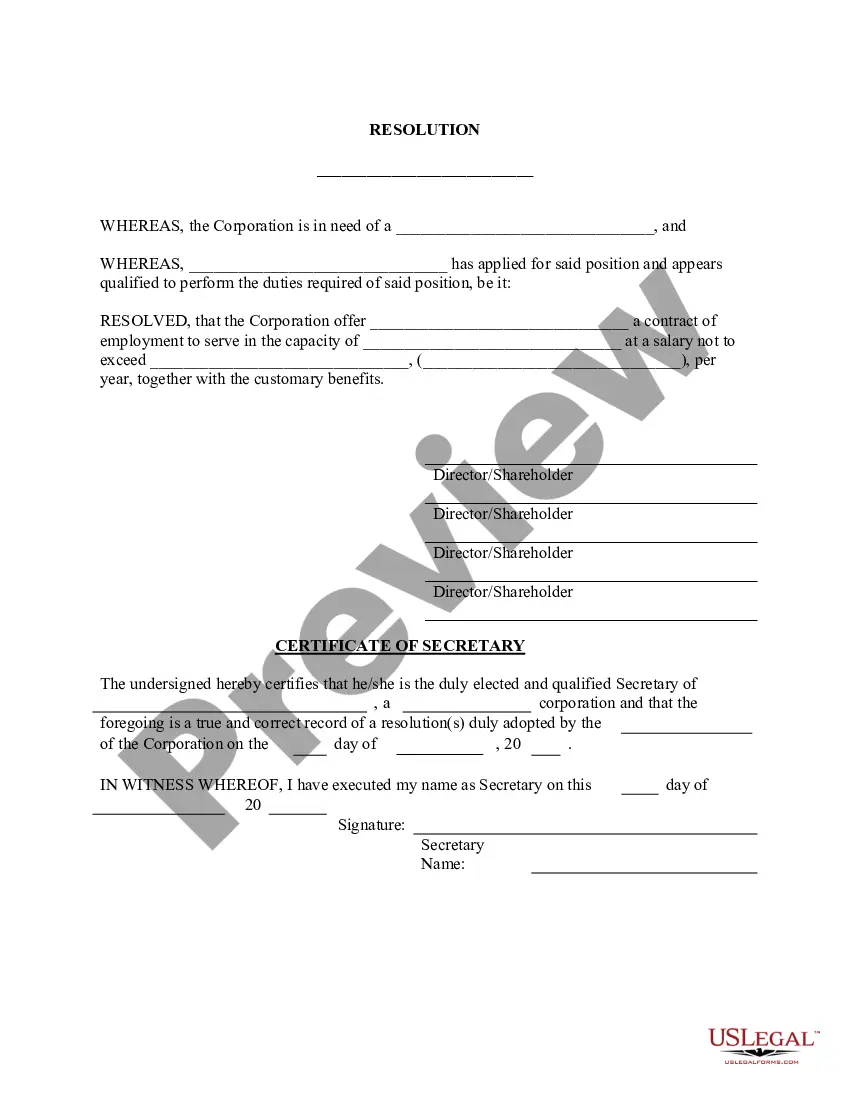

How to fill out Maryland Partnership Agreement For Investment Club?

US Legal Forms - one of the greatest libraries of authorized varieties in America - gives a wide array of authorized record themes you may acquire or produce. Making use of the site, you can get thousands of varieties for company and personal functions, categorized by categories, states, or keywords and phrases.You will discover the most recent models of varieties such as the Maryland Partnership Agreement for Investment Club within minutes.

If you have a subscription, log in and acquire Maryland Partnership Agreement for Investment Club from the US Legal Forms catalogue. The Download option can look on each and every form you see. You get access to all formerly saved varieties inside the My Forms tab of your own account.

If you would like use US Legal Forms the very first time, here are simple guidelines to obtain started off:

- Be sure to have chosen the proper form to your area/county. Click on the Review option to review the form`s articles. Browse the form information to actually have chosen the correct form.

- If the form doesn`t suit your requirements, take advantage of the Research field on top of the screen to find the one that does.

- When you are content with the form, verify your option by visiting the Acquire now option. Then, select the rates strategy you favor and provide your credentials to register for the account.

- Procedure the purchase. Make use of your bank card or PayPal account to complete the purchase.

- Find the formatting and acquire the form on the product.

- Make adjustments. Fill up, change and produce and indicator the saved Maryland Partnership Agreement for Investment Club.

Every design you added to your bank account lacks an expiry particular date and is your own property eternally. So, if you would like acquire or produce one more copy, just check out the My Forms section and click on about the form you will need.

Get access to the Maryland Partnership Agreement for Investment Club with US Legal Forms, one of the most comprehensive catalogue of authorized record themes. Use thousands of skilled and status-distinct themes that satisfy your company or personal needs and requirements.